San Jose California Agreement to Redeem Interest of a Single Member in an LLC is a legal document that outlines the terms and conditions for the redemption of a single member's interest in a limited liability company (LLC) located in San Jose, California. This agreement is essential for ensuring a smooth and orderly process when a member wishes to sell or transfer their ownership stake in the LLC. The San Jose California Agreement to Redeem Interest of a Single Member in an LLC typically includes the following key elements: 1. Parties: Identification of the LLC and the single member intending to redeem their interest. 2. Redemption Terms: Detailed provisions outlining the terms and conditions for the redemption, such as the redemption price, payment terms, and any applicable interest rates. 3. Transfer Restrictions: Any restrictions or limitations on the transfer or sale of the member's interest, which may include obtaining prior approval from other members or the LLC itself. 4. Valuation Method: A description of the method used to determine the fair market value of the member's interest, such as an independent appraisal or agreed-upon formula. 5. Payment Schedule: The agreed-upon timeline for the payment of the redemption price, including any installment payments if applicable. 6. Release and Discharge: Provisions stating that once the redemption is complete, the member will be released from any further obligations or liabilities related to the LLC. 7. Governing Law: Specification of the laws of the State of California and the jurisdiction of San Jose as the governing authority for any disputes or interpretation of the agreement. Types of San Jose California Agreement to Redeem Interest of a Single Member in an LLC may include: 1. Voluntary Redemption Agreement: When a member chooses to redeem their interest voluntarily, typically due to retirement, personal reasons, or a desire to exit the LLC. 2. Involuntary Redemption Agreement: In cases where a member's interest is to be redeemed involuntarily, often due to a breach of the LLC's operating agreement or other triggering events specified in the agreement. 3. Buyout Agreement: This type of agreement outlines the terms and conditions for the redemption of a single member's interest in the other members or the LLC itself, usually as a result of a buy-sell provision or a predetermined formula. 4. Dissolution Redemption Agreement: When an LLC is dissolved or undergoing liquidation, this agreement outlines the process for redeeming the interest of a single member. The San Jose California Agreement to Redeem Interest of a Single Member in an LLC is a crucial legal document that protects the rights and interests of the member and ensures a fair and transparent transaction. It is strongly recommended that individuals seek professional legal advice when drafting or entering into such agreements to ensure compliance with applicable laws and regulations.

San Jose California Agreement to Redeem Interest of a Single Member in an LLC

Description

How to fill out San Jose California Agreement To Redeem Interest Of A Single Member In An LLC?

Preparing legal documentation can be difficult. In addition, if you decide to ask a legal professional to write a commercial contract, papers for ownership transfer, pre-marital agreement, divorce papers, or the San Jose Agreement to Redeem Interest of a Single Member in an LLC, it may cost you a fortune. So what is the best way to save time and money and draft legitimate forms in total compliance with your state and local laws and regulations? US Legal Forms is an excellent solution, whether you're searching for templates for your individual or business needs.

US Legal Forms is biggest online catalog of state-specific legal documents, providing users with the up-to-date and professionally checked forms for any scenario accumulated all in one place. Consequently, if you need the current version of the San Jose Agreement to Redeem Interest of a Single Member in an LLC, you can easily locate it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample using the Download button. If you haven't subscribed yet, here's how you can get the San Jose Agreement to Redeem Interest of a Single Member in an LLC:

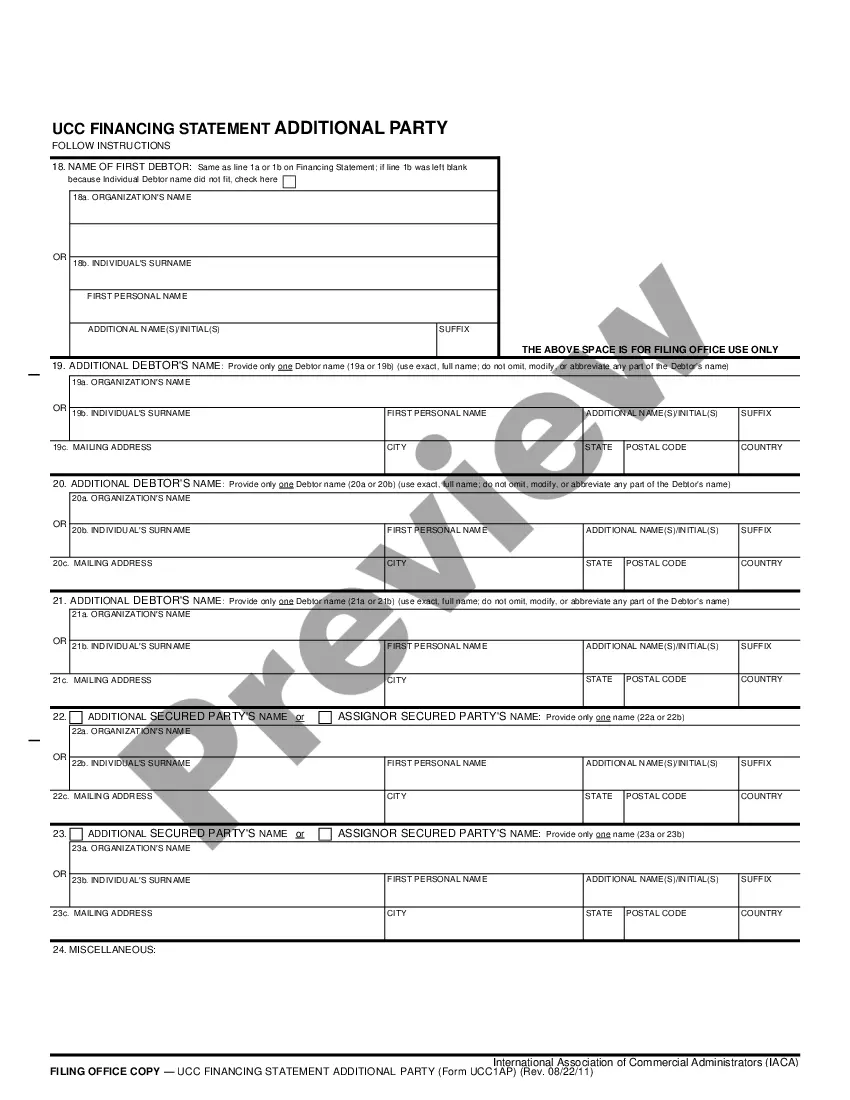

- Glance through the page and verify there is a sample for your area.

- Check the form description and use the Preview option, if available, to ensure it's the template you need.

- Don't worry if the form doesn't satisfy your requirements - search for the correct one in the header.

- Click Buy Now when you find the needed sample and choose the best suitable subscription.

- Log in or register for an account to purchase your subscription.

- Make a transaction with a credit card or through PayPal.

- Opt for the file format for your San Jose Agreement to Redeem Interest of a Single Member in an LLC and download it.

Once finished, you can print it out and complete it on paper or import the template to an online editor for a faster and more practical fill-out. US Legal Forms enables you to use all the paperwork ever purchased many times - you can find your templates in the My Forms tab in your profile. Give it a try now!

Form popularity

FAQ

A REDEMPTION AGREEMENT ALLOWS A DEPARTING SHAREHOLDER, PARTNER OR LLC MEMBER TO SELL OUT THEIR INTEREST IN THE BUSINESS TO THE COMPANY INSTEAD OF THEIR CO-OWNER. Another common type of buy-sell agreement is the stock redemption agreement.

The Supreme Administrative Court ruled that the transfer of shares for redemption is a special legal transaction which cannot be classified as a paid transfer of assets or rights. Additionally, Art.

A redemption is treated as a sale or exchange in the following situations: The distribution is not essentially equivalent to a dividend. It is substantially disproportionate with respect to the shareholder. It is in complete redemption of all of the stock of the corporation owned by the shareholder.

Redemptions are when a company requires shareholders to sell a portion of their shares back to the company. For a company to redeem shares, it must have stipulated upfront that those shares are redeemable, or callable.

A redemption offer is a special offer promoted by a supplier which runs for a limited period of time. For example it could be a free attachment for a mixer, or a capsule credit for a coffee machine. This gift won't be delivered with your order. Instead you will need to redeem it directly from the supplier.

Sale and Contribution Agreement means the Sale and Contribution Agreement dated as of even date herewith, relating to the sale and contribution by Credit Acceptance to the Seller of the Conveyed Property, as defined therein. Mandatory Redemption means a redemption of ETP Securities in accordance with Condition 8.7.

A REDEMPTION AGREEMENT ALLOWS A DEPARTING SHAREHOLDER, PARTNER OR LLC MEMBER TO SELL OUT THEIR INTEREST IN THE BUSINESS TO THE COMPANY INSTEAD OF THEIR CO-OWNER. Another common type of buy-sell agreement is the stock redemption agreement.

The transfer of membership interest in LLC entities is done through an LLC Membership Interest Assignment. This document is used when an owner (member) of an LLC wants to transfer their interest to another party. They are typically used when a member plans to leave or wants to relinquish their interest in the business.

Unlike a redemption, which is compulsory, selling shares back to the company with a repurchase is voluntary. However, a redemption typically pays investors a premium built into the call price, partly compensating them for the risk of having their shares redeemed.