The Cuyahoga Ohio Liquidation Agreement regarding Debtor's Collateral in Satisfaction of Indebtedness is a legal document that outlines the terms and conditions for the liquidation of a debtor's collateral in order to satisfy their outstanding debts. This agreement is commonly used in Cuyahoga County, Ohio, to facilitate the resolution of financial obligations between a debtor and a creditor. The liquidation agreement defines the process and procedures for the sale or disposal of the debtor's collateral, which may include assets such as real estate, vehicles, equipment, or other valuable possessions. It establishes the responsibilities and rights of both parties involved to ensure a fair and orderly liquidation process. This agreement typically includes provisions regarding the appraisal and valuation of the collateral, the method and timeline for selling the assets, and the distribution of proceeds to satisfy the debtor's indebtedness. It may also outline any conditions or restrictions for the sale, such as obtaining necessary permits or approvals. In Cuyahoga County, Ohio, there may be different types of liquidation agreements depending on the specific circumstances of the debtor's collateral and the nature of the indebtedness. Some of these variations may include: 1. Real Estate Liquidation Agreement: This type of agreement specifically pertains to the liquidation and sale of real property owned by the debtor. 2. Vehicle Liquidation Agreement: This agreement focuses on the liquidation and sale of vehicles, such as cars, trucks, motorcycles, or boats, owned by the debtor. 3. Equipment Liquidation Agreement: This agreement is designed for the liquidation and sale of equipment or machinery owned by the debtor, which may be applicable in business or commercial settings. It's important to note that the exact terms and provisions of a Cuyahoga Ohio Liquidation Agreement regarding Debtor's Collateral in Satisfaction of Indebtedness can vary depending on the specific circumstances and the negotiation between the debtor and creditor.

Cuyahoga Ohio Liquidation Agreement regarding Debtor's Collateral in Satisfaction of Indebtedness

Description

How to fill out Cuyahoga Ohio Liquidation Agreement Regarding Debtor's Collateral In Satisfaction Of Indebtedness?

Preparing documents for the business or personal demands is always a huge responsibility. When drawing up a contract, a public service request, or a power of attorney, it's important to take into account all federal and state laws and regulations of the specific region. However, small counties and even cities also have legislative procedures that you need to consider. All these aspects make it burdensome and time-consuming to draft Cuyahoga Liquidation Agreement regarding Debtor's Collateral in Satisfaction of Indebtedness without professional help.

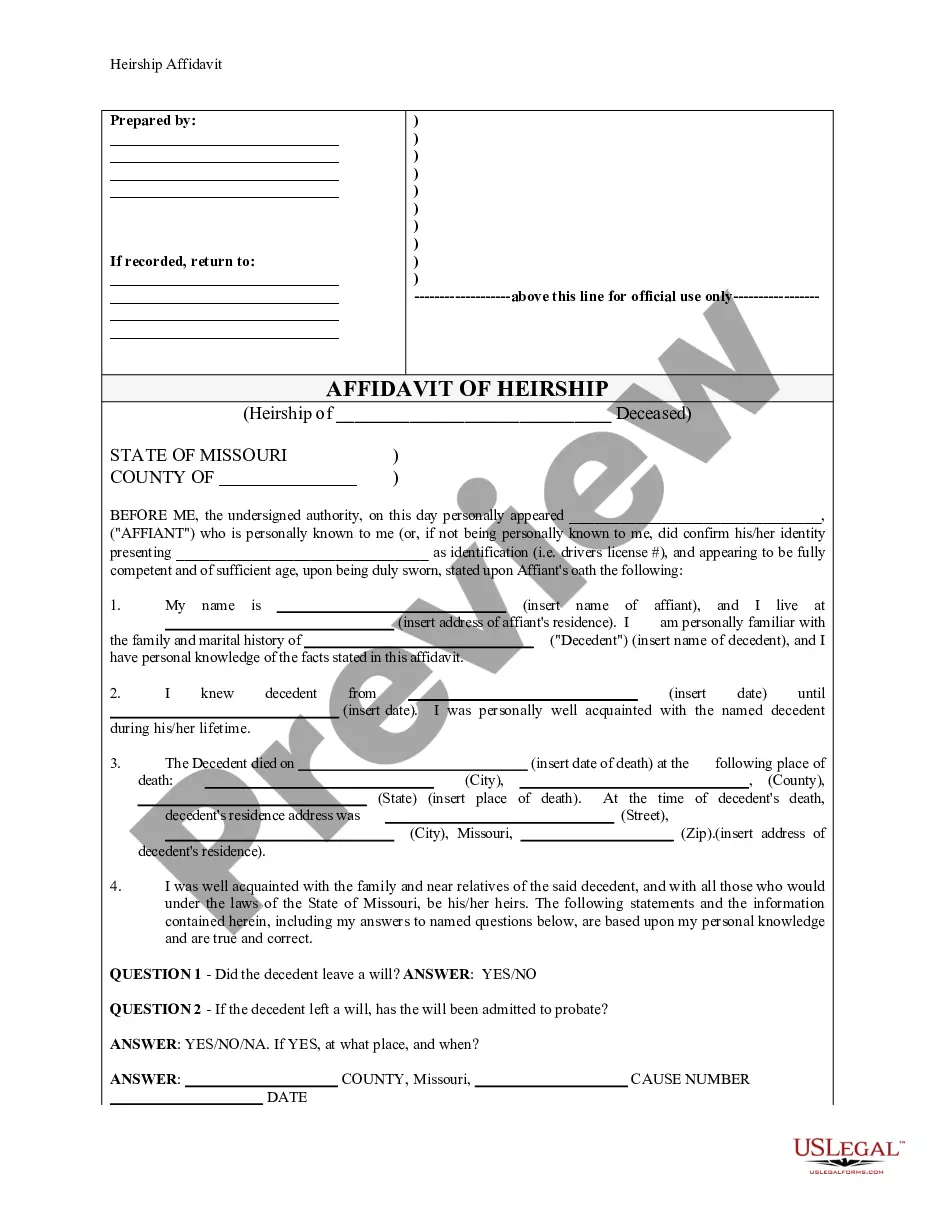

It's easy to avoid wasting money on lawyers drafting your documentation and create a legally valid Cuyahoga Liquidation Agreement regarding Debtor's Collateral in Satisfaction of Indebtedness on your own, using the US Legal Forms web library. It is the greatest online catalog of state-specific legal templates that are professionally cheched, so you can be sure of their validity when picking a sample for your county. Previously subscribed users only need to log in to their accounts to download the needed document.

In case you still don't have a subscription, adhere to the step-by-step instruction below to obtain the Cuyahoga Liquidation Agreement regarding Debtor's Collateral in Satisfaction of Indebtedness:

- Examine the page you've opened and verify if it has the document you require.

- To do so, use the form description and preview if these options are presented.

- To locate the one that satisfies your needs, utilize the search tab in the page header.

- Double-check that the sample complies with juridical criteria and click Buy Now.

- Pick the subscription plan, then log in or create an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the selected file in the preferred format, print it, or fill it out electronically.

The great thing about the US Legal Forms library is that all the documentation you've ever acquired never gets lost - you can get it in your profile within the My Forms tab at any time. Join the platform and easily obtain verified legal templates for any scenario with just a few clicks!

Form popularity

FAQ

1. Personal - jus ad rem, a right enforceable only against a definite person or group of persons. Real - jus ad re, a right enforceable against the whole world.

(a) After default, a secured party may (1) take possession of the collateral; and (2) without removal, may render equipment unusable and dispose of collateral on a debtor's premises.

Practice Overview. Creditor's rights and remedies as a practice area involves the procedural provisions designed to enable creditorspersons who are owed moneyto collect the money the money they are owed.

If a borrower defaults on a secured credit product, the secured creditor has a legal right to the secured asset used as collateral. The secured asset may be seized by the secured creditor and sold to pay off any remaining obligations.

In cases where the obligor breached his/her obligation, s/he shall be liable for damages. 1 If the obligation to give a specific thing is breach by the debtor, the creditor may either compel the debtor to make delivery (specific performance)2 or rescind.

Under §9-622, a proposal to accept collateral in full satisfaction of the debt that is consented to by the debtor discharges the obligation not just the consenting debtor's liability for that obligation.

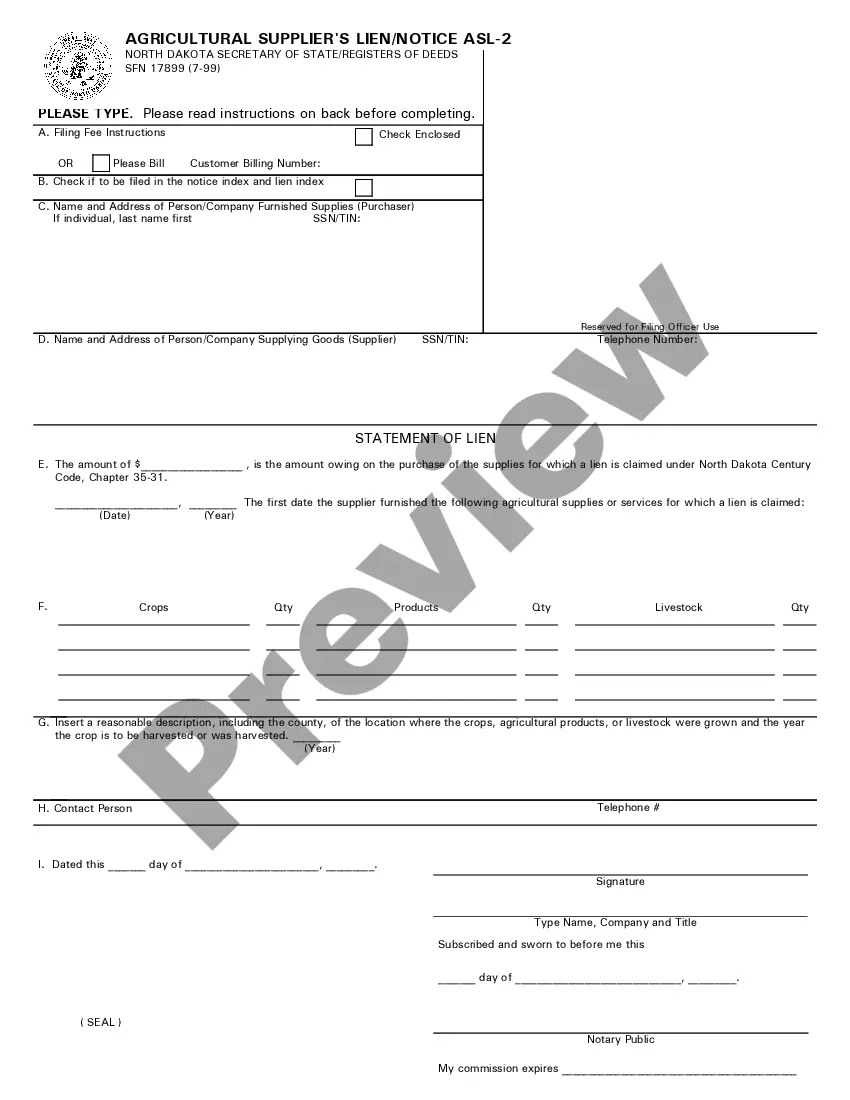

A person in whose favor a security interest is created or provided for under a security agreement, whether or not any obligation to be secured is outstanding. A person that holds an agricultural lien.

The secured party's agreement to accept collateral is self-executing and cannot be breached. The secured party is bound by its agreement to accept collateral and by any proposal to which the debtor consents.

To become a secured party, the creditor must obtain a security interest in the collateral of the debtor.

Secured Party (a/k/a Secured Creditor): A lender, seller, or any other person who is a beneficiary of a security interest, including a person to whom accounts or chattel paper has been sold.