The Nassau New York Liquidation Agreement regarding Debtor's Collateral in Satisfaction of Indebtedness is a legal arrangement that involves the liquidation of a debtor's collateral assets in order to satisfy a debt owed to a creditor in Nassau County, New York. This type of agreement provides a structured process for the resolution of debt by allowing the creditor to use the debtor's collateral as a means of repayment. The liquidation agreement ensures that the creditors are given the authority to seize and sell the debtor's collateral in order to recover the outstanding debt amount. This collateral can include physical assets like vehicles, real estate, equipment, or other valuable possessions that were pledged as security for the debt. The main objective of a Nassau New York Liquidation Agreement regarding Debtor's Collateral in Satisfaction of Indebtedness is to protect the rights and interests of both the creditor and the debtor throughout the liquidation process. By agreeing to this type of arrangement, the debtor acknowledges their inability to repay the debt and allows the creditor to take ownership of the collateral to offset the outstanding amount. Different types of Nassau New York Liquidation Agreements related to debtor's collateral may include: 1. Voluntary Liquidation Agreement: This occurs when the debtor willingly enters into an agreement with the creditor to liquidate the collateral in exchange for debt forgiveness or a negotiated settlement. 2. Involuntary Liquidation Agreement: In this scenario, the creditor initiates legal proceedings to seize and liquidate the debtor's collateral due to non-payment or default. 3. Court-Approved Liquidation Agreement: Sometimes, the liquidation process may require court approval to ensure fairness and adherence to legal procedures. This type of agreement ensures that the liquidation is conducted in accordance with applicable laws and regulations. In conclusion, the Nassau New York Liquidation Agreement regarding Debtor's Collateral in Satisfaction of Indebtedness is a legal mechanism that allows a creditor to liquidate a debtor's collateral assets in order to settle the outstanding debt. This ensures that creditors have a means of recovering their funds while protecting the rights and interests of all parties involved.

Nassau New York Liquidation Agreement regarding Debtor's Collateral in Satisfaction of Indebtedness

Description

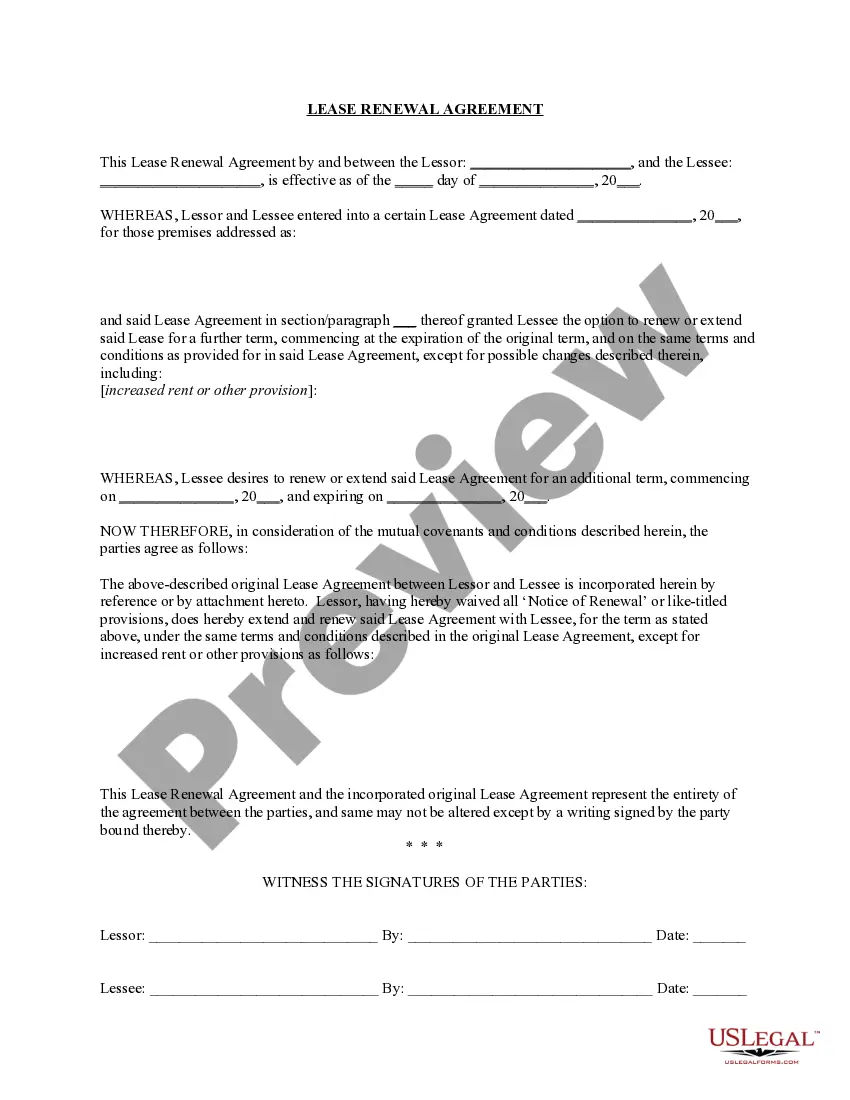

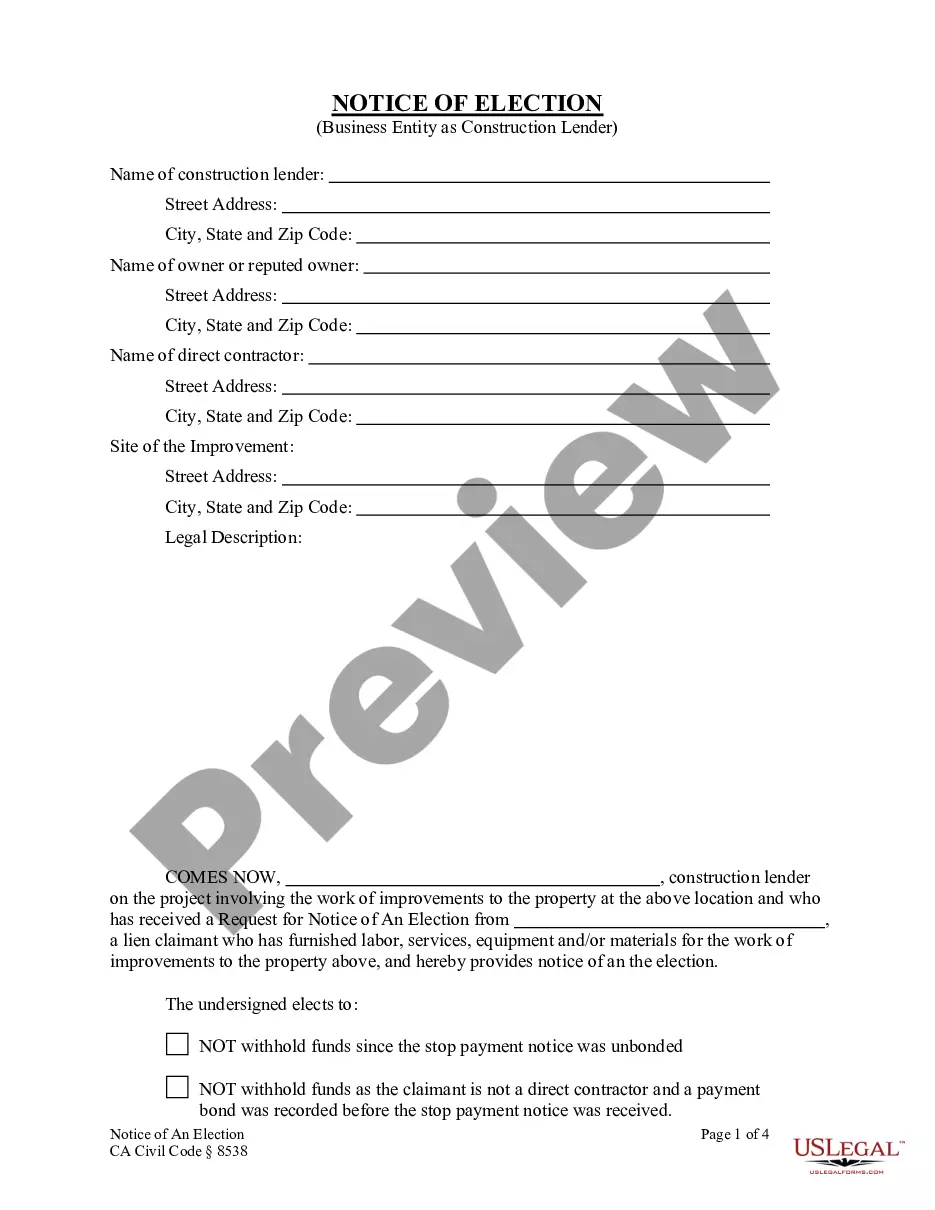

How to fill out Nassau New York Liquidation Agreement Regarding Debtor's Collateral In Satisfaction Of Indebtedness?

Whether you plan to open your company, enter into a deal, apply for your ID update, or resolve family-related legal issues, you need to prepare certain documentation corresponding to your local laws and regulations. Finding the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 professionally drafted and checked legal documents for any individual or business occasion. All files are collected by state and area of use, so opting for a copy like Nassau Liquidation Agreement regarding Debtor's Collateral in Satisfaction of Indebtedness is fast and straightforward.

The US Legal Forms website users only need to log in to their account and click the Download button next to the required form. If you are new to the service, it will take you several additional steps to get the Nassau Liquidation Agreement regarding Debtor's Collateral in Satisfaction of Indebtedness. Adhere to the guidelines below:

- Make certain the sample fulfills your individual needs and state law regulations.

- Read the form description and check the Preview if available on the page.

- Utilize the search tab specifying your state above to locate another template.

- Click Buy Now to get the sample once you find the right one.

- Select the subscription plan that suits you most to continue.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the Nassau Liquidation Agreement regarding Debtor's Collateral in Satisfaction of Indebtedness in the file format you prefer.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Forms provided by our website are reusable. Having an active subscription, you are able to access all of your earlier purchased paperwork at any moment in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date formal documentation. Join the US Legal Forms platform and keep your paperwork in order with the most extensive online form collection!