Although no definite rule exists for determining whether one is an independent contractor or an employee, certain indicia of the status of an independent contractor are recognized, and the insertion of provisions embodying these indicia in the contract will help to insure that the relationship reflects the intention of the parties. These indicia generally relate to the basic issue of control. The general test of what constitutes an independent contractor relationship involves which party has the right to direct what is to be done, and how and when. Another important test involves the method of payment of the contractor.

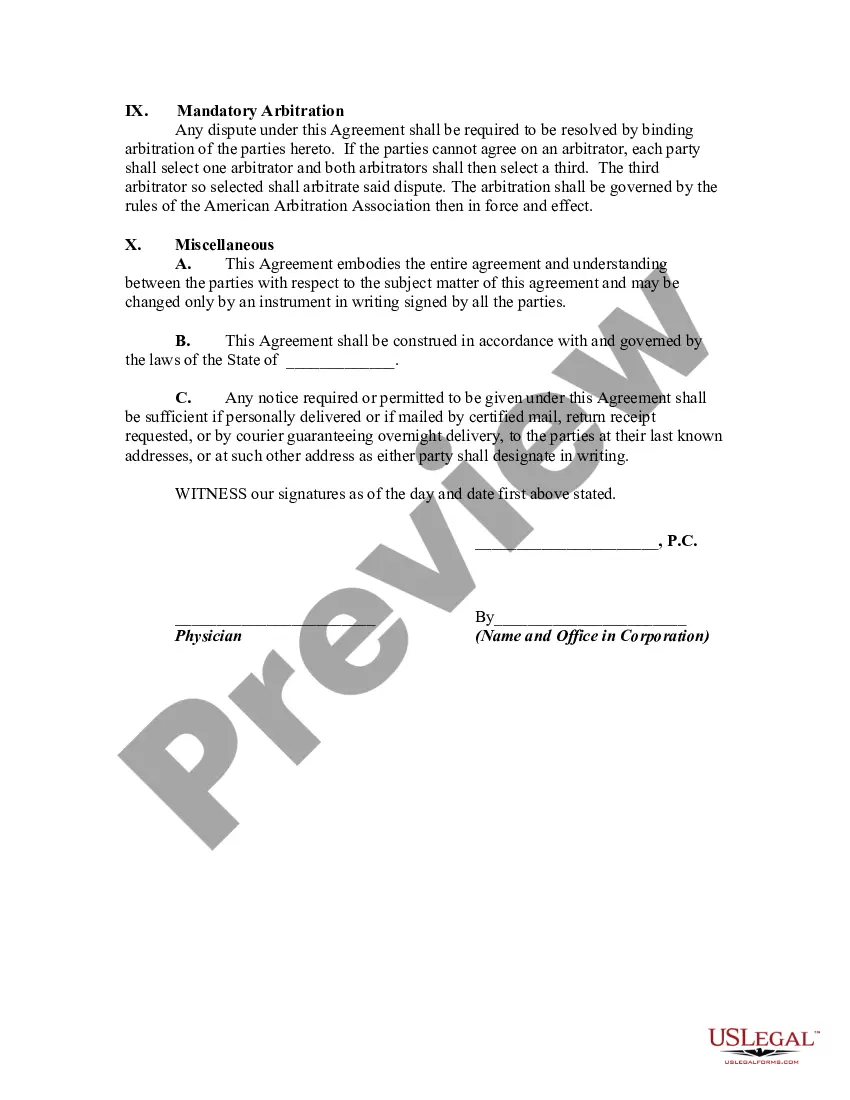

Collin Texas Agreement Between Physician as Self-Employed Independent Contractor and Professional Corporation is a legal document that outlines the terms and conditions for the provision of medical services by a physician as an independent contractor to a professional corporation. This agreement ensures clarity and protection for both parties involved in the arrangement. In Collin Texas, there may be different types of agreements between physicians and professional corporations, each with its own specific nuances and conditions. Some of these agreements may include: 1. General Collin Texas Agreement Between Physician as Self-Employed Independent Contractor and Professional Corporation: This is the most common type of agreement, covering the basic terms and responsibilities of the physician as an independent contractor providing medical services to the professional corporation. 2. Compensation Agreement: This type of agreement focuses on establishing the compensation structure for the physician's services, including fee structures, billing arrangements, and any additional compensation methods such as bonuses or incentives. 3. Non-Compete Agreement: In certain situations, a physician may be required to enter into a non-compete agreement with the professional corporation. This agreement restricts the physician from practicing within a specific geographic area or time period, both during and after the termination of the agreement. 4. Term Agreement: A term agreement specifies the duration of the contractual relationship between the physician and the professional corporation. It outlines the start and end dates of the agreement, termination clauses, and any provisions regarding the renewal or extension of the contract. 5. Scope of Services Agreement: This type of agreement defines the specific scope of medical services the physician is expected to provide. It may include details about the types of medical procedures, treatments, or specialties involved, as well as any limitations or expectations for the physician's professional practice. These are just a few examples of the different types of Collin Texas Agreement Between Physician as Self-Employed Independent Contractor and Professional Corporation. It is important for both parties to carefully review and negotiate the terms of the agreement to ensure mutual understanding and compliance with all legal requirements. It is always recommended seeking legal advice from professionals familiar with healthcare laws in Collin Texas to ensure the agreement conforms to all legal standards.