The Travis Texas Agreement Between Physician as Self-Employed Independent Contractor and Professional Corporation is a legally binding contract that establishes the terms and conditions between a physician and a professional corporation in Travis County, Texas. This agreement outlines the relationship, responsibilities, and obligations of both parties involved. Keywords: Travis Texas, Agreement Between Physician, Self-Employed Independent Contractor, Professional Corporation, legal contract, terms and conditions, responsibilities, obligations, relationship. There are different types of Travis Texas Agreement Between Physician as Self-Employed Independent Contractor and Professional Corporation, which include but are not limited to: 1. General Agreement: This type of agreement outlines the general terms and conditions of the physician's engagement as an independent contractor with the professional corporation. It covers aspects such as compensation, work hours, scope of practice, termination, and confidentiality. 2. Non-Compete Agreement: In certain cases, the physician may be required to sign a non-compete agreement as part of the contractual obligations. This agreement restricts the physician from practicing within a specific geographic area or competing with the professional corporation for a certain period after termination. 3. Partnership Agreement: If the physician wishes to become a partner in the professional corporation, a partnership agreement may be established. This agreement not only covers the usual terms and conditions but also outlines the capital contributions, profit-sharing arrangements, decision-making processes, and dissolution procedures. 4. Buy-Sell Agreement: In the scenario where the physician intends to buy or sell shares in the professional corporation, a buy-sell agreement is executed. This agreement sets the terms for the purchase or sale of shares, including valuation methods, payment terms, and conditions for triggering a buy-sell event. 5. Services Agreement: Occasionally, a physician may provide specific services to the professional corporation through an independent contractor arrangement. This services agreement details the nature of the services to be rendered, compensation, performance standards, and termination provisions. It is crucial for both the physician and the professional corporation to ensure that the type of Travis Texas Agreement Between Physician as Self-Employed Independent Contractor and Professional Corporation aligns with their specific needs and objectives. Seeking legal counsel to draft or review the agreement before signing is highly recommended protecting the interests of all parties involved.

Travis Texas Agreement Between Physician as Self-Employed Independent Contractor and Professional Corporation

Description

How to fill out Travis Texas Agreement Between Physician As Self-Employed Independent Contractor And Professional Corporation?

Drafting documents for the business or personal demands is always a big responsibility. When drawing up a contract, a public service request, or a power of attorney, it's essential to take into account all federal and state laws of the particular area. Nevertheless, small counties and even cities also have legislative procedures that you need to consider. All these details make it tense and time-consuming to draft Travis Agreement Between Physician as Self-Employed Independent Contractor and Professional Corporation without expert assistance.

It's easy to avoid wasting money on attorneys drafting your paperwork and create a legally valid Travis Agreement Between Physician as Self-Employed Independent Contractor and Professional Corporation on your own, using the US Legal Forms web library. It is the largest online collection of state-specific legal templates that are professionally verified, so you can be sure of their validity when choosing a sample for your county. Earlier subscribed users only need to log in to their accounts to download the needed document.

In case you still don't have a subscription, follow the step-by-step guide below to get the Travis Agreement Between Physician as Self-Employed Independent Contractor and Professional Corporation:

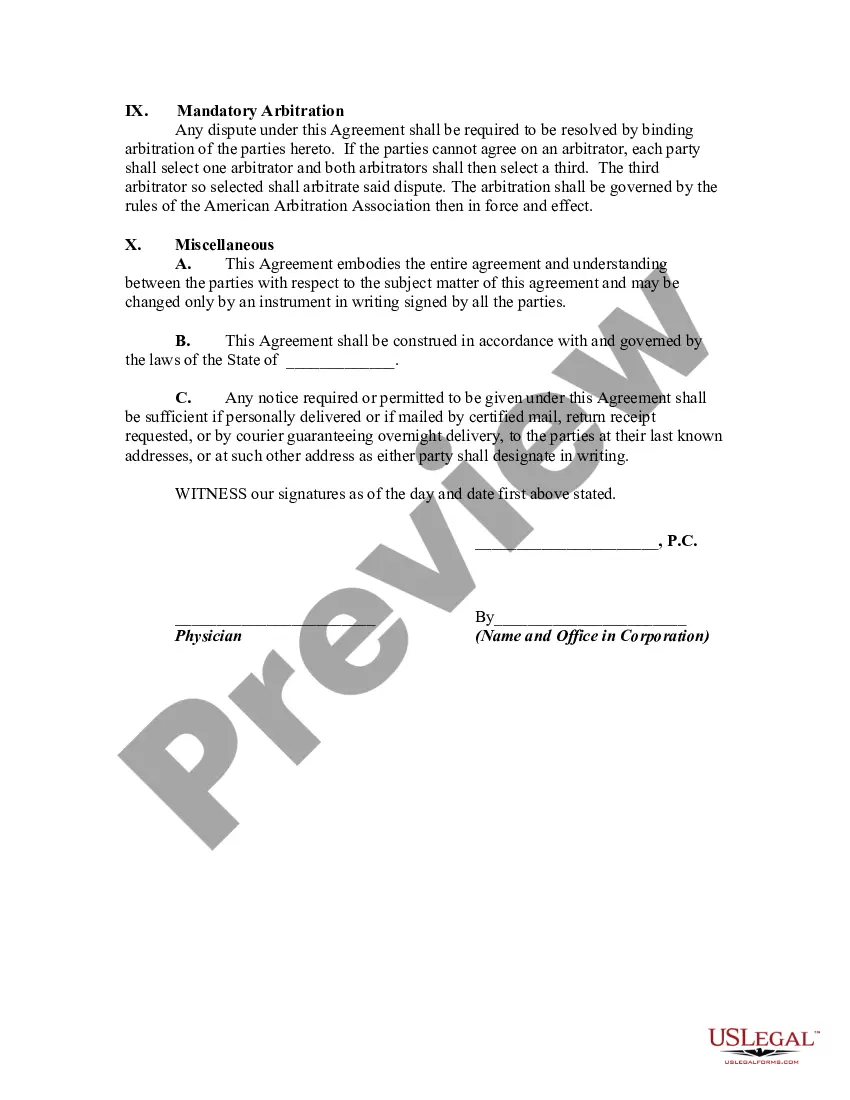

- Examine the page you've opened and verify if it has the sample you need.

- To do so, use the form description and preview if these options are presented.

- To find the one that fits your requirements, use the search tab in the page header.

- Double-check that the template complies with juridical criteria and click Buy Now.

- Opt for the subscription plan, then sign in or register for an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the selected document in the preferred format, print it, or fill it out electronically.

The exceptional thing about the US Legal Forms library is that all the paperwork you've ever obtained never gets lost - you can get it in your profile within the My Forms tab at any time. Join the platform and quickly obtain verified legal forms for any use case with just a few clicks!