Kings New York Assignment of Partnership Interest

Description

How to fill out Assignment Of Partnership Interest?

Drafting documents for commercial or personal needs is consistently a significant obligation.

When creating a contract, a public service application, or a power of attorney, it is crucial to consider all federal and state laws pertinent to the specific region.

However, small counties and even municipalities also possess legislative rules that must be taken into account.

- All these factors render it challenging and labor-intensive to prepare a Kings Assignment of Partnership Interest without professional assistance.

- It's feasible to avoid incurring expenses for attorneys by preparing your documents and producing a legally valid Kings Assignment of Partnership Interest independently, utilizing the US Legal Forms online library.

- This resource is the largest digital collection of state-specific legal templates that are professionally verified, ensuring you can trust their legitimacy when choosing a sample for your county.

- Previous subscribers only need to Log In to their accounts to retrieve the necessary form.

- If you do not currently have a subscription, follow the step-by-step instructions below to acquire the Kings Assignment of Partnership Interest.

- Examine the page you have accessed and verify if it contains the document you are looking for.

- Use the form description and preview if these options are available.

Form popularity

FAQ

Yes, the sale of partnership interest is reported on Schedule K-1 for IRS filings. The K-1 form details each partner's share of income, deductions, and payments. If you have a Kings New York Assignment of Partnership Interest, properly reporting this transaction is crucial for accurate tax compliance.

A partner may assign their interests in a partnership during various situations, such as retirement, financial necessity, or restructuring the partnership. Assigning interests is a strategic move that can help address business needs while realigning partnership roles. In the realm of Kings New York Assignment of Partnership Interest, it’s essential to recognize when and why such actions are taken to maintain a healthy partnership.

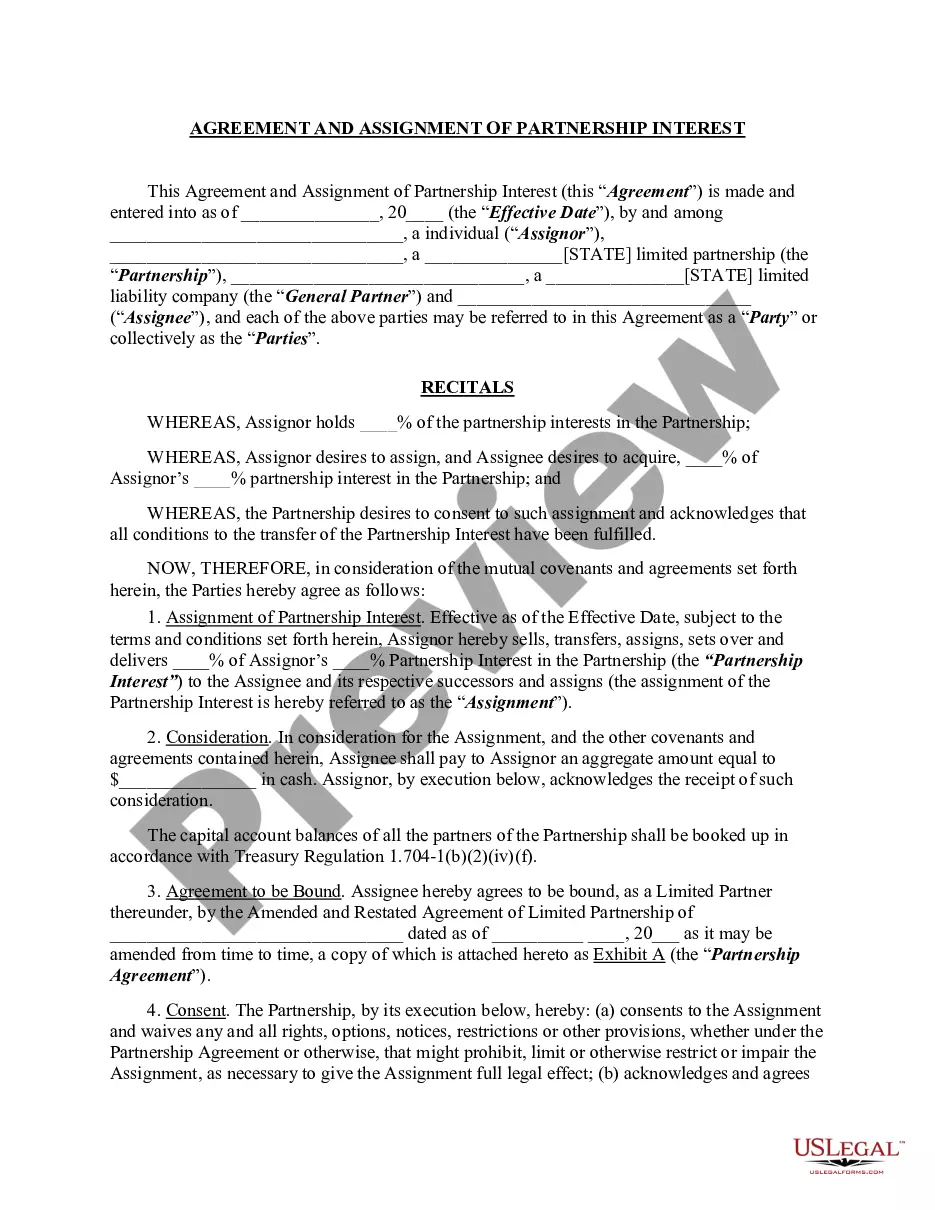

An Assignment of Partnership Interest occurs when a partner sells their stake in a partnership to a third party. The assignment document records the details of the transfer to the new partner.

Put simply, a partnership interest is the percentage of a partnership owned by a particular member or individual. Partnerships in this context refer to specific way of organizing business ownership wherein each owner is a partner, normally with equal rights, privileges, and obligations to the company as a whole.

There are two parties in the assignment of interest: assignor and assignee. The assignor is the business partner who is transferring their rights in the partnership in exchange for compensation. The assignee is a new partner who purchases the previous partner's interest in the partnership.

In general, as noted earlier, the transferee of a partnership interest must withhold a tax equal to 10% of the amount realized by the transferor on any transfer of a partnership interest unless an applicable exception applies (as discussed below).

An assignment of membership interest is a legal document that allows members of a Limited Liability Company (or LLC) to reassign their interest in the company to a different party. LLC laws are different from state to state, so what's required in an assignment of membership agreement changes.

Assigning Partner means a Partner who has assigned a beneficial interest in that Partner's partnership interest, the Assignee of which has not become a "Substituted Limited Partner."

The assignment of a limited partnership interest will often be effected by way of a deed of transfer and an accompanying sale and purchase agreement which may contain simple warranties such as those relating to ownership of the limited partnership interests.

A partner's interest in a partnership is considered personal property that may be assigned to other persons.