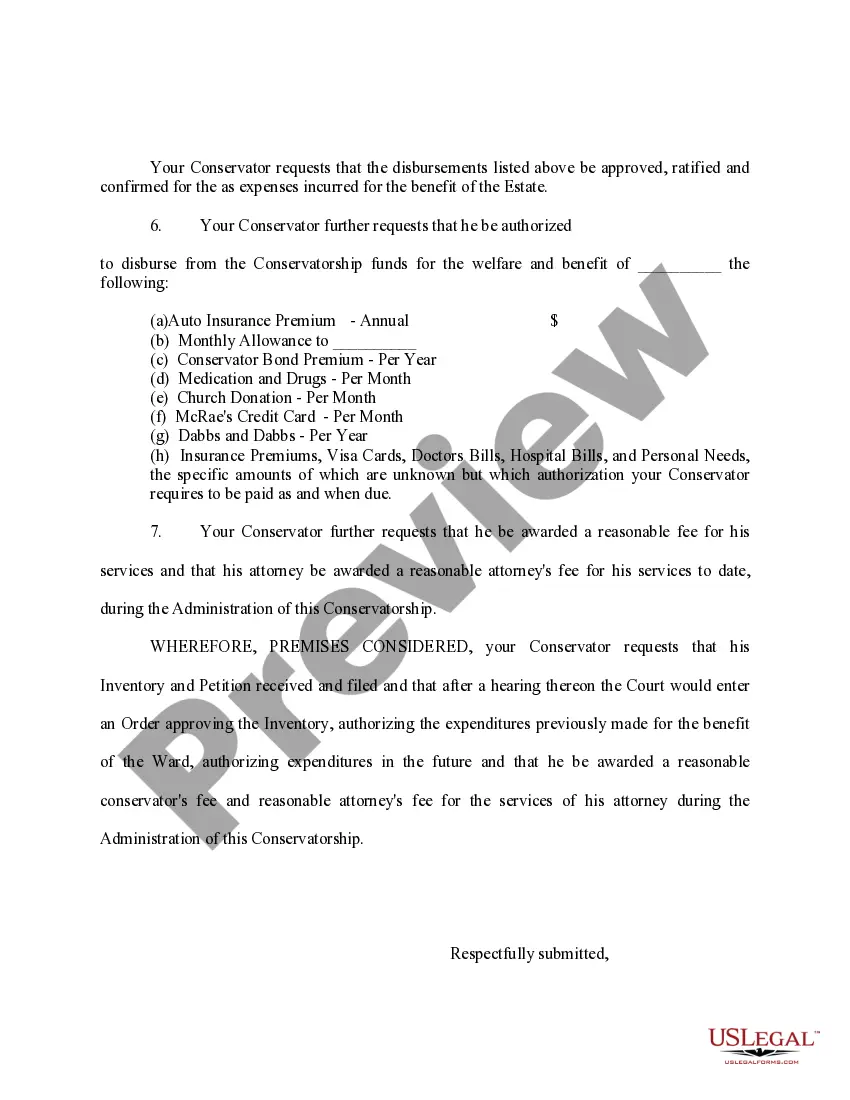

Clark Nevada Inventory is a legal document that provides a detailed listing of an individual's assets and possessions within Clark County, Nevada. This inventory acts as evidence to ascertain the value of the estate or property for various legal purposes such as probate, divorce proceedings, or bankruptcy cases. It includes all personal and real properties, financial accounts, valuables, vehicles, and other tangible and intangible assets owned by an individual at the time of creating the inventory. Petition to Approve Expenses and Monthly Allowances in Clark Nevada refers to a legal request submitted to the court seeking approval for various necessary expenses and regular allowances for individuals involved in legal matters. Such petitions are commonly filed in guardianship cases, wherein a person is appointed as a guardian for a minor, incapacitated adult, or an individual requiring protective services. The petition outlines the anticipated expenses related to the care, support, and education of the ward, including medical bills, housing costs, utilities, and other essentials. Monthly allowances may also be requested to ensure the ward's ongoing financial stability. Furthermore, Clark Nevada provides different types of relief options in addition to approving expenses and monthly allowances. These may include the following: 1. Petition for Special Relief: This type of petition is filed to request specific assistance or intervention from the court concerning a particular matter. It could involve an urgent request to address an emergency situation, temporary restraining order, or other exceptional circumstances requiring immediate attention. 2. Petition for Extraordinary Expenses: In certain cases, individuals may need to seek approval for substantial expenses that go beyond the regular allowances. These could involve costs for specialized medical treatments, education, or other unique circumstances requiring additional financial support. 3. Petition for Other Relief: This broad category encompasses various types of petitions that do not fit into the aforementioned classifications but still seek assistance from the court. It may include requests for modification of an existing court order, termination of guardianship, appointment of alternative guardian, or any other specific relief required based on the individual circumstances of the case. Overall, the Clark Nevada Inventory, Petition to Approve Expenses and Monthly Allowances, and Other Relief processes are important legal procedures aimed at ensuring the fair and equitable management of assets, the provision of essential support, and the resolution of specific issues within the jurisdiction of Clark County, Nevada.

Clark Nevada Inventory, Petition to Approve Expenses and Monthly Allowances, and for Other Relief

Description

How to fill out Clark Nevada Inventory, Petition To Approve Expenses And Monthly Allowances, And For Other Relief?

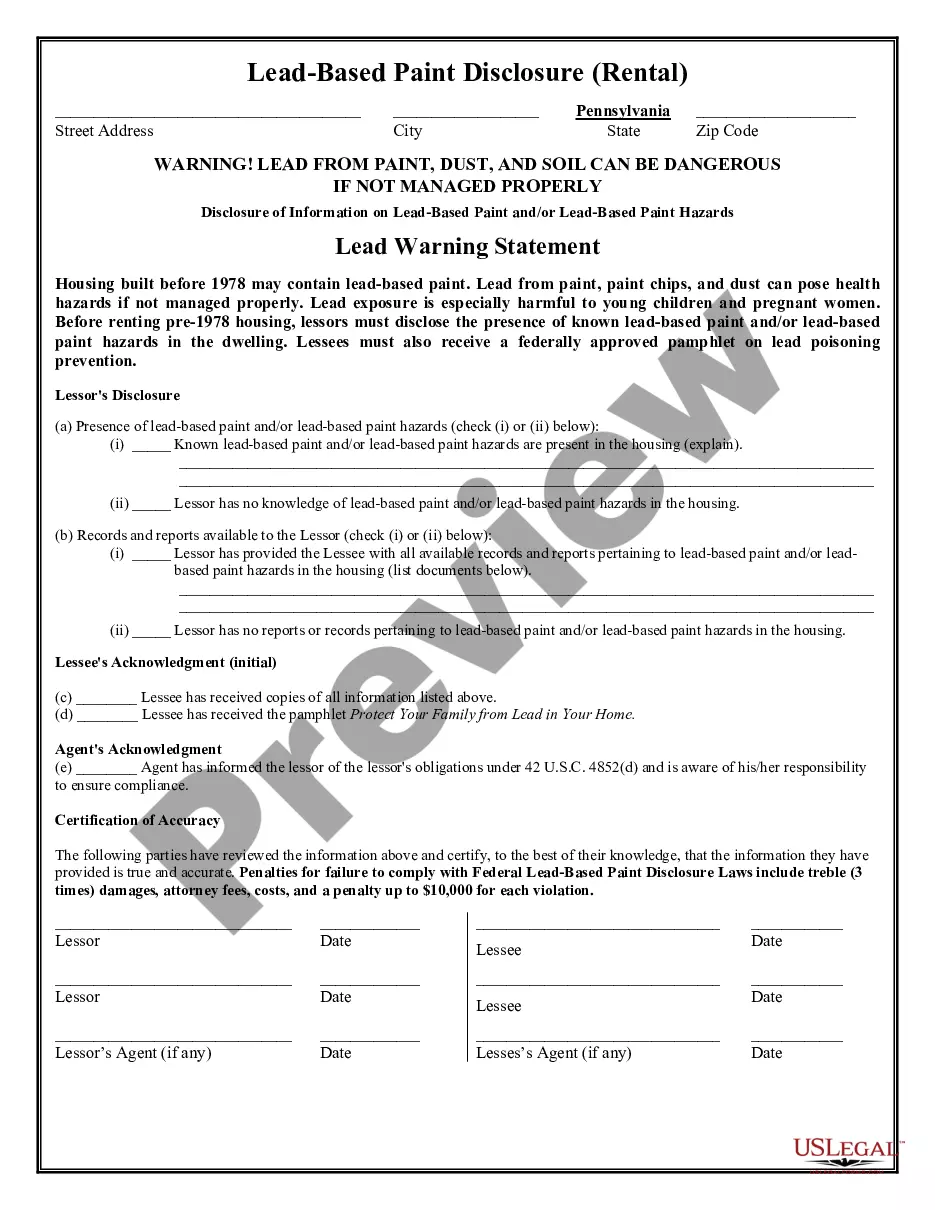

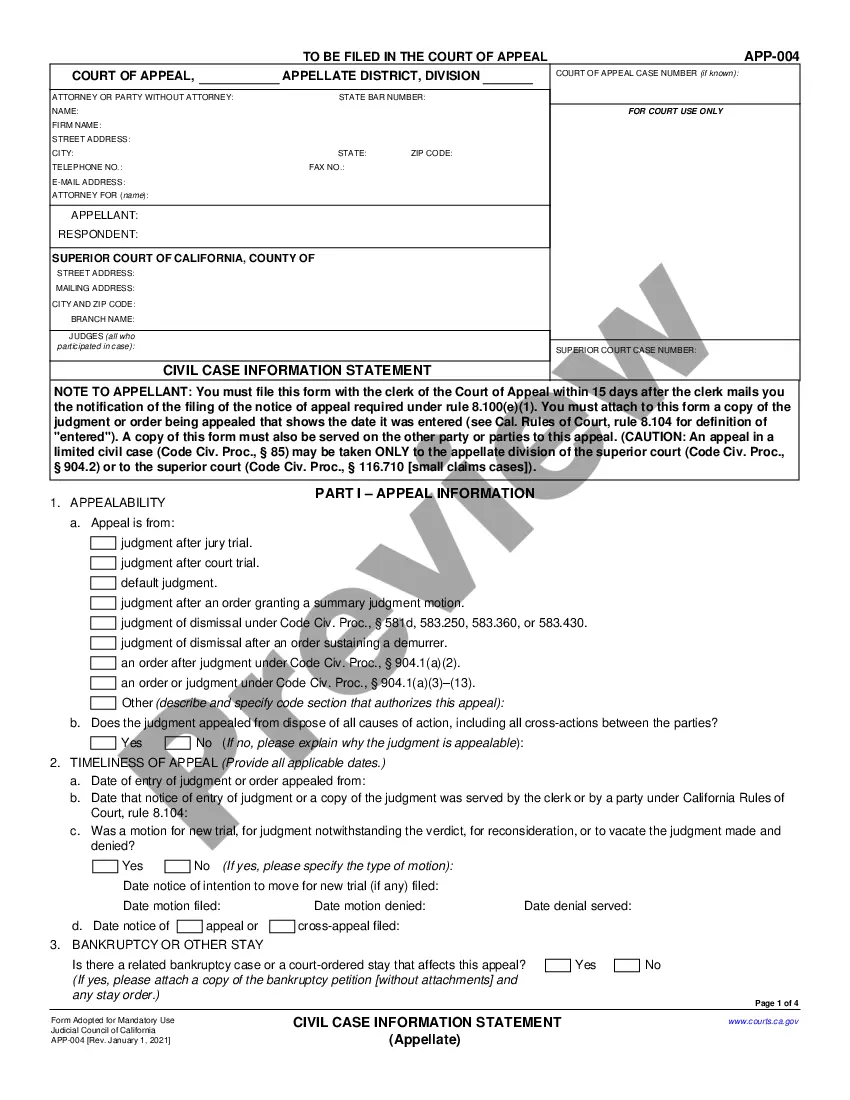

How much time does it normally take you to draw up a legal document? Because every state has its laws and regulations for every life situation, finding a Clark Inventory, Petition to Approve Expenses and Monthly Allowances, and for Other Relief meeting all local requirements can be tiring, and ordering it from a professional attorney is often costly. Numerous web services offer the most common state-specific templates for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most comprehensive web catalog of templates, gathered by states and areas of use. Aside from the Clark Inventory, Petition to Approve Expenses and Monthly Allowances, and for Other Relief, here you can get any specific form to run your business or individual deeds, complying with your county requirements. Professionals verify all samples for their validity, so you can be certain to prepare your documentation correctly.

Using the service is remarkably easy. If you already have an account on the platform and your subscription is valid, you only need to log in, choose the required form, and download it. You can retain the file in your profile anytime in the future. Otherwise, if you are new to the platform, there will be a few more actions to complete before you obtain your Clark Inventory, Petition to Approve Expenses and Monthly Allowances, and for Other Relief:

- Examine the content of the page you’re on.

- Read the description of the template or Preview it (if available).

- Look for another form using the corresponding option in the header.

- Click Buy Now when you’re certain in the chosen file.

- Select the subscription plan that suits you most.

- Register for an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Switch the file format if needed.

- Click Download to save the Clark Inventory, Petition to Approve Expenses and Monthly Allowances, and for Other Relief.

- Print the doc or use any preferred online editor to complete it electronically.

No matter how many times you need to use the purchased template, you can locate all the samples you’ve ever downloaded in your profile by opening the My Forms tab. Give it a try!

Form popularity

FAQ

How long does probate take? California law says the personal representative must complete probate within one year from the date of appointment, unless s/he files a federal estate tax. In this case, the personal representative can have 18 months to complete probate.

In order to close a probate estate in California, the appointed personal representative must file a petition with the probate court which reports everything he/she has done in regards to the estate. The personal representative must file a Petition for Final Distribution within one year after Letters are issued.

Most Estates are open about a year since the various tasks of paying taxes, selling property, locating heirs, etc, often take that long. At the very least, one can expect six to nine months of time before the Estate can close and if there is litigation outstanding, the Estate can stay open for years.

Without opening probate, any assets titled in the decedent's name, including real estate and vehicles, will remain in the decedent's name for an indefinite period of time. This prevents you from selling them to pay off debts, distributing them to the beneficiaries, or keeping registration current.

The final accounting is a summary of accounts filed by the probate executor, showing details of important financial undertakings during the accounting period. This form may not outline all the information, but those records are kept for future use.

The court issues this person "letters testamentary," which give the person authority to take charge of estate assets. If there's no will, a family memberusually the surviving spouse or grown childasks the court to be appointed as administrator, and the court issues "letters of administration."

Paying Debts and Taxes Illinois, for example, requires executors to allow six months. California requires a bit less, with four months.

The final distribution of probate is the transfer of title and assets to the heirs and beneficiaries named in the decedent's estate. This takes place after the probate has been fully administered and the judge signs off that the estate is settled and can be distributed.

Probate is generally required in California. However, there are two different types of probate for estates. Simplified procedures may be used if the value of the estate is less than $166,250. Probate may not be necessary if assets are attached to a beneficiary or surviving owner.

The California petition for final distribution gives the court a detailed history of the probate case. More specifically, it explains why the estate is ready to close and outlines the distributions to beneficiaries.