Nassau New York Agreement to Repay Cash Advance on Credit Card is a legally binding contract that outlines the terms and conditions for repaying a cash advance taken on a credit card within the jurisdiction of Nassau County, New York. This agreement ensures that both the credit card holder and the creditor are on the same page regarding the repayment schedule and any associated fees or interest rates. Relevant Keywords: Nassau New York Agreement, Repay, Cash Advance, Credit Card, Terms and Conditions, Legally Binding, Jurisdiction, Nassau County, New York, Repayment Schedule, Fees, Interest Rates. Different Types of Nassau New York Agreement to Repay Cash Advance on Credit Card: 1. Standard Repayment Agreement: This type of agreement is the most common and establishes the repayment terms for a cash advance taken on a credit card. It outlines the duration of the repayment period, the minimum monthly payments required, and any applicable interest rates or fees. 2. Balance Transfer Agreement: In this type of agreement, the credit card holder can transfer the outstanding balance from one credit card to another. It specifies the terms and conditions of the balance transfer, including any introductory interest rates or promotional offers. 3. Deferred Payment Agreement: When a credit card holder is facing financial difficulties, they may negotiate a deferred payment agreement with the creditor. This type of agreement allows for a temporary suspension or reduction of the monthly payments, providing some relief until the cardholder can resume regular payments. 4. Settlement Agreement: In certain cases, a credit card issuer may agree to settle the outstanding debt for a lesser amount than what is owed. This agreement outlines the terms of the settlement, including the reduced payment amount, any required lump sum payment, and the impact on the credit score of the cardholder. 5. Pay-for-Delete Agreement: If there are inaccuracies or discrepancies on a credit card holder's account, they may negotiate a pay-for-delete agreement. This type of agreement involves paying off the debt in exchange for the creditor removing the negative information from the credit report. 6. Hardship Repayment Agreement: When a credit cardholder experiences a significant change in their financial circumstances, such as a job loss or medical emergency, they may seek a hardship repayment agreement. This agreement typically reduces the interest rate, lowers the monthly payments, or extends the repayment term to accommodate the cardholder's financial situation. In conclusion, the Nassau New York Agreement to Repay Cash Advance on Credit Card ensures that credit card holders and creditors in Nassau County, New York, have a clear understanding of the terms and conditions for repaying cash advances. This agreement can take various forms, including standard repayment agreements, balance transfer agreements, deferred payment agreements, settlement agreements, pay-for-delete agreements, and hardship repayment agreements.

Nassau New York Agreement to Repay Cash Advance on Credit Card

Description

How to fill out Nassau New York Agreement To Repay Cash Advance On Credit Card?

Drafting papers for the business or individual demands is always a huge responsibility. When drawing up a contract, a public service request, or a power of attorney, it's important to take into account all federal and state laws of the specific region. However, small counties and even cities also have legislative provisions that you need to consider. All these details make it stressful and time-consuming to draft Nassau Agreement to Repay Cash Advance on Credit Card without expert help.

It's possible to avoid wasting money on lawyers drafting your paperwork and create a legally valid Nassau Agreement to Repay Cash Advance on Credit Card on your own, using the US Legal Forms web library. It is the biggest online catalog of state-specific legal documents that are professionally cheched, so you can be certain of their validity when selecting a sample for your county. Earlier subscribed users only need to log in to their accounts to save the required document.

In case you still don't have a subscription, follow the step-by-step guideline below to get the Nassau Agreement to Repay Cash Advance on Credit Card:

- Examine the page you've opened and check if it has the document you require.

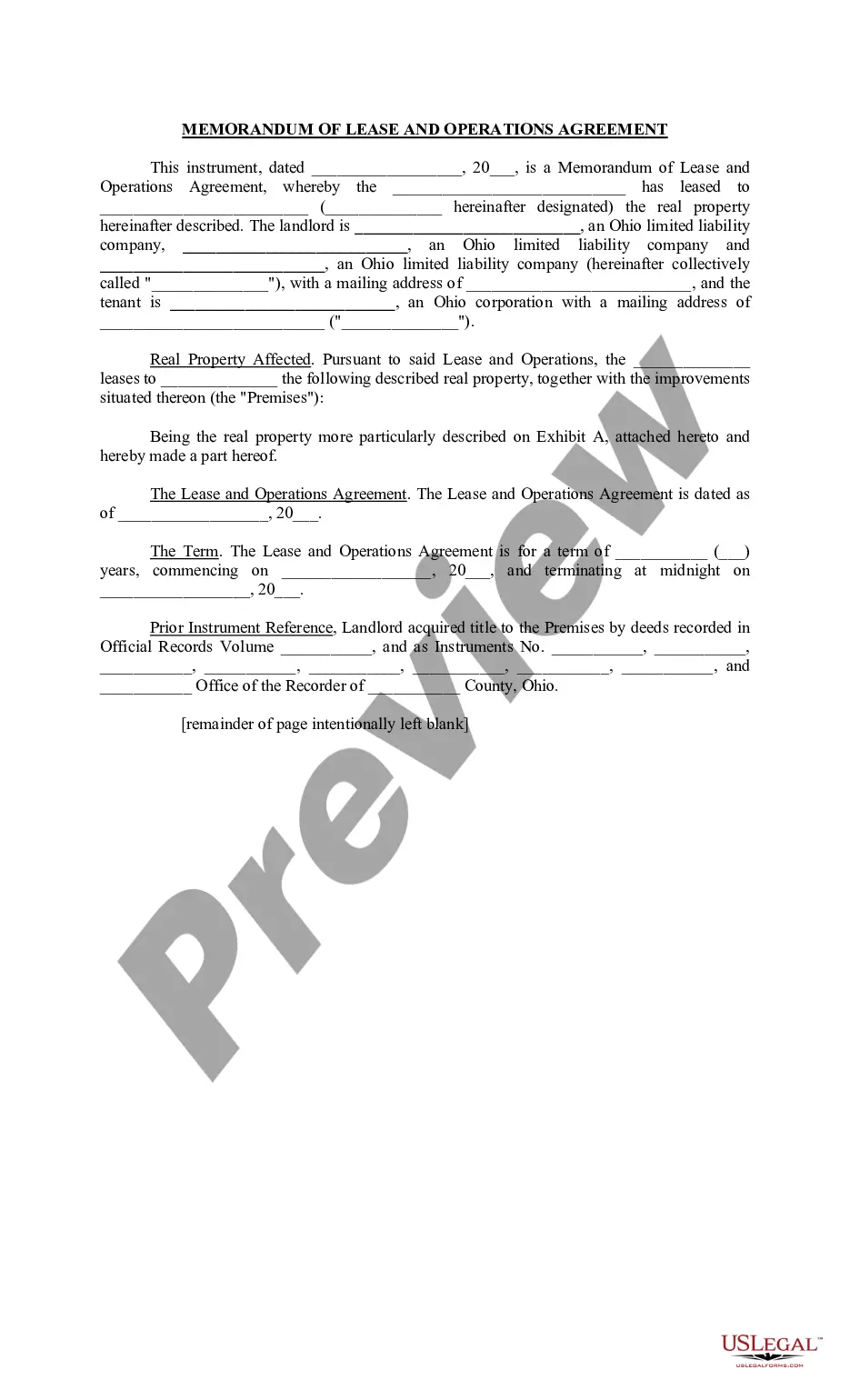

- To do so, use the form description and preview if these options are presented.

- To find the one that fits your needs, utilize the search tab in the page header.

- Recheck that the template complies with juridical criteria and click Buy Now.

- Choose the subscription plan, then log in or register for an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the selected document in the preferred format, print it, or fill it out electronically.

The great thing about the US Legal Forms library is that all the paperwork you've ever purchased never gets lost - you can access it in your profile within the My Forms tab at any time. Join the platform and easily get verified legal forms for any scenario with just a couple of clicks!