Queens New York Agreement to Repay Cash Advance on Credit Card: A Comprehensive Guide Introduction: The Queens New York Agreement to Repay Cash Advance on Credit Card is a legally binding document that outlines the terms and conditions for repaying a cash advance borrowed by a credit card holder in Queens, New York. This agreement protects both the cardholder and the credit card issuer by establishing clear repayment terms, interest rates, and penalty fees in case of default. Keywords: Queens New York, Agreement, Repay, Cash Advance, Credit Card Types of Queens New York Agreements to Repay Cash Advances on Credit Cards: 1. Fixed-Term Repayment Agreement: In this type of agreement, the cardholder agrees to repay the cash advance in equal monthly installments over a predetermined period. The repayment period usually ranges between six months to a year, depending on the amount borrowed and the credit card issuer's policies. 2. Variable Repayment Agreement: A variable repayment agreement allows the cardholder to repay the cash advance based on a percentage of their monthly credit card sales or a fixed monthly payment. This type of arrangement is commonly used by business owners who rely on credit card sales as their main source of income. 3. Deferred Repayment Agreement: In certain cases, cardholders may opt for a deferred repayment agreement, where they can postpone the repayment of the cash advance for a specific period. However, interest charges may still accrue during the deferral period. 4. Balance Transfer Agreement: Sometimes, credit cardholders in Queens, New York, choose to transfer the outstanding cash advance balance to another credit card with a lower interest rate. This type of agreement involves terms and conditions specific to the credit card issuer accepting the balance transfer. Relevant content for Queens New York Agreement to Repay Cash Advance on Credit Card: When entering into a Queens New York Agreement to Repay Cash Advance on a Credit Card, it is crucial to consider the following key points: 1. Repayment Terms: The agreement should clearly state the repayment terms, including the amount borrowed, the interest rate applied, and the repayment period. It is essential to understand the repayment schedule to avoid any surprises or penalties for late payments. 2. Interest Rates and Fees: The document should outline the interest rates applied to the cash advance and any additional fees associated with late payments or defaults. Queens, New York, may have specific laws regarding maximum interest rates and fees that need to be adhered to. 3. Payment Methods: The agreement should specify the accepted payment methods and the channels through which the cardholder can make timely repayments. This may include online payment platforms, automatic deductions, or over-the-counter cash payments. 4. Default Consequences: In the event of default on repayments, the agreement should clearly define the consequences. This may include increased interest rates, penalty fees, reporting to credit bureaus, or legal actions, such as debt collection or lawsuits. 5. Rights and Responsibilities: Both the cardholder and the credit card issuer have rights and responsibilities outlined in the agreement. The cardholder is responsible for making timely payments, while the issuer must provide accurate monthly statements, adhere to the agreed-upon interest rates, and handle any disputes fairly. Conclusion: The Queens New York Agreement to Repay Cash Advance on Credit Card is a vital legal document that ensures the smooth repayment of cash advances borrowed on credit cards. It safeguards the interests of both the cardholder and the credit card issuer by providing clear guidelines for repayment terms, interest rates, and penalties. By understanding the details and different types of Queens New York Agreements to Repay Cash Advances on Credit Cards, cardholders can make informed decisions and ensure responsible borrowing practices.

Queens New York Agreement to Repay Cash Advance on Credit Card

Description

How to fill out Queens New York Agreement To Repay Cash Advance On Credit Card?

Creating legal forms is a must in today's world. However, you don't always need to look for qualified assistance to draft some of them from scratch, including Queens Agreement to Repay Cash Advance on Credit Card, with a service like US Legal Forms.

US Legal Forms has over 85,000 forms to pick from in different types varying from living wills to real estate papers to divorce documents. All forms are arranged based on their valid state, making the searching process less challenging. You can also find information materials and tutorials on the website to make any tasks associated with paperwork completion straightforward.

Here's how to purchase and download Queens Agreement to Repay Cash Advance on Credit Card.

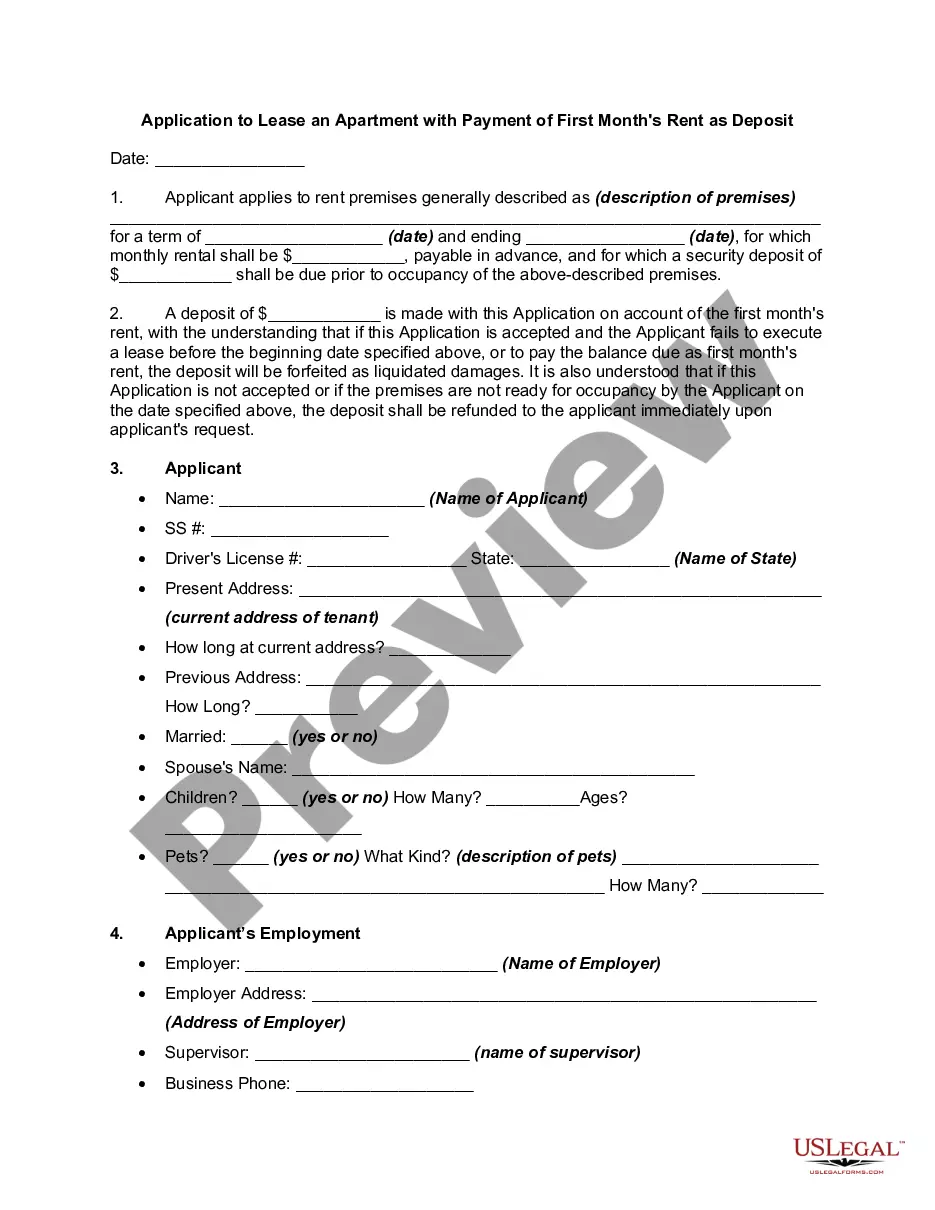

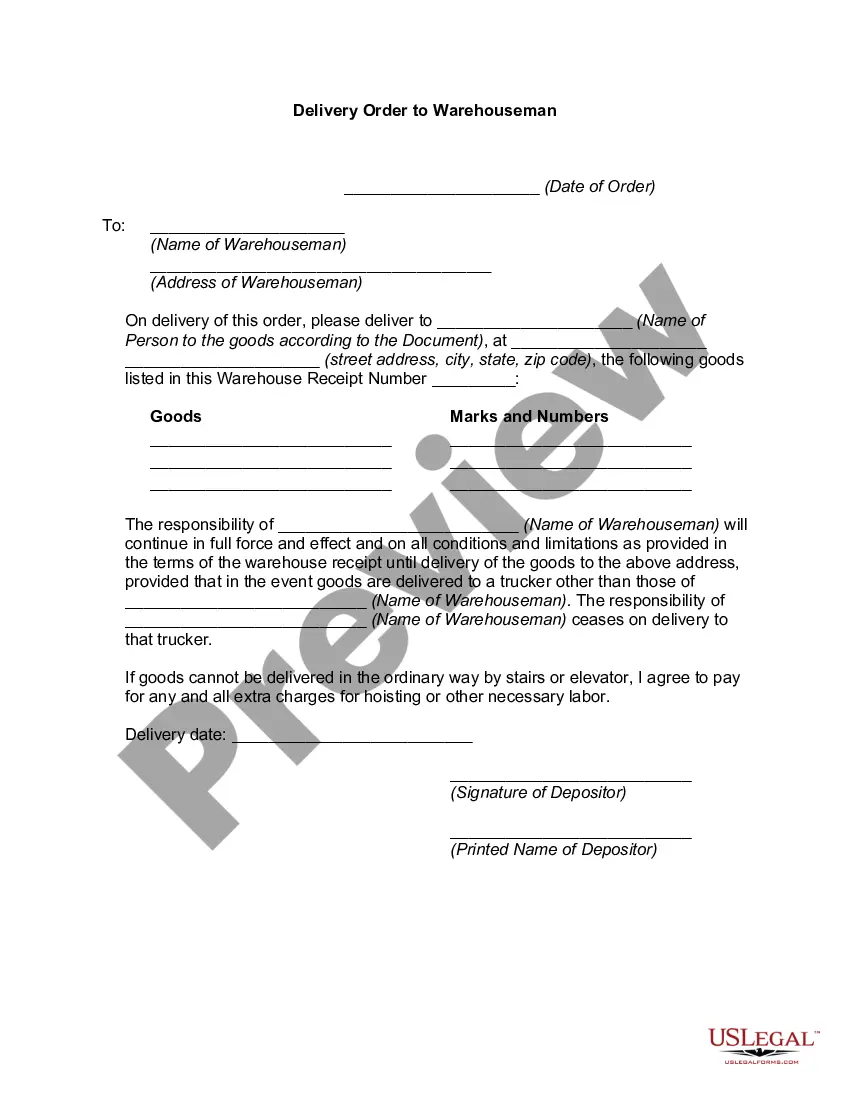

- Go over the document's preview and outline (if available) to get a basic information on what you’ll get after downloading the form.

- Ensure that the template of your choice is specific to your state/county/area since state laws can affect the legality of some documents.

- Check the related forms or start the search over to find the correct file.

- Hit Buy now and register your account. If you already have an existing one, select to log in.

- Choose the pricing {plan, then a suitable payment gateway, and buy Queens Agreement to Repay Cash Advance on Credit Card.

- Select to save the form template in any offered file format.

- Go to the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can find the appropriate Queens Agreement to Repay Cash Advance on Credit Card, log in to your account, and download it. Needless to say, our platform can’t replace a lawyer entirely. If you need to cope with an extremely difficult situation, we recommend getting an attorney to review your document before signing and filing it.

With more than 25 years on the market, US Legal Forms became a go-to platform for many different legal forms for millions of customers. Join them today and purchase your state-compliant paperwork effortlessly!