San Diego California Officers Bonus — Percenprofitfi— - Resolution Form is a vital document that outlines the terms and conditions for calculating and issuing bonuses to officers of a company based on the percentage of profit earned. This form is specifically designed to ensure fairness and transparency in distributing bonuses among officers in San Diego, California, in line with the company's determined profit-sharing policies. The San Diego California Officers Bonus — Percenprofitfi— - Resolution Form serves as a binding agreement between the company and its officers, establishing clear guidelines for calculating the bonus amount based on the organization's profit margin. The form typically includes the following key elements: 1. Company Information: The form starts by stating the company's name, address, and other essential details to identify the party offering the bonus. 2. Officer Details: This section collects pertinent information such as the names, positions, and contact details of the officers entitled to receive the bonus. 3. Profit Calculation: The form contains a detailed explanation of the profit calculation method, highlighting the specific measures used to determine the profit. Common methods include gross profit, net profit, or EBITDA (earnings before interest, taxes, depreciation, and amortization). 4. Bonus Percentage: The form specifies the predetermined percentage of profit that will be allocated towards calculating the bonus amount for officers. This percentage is typically determined by the company's policies or negotiated as part of individual employment contracts. 5. Allocation Guidelines: The form outlines the process for allocating the calculated bonus amount. It may specify whether the bonus will be paid out in a lump sum or through installments over a designated period. 6. Certification: The form provides space for signatures from authorized company representatives and officers eligible for the bonus. This ensures that all parties involved acknowledge and agree upon the terms and conditions outlined in the document. Types of San Diego California Officers Bonus — Percenprofitfi— - Resolution Forms: 1. Annual Bonus Resolution Form: This type of form is used to determine the yearly bonus granted to officers based on the percentage of the company's profit during a particular fiscal year. 2. Quarterly Bonus Resolution Form: Some companies offer bonuses on a quarterly basis. This form outlines the specific guidelines and procedures for calculating and allocating bonuses on a quarterly profit-sharing basis. 3. Discretionary Bonus Resolution Form: While the primary focus is on percent of profit bonus allocation, this form allows flexibility for the company's management to grant additional discretionary bonuses, which are not solely tied to profit percentage but can be awarded based on outstanding performance or other factors. By utilizing the San Diego California Officers Bonus — Percenprofitfi— - Resolution Form, companies can establish a fair and transparent system for distributing bonuses to officers in San Diego, California, encouraging motivation, and fostering a collaborative work environment.

San Diego California Officers Bonus - Percent of Profit - Resolution Form

Description

How to fill out San Diego California Officers Bonus - Percent Of Profit - Resolution Form?

Preparing paperwork for the business or personal demands is always a huge responsibility. When drawing up an agreement, a public service request, or a power of attorney, it's important to take into account all federal and state regulations of the particular area. However, small counties and even cities also have legislative provisions that you need to consider. All these aspects make it tense and time-consuming to create San Diego Officers Bonus - Percent of Profit - Resolution Form without expert assistance.

It's possible to avoid spending money on lawyers drafting your paperwork and create a legally valid San Diego Officers Bonus - Percent of Profit - Resolution Form on your own, using the US Legal Forms online library. It is the most extensive online catalog of state-specific legal templates that are professionally verified, so you can be sure of their validity when picking a sample for your county. Earlier subscribed users only need to log in to their accounts to download the required form.

In case you still don't have a subscription, adhere to the step-by-step instruction below to obtain the San Diego Officers Bonus - Percent of Profit - Resolution Form:

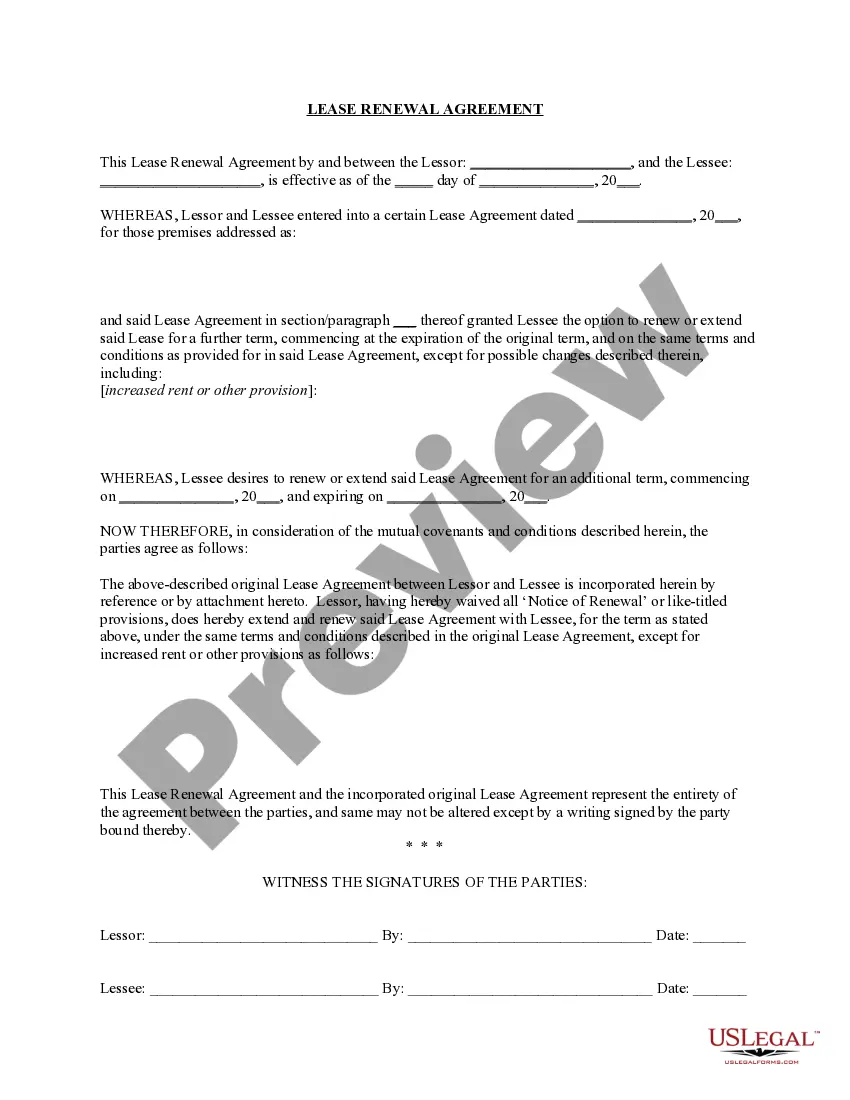

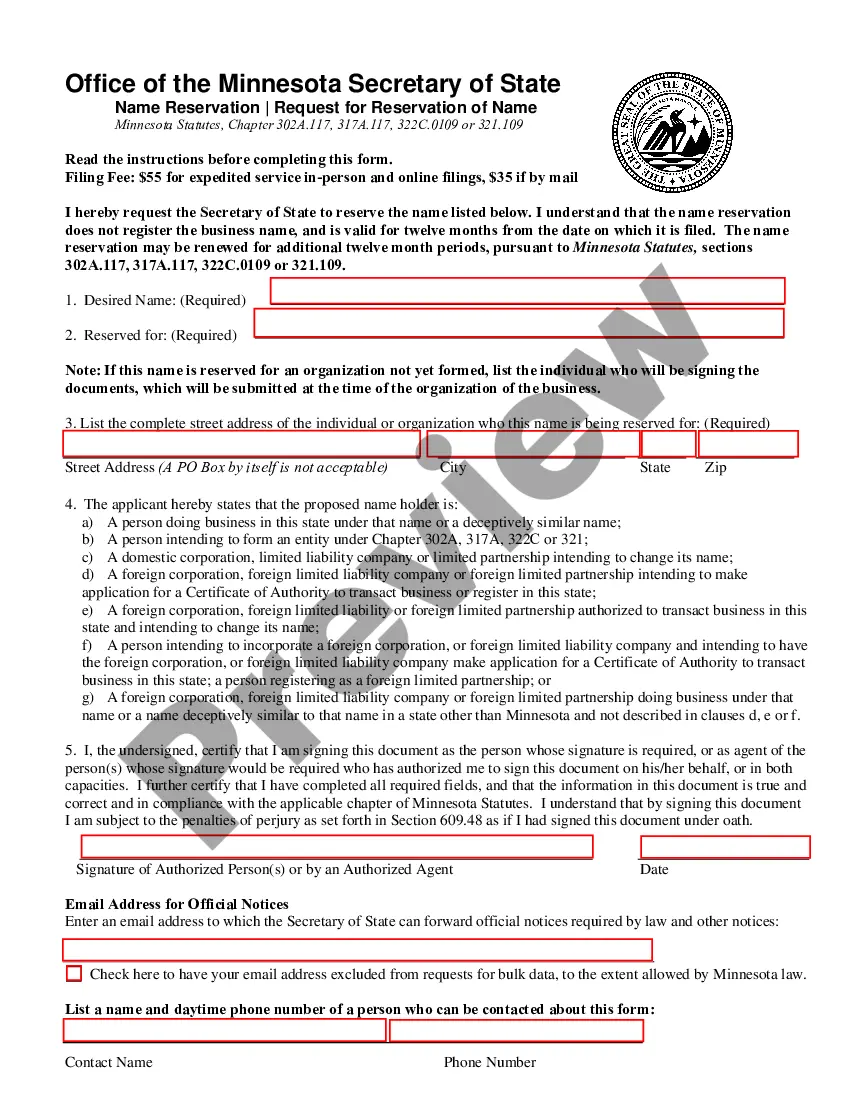

- Examine the page you've opened and check if it has the document you require.

- To achieve this, use the form description and preview if these options are presented.

- To find the one that suits your requirements, use the search tab in the page header.

- Recheck that the sample complies with juridical criteria and click Buy Now.

- Select the subscription plan, then sign in or register for an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the chosen file in the preferred format, print it, or fill it out electronically.

The great thing about the US Legal Forms library is that all the paperwork you've ever purchased never gets lost - you can access it in your profile within the My Forms tab at any time. Join the platform and quickly get verified legal forms for any scenario with just a few clicks!