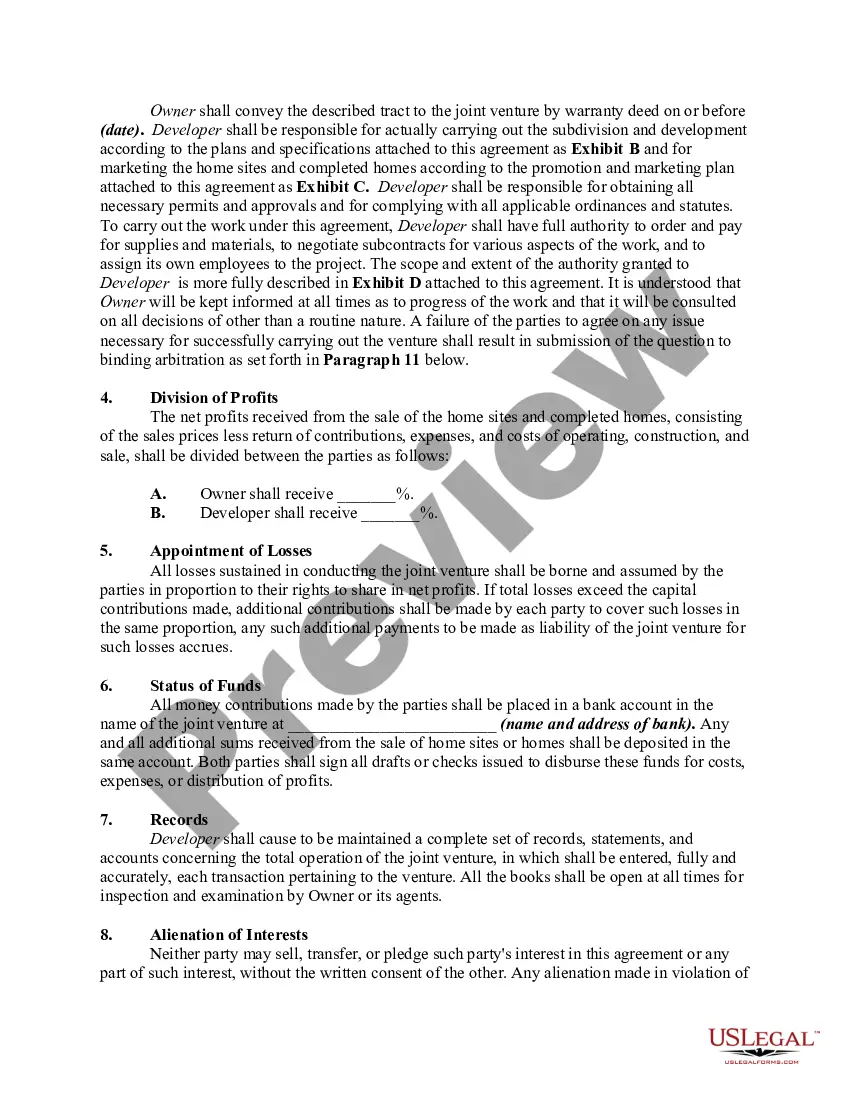

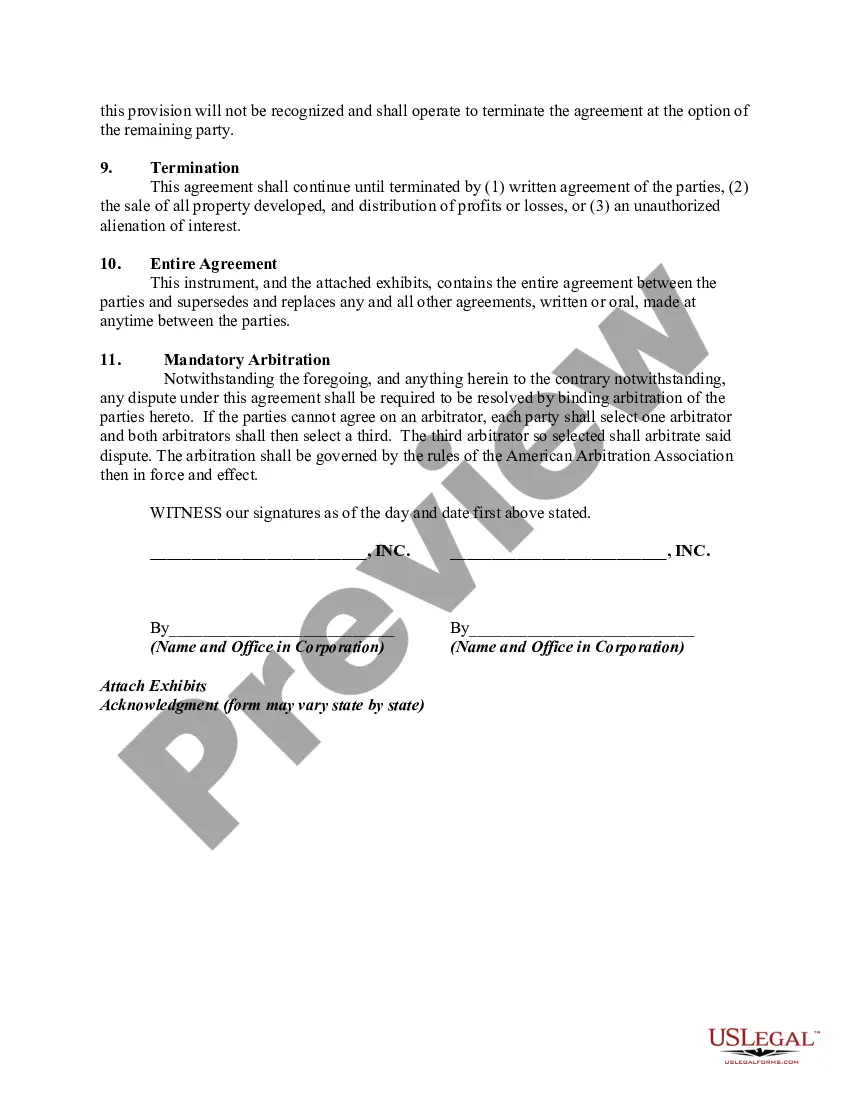

Title: Los Angeles California Joint Venture Agreement to Develop and Sell Residential Real Property: A Comprehensive Overview Keywords: Los Angeles California, joint venture agreement, develop and sell, residential real property, types Introduction: A Los Angeles California Joint Venture Agreement to Develop and Sell Residential Real Property is a legal document that outlines the terms and conditions between two or more parties intending to collaborate on property development and subsequent sale in the residential real estate sector. In Los Angeles, there may be various types of joint venture agreements tailored to suit the specific requirements of the involved parties. This detailed description aims to provide an overview of the primary aspects of a typical joint venture agreement while highlighting different types that may exist. Main Content: 1. Key Components of a Los Angeles Joint Venture Agreement: — Parties Involved: Identifies the involved entities, including developers, investors, landowners, and any additional stakeholders. — Purpose and Goals: Clearly states the purpose of the joint venture, such as the development and sale of a specific residential property, along with the objectives to be achieved. — Contributions: Describes the contributions each party will make, including financial investments, expertise, resources, or land acquisition. — Profit Sharing: Outlines the distribution of profits or losses among the parties, detailing the percentage allocation. — Decision-Making: Establishes the decision-making process, whether through unanimous or majority voting, or in accordance with specific expertise and roles. — Duration and Termination: Specifies the initial duration of the joint venture and conditions leading to termination or renewal. — Dispute Resolution: Identifies the method of resolving potential disputes, such as mediation, arbitration, or litigation. — Intellectual Property: Addresses ownership and protection of intellectual property rights generated during the joint venture. — Exit Strategy: Outlines possibilities and procedures for exiting the joint venture, including buyouts, sale of interests, or transfer of ownership. 2. Types of Los Angeles Joint Venture Agreements for Residential Real Property: a) Equity-based Joint Venture: An equity-based joint venture agreement involves partners pooling financial resources, expertise, or land interests to develop and sell residential real estate. Each party's share of profit or loss is determined by their initial investment, and decision-making powers may be weighted accordingly. b) Landowner and Developer Joint Venture: This type involves landowners who provide the property or land and collaborate with developers to enhance its value by building residential real estate. Profits are generally shared based on the landowner's ownership share and the developer's efforts and investment. c) Investor and Developer Joint Venture: Investors partner with developers to fund residential real estate development projects. The agreement sets forth the investment contributions, profit distribution rules, and decision-making processes. The investors often leverage their capital and the developers' expertise to maximize returns. d) Consortium Joint Venture: A consortium joint venture forms when multiple developers or companies come together to collectively develop and sell residential properties. This type allows for sharing resources, expertise, and risk across multiple entities, fostering synergy and access to broader markets. Conclusion: Los Angeles California Joint Venture Agreements to Develop and Sell Residential Real Property provide a legal framework for collaboration between parties involved in property development and sale. Understanding the key components and the various types of joint venture agreements mentioned above is crucial for prospective partners intending to engage in real estate ventures in Los Angeles, enabling them to navigate the legal and financial aspects more effectively.

Los Angeles California Joint Venture Agreement to Develop and to Sell Residential Real Property

Description

How to fill out Los Angeles California Joint Venture Agreement To Develop And To Sell Residential Real Property?

How much time does it usually take you to draft a legal document? Given that every state has its laws and regulations for every life situation, locating a Los Angeles Joint Venture Agreement to Develop and to Sell Residential Real Property meeting all local requirements can be exhausting, and ordering it from a professional attorney is often costly. Many online services offer the most common state-specific templates for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most comprehensive online collection of templates, grouped by states and areas of use. In addition to the Los Angeles Joint Venture Agreement to Develop and to Sell Residential Real Property, here you can find any specific document to run your business or individual deeds, complying with your regional requirements. Experts check all samples for their actuality, so you can be sure to prepare your documentation correctly.

Using the service is pretty straightforward. If you already have an account on the platform and your subscription is valid, you only need to log in, pick the needed sample, and download it. You can get the document in your profile anytime later on. Otherwise, if you are new to the website, there will be some extra actions to complete before you obtain your Los Angeles Joint Venture Agreement to Develop and to Sell Residential Real Property:

- Examine the content of the page you’re on.

- Read the description of the sample or Preview it (if available).

- Search for another document utilizing the corresponding option in the header.

- Click Buy Now once you’re certain in the selected document.

- Choose the subscription plan that suits you most.

- Register for an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Switch the file format if necessary.

- Click Download to save the Los Angeles Joint Venture Agreement to Develop and to Sell Residential Real Property.

- Print the doc or use any preferred online editor to complete it electronically.

No matter how many times you need to use the purchased document, you can find all the files you’ve ever downloaded in your profile by opening the My Forms tab. Try it out!