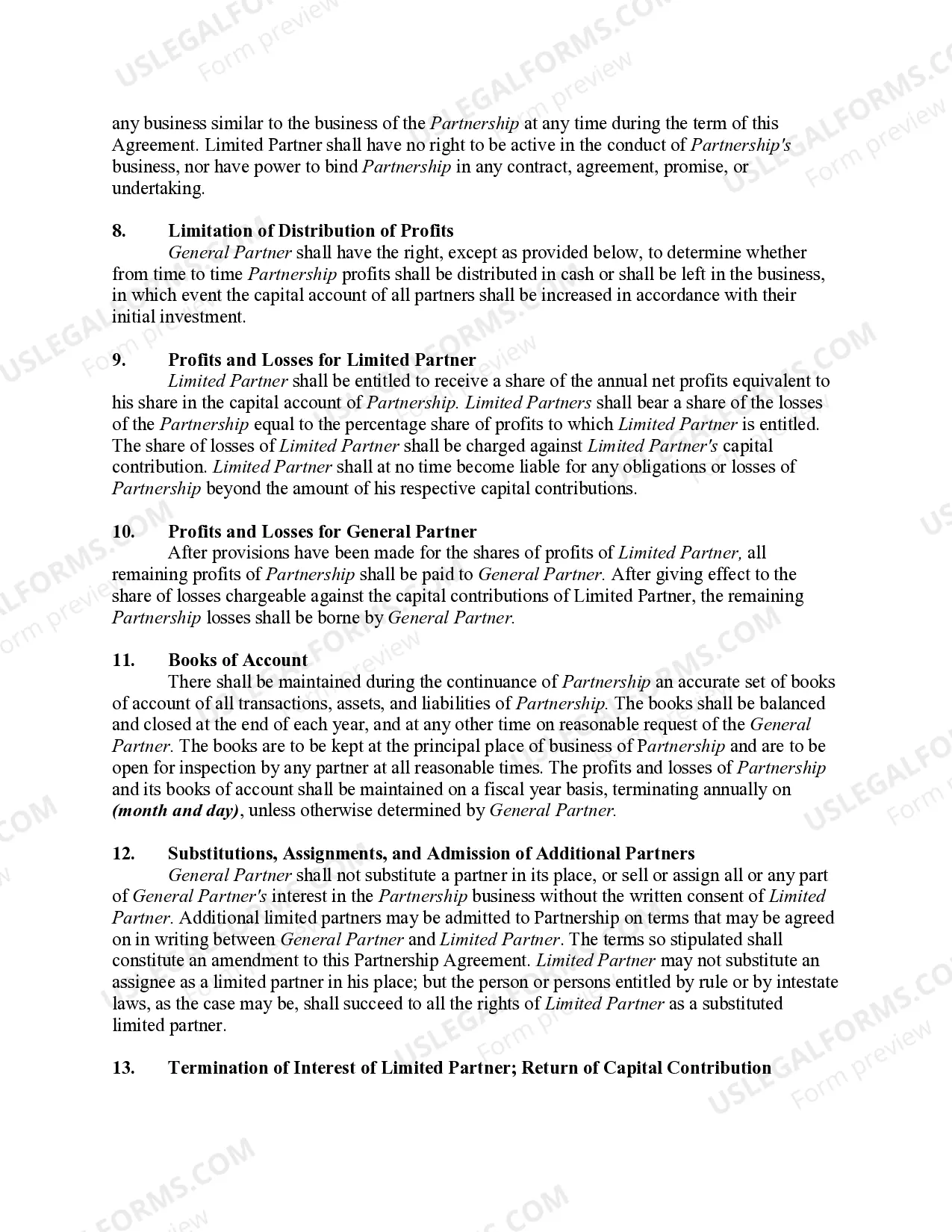

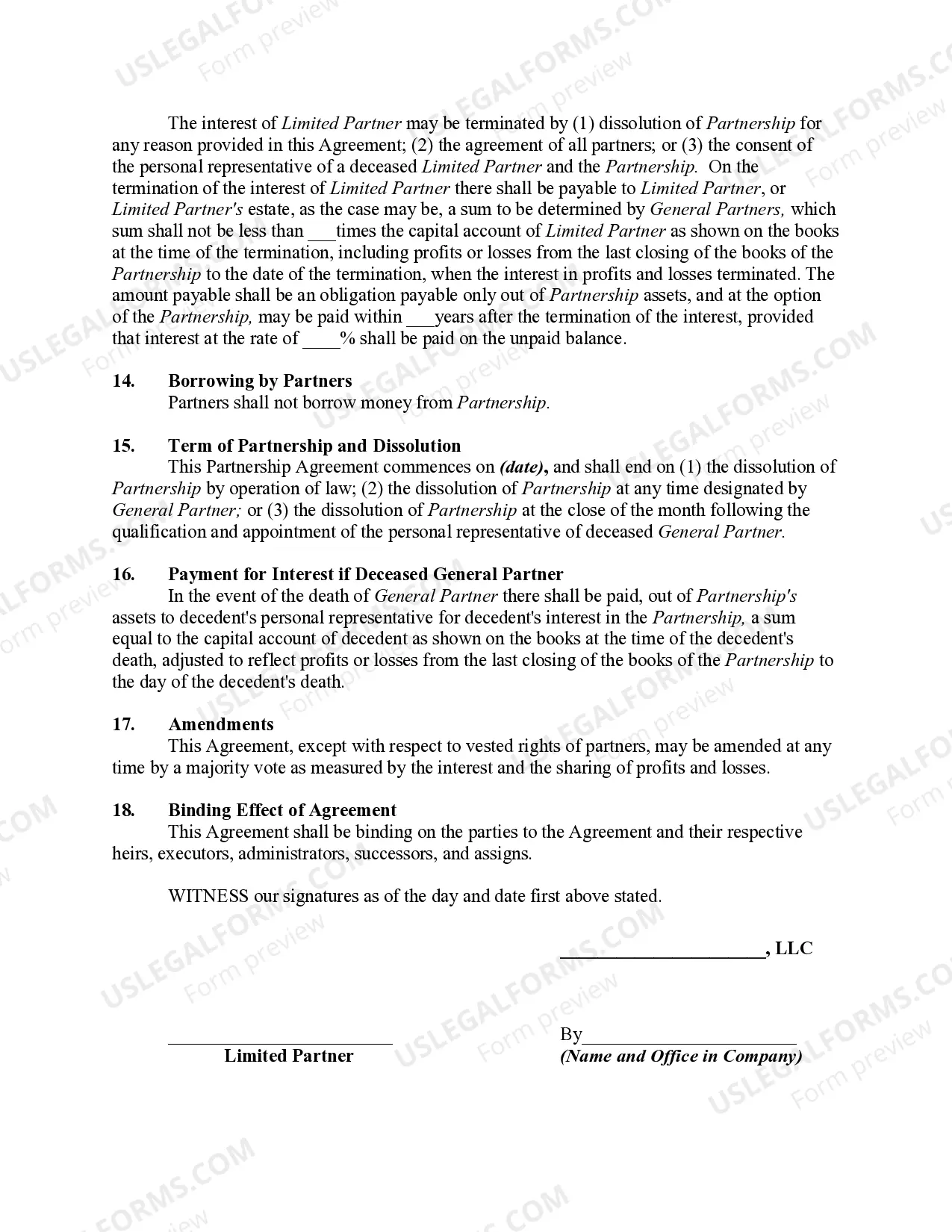

A Bexar Texas Limited Partnership Agreement is a legal document that outlines the terms and conditions of a partnership between a limited liability company (LLC) and a limited partner. This partnership agreement serves as a guide for the relationship between the LLC, which is responsible for managing and operating the business, and the limited partner, who typically provides capital investment but does not participate in the management of the company. The Bexar Texas Limited Partnership Agreement outlines the financial contributions and responsibilities of both the LLC and the limited partner. It addresses important aspects such as profit and loss sharing, governance structure, decision-making processes, distribution of assets and liabilities, and dissolution procedures. There are several types of Bexar Texas Limited Partnership Agreements that can be established between a limited liability company and a limited partner, depending on the specific needs and objectives of the parties involved. Some common types include: 1. Capital Contribution Agreement: This type of agreement focuses on the capital contributions made by the limited partner to the partnership. It outlines the amount and timing of the investments, as well as the rights and obligations associated with these contributions. 2. Profit Sharing Agreement: This type of agreement determines how the profits generated by the partnership will be allocated between the LLC and the limited partner. It may specify a fixed percentage or a formula-based calculation for distributing profits. 3. Management Agreement: In some cases, a limited partner may want to participate in the management and decision-making processes of the LLC. A management agreement outlines the extent of the limited partner's involvement and the specific areas in which they have authority. 4. Buy-Sell Agreement: This type of agreement addresses the circumstances in which a limited partner may want to sell or transfer their interest in the partnership. It establishes the valuation method and procedures for the sale or transfer of ownership. 5. Dissolution Agreement: If the partnership needs to be dissolved, a dissolution agreement outlines the steps to be taken, including the distribution of assets, settlement of liabilities, and termination of the partnership. In conclusion, a Bexar Texas Limited Partnership Agreement Between Limited Liability Company and Limited Partner is a crucial document that governs the collaboration between an LLC and a limited partner. It ensures clarity, fairness, and legal protection for both parties involved in the partnership.

Bexar Texas Limited Partnership Agreement Between Limited Liability Company and Limited Partner

Description

How to fill out Bexar Texas Limited Partnership Agreement Between Limited Liability Company And Limited Partner?

Dealing with legal forms is a necessity in today's world. However, you don't always need to seek professional help to create some of them from scratch, including Bexar Limited Partnership Agreement Between Limited Liability Company and Limited Partner, with a service like US Legal Forms.

US Legal Forms has over 85,000 forms to choose from in various categories varying from living wills to real estate paperwork to divorce documents. All forms are arranged based on their valid state, making the searching experience less challenging. You can also find information materials and tutorials on the website to make any tasks related to paperwork completion simple.

Here's how to purchase and download Bexar Limited Partnership Agreement Between Limited Liability Company and Limited Partner.

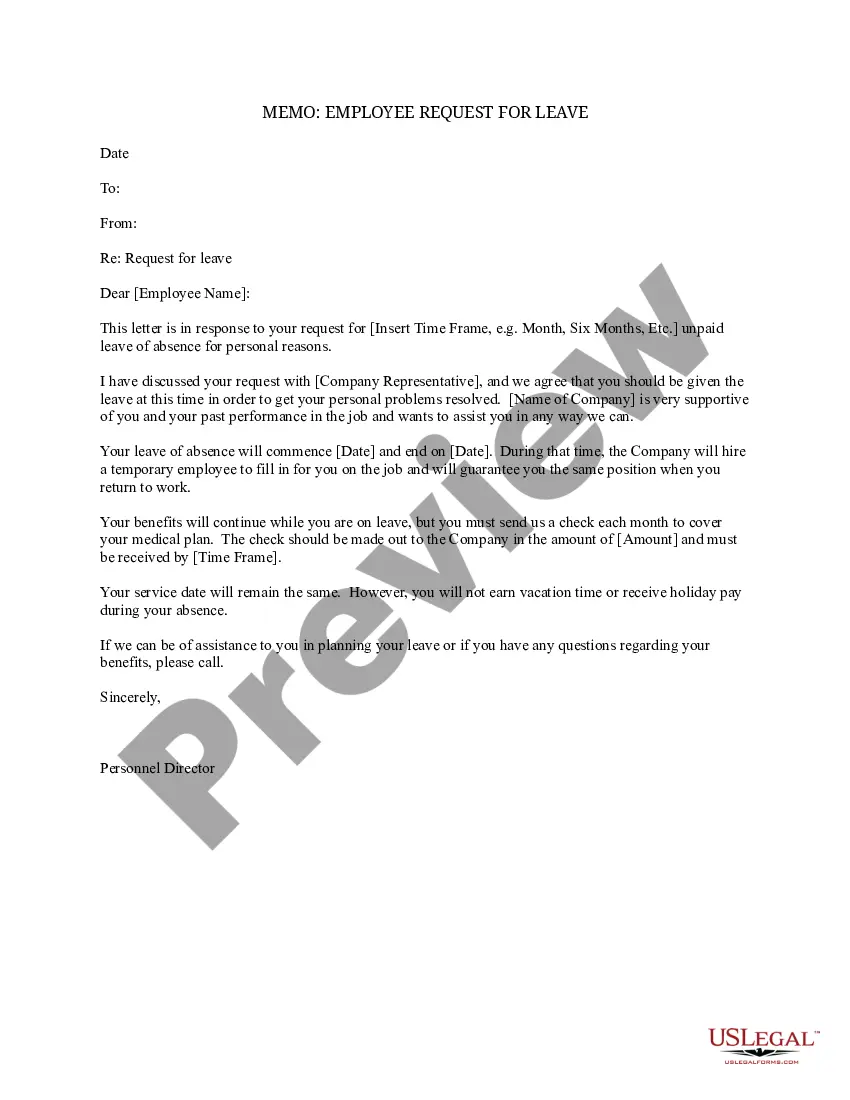

- Take a look at the document's preview and outline (if available) to get a general idea of what you’ll get after downloading the form.

- Ensure that the template of your choosing is specific to your state/county/area since state regulations can impact the validity of some records.

- Check the related forms or start the search over to locate the appropriate file.

- Click Buy now and register your account. If you already have an existing one, choose to log in.

- Choose the pricing {plan, then a needed payment method, and purchase Bexar Limited Partnership Agreement Between Limited Liability Company and Limited Partner.

- Choose to save the form template in any offered file format.

- Visit the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can locate the appropriate Bexar Limited Partnership Agreement Between Limited Liability Company and Limited Partner, log in to your account, and download it. Needless to say, our platform can’t replace an attorney completely. If you need to deal with an exceptionally challenging situation, we advise getting a lawyer to examine your document before signing and submitting it.

With over 25 years on the market, US Legal Forms proved to be a go-to platform for many different legal forms for millions of customers. Join them today and get your state-compliant paperwork with ease!