Fairfax Virginia Limited Partnership Agreement between a Limited Liability Company (LLC) and a Limited Partner is a legally binding document that establishes the rights, responsibilities, and obligations of the involved parties in a limited partnership in the state of Virginia. This agreement outlines the framework for the partnership, including investment contributions, profit sharing, decision-making authority, and dissolution procedures. It serves as a crucial instrument for ensuring a smooth and transparent partnership operation. The Limited Partnership Agreement defines the roles and responsibilities of the Limited Liability Company and the Limited Partner(s). The LLC acts as the general partner, assuming management and decision-making authority, while the Limited Partner(s) contribute capital but possess limited control over the partnership's ongoing operations. This structure offers liability protection to the Limited Partner(s), shielding them from personal responsibility for the partnership's obligations and debts. The Fairfax Virginia Limited Partnership Agreement requires careful consideration of various key elements, including: 1. Partner Information: It includes the names and addresses of all partners, distinguishing between general and limited partners. 2. Capital Contributions: This section specifies the amount and nature of the capital each partner contributes, as well as any additional contributions during the partnership's lifespan. 3. Profit and Loss Allocation: Details how profits and losses are shared among partners. The agreement may stipulate a predetermined allocation or provide a formula based on the percentage of capital contributions. 4. Distribution of Profits: Outlines the procedure for distributing profits, which may be on a monthly, quarterly, or annual basis, depending on the partnership's agreed-upon terms. 5. Management and Decision-Making: Clarifies the authority and decision-making powers vested in the general partner(s), establishing their responsibility for day-to-day operations. 6. Partnership Dissolution: Sets out the process for dissolving the partnership, including the distribution of assets, repayment of debts, and any remaining proceeds. Different types of Limited Partnership Agreements may exist within the Fairfax Virginia jurisdiction, varying based on the specific needs and arrangements of the partners involved. Some common types include: 1. General Partnership Agreement: Establishes an arrangement where all partners bear equal responsibility for the partnership's obligations and debts. Each partner has equal control over the decision-making process. 2. Limited Liability Partnership Agreement: This agreement offers limited liability protection to all partners, shielding them from personal responsibility for the partnership's actions or debts. Partners still maintain significant control over the partnership's management. 3. Master Limited Partnership (MLP) Agreement: This type of partnership is often used in the energy sector and involves publicly traded limited partnership units. The partnership structure allows for pooling capital from investors, usually with the involvement of both general and limited partners. 4. Limited Liability Limited Partnership (LL LP) Agreement: LL LP combines aspects of both limited partnerships and limited liability partnerships. It offers limited liability protection to all partners while allowing some partners to have limited control over day-to-day operations. In conclusion, the Fairfax Virginia Limited Partnership Agreement between a Limited Liability Company and a Limited Partner defines the legal and financial framework for their partnership. This agreement outlines each party's rights and responsibilities, capital contributions, profit sharing, decision-making authority, and the dissolution process. It's crucial for any partnership to have a well-drafted agreement to establish transparency, protect the interests of all partners, and ensure the smooth operation of the business.

Fairfax Virginia Limited Partnership Agreement Between Limited Liability Company and Limited Partner

Description

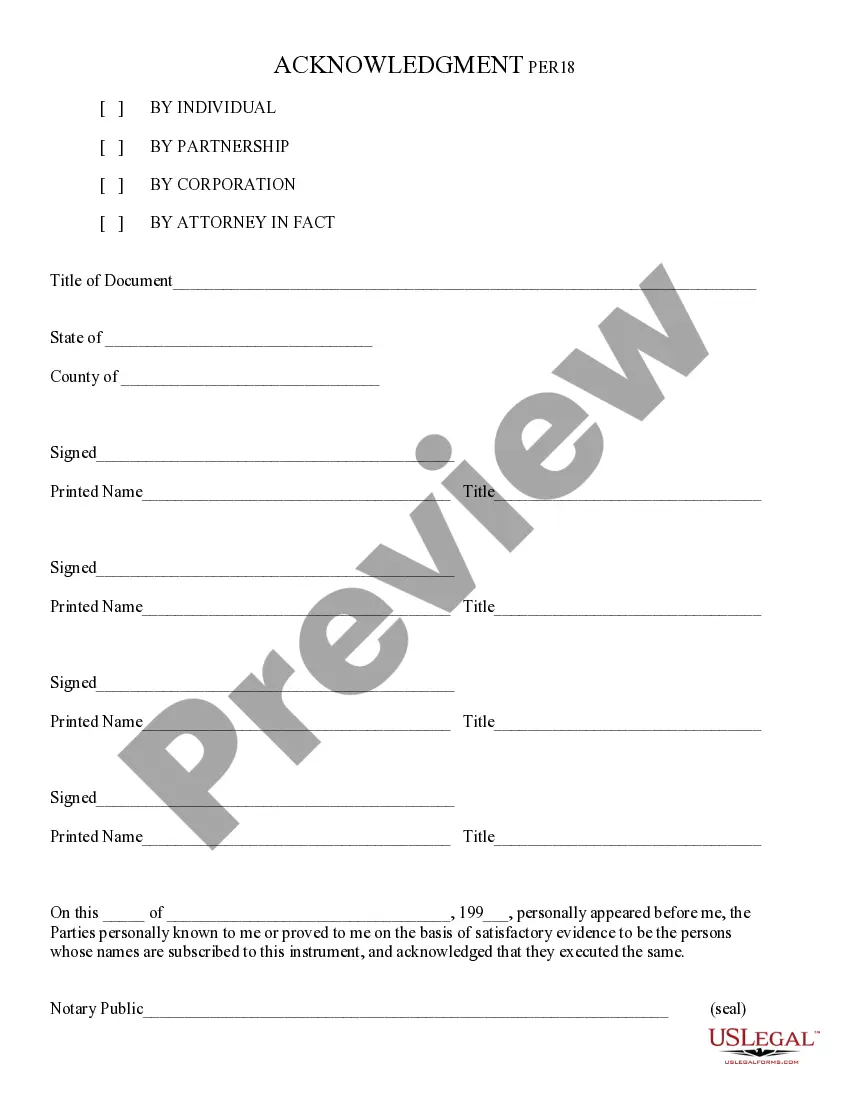

How to fill out Fairfax Virginia Limited Partnership Agreement Between Limited Liability Company And Limited Partner?

If you need to find a reliable legal paperwork provider to find the Fairfax Limited Partnership Agreement Between Limited Liability Company and Limited Partner, consider US Legal Forms. Whether you need to start your LLC business or manage your asset distribution, we got you covered. You don't need to be knowledgeable about in law to find and download the appropriate template.

- You can select from more than 85,000 forms categorized by state/county and case.

- The self-explanatory interface, variety of learning resources, and dedicated support team make it easy to locate and complete various papers.

- US Legal Forms is a reliable service offering legal forms to millions of users since 1997.

Simply select to look for or browse Fairfax Limited Partnership Agreement Between Limited Liability Company and Limited Partner, either by a keyword or by the state/county the form is created for. After locating needed template, you can log in and download it or save it in the My Forms tab.

Don't have an account? It's effortless to get started! Simply locate the Fairfax Limited Partnership Agreement Between Limited Liability Company and Limited Partner template and take a look at the form's preview and short introductory information (if available). If you're confident about the template’s terminology, go ahead and hit Buy now. Create an account and choose a subscription plan. The template will be immediately ready for download once the payment is processed. Now you can complete the form.

Taking care of your legal matters doesn’t have to be pricey or time-consuming. US Legal Forms is here to demonstrate it. Our extensive collection of legal forms makes these tasks less expensive and more reasonably priced. Create your first company, organize your advance care planning, draft a real estate agreement, or execute the Fairfax Limited Partnership Agreement Between Limited Liability Company and Limited Partner - all from the comfort of your home.

Join US Legal Forms now!