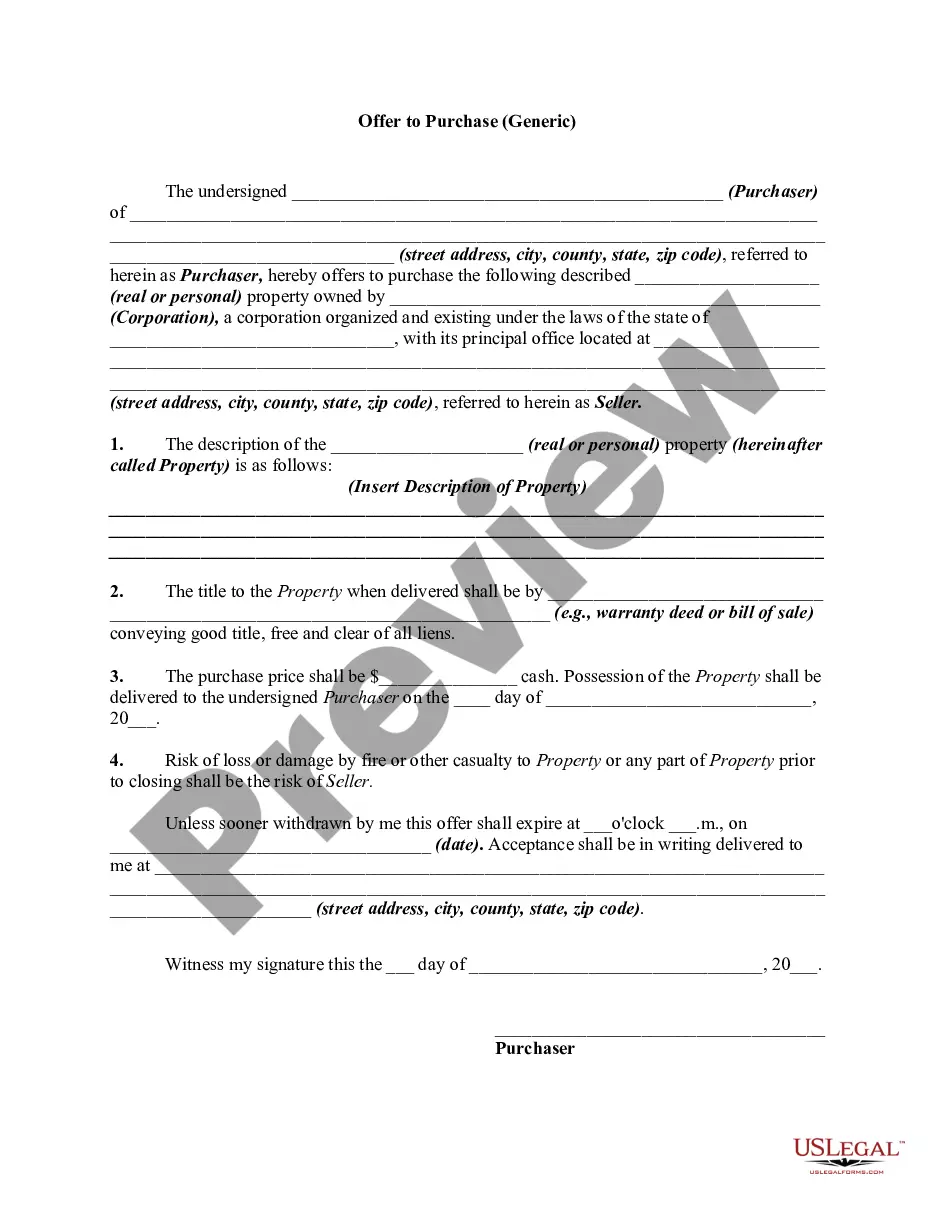

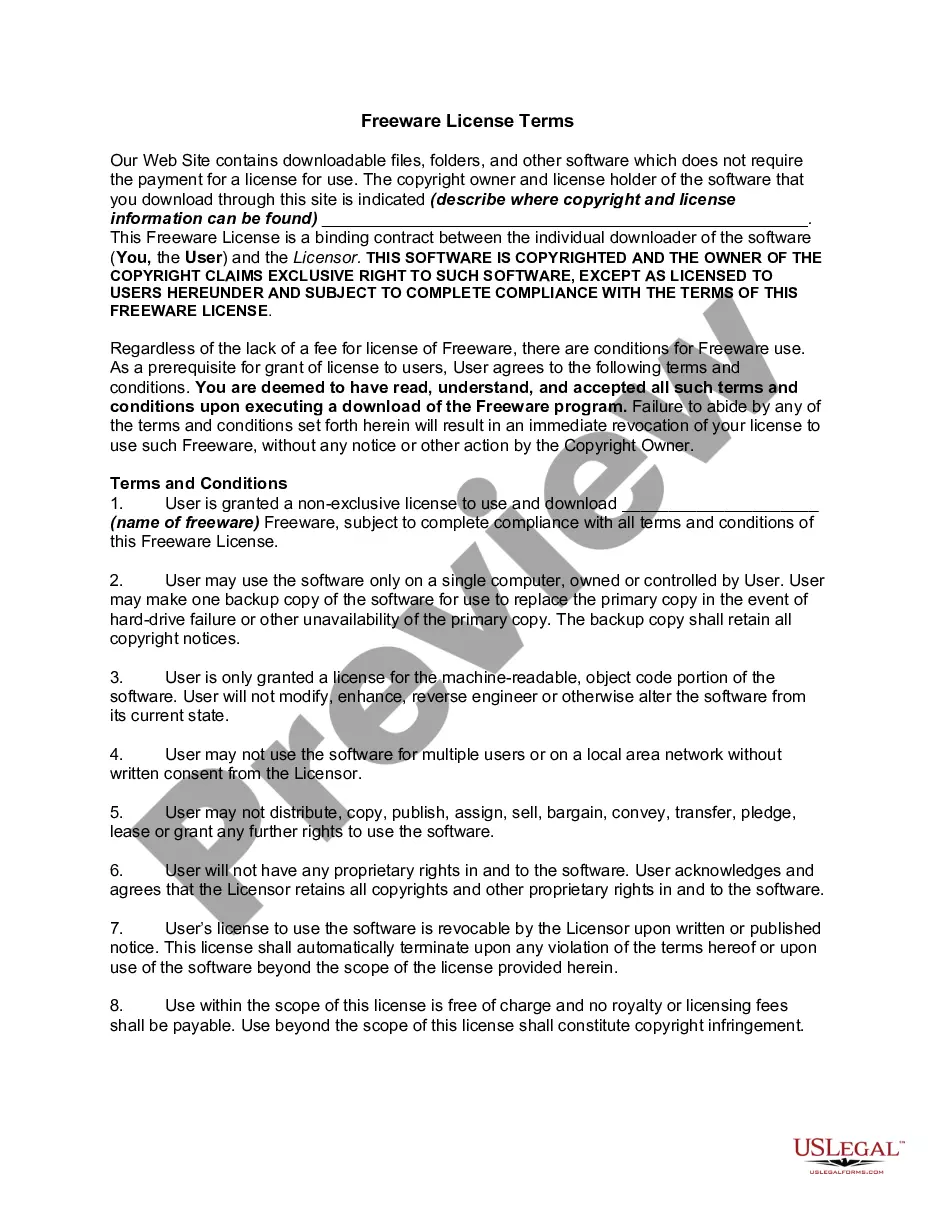

A limited partnership agreement between a limited liability company (LLC) and a limited partner is a legal contract that establishes the terms and conditions of a partnership between these entities in Miami-Dade, Florida. This partnership agreement outlines the roles, responsibilities, and rights of the involved parties and serves as a crucial document for conducting business operations smoothly and legally. In Miami-Dade, Florida, there are several types of limited partnership agreements that can be formed between an LLC and a limited partner: 1. General Partnership Agreement: This type of agreement grants the limited partner the ability to participate in the day-to-day management of the business alongside the LLC. The limited partner shares both profits and losses in proportion to their partnership interest. 2. Limited Liability Partnership Agreement: This agreement offers limited liability protection to both the LLC and the limited partner. The LLC handles the management responsibilities, while the limited partner typically has a more passive role and limited liability for business debts. 3. Limited Partnership Agreement with Silent Partner: In this scenario, the limited partner acts as a silent investor by providing capital to the LLC while having no control or involvement in the company's management or decision-making process. Regardless of the specific type of Miami-Dade Florida limited partnership agreement, it is essential to include certain critical clauses: 1. Partnership Duration: This section outlines the intended lifespan of the partnership, such as a fixed term, indefinite term, or termination upon the occurrence of certain events. 2. Capital Contributions: It specifies the amount and timing of capital contributions made by each party, along with any subsequent provisions for additional contributions. 3. Profit and Loss Allocation: The agreement will define how the profits and losses will be distributed among the LLC and limited partner. This can be based on a fixed percentage or proportionate to the capital contributions made. 4. Management and Decision-Making: It states how the LLC will handle management responsibilities and decision-making authority within the partnership. For general partnerships, the limited partner may be granted more involvement, while limited liability partnerships typically grant control to the LLC. 5. Dissolution and Termination: This section outlines the circumstances under which the partnership may be dissolved, such as bankruptcy, retirement, or mutual agreement. 6. Dispute Resolution: It includes provisions for resolving disputes among the LLC and limited partner, such as through mediation or arbitration, to avoid costly litigation. The Miami-Dade Florida limited partnership agreement between an LLC and a limited partner is a vital document for formalizing the partnership arrangement. Seeking legal advice from a qualified attorney to draft or review this agreement ensures that all necessary stipulations are included, protecting the rights and interests of both parties involved.

Miami-Dade Florida Limited Partnership Agreement Between Limited Liability Company and Limited Partner

Category:

State:

Multi-State

County:

Miami-Dade

Control #:

US-00802BG

Format:

Word;

Rich Text

Instant download

Description

This form has one general partner, which is a limited liability company, and one limited partner, who basically is an investor.

A limited partnership agreement between a limited liability company (LLC) and a limited partner is a legal contract that establishes the terms and conditions of a partnership between these entities in Miami-Dade, Florida. This partnership agreement outlines the roles, responsibilities, and rights of the involved parties and serves as a crucial document for conducting business operations smoothly and legally. In Miami-Dade, Florida, there are several types of limited partnership agreements that can be formed between an LLC and a limited partner: 1. General Partnership Agreement: This type of agreement grants the limited partner the ability to participate in the day-to-day management of the business alongside the LLC. The limited partner shares both profits and losses in proportion to their partnership interest. 2. Limited Liability Partnership Agreement: This agreement offers limited liability protection to both the LLC and the limited partner. The LLC handles the management responsibilities, while the limited partner typically has a more passive role and limited liability for business debts. 3. Limited Partnership Agreement with Silent Partner: In this scenario, the limited partner acts as a silent investor by providing capital to the LLC while having no control or involvement in the company's management or decision-making process. Regardless of the specific type of Miami-Dade Florida limited partnership agreement, it is essential to include certain critical clauses: 1. Partnership Duration: This section outlines the intended lifespan of the partnership, such as a fixed term, indefinite term, or termination upon the occurrence of certain events. 2. Capital Contributions: It specifies the amount and timing of capital contributions made by each party, along with any subsequent provisions for additional contributions. 3. Profit and Loss Allocation: The agreement will define how the profits and losses will be distributed among the LLC and limited partner. This can be based on a fixed percentage or proportionate to the capital contributions made. 4. Management and Decision-Making: It states how the LLC will handle management responsibilities and decision-making authority within the partnership. For general partnerships, the limited partner may be granted more involvement, while limited liability partnerships typically grant control to the LLC. 5. Dissolution and Termination: This section outlines the circumstances under which the partnership may be dissolved, such as bankruptcy, retirement, or mutual agreement. 6. Dispute Resolution: It includes provisions for resolving disputes among the LLC and limited partner, such as through mediation or arbitration, to avoid costly litigation. The Miami-Dade Florida limited partnership agreement between an LLC and a limited partner is a vital document for formalizing the partnership arrangement. Seeking legal advice from a qualified attorney to draft or review this agreement ensures that all necessary stipulations are included, protecting the rights and interests of both parties involved.

Free preview