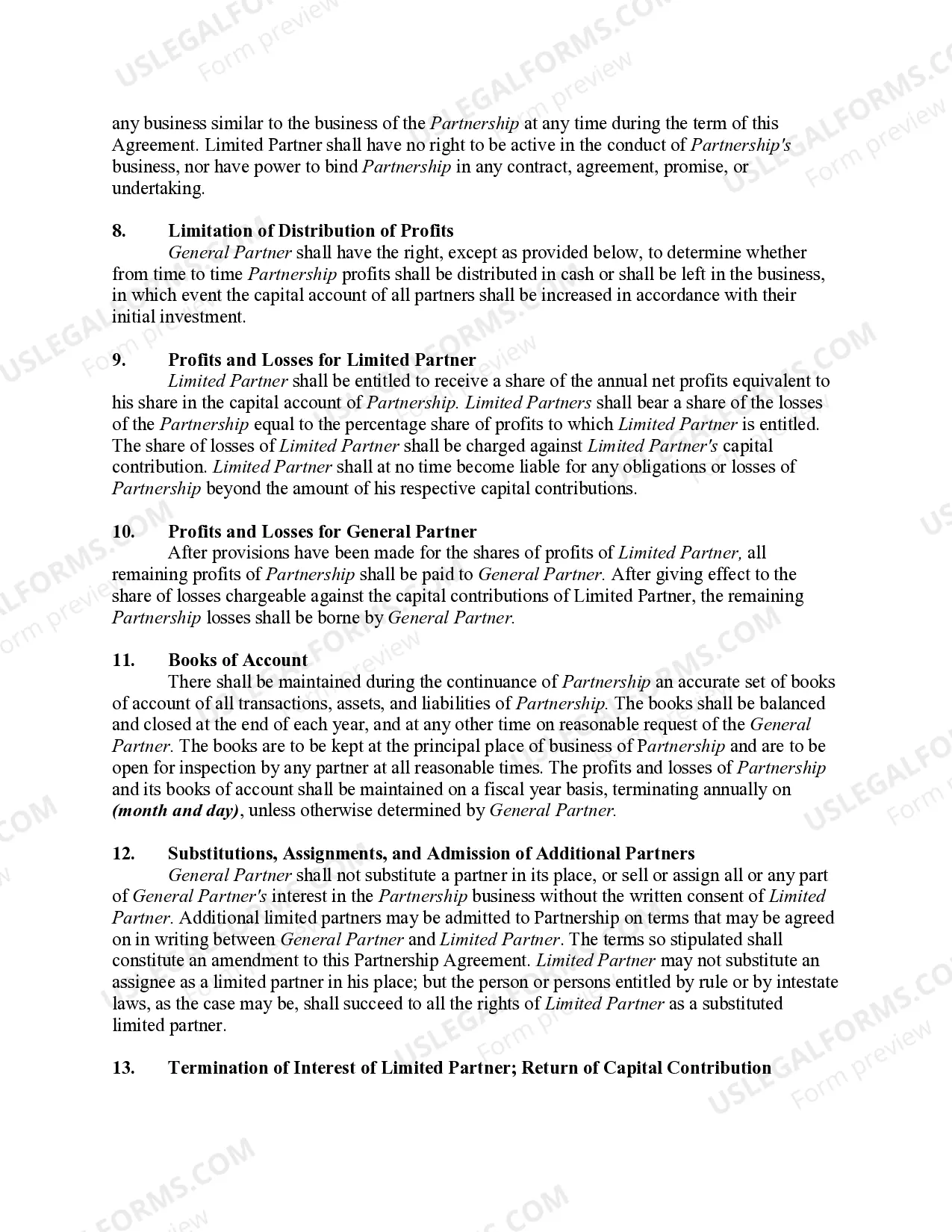

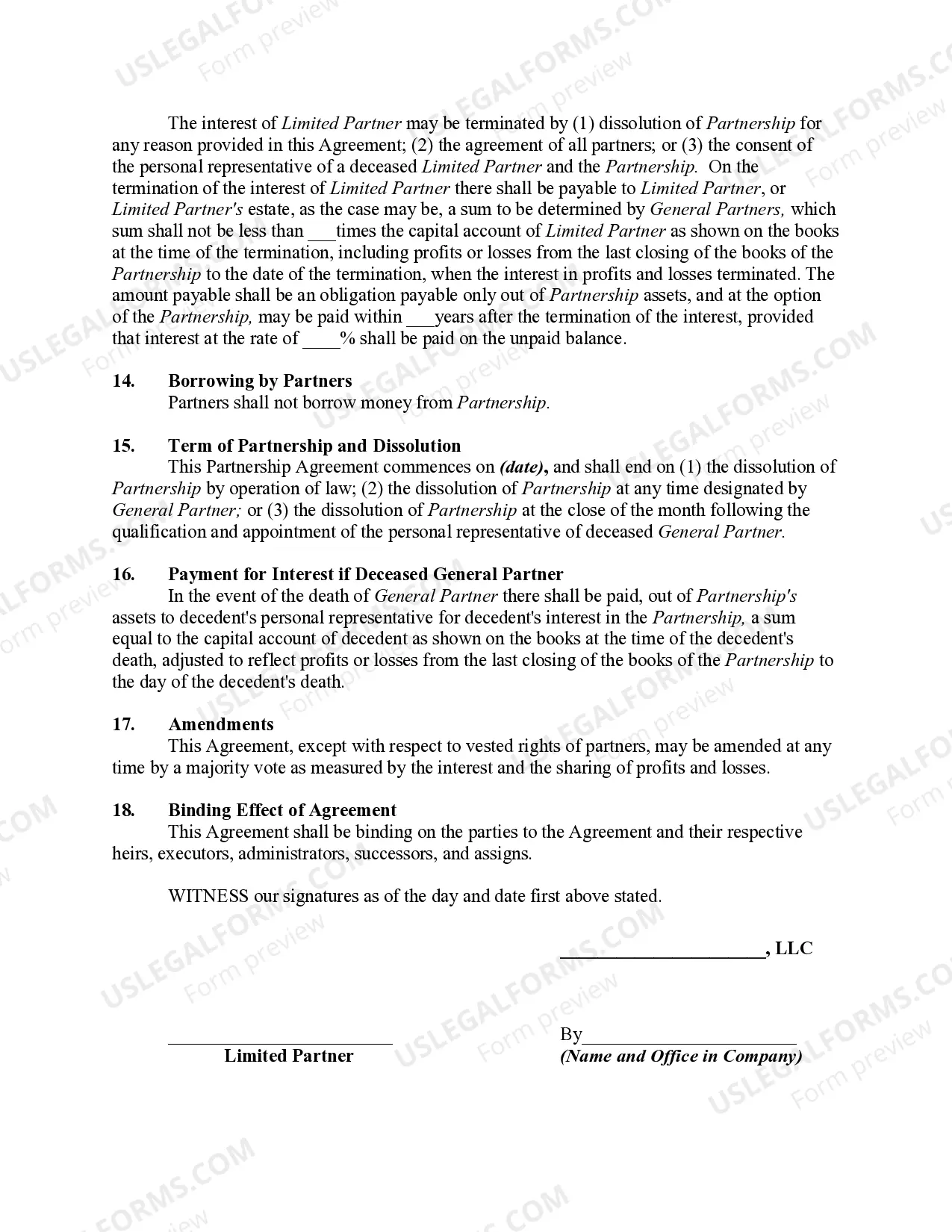

San Diego California Limited Partnership Agreement Between Limited Liability Company and Limited Partner

Description

How to fill out Limited Partnership Agreement Between Limited Liability Company And Limited Partner?

Drafting paperwork for professional or personal needs is consistently a significant obligation.

When formulating a contract, a governmental service application, or a power of attorney, it's crucial to consider all national and regional laws and guidelines of the specific location.

Nevertheless, smaller counties and even towns also have legislative processes that you must take into account.

Utilize the search tab in the page header to locate the one that satisfies your requirements.

- All these factors contribute to the stress and time-consuming nature of preparing a San Diego Limited Partnership Agreement Between Limited Liability Company and Limited Partner without expert help.

- You can save money on attorneys drafting your paperwork and develop a legally binding San Diego Limited Partnership Agreement Between Limited Liability Company and Limited Partner on your own, utilizing the US Legal Forms online repository.

- It is the largest online collection of state-specific legal templates that are professionally verified, ensuring their legitimacy when selecting a template for your county.

- Previously registered users only need to Log In to their accounts to access the necessary document.

- If you still lack a subscription, follow the step-by-step guide below to acquire the San Diego Limited Partnership Agreement Between Limited Liability Company and Limited Partner.

- Review the page you've opened and confirm it contains the document you need.

- To do that, use the form description and preview if those options are available.

Form popularity

FAQ

Steps to Form a Limited Partnership in California Step 1: Register with the California Secretary of State.Step 2: Prepare a Partnership Agreement.Step 3: Get Local Business License and Comply With Local Laws.Step 4: Obtain an Employer Identification Number (EIN)Step 5: Pay California Limited Partnership Taxes/Fees.

Registering to Do Business in California All foreign limited partnerships doing business in California must register with the California Secretary of State. Domestic partnerships that do not register with the Secretary of State are not limited partnerships.

An Overview of California LLCs Under the California Corporations Code, business owners can enjoy the benefits of a partnership while avoiding general liability by forming an LLC. The company itself will be held responsible for all debts and obligations.

An LLC is similar to a limited partnership in that it provides liability protection to the owners of the business, and the owners have flexibility in deciding how the business will be managed. However, unlike limited partnerships, all of the owners of the LLC have limited liability protection.

Unlimited liability for general partners only. In a limited partnership (LP), at least one partner has unlimited liabilitythe general partner(s). The other partners (limited partners) have limited liability, meaning their personal assets typically cannot be used to satisfy business debts and liabilities.

To form a California LLP, partners are required to file an Application to Register a Limited Liability Partnership with the Secretary of State (SOS). If you're an attorney, you need to register your LLP with the California State Bar once you receive approval from the SOS.

In a limited partnership (LP), at least one partner has unlimited liabilitythe general partner(s). The other partners (limited partners) have limited liability, meaning their personal assets typically cannot be used to satisfy business debts and liabilities.

The difference between a limited partnership and an LLLP is that the liability of the general partner in an LLLP is the same as the liability of the limited partner. That is, the liability of all partners is limited to the amount of their investments in the firm.

Key Takeaways. A limited partnership (LP) exists when two or more partners go into business together, but the limited partners are only liable up to the amount of their investment. An LP is defined as having limited partners and a general partner, which has unlimited liability.

What Is the Difference Between an LP and LLP? An LP and LLP have a similar structure. However, LPs have general partners and limited partners, while LLPs have no general partners. All partners in an LLP have limited liability.