The Riverside California Rental Lease Agreement for Business is a legally binding document that outlines the terms and conditions under which a business or commercial property is rented out in the Riverside area. This agreement is crucial for both the landlord and the tenant as it establishes the rights and responsibilities of each party involved. One type of Riverside California Rental Lease Agreement for Business is the Triple Net Lease (NNN). This lease agreement requires the tenant to pay for all operational expenses, including property taxes, insurance, and maintenance costs in addition to the rent. The NNN lease shifts a majority of the financial burden from the landlord to the tenant. Another type of lease agreement prevalent in Riverside is the Modified Gross Lease. This agreement requires the tenant to pay for rent and a portion of the operating expenses, such as utilities, while the landlord covers property taxes and maintenance costs. The division of responsibilities may vary depending on the negotiations between both parties. The Rental Lease Agreement for Business in Riverside typically includes various key components. Firstly, it identifies the parties involved, including the landlord (property owner) and the tenant (business entity). It also includes a detailed description of the rented premises, specifying its location, size, and permitted usage. The lease agreement outlines the duration of the lease, including the start and end dates, along with any renewal or termination options. Additionally, it highlights the agreed-upon rental amount, payment schedule, and any penalties for late payments. Maintenance and repair obligations are also addressed in the lease agreement. It states whether the landlord or the tenant is responsible for specific repairs, maintenance costs, and who should carry property insurance. Moreover, the lease agreement typically covers provisions related to alterations or modifications made to the premises during the lease term. It specifies whether the tenant is allowed to make any changes and whether prior approval from the landlord is required. Other important components include provisions for security deposits, late fees, and dispute resolution mechanisms. It may also cover clauses related to subleasing, assignment of lease, and any restrictions on the use of the premises. In conclusion, the Riverside California Rental Lease Agreement for Business is a comprehensive legal contract that protects the rights of both landlords and tenants. It ensures transparency, clear communication, and establishes guidelines for the successful rental of commercial properties in the Riverside area. Whether it's a Triple Net Lease or a Modified Gross Lease, the lease agreement sets the foundation for a mutually beneficial business relationship.

Riverside California Rental Lease Agreement for Business

Description

How to fill out Riverside California Rental Lease Agreement For Business?

How much time does it usually take you to create a legal document? Since every state has its laws and regulations for every life situation, locating a Riverside Rental Lease Agreement for Business meeting all regional requirements can be exhausting, and ordering it from a professional attorney is often costly. Many online services offer the most popular state-specific documents for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most extensive online catalog of templates, collected by states and areas of use. In addition to the Riverside Rental Lease Agreement for Business, here you can find any specific form to run your business or personal deeds, complying with your regional requirements. Experts check all samples for their actuality, so you can be certain to prepare your documentation correctly.

Using the service is remarkably simple. If you already have an account on the platform and your subscription is valid, you only need to log in, pick the required sample, and download it. You can retain the file in your profile anytime later on. Otherwise, if you are new to the website, there will be some extra actions to complete before you obtain your Riverside Rental Lease Agreement for Business:

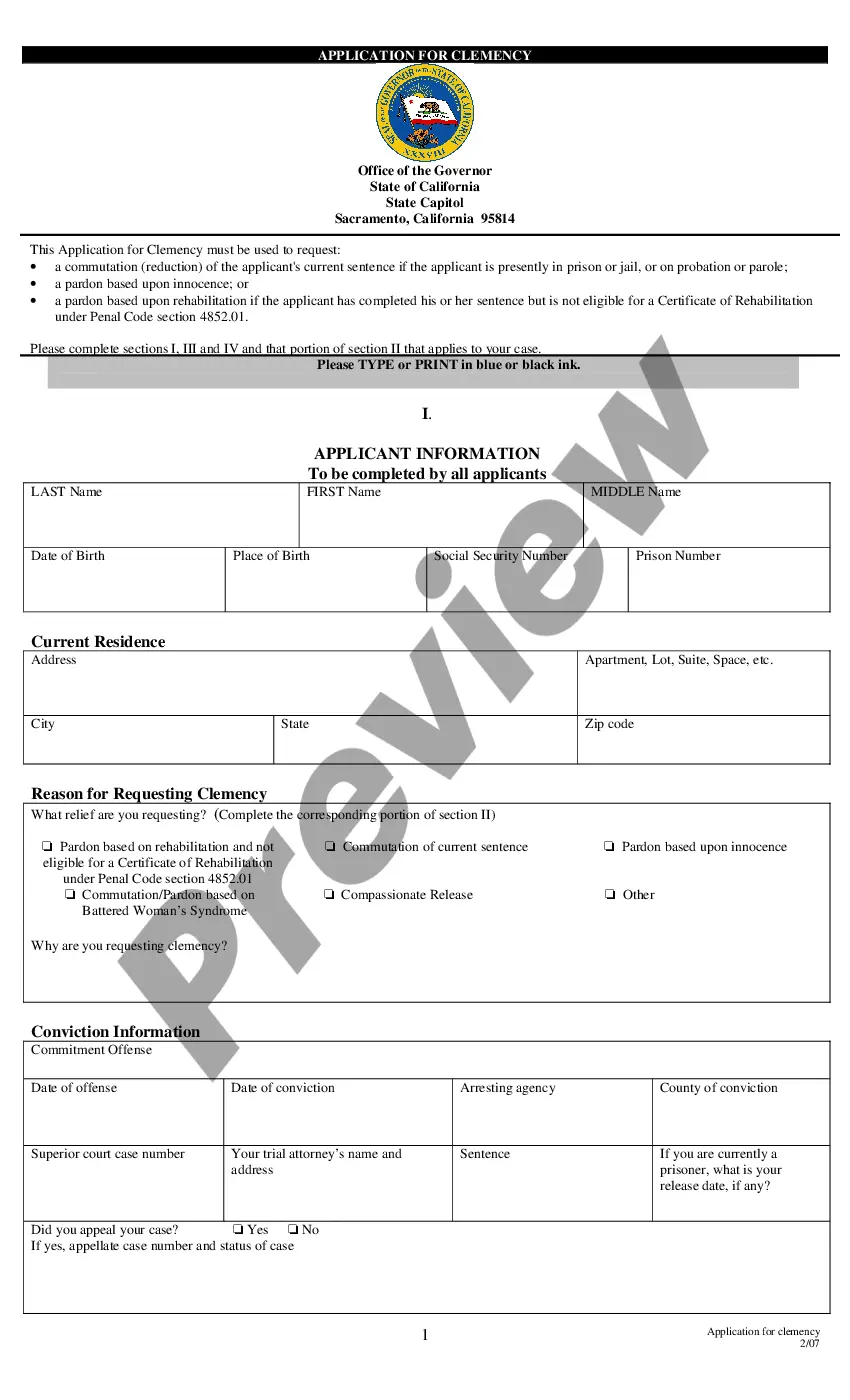

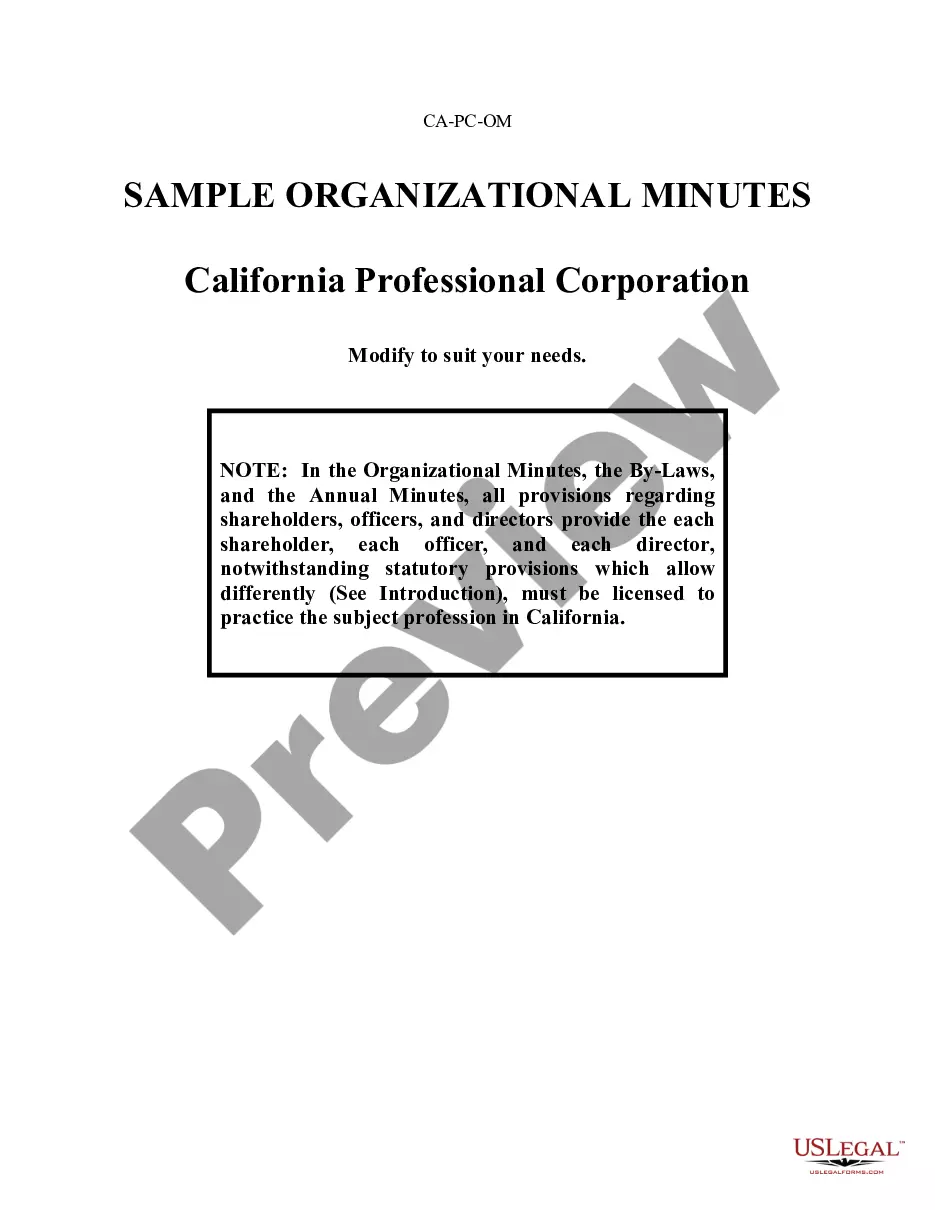

- Examine the content of the page you’re on.

- Read the description of the sample or Preview it (if available).

- Search for another form utilizing the corresponding option in the header.

- Click Buy Now once you’re certain in the chosen file.

- Select the subscription plan that suits you most.

- Register for an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Switch the file format if needed.

- Click Download to save the Riverside Rental Lease Agreement for Business.

- Print the doc or use any preferred online editor to complete it electronically.

No matter how many times you need to use the acquired document, you can locate all the files you’ve ever downloaded in your profile by opening the My Forms tab. Try it out!