Santa Clara California Lease of Business Premises - Real Estate Rental

Description

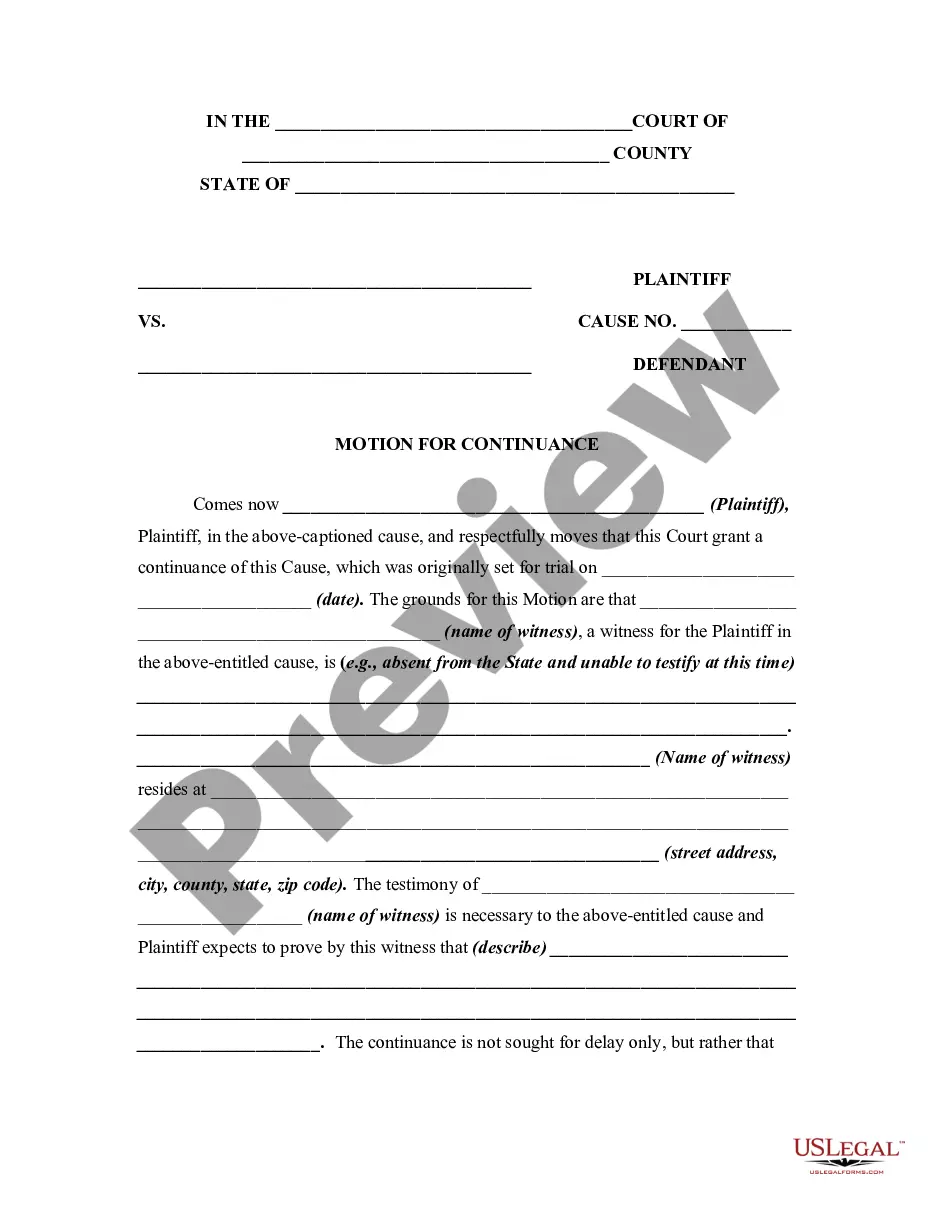

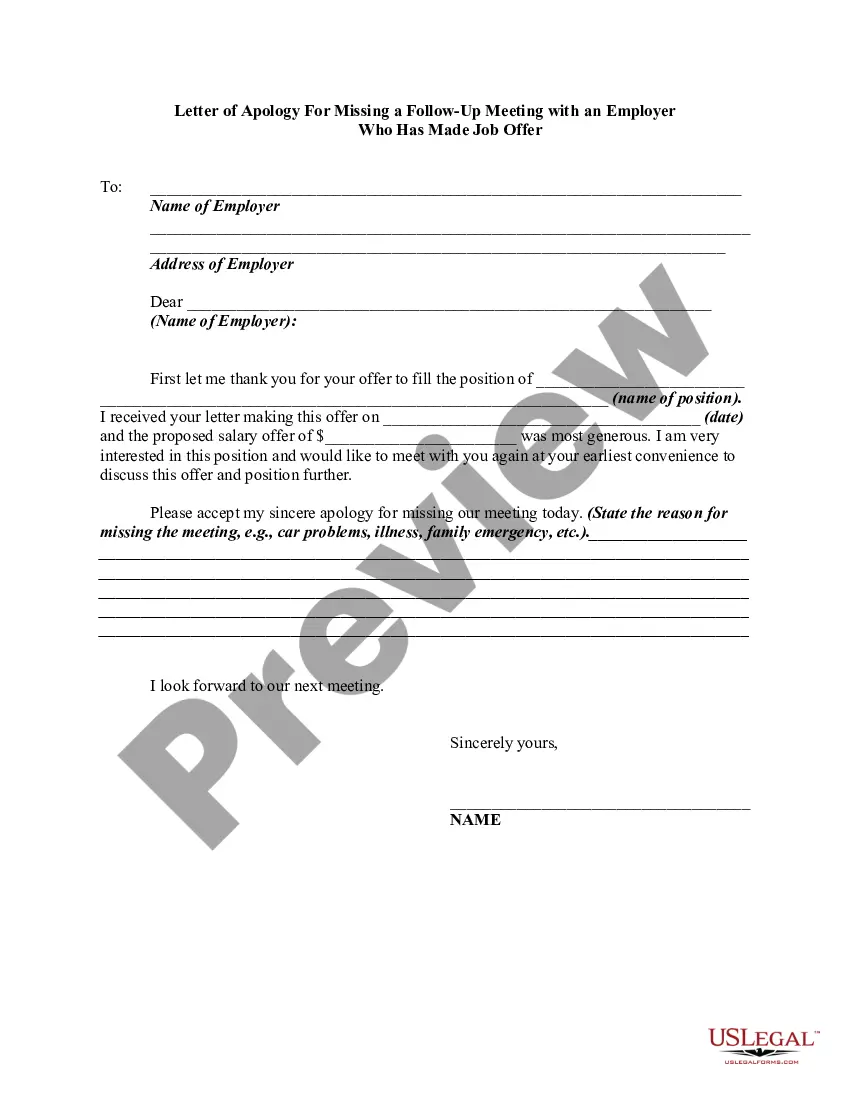

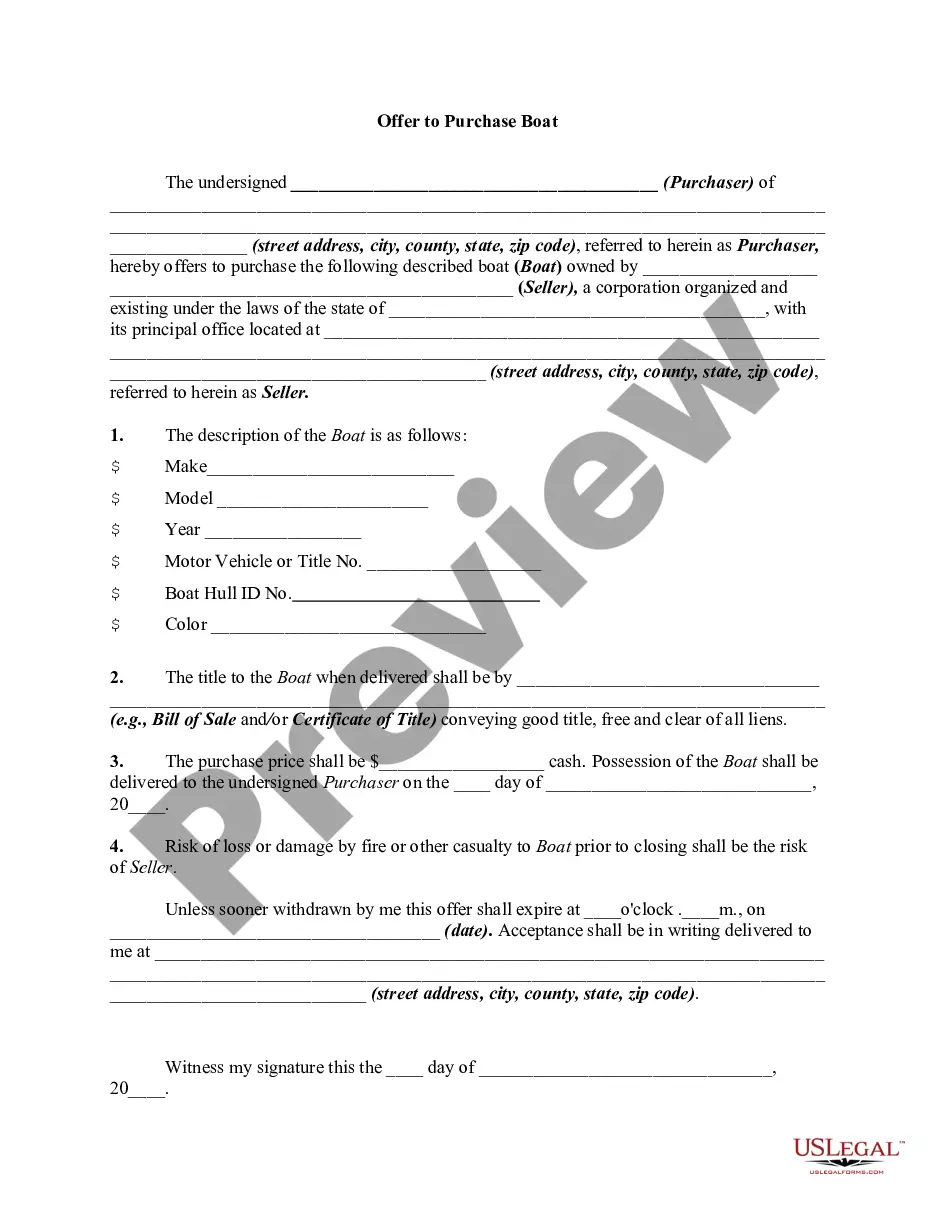

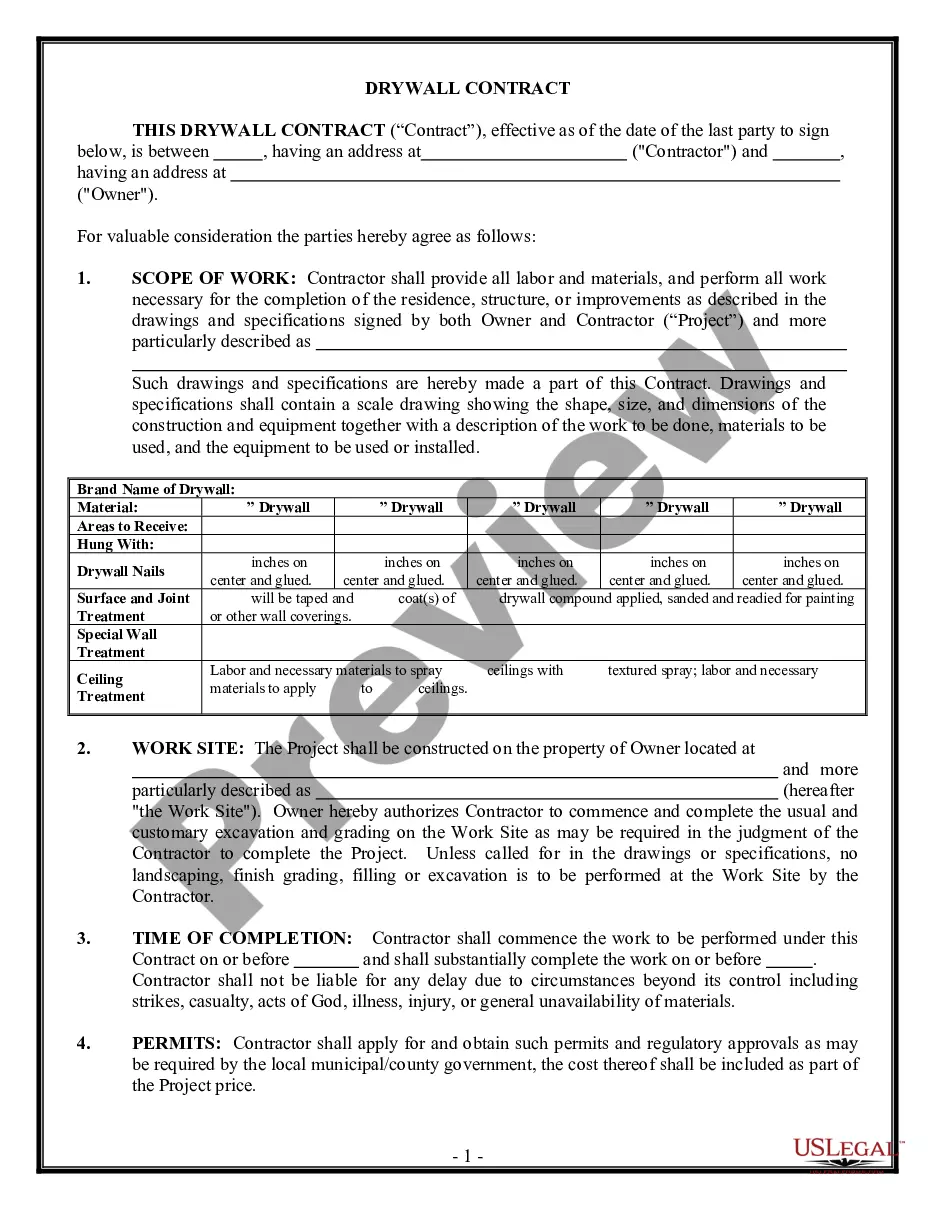

How to fill out Lease Of Business Premises - Real Estate Rental?

How long does it typically take you to draft a legal document.

Considering that each state has its own laws and regulations for every life situation, finding a Santa Clara Lease of Business Premises - Real Estate Rental that meets all local requirements can be daunting, and obtaining it from a qualified attorney is often expensive.

Numerous online services provide the most sought-after state-specific documents for download, yet utilizing the US Legal Forms repository is the most beneficial.

Press Buy Now when you’re confident about the chosen file.

- US Legal Forms is the largest online collection of templates, organized by states and areas of application.

- In addition to the Santa Clara Lease of Business Premises - Real Estate Rental, you can acquire any particular form to manage your business or personal transactions, adhering to your county guidelines.

- Experts verify all templates for their accuracy, so you can be assured of preparing your documents correctly.

- Using the service is quite straightforward.

- If you already possess an account on the site and your subscription is active, you simply need to Log In, choose the required template, and download it.

- You can keep the file in your account at any later time.

- If you’re a newcomer to the site, there will be a few additional steps to take before you obtain your Santa Clara Lease of Business Premises - Real Estate Rental.

- Examine the content of the page you’re currently on.

- Review the description of the template or Preview it (if accessible).

- Search for another form using the related option in the header.

Form popularity

FAQ

Each year, every company in California is required to file a form 571-L Business Property Statement. This 571 L is the form that companies' file with their local county assessor. This lists of all of their non-real estate related property and equipment (machinery, computers etc.).

Leasing is structured differently than a purchase, and you are in effect paying for the use of the car rather than paying for the car. As a result, most states charge sales tax on each lease payment.

Form 571L Training Video - YouTube YouTube Start of suggested clip End of suggested clip The filing due date is April 1st please modify your name and mailing address if necessary forMoreThe filing due date is April 1st please modify your name and mailing address if necessary for instance a name is misspelled or a mailing address that's incorrect on your pre-printed. Form.

The Form 571L or 571A constitutes an official request that you declare all assessable business property situated in this county which you owned, claimed, possessed, controlled or managed on the tax lien date.

You must pay tax on any profit from renting out property. For California, rental income and losses are always considered a passive activity.

The Business Property Statement is used for reporting all business equipment, supplies and fixtures for each business location along with other important information. The information provided on the statement is used to assess and tax property in accordance with California State Law.

This form constitutes an official request that you declare all assessable business property situated in this county which you owned, claimed, possessed, controlled, or managed on the tax lien date, and that you sign (under penalty of perjury) and return the statement to the Assessor's Office by the date cited on the

California generally does charge sales tax on the rental or lease of tangible personal property unless a specific exemption applies. As a lessor, you may have the option to pay sales tax up-front on the asset purchase, rather than charge your lessees sales tax.

With a lease, you don't pay the sales tax up front. You pay sales tax monthly based on the amount of your payment. You may also have to pay an acquisition fee to the bank and a down payment called a cap reduction fee.

Some items are exempt from sales and use tax, including: Sales of certain food products for human consumption (many groceries) Sales to the U.S. Government. Sales of prescription medicine and certain medical devices.