Dallas, Texas Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts — Real Estate A Dallas, Texas lease of a retail store with additional rent based on a percentage of gross receipts is a type of commercial lease agreement that is commonly used in the real estate industry. This lease structure is especially popular in the retail sector, where tenants pay a base rent along with an additional percentage-based rent calculated on their gross sales or gross receipts. The purpose of this type of lease is to align the interests of both the landlord and tenant, as the additional rent incentivizes the tenant to increase their sales and perform well. It also ensures that the landlord benefits from the success of the tenant's business. There are different variations of the Dallas, Texas lease of retail store with additional rent based on a percentage of gross receipts. Some common types include: 1. Percentage Lease: In this lease type, the tenant pays a base rent along with a percentage of their gross sales or gross receipts. 2. Step-Up Lease: This lease structure allows the landlord to gradually increase the percentage of gross sales or receipts paid by the tenant over the lease term. For example, the percentage may start lower in the initial years and increase gradually every few years. 3. Graduated Lease: In a graduated lease, the percentage of the tenant's gross sales or receipts increases based on their sales performance. The more sales the tenant generates, the higher the percentage paid to the landlord. 4. Hybrid Lease: This type of lease combines a fixed base rent with a variable percentage-based rent. The base rent is typically lower than in a traditional lease, but the overall rent can increase if the tenant's sales exceed a certain threshold. A Dallas, Texas lease of a retail store with additional rent based on a percentage of gross receipts is a beneficial arrangement for both landlords and tenants. It encourages tenants to drive sales and perform well while ensuring that landlords have a stake in the success of the businesses they lease to. It also provides a fair and transparent method of determining rent, as the percentage is based on actual sales figures. However, it is crucial for both parties to clearly define the terms and conditions of the lease agreement, including the percentage calculation method, exclusions, and any thresholds or limitations. This will prevent any misunderstandings or disputes in the future. In conclusion, a Dallas, Texas lease of a retail store with additional rent based on a percentage of gross receipts is a popular type of commercial lease in the real estate industry. It aligns the interests of landlords and tenants, encourages business growth, and provides a transparent method of determining rent based on actual sales.

Percentage Rent

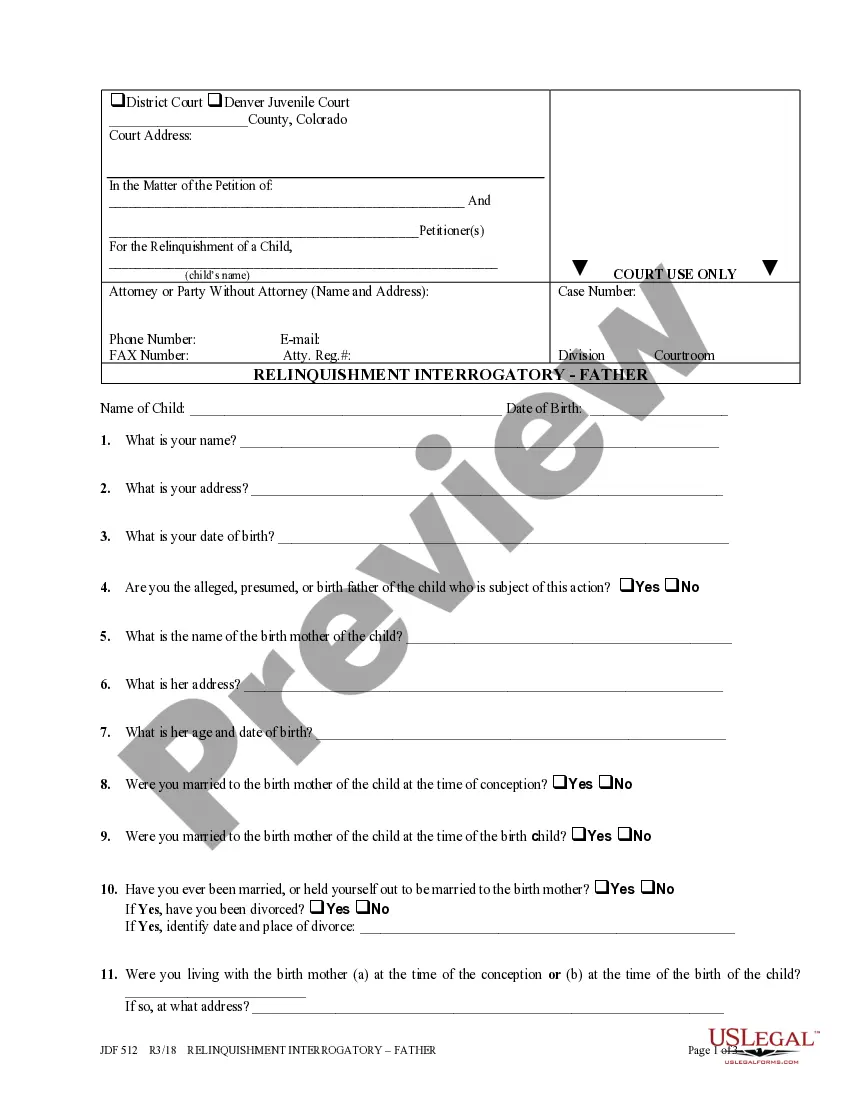

Description

How to fill out Dallas Texas Lease Of Retail Store With Additional Rent Based On Percentage Of Gross Receipts - Real Estate?

A document routine always goes along with any legal activity you make. Staring a company, applying or accepting a job offer, transferring ownership, and many other life scenarios demand you prepare formal paperwork that varies from state to state. That's why having it all collected in one place is so helpful.

US Legal Forms is the most extensive online library of up-to-date federal and state-specific legal forms. Here, you can easily locate and get a document for any personal or business purpose utilized in your county, including the Dallas Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate.

Locating forms on the platform is extremely straightforward. If you already have a subscription to our library, log in to your account, find the sample using the search bar, and click Download to save it on your device. Afterward, the Dallas Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate will be available for further use in the My Forms tab of your profile.

If you are using US Legal Forms for the first time, follow this simple guide to obtain the Dallas Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate:

- Ensure you have opened the right page with your local form.

- Use the Preview mode (if available) and browse through the template.

- Read the description (if any) to ensure the form meets your needs.

- Look for another document via the search tab in case the sample doesn't fit you.

- Click Buy Now once you locate the necessary template.

- Decide on the appropriate subscription plan, then log in or register for an account.

- Choose the preferred payment method (with credit card or PayPal) to continue.

- Opt for file format and download the Dallas Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the easiest and most reliable way to obtain legal documents. All the templates available in our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs effectively with the US Legal Forms!