Travis Texas Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts — Real Estate allows tenants to lease a retail store in Travis County, Texas, and pay additional rent based on a percentage of their gross receipts. This lease agreement is commonly used in the real estate industry and ensures that the tenant's rent is directly proportional to their business's success. This type of lease is advantageous for both landlords and tenants. Landlords benefit from the potential increase in rent as the tenant's business grows. Meanwhile, tenants have the flexibility of paying rent proportional to their revenue, which can be particularly helpful for small businesses or startups. It aligns the interests of both parties, as the landlord directly benefits from the tenant's success. The Travis Texas Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts can be customized to suit specific needs. Different variations may exist, such as leases with graduated rent percentages or fixed rent amounts alongside the gross receipt percentage calculation. Landlords may also choose to include additional provisions, such as rent caps, minimum rent amounts, or exclusions for certain revenue sources. By incorporating the percentage of gross receipts into the lease, both parties have a clear understanding of how rent is calculated. Gross receipts usually refer to the total revenue generated by the tenant's business through sales, services, or other income sources. This figure is calculated before deducting any expenses or taxes. The lease may outline how gross receipts are defined, including any exclusions or adjustments. The Travis Texas Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts may also include provisions related to reporting requirements. Tenants may be obligated to submit periodic reports, such as monthly or quarterly, detailing their gross receipts or any other financial information relevant to rent calculation. This allows landlords to track the tenant's performance and ensure accurate rent payments. Overall, this type of lease offers an innovative and fair approach to rent determination, benefiting both tenants and landlords. It encourages business growth and rewards success, making it an attractive option for retail store tenants in Travis County, Texas.

Travis Texas Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate

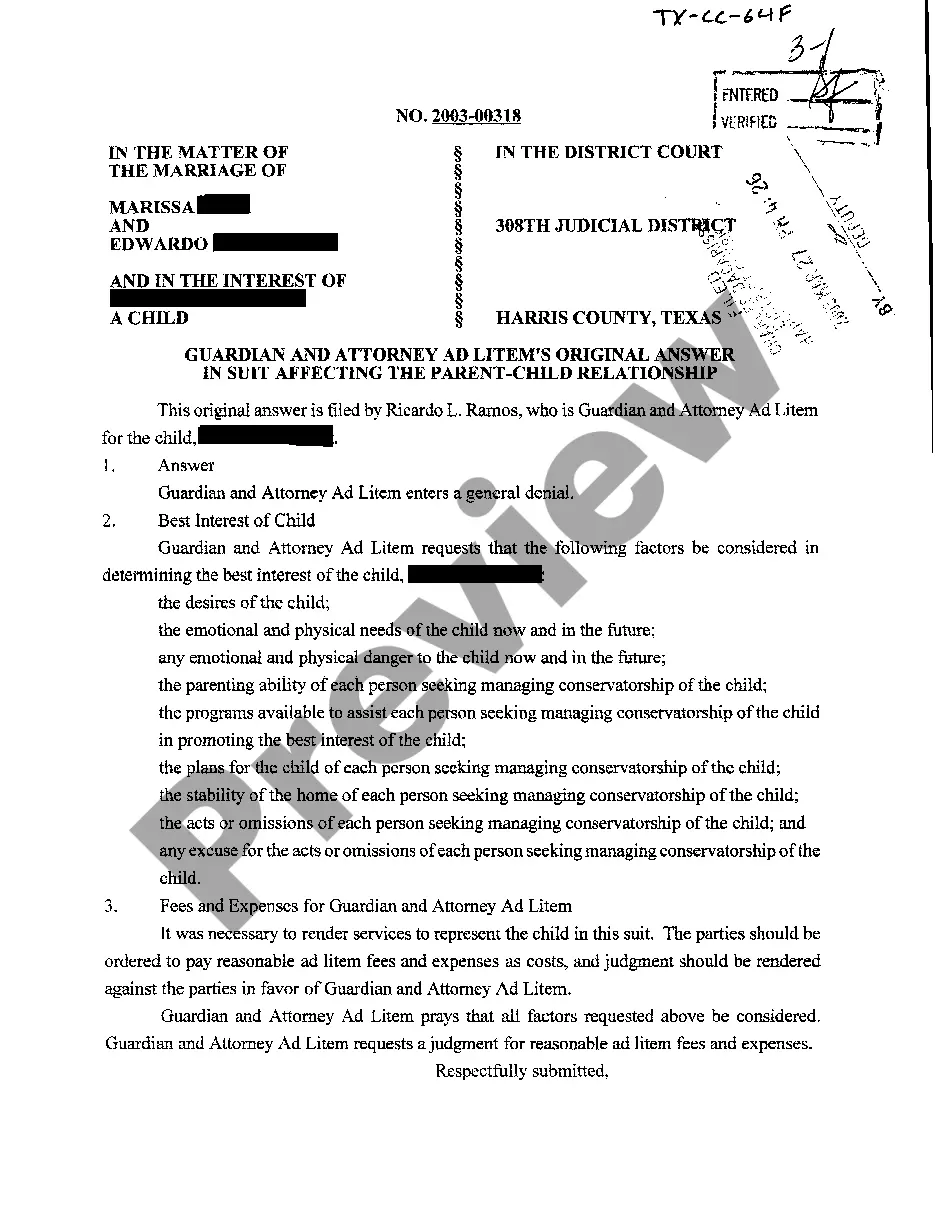

Description

How to fill out Travis Texas Lease Of Retail Store With Additional Rent Based On Percentage Of Gross Receipts - Real Estate?

Drafting documents for the business or personal demands is always a huge responsibility. When drawing up a contract, a public service request, or a power of attorney, it's important to take into account all federal and state laws and regulations of the particular region. Nevertheless, small counties and even cities also have legislative procedures that you need to consider. All these aspects make it burdensome and time-consuming to draft Travis Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate without expert help.

It's possible to avoid spending money on lawyers drafting your documentation and create a legally valid Travis Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate on your own, using the US Legal Forms web library. It is the greatest online catalog of state-specific legal templates that are professionally cheched, so you can be certain of their validity when picking a sample for your county. Earlier subscribed users only need to log in to their accounts to download the required document.

If you still don't have a subscription, follow the step-by-step guide below to get the Travis Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate:

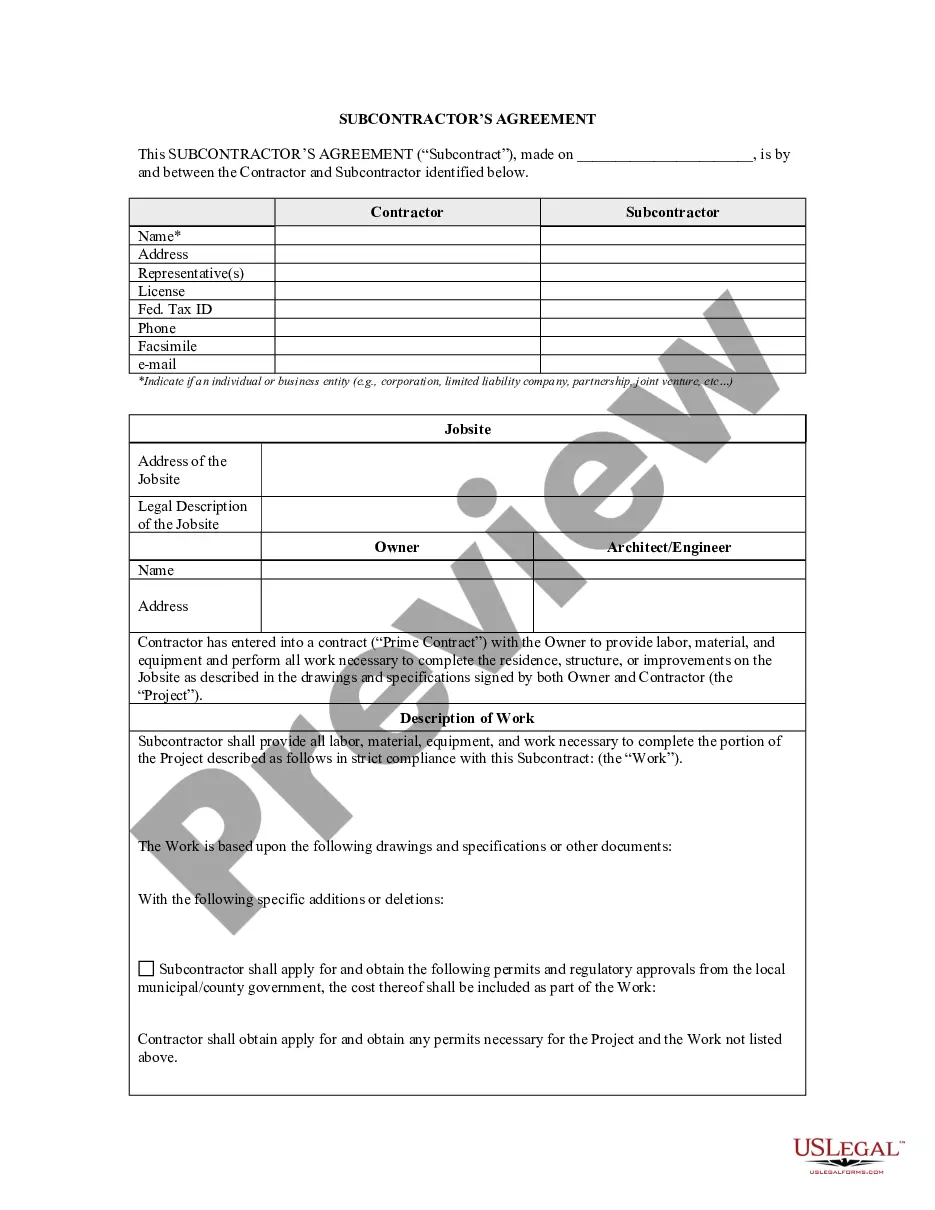

- Examine the page you've opened and check if it has the document you need.

- To do so, use the form description and preview if these options are presented.

- To find the one that fits your needs, utilize the search tab in the page header.

- Recheck that the sample complies with juridical standards and click Buy Now.

- Choose the subscription plan, then sign in or register for an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the selected document in the preferred format, print it, or complete it electronically.

The exceptional thing about the US Legal Forms library is that all the documentation you've ever acquired never gets lost - you can get it in your profile within the My Forms tab at any moment. Join the platform and quickly get verified legal forms for any situation with just a few clicks!