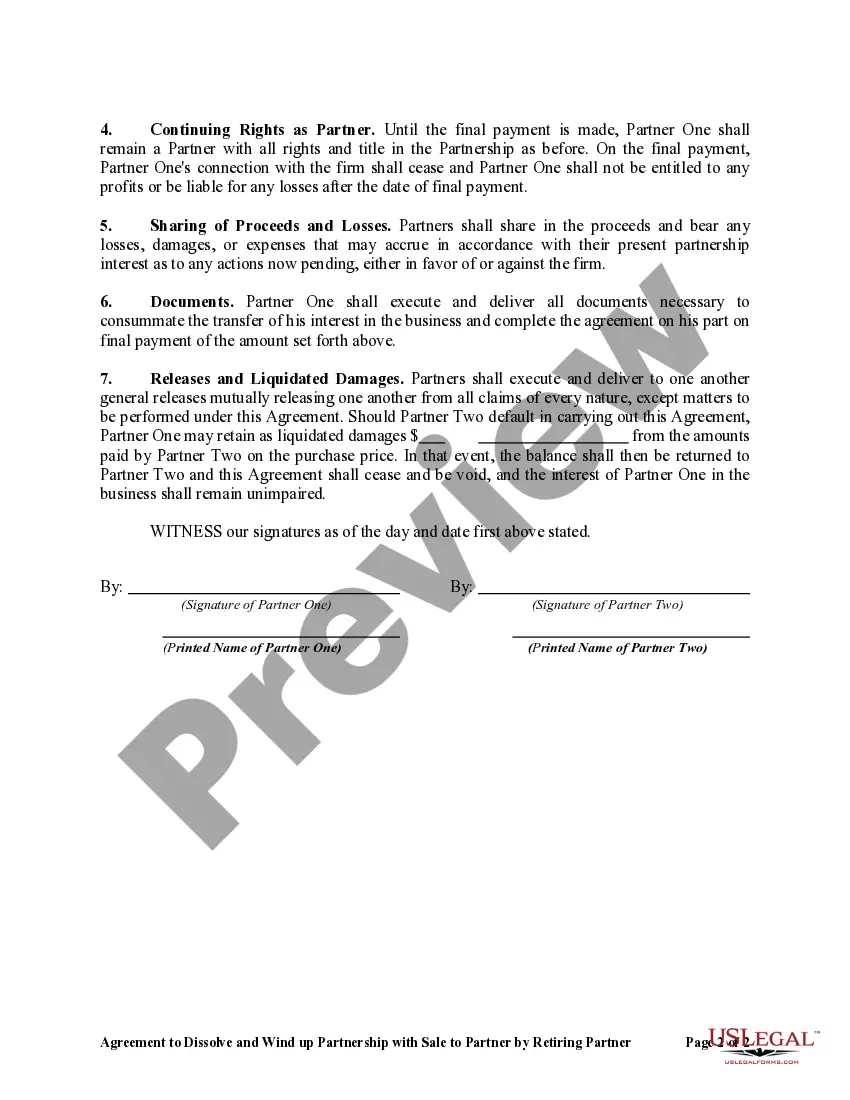

Allegheny Pennsylvania Agreement to Dissolve and Wind up Partnership with Sale to Partner by Retiring Partner is a legal document that outlines the terms and procedures for ending a partnership in Allegheny, Pennsylvania, while also including a provision for selling the retiring partner's share to one of the remaining partners. This agreement ensures a smooth dissolution of the partnership and a fair distribution of assets. The primary purpose of the Allegheny Pennsylvania Agreement to Dissolve and Wind up Partnership with Sale to Partner by Retiring Partner is to establish a clear and mutually agreed-upon process for dissolution. This agreement includes various key elements such as the effective date of dissolution, the manner of winding up business affairs, and the allocation of partnership assets and liabilities. One essential clause of this agreement is the sale provision to the remaining partner(s). When a partner decides to retire, they may sell their share in the partnership to one of the remaining partners. This provision allows for a seamless transfer of ownership and the continuation of the partnership business without disruption. There can be different types of Allegheny Pennsylvania Agreement to Dissolve and Wind up Partnership with Sale to Partner by Retiring Partner, which can be tailored to specific circumstances. These variations may include: 1. Buyout Agreement: This type of agreement outlines the terms and conditions under which the retiring partner's share will be purchased by the remaining partner(s). It specifies the sale price, payment terms, and any conditions that must be met for the buyout to occur. 2. Partner Retirement Plan: This agreement may include provisions for the retirement plan of partners, such as the distribution of profits, the valuation of the partnership, and the timetable for the retirement process. 3. Dissolution and Liquidation Plan: This type of agreement provides a detailed plan for winding up the partnership's affairs, liquidating assets, and settling liabilities. It may also address issues such as the sale of physical assets, termination of leases, and the settlement of any outstanding debts. 4. Succession Agreement: In some cases, a retiring partner may choose to appoint a successor to take over their share in the partnership. This type of agreement outlines the process for selecting and admitting a new partner, as well as the terms of the transfer of ownership. Creating an Allegheny Pennsylvania Agreement to Dissolve and Wind up Partnership with Sale to Partner by Retiring Partner is crucial for ensuring a smooth transition and the equitable distribution of assets. It is advisable to consult legal professionals specializing in partnership law to draft a customized agreement that meets the specific needs and goals of all the partners involved.

Allegheny Pennsylvania Agreement to Dissolve and Wind up Partnership with Sale to Partner by Retiring Partner

Description

How to fill out Allegheny Pennsylvania Agreement To Dissolve And Wind Up Partnership With Sale To Partner By Retiring Partner?

Are you looking to quickly create a legally-binding Allegheny Agreement to Dissolve and Wind up Partnership with Sale to Partner by Retiring Partner or probably any other document to take control of your personal or corporate affairs? You can go with two options: contact a legal advisor to write a legal document for you or draft it entirely on your own. Thankfully, there's an alternative solution - US Legal Forms. It will help you get professionally written legal paperwork without having to pay unreasonable fees for legal services.

US Legal Forms provides a huge catalog of over 85,000 state-compliant document templates, including Allegheny Agreement to Dissolve and Wind up Partnership with Sale to Partner by Retiring Partner and form packages. We provide templates for a myriad of life circumstances: from divorce papers to real estate documents. We've been on the market for more than 25 years and gained a rock-solid reputation among our clients. Here's how you can become one of them and get the needed document without extra troubles.

- To start with, double-check if the Allegheny Agreement to Dissolve and Wind up Partnership with Sale to Partner by Retiring Partner is tailored to your state's or county's laws.

- If the form comes with a desciption, make sure to check what it's intended for.

- Start the searching process again if the document isn’t what you were looking for by utilizing the search bar in the header.

- Choose the subscription that is best suited for your needs and proceed to the payment.

- Select the format you would like to get your form in and download it.

- Print it out, complete it, and sign on the dotted line.

If you've already registered an account, you can simply log in to it, locate the Allegheny Agreement to Dissolve and Wind up Partnership with Sale to Partner by Retiring Partner template, and download it. To re-download the form, simply head to the My Forms tab.

It's easy to buy and download legal forms if you use our catalog. Additionally, the templates we provide are updated by law professionals, which gives you greater confidence when writing legal matters. Try US Legal Forms now and see for yourself!