The Clark Nevada Agreement to Dissolve and Wind up Partnership with Sale to Partner by Retiring Partner is a legal document that outlines the process by which a partnership is dissolved and its assets distributed when one partner decides to retire and sell their stake to the remaining partner(s). This agreement ensures a smooth transition and fair division of assets, liabilities, and responsibilities. Key factors involved in the Clark Nevada Agreement to Dissolve and Wind up Partnership with Sale to Partner by Retiring Partner include: 1. Partnership Dissolution: The agreement clarifies that the partnership is being dissolved due to the retirement of one of the partners, and outlines the procedure for winding up its affairs. 2. Retirement Sale: The retiring partner sells their stake in the partnership to the remaining partner(s) at an agreed-upon price or valuation. The terms of the sale, including payment schedule and method, are detailed in the document. 3. Asset Valuation and Allocation: The agreement specifies the process for valuing the partnership's assets, including physical assets, intellectual property, and any outstanding debts. It determines how these assets will be allocated among the partners or sold to settle outstanding obligations. 4. Liability Settlement: The agreement also addresses the settlement of any outstanding liabilities, such as loans, debts, or contractual obligations. It ensures that all parties are aware of their responsibility for such liabilities and outlines a plan for their settlement. 5. Partner's Exit: The retiring partner's exit strategy is outlined in the agreement, including the transfer of ownership rights, termination of partnership interest, and any non-compete or non-disclosure clauses that may apply. Different types of Clark Nevada Agreement to Dissolve and Wind up Partnership with Sale to Partner by Retiring Partner may vary depending on the specific details and circumstances of the partnership. Some variations include: 1. Voluntary Retirement: When a partner voluntarily decides to retire from the partnership and sell their stake. 2. Forced Retirement: In some cases, a partner may be forced to retire due to legal or health issues. The agreement would outline the specific circumstances and procedures for the dissolution of the partnership under such circumstances. 3. Partial Sale: If only a portion of the retiring partner's stake is being sold to the remaining partner(s), the agreement would include provisions for the partial sale and the resulting distribution of ownership. 4. Mediation or Arbitration Clauses: Some agreements may include provisions for mediation or arbitration in case of disputes or disagreements during the dissolution and sale process. In summary, the Clark Nevada Agreement to Dissolve and Wind up Partnership with Sale to Partner by Retiring Partner is a comprehensive legal document that ensures an orderly dissolution and fair distribution of assets in a partnership when a partner chooses to retire and sell their share to the remaining partner(s). It provides clarity and protection for all parties involved, facilitating a smooth transition and minimizing potential conflicts.

Clark Nevada Agreement to Dissolve and Wind up Partnership with Sale to Partner by Retiring Partner

Description

How to fill out Clark Nevada Agreement To Dissolve And Wind Up Partnership With Sale To Partner By Retiring Partner?

Whether you intend to start your business, enter into a deal, apply for your ID renewal, or resolve family-related legal issues, you need to prepare specific paperwork corresponding to your local laws and regulations. Finding the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 expertly drafted and checked legal templates for any personal or business occasion. All files are collected by state and area of use, so picking a copy like Clark Agreement to Dissolve and Wind up Partnership with Sale to Partner by Retiring Partner is fast and straightforward.

The US Legal Forms library users only need to log in to their account and click the Download key next to the required template. If you are new to the service, it will take you a few more steps to obtain the Clark Agreement to Dissolve and Wind up Partnership with Sale to Partner by Retiring Partner. Adhere to the guidelines below:

- Make certain the sample fulfills your individual needs and state law requirements.

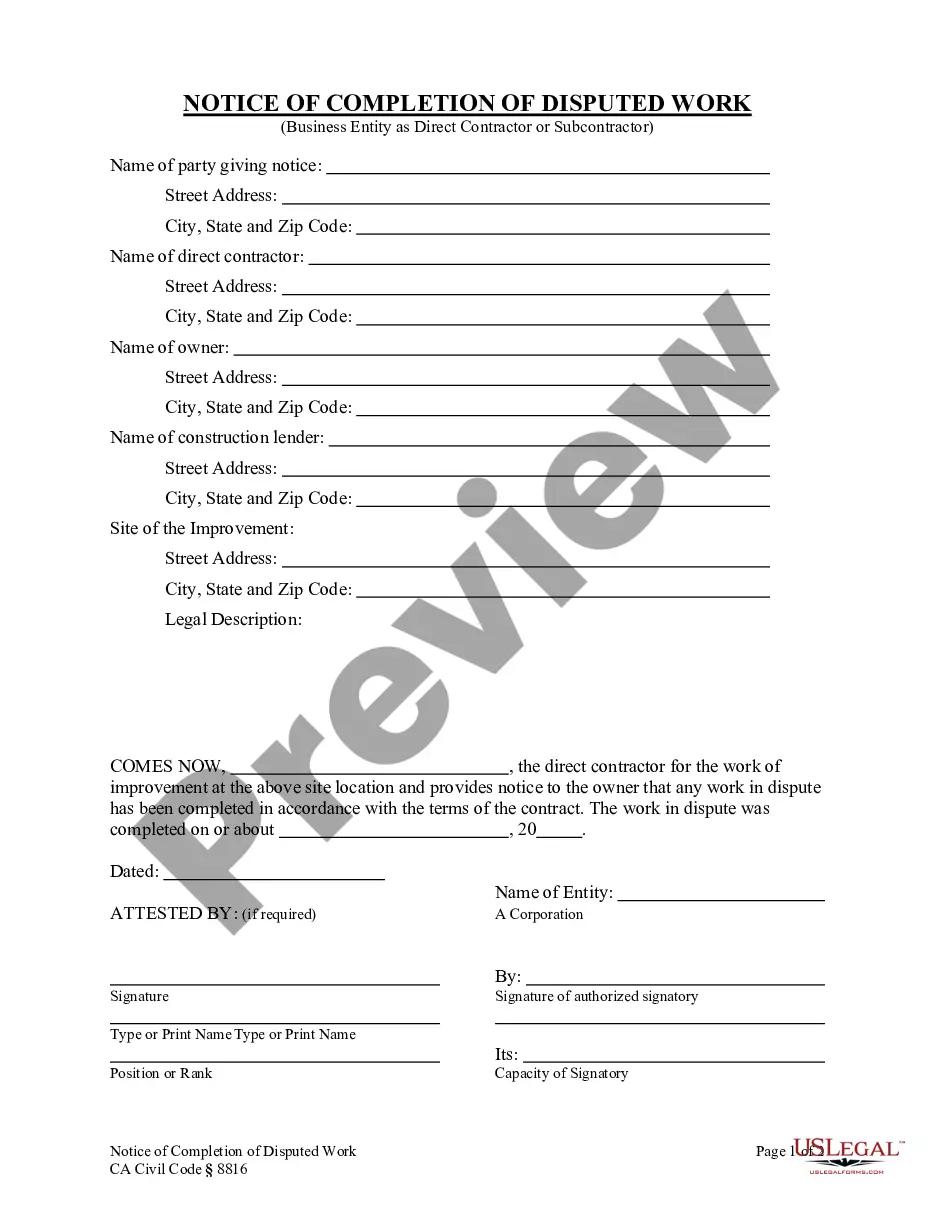

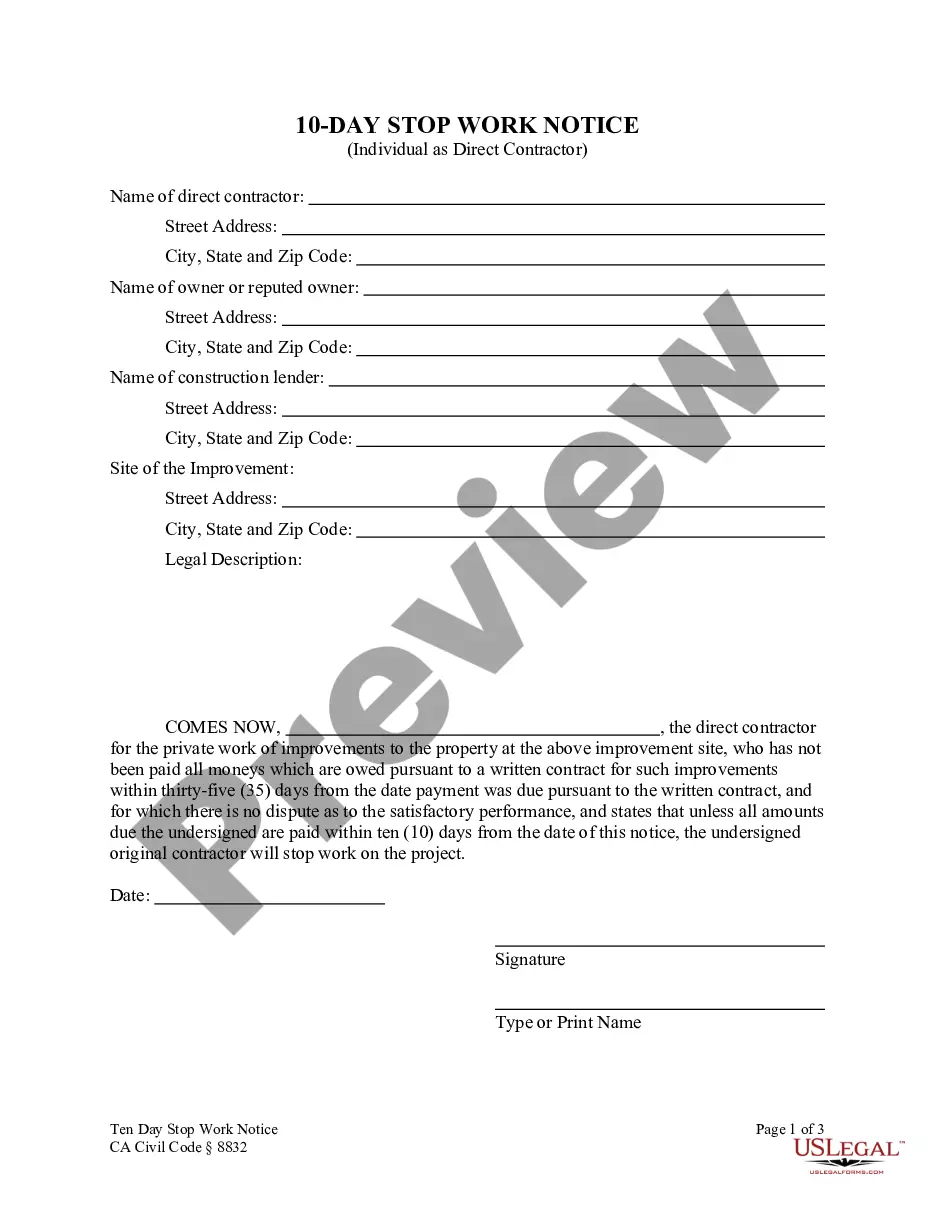

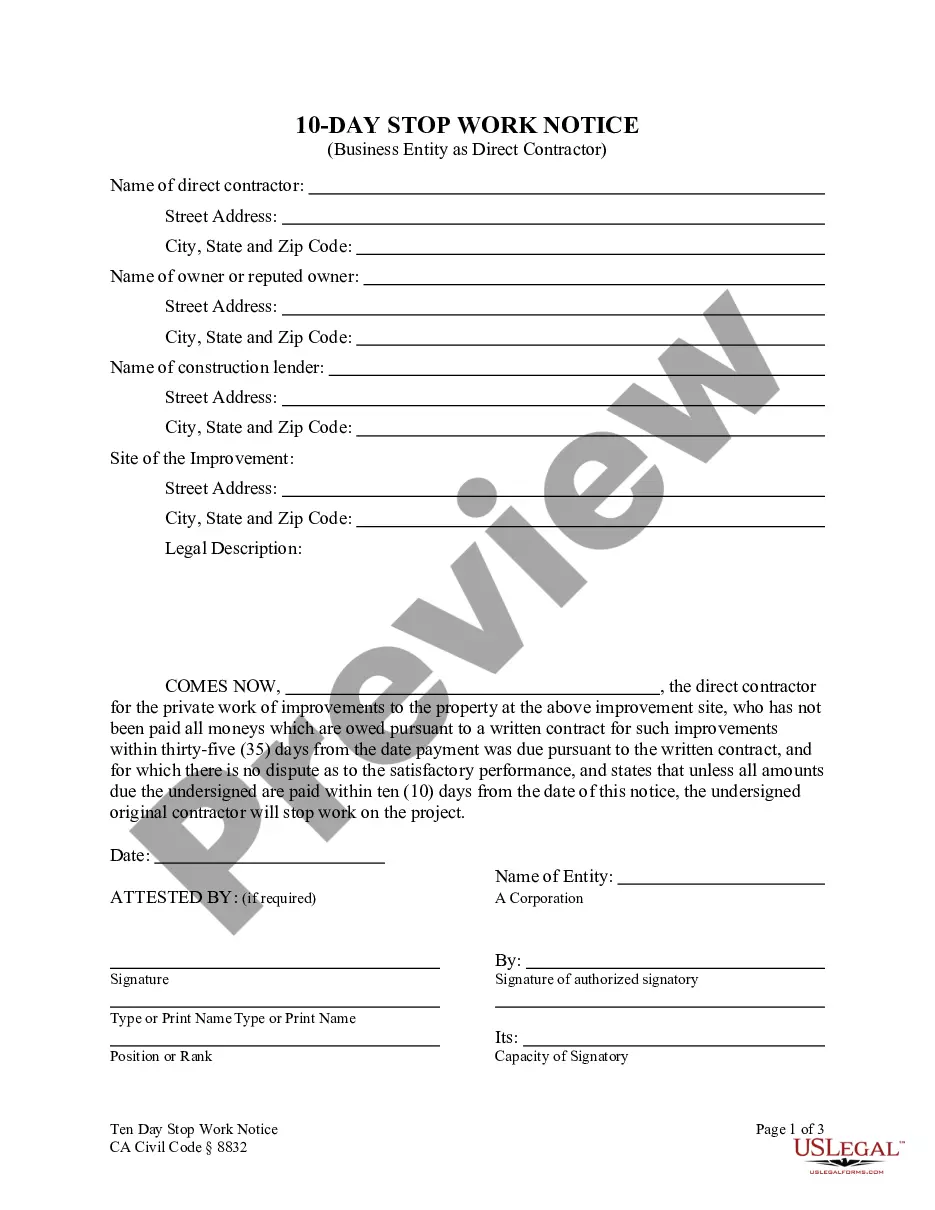

- Look through the form description and check the Preview if there’s one on the page.

- Make use of the search tab specifying your state above to find another template.

- Click Buy Now to get the file once you find the proper one.

- Opt for the subscription plan that suits you most to continue.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the Clark Agreement to Dissolve and Wind up Partnership with Sale to Partner by Retiring Partner in the file format you need.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Forms provided by our library are reusable. Having an active subscription, you are able to access all of your previously purchased paperwork at any moment in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date formal documentation. Sign up for the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form library!