The Alameda California Agreement for Purchase of Business Assets from a Corporation is a legal document that outlines the terms and conditions for the acquisition of a corporation's business assets. This agreement is specifically tailored to the jurisdiction of Alameda, California and ensures that both parties involved in the transaction are protected and bound by the agreed-upon terms. The key components of this agreement include: 1. Parties involved: The agreement clearly identifies the buyer, who intends to purchase the business assets, and the corporation, which is the entity selling the assets. 2. Asset description: A detailed description of the business assets being sold is provided. This may include tangible assets such as inventory, equipment, and real estate, as well as intangible assets like intellectual property, goodwill, and customer lists. 3. Purchase price and payment terms: The agreement specifies the total purchase price for the assets and outlines the payment terms, including any down payments, financing arrangements, or installment payments. 4. Representations and warranties: Both parties provide representations and warranties, ensuring that they have the legal authority to enter into the agreement, and that the assets being sold are free from any liens, encumbrances, or legal disputes. 5. Due diligence: The buyer is typically given the opportunity to conduct a thorough investigation of the assets, financial records, and other relevant documents of the corporation before finalizing the purchase. 6. Closing conditions: The agreement outlines the conditions that need to be met for the closing of the transaction, such as obtaining necessary governmental approvals and consents, and complying with any applicable laws or regulations. 7. Indemnification: The parties may agree to indemnify each other in case of any losses, damages, or liabilities arising from any breach of the agreement or any misrepresentations made by either party. 8. Confidentiality and non-compete clauses: The agreement may include provisions to ensure that both parties maintain the confidentiality of any proprietary information shared during the transaction, and non-compete clauses to restrict the corporation from engaging in similar business activities for a specified period after the sale. It's important to note that while the Alameda California Agreement for Purchase of Business Assets from a Corporation is a standard template, there may be different variations or specialized agreements suited for specific industries or circumstances.

Alameda California Agreement for Purchase of Business Assets from a Corporation

Description

How to fill out Alameda California Agreement For Purchase Of Business Assets From A Corporation?

Laws and regulations in every area differ from state to state. If you're not an attorney, it's easy to get lost in countless norms when it comes to drafting legal paperwork. To avoid pricey legal assistance when preparing the Alameda Agreement for Purchase of Business Assets from a Corporation, you need a verified template legitimate for your region. That's when using the US Legal Forms platform is so advantageous.

US Legal Forms is a trusted by millions online catalog of more than 85,000 state-specific legal forms. It's a great solution for professionals and individuals searching for do-it-yourself templates for different life and business scenarios. All the documents can be used many times: once you purchase a sample, it remains available in your profile for future use. Thus, when you have an account with a valid subscription, you can simply log in and re-download the Alameda Agreement for Purchase of Business Assets from a Corporation from the My Forms tab.

For new users, it's necessary to make a couple of more steps to get the Alameda Agreement for Purchase of Business Assets from a Corporation:

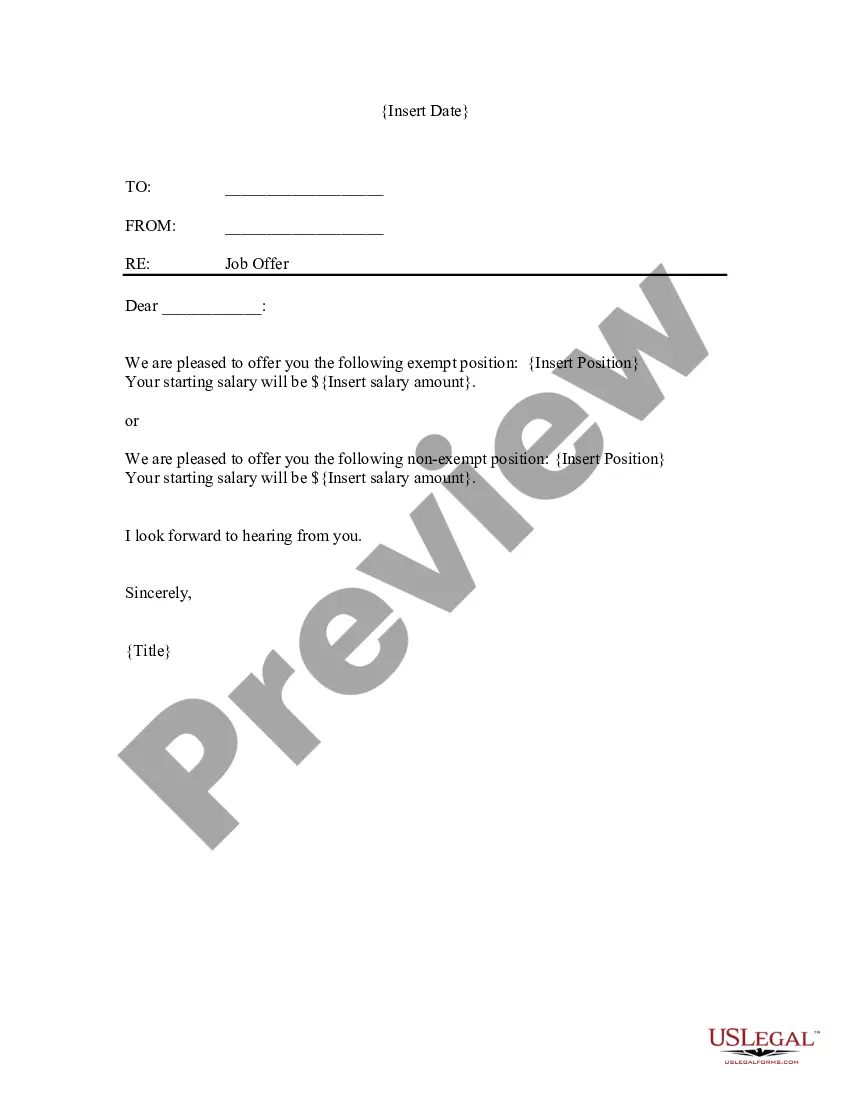

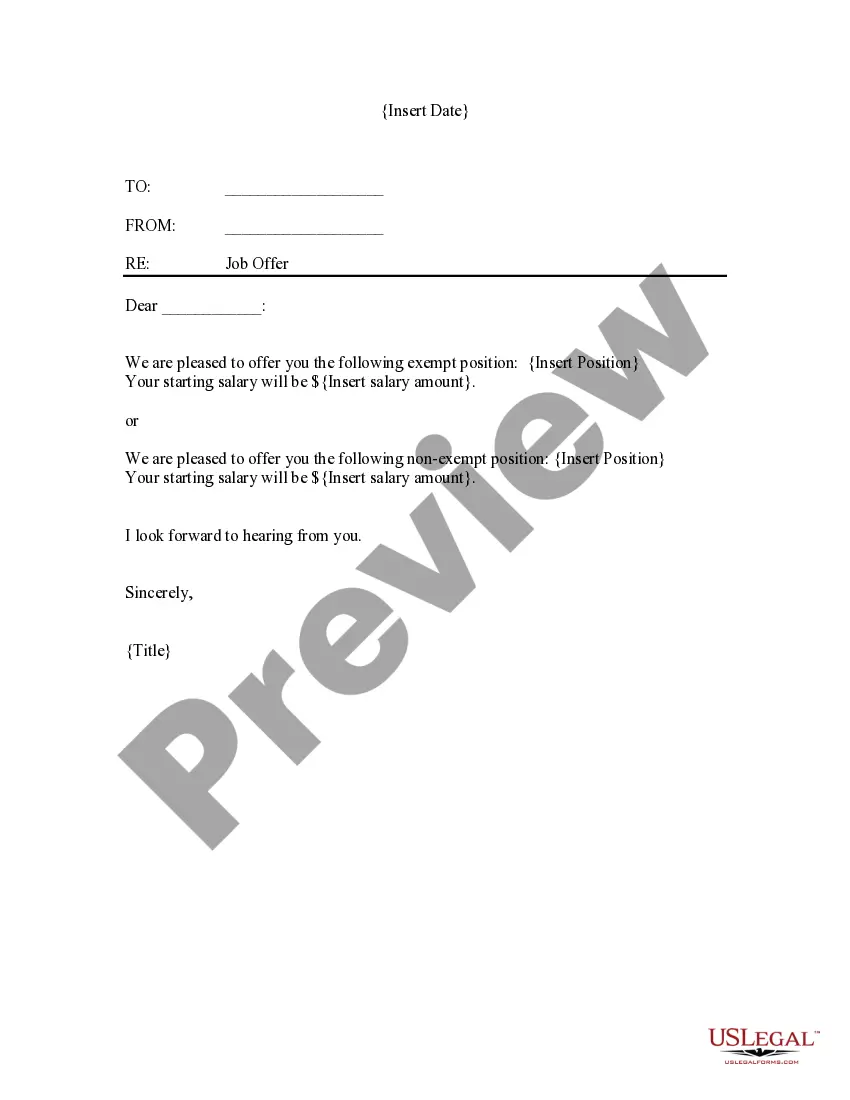

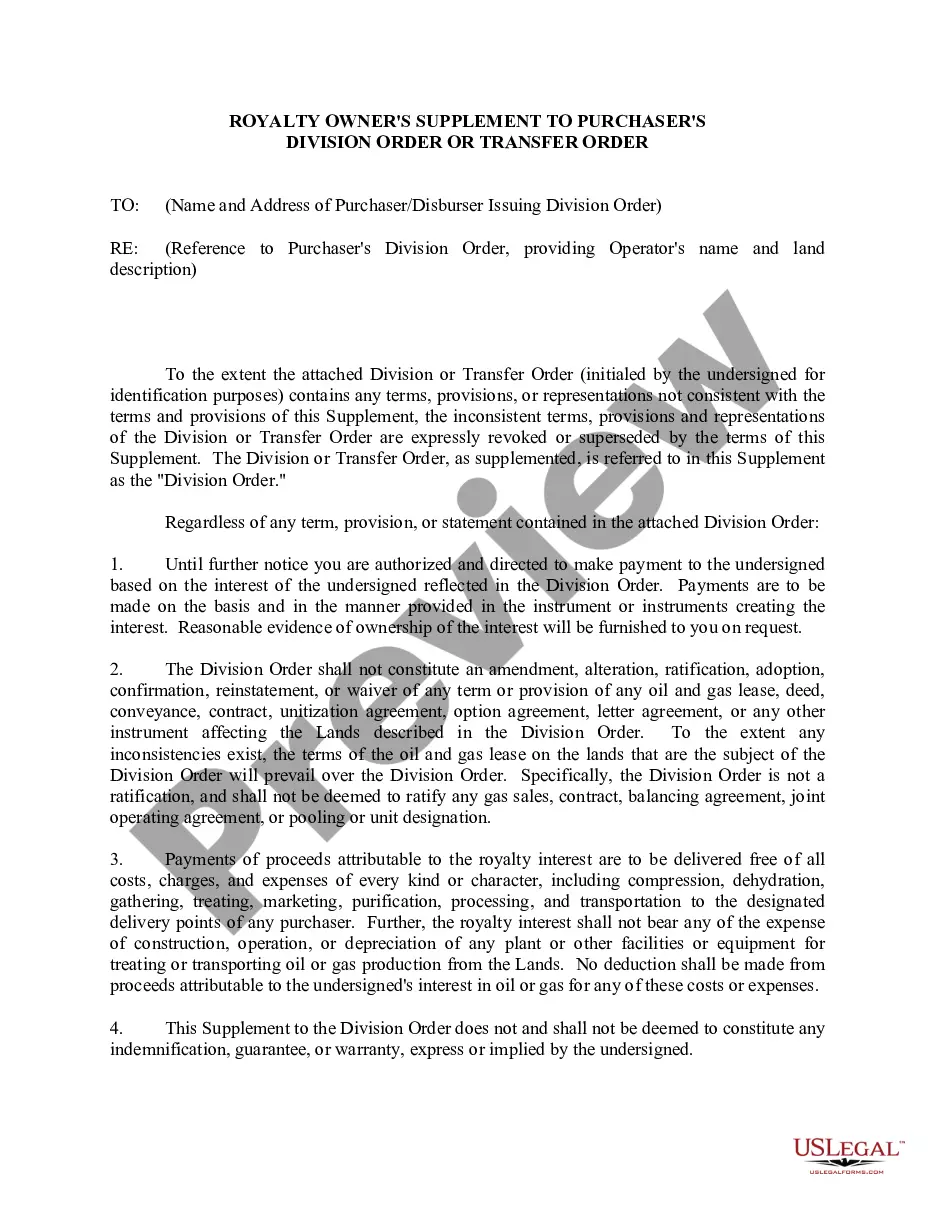

- Take a look at the page content to ensure you found the right sample.

- Use the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your requirements.

- Utilize the Buy Now button to get the document when you find the correct one.

- Choose one of the subscription plans and log in or create an account.

- Choose how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the document in and click Download.

- Complete and sign the document on paper after printing it or do it all electronically.

That's the simplest and most economical way to get up-to-date templates for any legal scenarios. Find them all in clicks and keep your documentation in order with the US Legal Forms!