The Cook Illinois Agreement for Purchase of Business Assets from a Corporation is a legal document that outlines the terms and conditions for the acquisition of specific business assets from a corporation in Cook County, Illinois. This agreement serves as a binding contract between the buyer and the seller, guaranteeing a smooth transfer of assets while protecting the interests of both parties involved. The Cook Illinois Agreement for Purchase of Business Assets covers various aspects of the transaction, including the identification and description of the assets being purchased, their valuation, and the purchase price. The agreement also delineates any liabilities or encumbrances associated with the assets that the buyer will assume upon completion of the sale. Additionally, the agreement includes provisions for warranties and representations from both the buyer and the seller. These warranties stipulate that the seller has full ownership and authority to sell the assets, and that the assets are free from any liens or legal disputes. It also ensures that the buyer will honor any outstanding obligations related to the assets, such as contracts, leases, or licenses. Furthermore, the Cook Illinois Agreement for Purchase of Business Assets addresses the terms of payment and the specific timeframe for completing the transaction. It may include provisions for installment payments, financing arrangements, or escrow accounts to settle any disputes that may arise during the purchase. Different types or variations of the Cook Illinois Agreement for Purchase of Business Assets may include: 1. Asset Purchase Agreement: This type of agreement focuses on the acquisition of tangible and intangible assets, such as inventory, equipment, intellectual property, and customer contracts. 2. Stock Purchase Agreement: In this variation, the buyer purchases the corporation's stocks, thus acquiring all of its assets and liabilities, including contracts, debts, and legal obligations. This form of agreement may require additional compliance with securities laws and regulations. 3. Merger or Acquisition Agreement: This agreement encompasses both the purchase of assets and the assumption of liabilities, often involving multiple corporations or entities. It details the terms and conditions for combining businesses and determines the allocation of assets, shares, and profits. In conclusion, the Cook Illinois Agreement for Purchase of Business Assets from a Corporation is a critical legal document that governs the transfer of assets and liabilities from a corporation in Cook County. Its comprehensive nature ensures a transparent and fair transaction, safeguarding the interests of all parties involved and providing a clear roadmap for the purchase process.

Cook Illinois Agreement for Purchase of Business Assets from a Corporation

Description

How to fill out Cook Illinois Agreement For Purchase Of Business Assets From A Corporation?

Whether you plan to start your company, enter into a contract, apply for your ID update, or resolve family-related legal issues, you must prepare specific paperwork corresponding to your local laws and regulations. Locating the right papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 expertly drafted and checked legal templates for any personal or business occurrence. All files are grouped by state and area of use, so picking a copy like Cook Agreement for Purchase of Business Assets from a Corporation is quick and easy.

The US Legal Forms library users only need to log in to their account and click the Download key next to the required template. If you are new to the service, it will take you several additional steps to obtain the Cook Agreement for Purchase of Business Assets from a Corporation. Follow the guide below:

- Make sure the sample meets your personal needs and state law requirements.

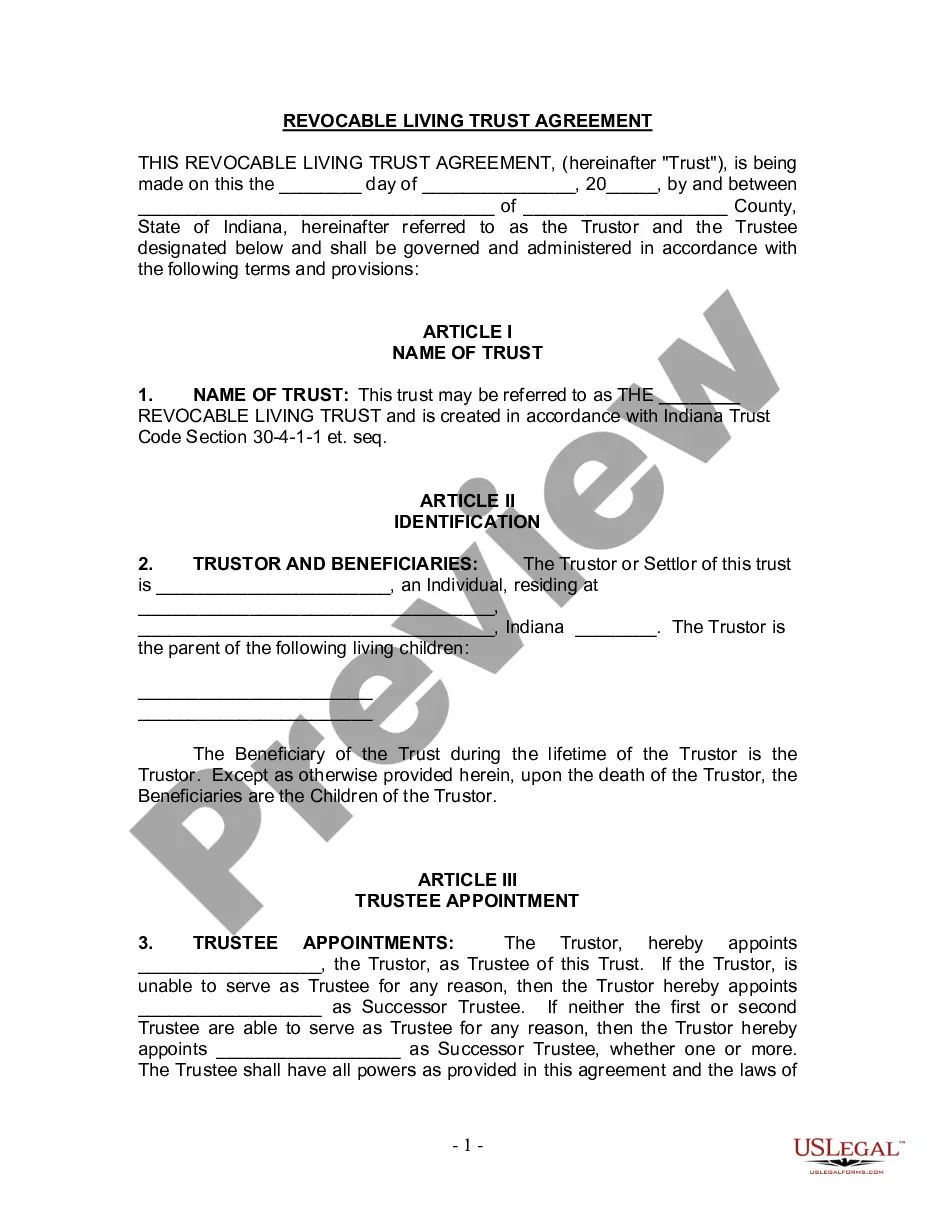

- Look through the form description and check the Preview if available on the page.

- Use the search tab providing your state above to locate another template.

- Click Buy Now to get the sample once you find the correct one.

- Opt for the subscription plan that suits you most to proceed.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the Cook Agreement for Purchase of Business Assets from a Corporation in the file format you need.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Documents provided by our library are reusable. Having an active subscription, you can access all of your previously purchased paperwork at any time in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date formal documentation. Join the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form library!