The Montgomery Maryland Agreement for Purchase of Business Assets from a Corporation is a legal contract that outlines the terms and conditions governing the acquisition of a corporation's assets by a buyer. This agreement is crucial for facilitating a smooth and lawful transfer of ownership. Key elements of the Montgomery Maryland Agreement for Purchase of Business Assets from a Corporation typically include: 1. Parties involved: The agreement should identify the buyer and the corporation selling their business assets. Their full legal names, addresses, and contact details should be stated. 2. Description of assets: A detailed description of the assets being transferred should be provided. This may include tangible assets like equipment, inventory, real estate, as well as intangible assets like intellectual property rights and customer contracts. 3. Purchase price and payment terms: The agreement should specify the purchase price for the assets, including any associated liabilities. The payment terms, such as down payment amount, installment schedule, and the method of payment (cash, check, or financing), should also be clearly stated. 4. Due diligence: The agreement may outline the scope of due diligence activities to be conducted by the buyer prior to the acquisition. This may involve reviewing financial records, contracts, permits, and any potential legal or operational issues. 5. Representations and warranties: Both the buyer and the corporation may provide various representations and warranties to ensure the accuracy of information provided and protect both parties in case of any misrepresentations or breaches. 6. Closing conditions: The agreement should establish the conditions that must be met before the transaction can be completed. This may include obtaining necessary regulatory approvals, shareholder consent, or the fulfillment of any outstanding obligations. 7. Indemnification: Provisions for indemnification, which allocate responsibility for any future liabilities or claims, should be included. This protects the buyer from assuming unexpected risks associated with the acquired assets. 8. Non-compete clause: In some cases, a non-compete clause may be included to prevent the corporation's management or key employees from competing or disclosing sensitive information to competitors for a specified period following the transaction. Different types or variations of the Montgomery Maryland Agreement for Purchase of Business Assets from a Corporation may include specific agreements tailored to various industries or specialized asset purchases. Some examples could include: 1. Technology Company Asset Purchase Agreement: Designed for the acquisition of technology-based corporations, including software, patents, or copyrights. 2. Real Estate Asset Purchase Agreement: Focused on the acquisition of a corporation's real estate assets, such as land, buildings, or rental properties. 3. Manufacturing Company Asset Purchase Agreement: Tailored for the purchase of manufacturing-related assets, such as machinery, equipment, and production facilities. Regardless of the specific type, a Montgomery Maryland Agreement for Purchase of Business Assets from a Corporation serves as a legally binding document that protects both the buyer and seller, ensuring a smooth and transparent transaction.

Montgomery Maryland Agreement for Purchase of Business Assets from a Corporation

Description

How to fill out Montgomery Maryland Agreement For Purchase Of Business Assets From A Corporation?

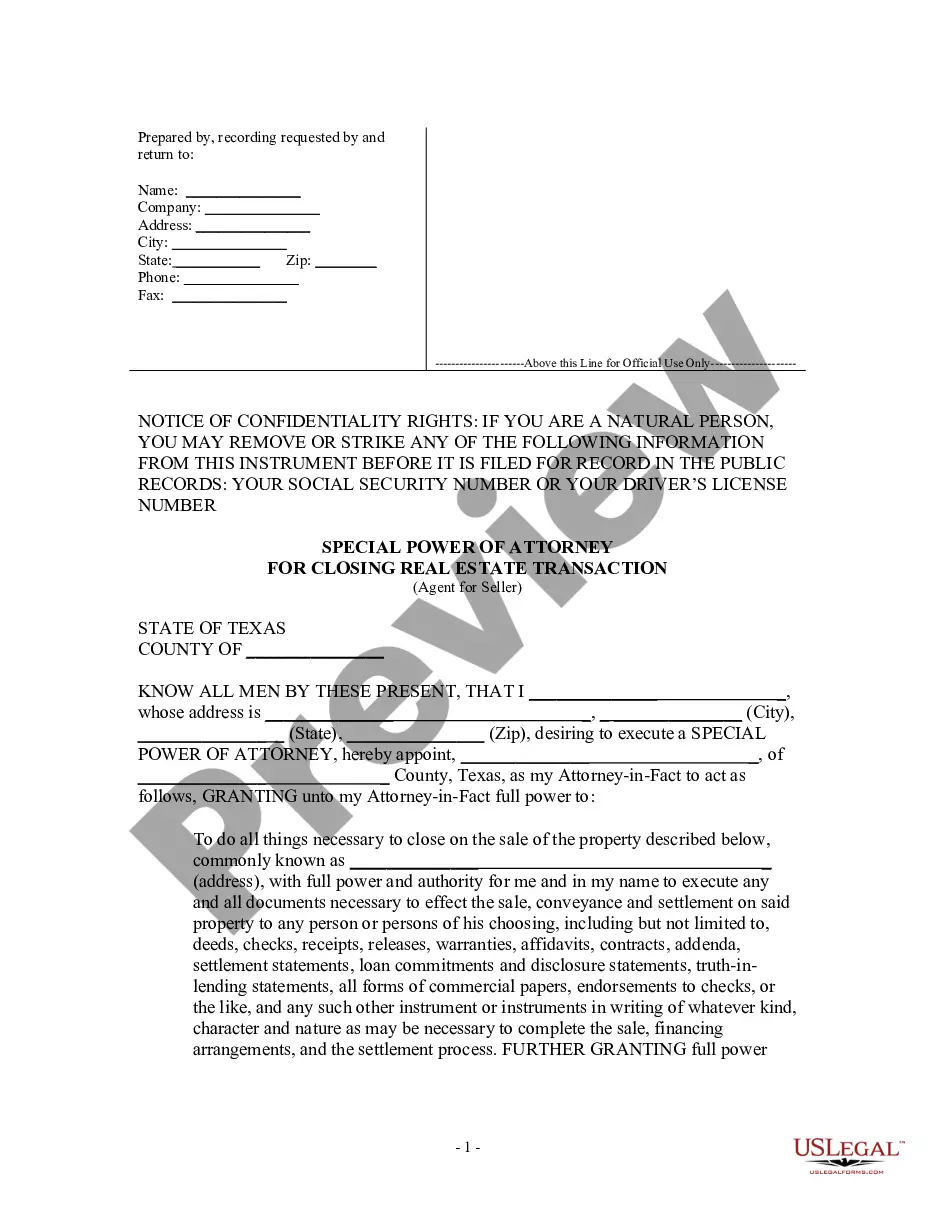

Preparing legal documentation can be difficult. Besides, if you decide to ask a legal professional to write a commercial agreement, documents for proprietorship transfer, pre-marital agreement, divorce paperwork, or the Montgomery Agreement for Purchase of Business Assets from a Corporation, it may cost you a fortune. So what is the most reasonable way to save time and money and draft legitimate documents in total compliance with your state and local laws and regulations? US Legal Forms is a great solution, whether you're looking for templates for your personal or business needs.

US Legal Forms is the most extensive online collection of state-specific legal documents, providing users with the up-to-date and professionally checked templates for any use case accumulated all in one place. Therefore, if you need the latest version of the Montgomery Agreement for Purchase of Business Assets from a Corporation, you can easily locate it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample by clicking on the Download button. If you haven't subscribed yet, here's how you can get the Montgomery Agreement for Purchase of Business Assets from a Corporation:

- Look through the page and verify there is a sample for your area.

- Check the form description and use the Preview option, if available, to ensure it's the template you need.

- Don't worry if the form doesn't satisfy your requirements - search for the correct one in the header.

- Click Buy Now once you find the needed sample and choose the best suitable subscription.

- Log in or sign up for an account to pay for your subscription.

- Make a transaction with a credit card or via PayPal.

- Choose the document format for your Montgomery Agreement for Purchase of Business Assets from a Corporation and download it.

Once done, you can print it out and complete it on paper or upload the samples to an online editor for a faster and more convenient fill-out. US Legal Forms enables you to use all the paperwork ever purchased multiple times - you can find your templates in the My Forms tab in your profile. Try it out now!