The Salt Lake Utah Agreement for Purchase of Business Assets from a Corporation is a legally binding document that outlines the terms and conditions of transferring ownership of a corporation's business assets to another party in Salt Lake City, Utah. This agreement is crucial when a corporation wishes to sell its business assets or when an individual or entity intends to acquire a corporation's assets. The agreement includes various essential components, such as: 1. Parties Involved: This section identifies the buyer and the seller involved in the transaction. It provides their legal names, addresses, and contact information. 2. Asset Description: This section provides a detailed description of the business assets being sold. It includes tangible assets like inventory, equipment, real estate, and intangible assets like intellectual property rights, trademarks, patents, or customer databases. 3. Purchase Price and Payment Terms: The agreement specifies the total purchase price for the business assets, along with the payment terms such as the amount to be paid at closing and any additional installments. It may also outline any specific payment methods, such as check or wire transfer. 4. Allocation of Purchase Price: This section outlines how the purchase price will be allocated among the different assets involved in the transaction. This allocation is crucial for tax and accounting purposes. 5. Representations and Warranties: The agreement includes a list of representations and warranties made by both the buyer and the seller. These assurances cover various aspects like the corporation's legal status, accuracy of financial statements, absence of undisclosed liabilities, and ownership of intellectual property rights. 6. Closing Conditions: This section outlines the conditions that must be met before the closing of the transaction. It may include obtaining necessary consents, approvals, or permits, or the absence of any litigation or material adverse changes in the business. 7. Confidentiality and Non-Compete Agreements: The agreement may include provisions to protect the buyer's interests, such as confidentiality clauses preventing the seller from disclosing sensitive information, and non-compete clauses restricting the seller's ability to compete with the purchased business assets. Types of Salt Lake Utah Agreements for Purchase of Business Assets from a Corporation: 1. Asset Purchase Agreement: This type of agreement is used when the buyer only intends to acquire specific assets of the corporation, rather than purchasing the entire entity. 2. Stock Purchase Agreement: This agreement is employed when the buyer wishes to purchase all the corporation's outstanding shares or ownership interests, effectively obtaining ownership and control of the entire corporation. 3. Merger Agreement: This agreement is utilized when two or more corporations decide to merge, forming a single entity. It involves the consolidation of assets and liabilities, and the agreement outlines the terms and conditions of the merger. In conclusion, the Salt Lake Utah Agreement for Purchase of Business Assets from a Corporation is a comprehensive legal document that facilitates the transfer of a corporation's business assets to another party in Salt Lake City, Utah. It ensures that both buyer and seller are protected and that the transaction is executed smoothly within the framework of the law.

Salt Lake Utah Agreement for Purchase of Business Assets from a Corporation

Description

How to fill out Salt Lake Utah Agreement For Purchase Of Business Assets From A Corporation?

Preparing legal documentation can be difficult. Besides, if you decide to ask an attorney to write a commercial agreement, documents for ownership transfer, pre-marital agreement, divorce paperwork, or the Salt Lake Agreement for Purchase of Business Assets from a Corporation, it may cost you a fortune. So what is the best way to save time and money and draw up legitimate forms in total compliance with your state and local laws and regulations? US Legal Forms is a great solution, whether you're searching for templates for your individual or business needs.

US Legal Forms is largest online collection of state-specific legal documents, providing users with the up-to-date and professionally verified templates for any scenario gathered all in one place. Consequently, if you need the current version of the Salt Lake Agreement for Purchase of Business Assets from a Corporation, you can easily locate it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample by clicking on the Download button. If you haven't subscribed yet, here's how you can get the Salt Lake Agreement for Purchase of Business Assets from a Corporation:

- Look through the page and verify there is a sample for your area.

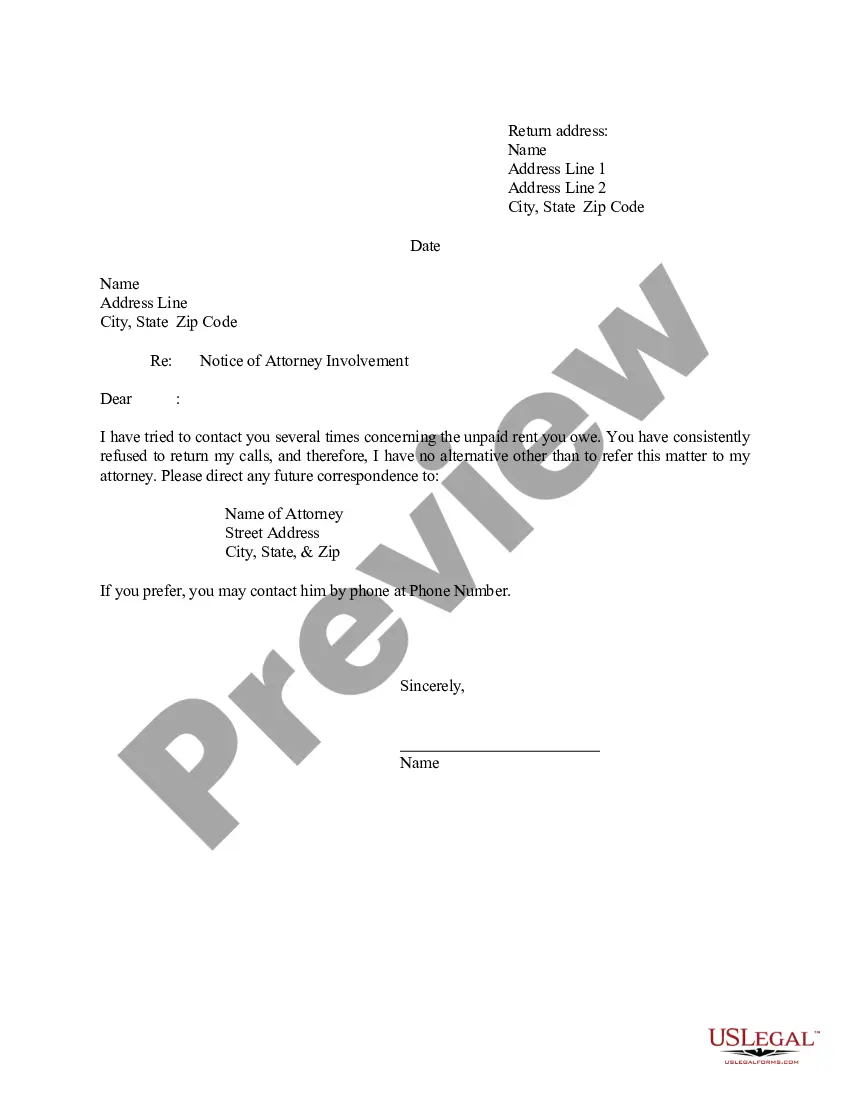

- Examine the form description and use the Preview option, if available, to make sure it's the sample you need.

- Don't worry if the form doesn't satisfy your requirements - search for the correct one in the header.

- Click Buy Now once you find the needed sample and select the best suitable subscription.

- Log in or register for an account to purchase your subscription.

- Make a transaction with a credit card or via PayPal.

- Opt for the file format for your Salt Lake Agreement for Purchase of Business Assets from a Corporation and save it.

Once finished, you can print it out and complete it on paper or upload the template to an online editor for a faster and more practical fill-out. US Legal Forms enables you to use all the paperwork ever acquired many times - you can find your templates in the My Forms tab in your profile. Give it a try now!