The Nassau New York Agreement to Purchase Condominium with Purchase Money Mortgage Financing by Seller, and Subject to Existing Mortgage is a legal contract used in real estate transactions involving the purchase of a condominium unit. This agreement outlines the terms and conditions under which the buyer will purchase the property while relying on financing provided by the seller. Keywords: Nassau New York, Agreement to Purchase Condominium, Purchase Money Mortgage Financing, Seller, Subject to Existing Mortgage. The Nassau New York Agreement to Purchase Condominium with Purchase Money Mortgage Financing by Seller, and Subject to Existing Mortgage enables a buyer to acquire a condominium unit by obtaining a loan directly from the seller instead of relying on traditional financial institutions. This unconventional financing option can offer flexibility and convenience to buyers who may face difficulties obtaining a mortgage loan from banks. In this agreement, the buyer and seller agree upon the purchase price, terms, and conditions of the transaction. The agreement usually includes clauses addressing the property's condition, title, inspections, and contingencies. It outlines the specific terms of the purchase money mortgage financing provided by the seller, including the interest rate, payment terms, and any applicable fees. Additionally, the agreement may address the existing mortgage on the property. If there is an existing mortgage, the buyer agrees to assume and take responsibility for the payments and obligations associated with that mortgage, subject to the terms and conditions outlined in the agreement. Different types of Nassau New York Agreements to Purchase Condominium with Purchase Money Mortgage Financing by Seller, and Subject to Existing Mortgage may include variations in the terms of seller financing. For example, the agreement might specify a fixed or adjustable interest rate, require a down payment, or outline the duration of the financing period. It is essential for both buyers and sellers to clearly understand the terms and conditions of these agreements before entering into a transaction. In conclusion, the Nassau New York Agreement to Purchase Condominium with Purchase Money Mortgage Financing by Seller, and Subject to Existing Mortgage is a specialized legal document that facilitates real estate transactions between buyers and sellers, empowering buyers to secure financing directly from sellers while assuming the obligations of any existing mortgage on the property. This agreement provides an alternative financing option for buyers who may face challenges obtaining traditional mortgage loans.

Nassau New York Agreement to Purchase Condominium with Purchase Money Mortgage Financing by Seller, and Subject to Existing Mortgage

Description

How to fill out Nassau New York Agreement To Purchase Condominium With Purchase Money Mortgage Financing By Seller, And Subject To Existing Mortgage?

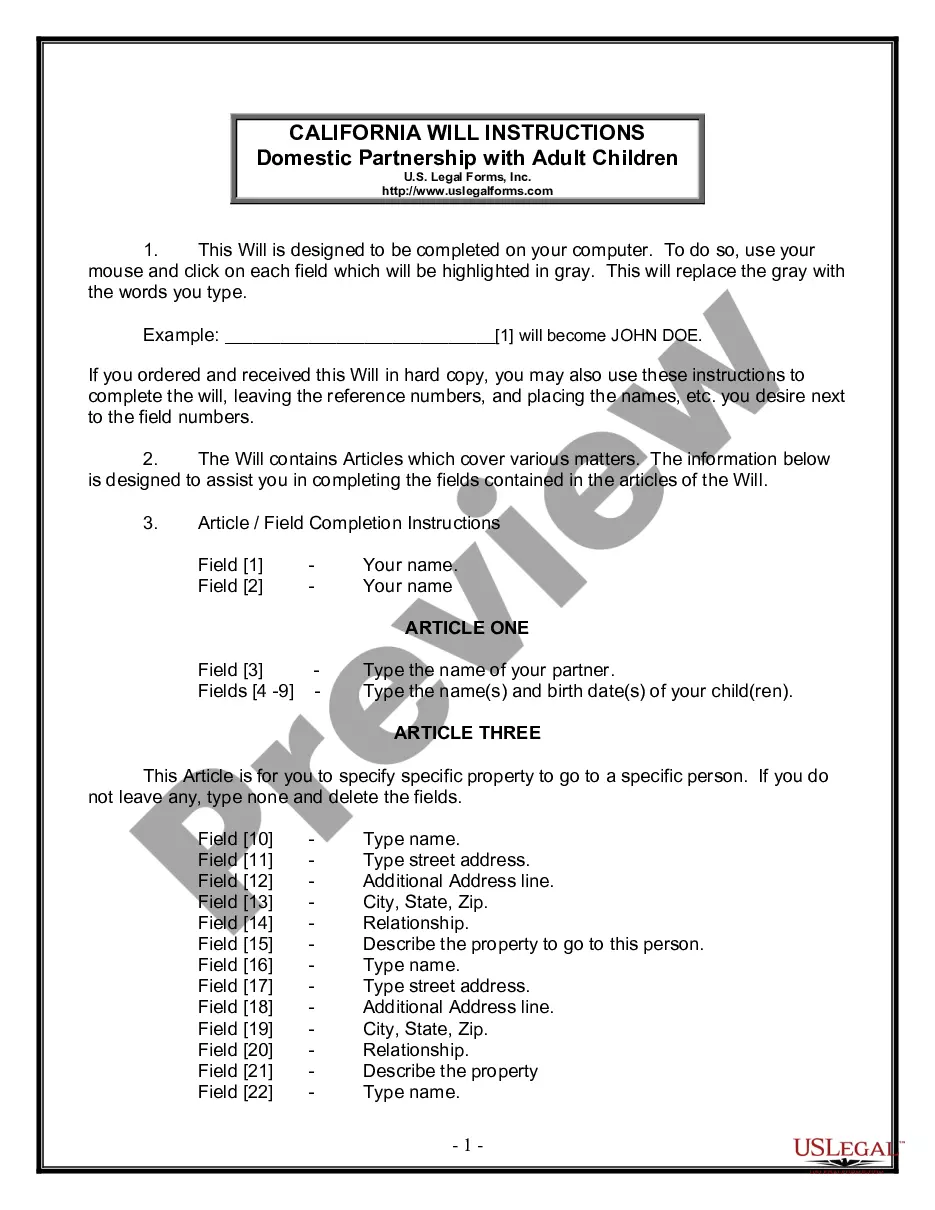

Dealing with legal forms is a necessity in today's world. However, you don't always need to look for professional help to draft some of them from the ground up, including Nassau Agreement to Purchase Condominium with Purchase Money Mortgage Financing by Seller, and Subject to Existing Mortgage, with a service like US Legal Forms.

US Legal Forms has more than 85,000 forms to select from in different types varying from living wills to real estate papers to divorce documents. All forms are organized according to their valid state, making the searching process less challenging. You can also find detailed resources and tutorials on the website to make any tasks related to paperwork execution simple.

Here's how to locate and download Nassau Agreement to Purchase Condominium with Purchase Money Mortgage Financing by Seller, and Subject to Existing Mortgage.

- Go over the document's preview and outline (if available) to get a basic information on what you’ll get after downloading the form.

- Ensure that the template of your choosing is specific to your state/county/area since state regulations can affect the legality of some documents.

- Examine the related document templates or start the search over to locate the right file.

- Click Buy now and register your account. If you already have an existing one, choose to log in.

- Pick the pricing {plan, then a needed payment method, and buy Nassau Agreement to Purchase Condominium with Purchase Money Mortgage Financing by Seller, and Subject to Existing Mortgage.

- Choose to save the form template in any offered file format.

- Visit the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can locate the needed Nassau Agreement to Purchase Condominium with Purchase Money Mortgage Financing by Seller, and Subject to Existing Mortgage, log in to your account, and download it. Of course, our platform can’t replace an attorney entirely. If you have to deal with an extremely challenging situation, we advise using the services of an attorney to examine your form before executing and submitting it.

With more than 25 years on the market, US Legal Forms became a go-to provider for various legal forms for millions of customers. Join them today and get your state-specific paperwork with ease!

Form popularity

FAQ

Buying subject-to means buying a home subject-to the existing mortgage. It means that the seller is not paying off the existing mortgage. Instead, the buyer is taking over the payments. 1 The unpaid balance of the existing mortgage is then calculated as part of the buyer's purchase price.

Though they sound similar, a PSA is different from a purchase agreement. PSAs define the terms of the transaction and include the date of closing and other details. Signing a PSA does not complete the sale of the home. Signing a purchase agreement, however, does complete the home sale.

Understanding The Tripartite Agreement A tripartite agreement is the principal legal document involving the buyer, bank, and seller. It is an essential document when a buyer prefers a home loan to buy a house in an under-construction project.

Mortgages are types of loans that are secured with real estate or personal property. A loan is a relationship between a lender and borrower.

Yes, you can use a home equity loan to buy another house. Using a home equity loan (also called a second mortgage) to purchase another home can eliminate or reduce a homeowner's out-of-pocket expenses. However, taking equity out of your home to buy another house comes with risks.

A purchase arrangement whereby the buyer of a parcel of real property agrees that a mortgage against the property to be purchased shall be permitted to remain a lien upon sale. Unlike a loan assumption, the subject-to buyer does not become personally liable on the underlying debt.

16. When a buyer acquires a property having an existing mortgage loan, a decision must be made as to whether or not the subsequent owner of the property can preserve the loan. If the buyer does not add his or her signature to the note, the buyer does not take on any personal liability.

An agreement for sale is a document between the buyer and seller of real estate agreeing to terms of sale. A mortgage is a security instrument giving a lender a security interest in the property in exchange for a loan.

An assumable mortgage allows someone to find a house they want to buy and take over the seller's existing home loan without applying for a new mortgage. This means the remaining balance, mortgage rate, repayment period and other loan terms stay the same, but the responsibility for the debt is transferred to the buyer.

Subject to financing is when the investor or purchaser takes rights to the title for a property while the seller's existing mortgage stays in place. In the simplest terms, the real estate deal is subject to the seller's mortgage financing the deal. Subject to financing is a creative way to invest in real estate.