Alameda California Lease to Own for Commercial Property offers a unique opportunity for individuals or businesses looking to acquire a commercial property in the city of Alameda. This option allows potential buyers to lease a commercial property with the option to buy it at a later date. With Alameda's thriving business community, lease to own for commercial property presents an attractive solution for entrepreneurs, startups, or established businesses seeking a long-term investment. This flexible and customizable arrangement provides a viable path towards property ownership while offering the benefits of leasing initially. There are different types of Alameda California Lease to Own for Commercial Property, each varying in terms and conditions to cater to different buyer requirements. Some of these include: 1. Traditional Lease to Own: In this type of arrangement, a tenant and property owner agree on a lease contract with an option to buy the property at the end of the lease period. A portion of the monthly lease payments often goes towards the eventual purchase price. 2. Rent Credit Lease: This lease to own option allows tenants to accumulate rent credits over the lease period, which can be applied towards the purchase price when exercising the buying option. The accumulated credits can substantially reduce the overall cost of the property. 3. Lease with Purchase Agreement: This type of lease agreement specifies the future purchase price of the property, allowing tenants to lock in a price even before the lease commences. It provides stability and eliminates worries about market fluctuations. 4. Sandwich Lease Option: This arrangement involves three parties: the tenant-buyer, the property owner, and an intermediary. The tenant-buyer subleases the property from the intermediary, who holds the primary lease with the property owner. The tenant-buyer has the right, but not the obligation, to buy the property during the lease term. Alameda California Lease to Own for Commercial Property brings tremendous advantages to aspiring property buyers. These benefits include building equity through rent payments, potential tax advantages, time to establish business operations without immediate high upfront costs, and the opportunity to carefully evaluate the property before making a long-term commitment. In conclusion, Alameda California Lease to Own for Commercial Property provides an attractive avenue for individuals or businesses aspiring to own a commercial property in Alameda. With various types of lease to own options available, interested parties can tailor the agreement to suit their specific needs and goals. This arrangement bridges the gap between leasing and ownership, ultimately paving the way for a successful business venture in Alameda, California.

Alameda California Lease to Own for Commercial Property

Description

How to fill out Alameda California Lease To Own For Commercial Property?

Preparing documents for the business or individual needs is always a huge responsibility. When drawing up a contract, a public service request, or a power of attorney, it's crucial to take into account all federal and state laws of the particular region. However, small counties and even cities also have legislative provisions that you need to consider. All these aspects make it burdensome and time-consuming to create Alameda Lease to Own for Commercial Property without professional assistance.

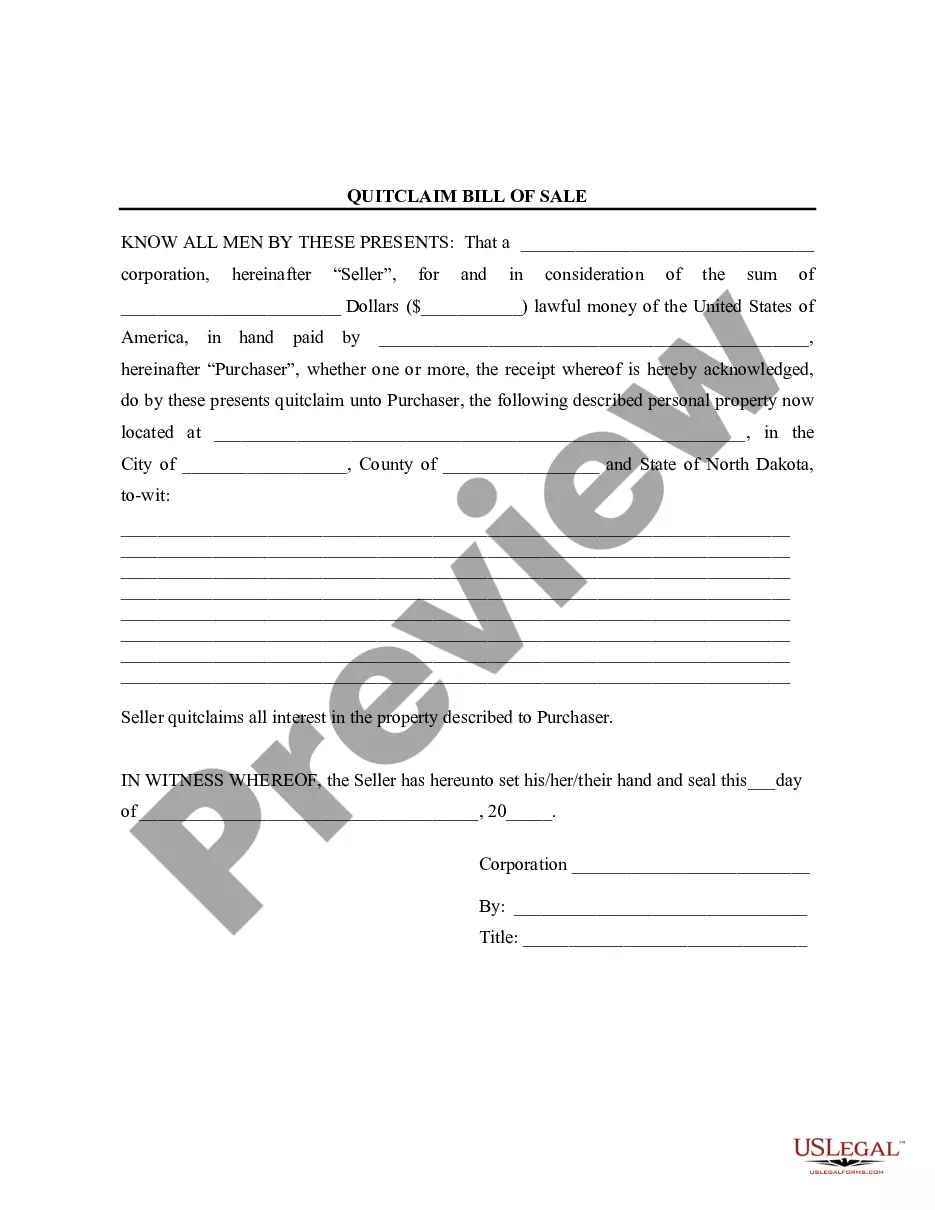

It's possible to avoid wasting money on attorneys drafting your paperwork and create a legally valid Alameda Lease to Own for Commercial Property by yourself, using the US Legal Forms online library. It is the biggest online collection of state-specific legal templates that are professionally cheched, so you can be sure of their validity when choosing a sample for your county. Previously subscribed users only need to log in to their accounts to save the required document.

In case you still don't have a subscription, adhere to the step-by-step guideline below to get the Alameda Lease to Own for Commercial Property:

- Examine the page you've opened and verify if it has the document you need.

- To do so, use the form description and preview if these options are presented.

- To find the one that fits your requirements, utilize the search tab in the page header.

- Recheck that the template complies with juridical criteria and click Buy Now.

- Pick the subscription plan, then sign in or create an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the selected document in the preferred format, print it, or complete it electronically.

The great thing about the US Legal Forms library is that all the paperwork you've ever acquired never gets lost - you can get it in your profile within the My Forms tab at any moment. Join the platform and easily obtain verified legal forms for any situation with just a few clicks!