Allegheny Pennsylvania Lease to Own for Commercial Property

Category:

State:

Multi-State

County:

Allegheny

Control #:

US-00836BG-1

Format:

Word;

Rich Text

Instant download

Description

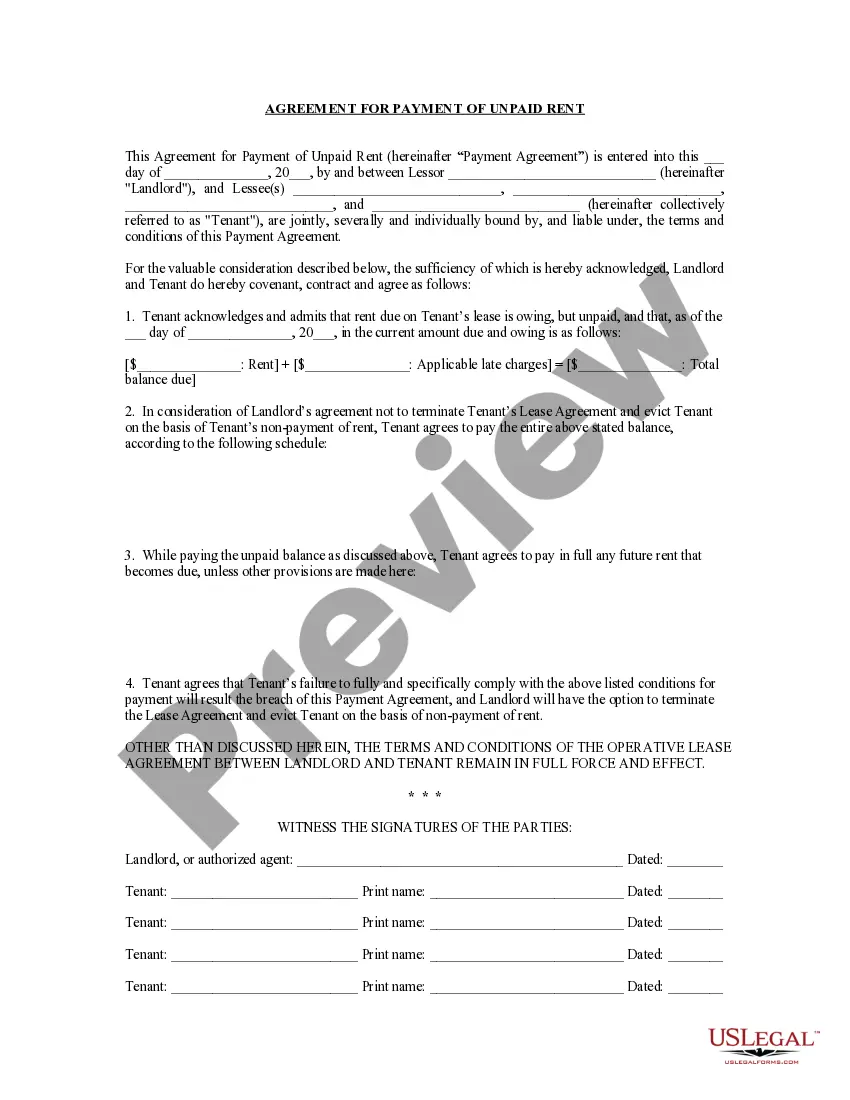

This form is a sample of a commercial lease of real property which contains an option to purchase the property at the end of the term. This lease is a triple net lease which means that the lessee pays, in addition to rent, all expenses associated with the property such as property taxes, insurance and maintenance and operation charges.

Free preview

How to fill out Lease To Own For Commercial Property?

Organizing paperwork for commercial or individual needs is consistently a major obligation.

When drafting an agreement, a public service inquiry, or a power of attorney, it's crucial to take into account all federal and state statutes relevant to the specific locality.

Nonetheless, minor counties and even municipalities also have legislative regulations that must be taken into account.

The excellent aspect of the US Legal Forms library is that all the documents you've ever obtained are never lost - you can access them in your profile under the My documents section at any time. Join the platform and effortlessly acquire verified legal forms for any circumstance with just a few clicks!

- All these factors make it daunting and labor-intensive to generate an Allegheny Lease to Own for Commercial Property without expert help.

- It is feasible to avoid incurring legal fees for drafting your paperwork and create a legally sound Allegheny Lease to Own for Commercial Property independently, utilizing the US Legal Forms online database.

- It is the largest digital compilation of state-specific legal documents that are expertly verified, ensuring their legitimacy when selecting a template for your county.

- Previously registered users simply need to Log In to their profiles to retrieve the necessary form.

- If you do not have a subscription yet, follow the step-by-step guide below to acquire the Allegheny Lease to Own for Commercial Property.

- Review the page you've accessed and confirm if it contains the document you require.

- To do this, make use of the form description and preview if those options are provided.