Orange California Agreement to Lease Commercial Property with Option to Purchase at End of Lease Term — Rent to Ow— - Real Estate Rental is a legal contract between a landlord and a tenant in Orange, California, that offers the tenant the exclusive right to lease and potentially purchase a commercial property at the end of the lease term. This unique agreement combines the advantages of leasing and owning, providing tenants with the opportunity to run their business while also considering the possibility of becoming property owners in the future. The Orange California Agreement to Lease Commercial Property with Option to Purchase at the End of Lease Term — Rent to Ow— - Real Estate Rental offers several key benefits for both landlords and tenants. For landlords, this agreement opens up a wider pool of potential tenants who may be interested in the opportunity to eventually own the property. It also provides landlords with a greater sense of stability, as the agreement typically includes a predetermined purchase price and terms that can protect them from market fluctuations. Tenants, on the other hand, benefit from the flexibility and potential tax advantages associated with leasing. This agreement allows businesses to establish their presence in Orange, California, and generate income while taking the time to evaluate the property's long-term suitability for their operation. Additionally, the agreement provides tenants with the chance to improve their credit score and build equity while fulfilling their rental obligations. There are different types of Orange California Agreement to Lease Commercial Property with Option to Purchase at the End of Lease Term — Rent to Ow— - Real Estate Rental. They can vary based on the duration of the lease term, purchase price, and terms of the agreement. Some agreements may have a shorter lease term with a higher monthly rent, while others may offer a longer lease term with a lower monthly rent to provide tenants with more time to explore the option to purchase. When entering into such an agreement, it is crucial for both landlords and tenants to seek legal advice to ensure that the contract aligns with their individual needs and protects their interests. Professional guidance can help negotiate key terms, including the purchase price, payment schedule, maintenance responsibilities, and the process for exercising the option to purchase. In conclusion, the Orange California Agreement to Lease Commercial Property with Option to Purchase at the End of Lease Term — Rent to Ow— - Real Estate Rental is a unique opportunity for tenants in Orange, California, to explore the possibility of owning a commercial property while enjoying the benefits of leasing. This agreement fosters a partnership between landlords and tenants and provides a platform for business growth and long-term financial stability.

Orange California Agreement to Lease Commercial Property with Option to Purchase at End of Lease Term - Rent to Own - Real Estate Rental

Description

How to fill out Orange California Agreement To Lease Commercial Property With Option To Purchase At End Of Lease Term - Rent To Own - Real Estate Rental?

Laws and regulations in every sphere vary from state to state. If you're not a lawyer, it's easy to get lost in various norms when it comes to drafting legal documentation. To avoid pricey legal assistance when preparing the Orange Agreement to Lease Commercial Property with Option to Purchase at End of Lease Term - Rent to Own - Real Estate Rental, you need a verified template valid for your region. That's when using the US Legal Forms platform is so advantageous.

US Legal Forms is a trusted by millions web catalog of more than 85,000 state-specific legal templates. It's an excellent solution for professionals and individuals searching for do-it-yourself templates for different life and business situations. All the forms can be used multiple times: once you purchase a sample, it remains available in your profile for further use. Therefore, when you have an account with a valid subscription, you can just log in and re-download the Orange Agreement to Lease Commercial Property with Option to Purchase at End of Lease Term - Rent to Own - Real Estate Rental from the My Forms tab.

For new users, it's necessary to make a few more steps to get the Orange Agreement to Lease Commercial Property with Option to Purchase at End of Lease Term - Rent to Own - Real Estate Rental:

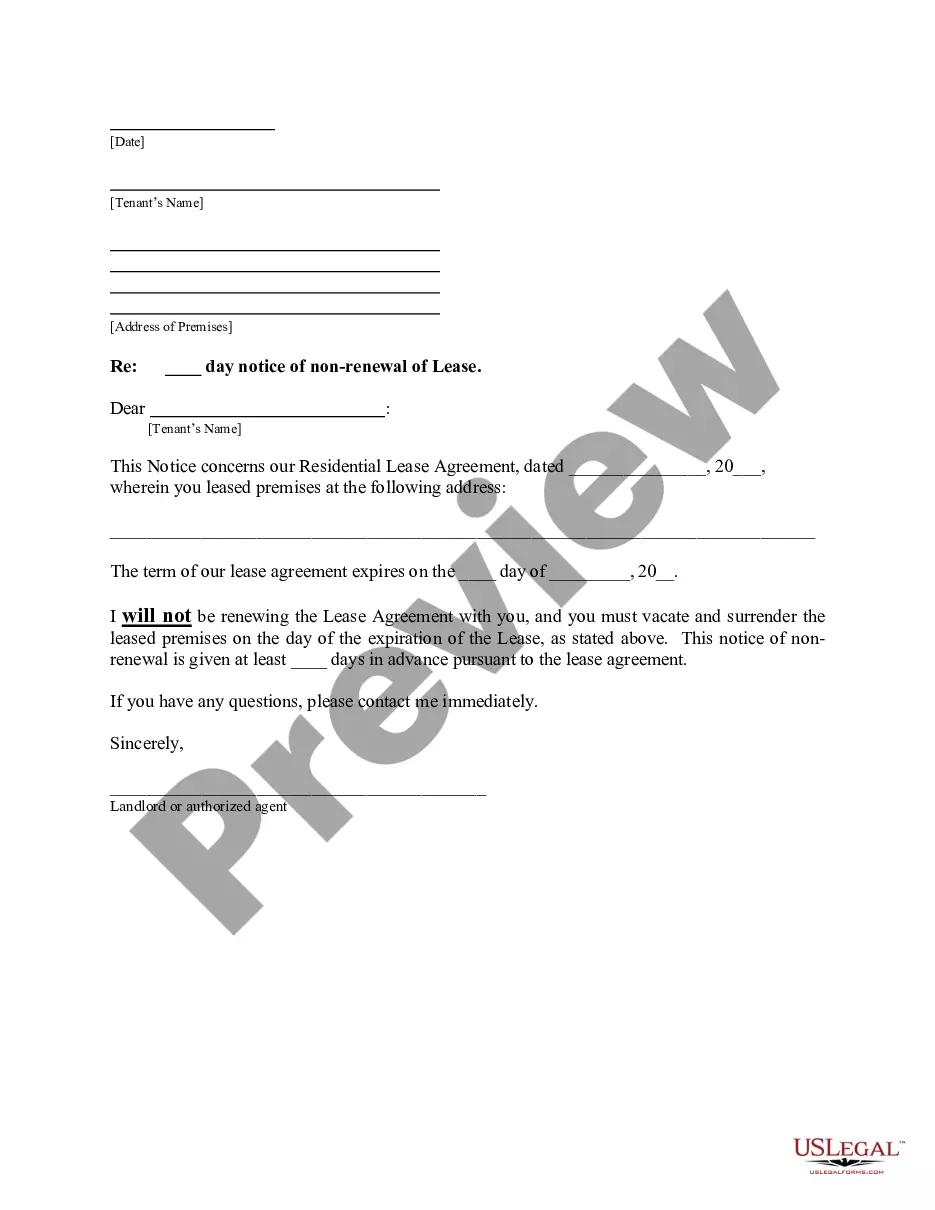

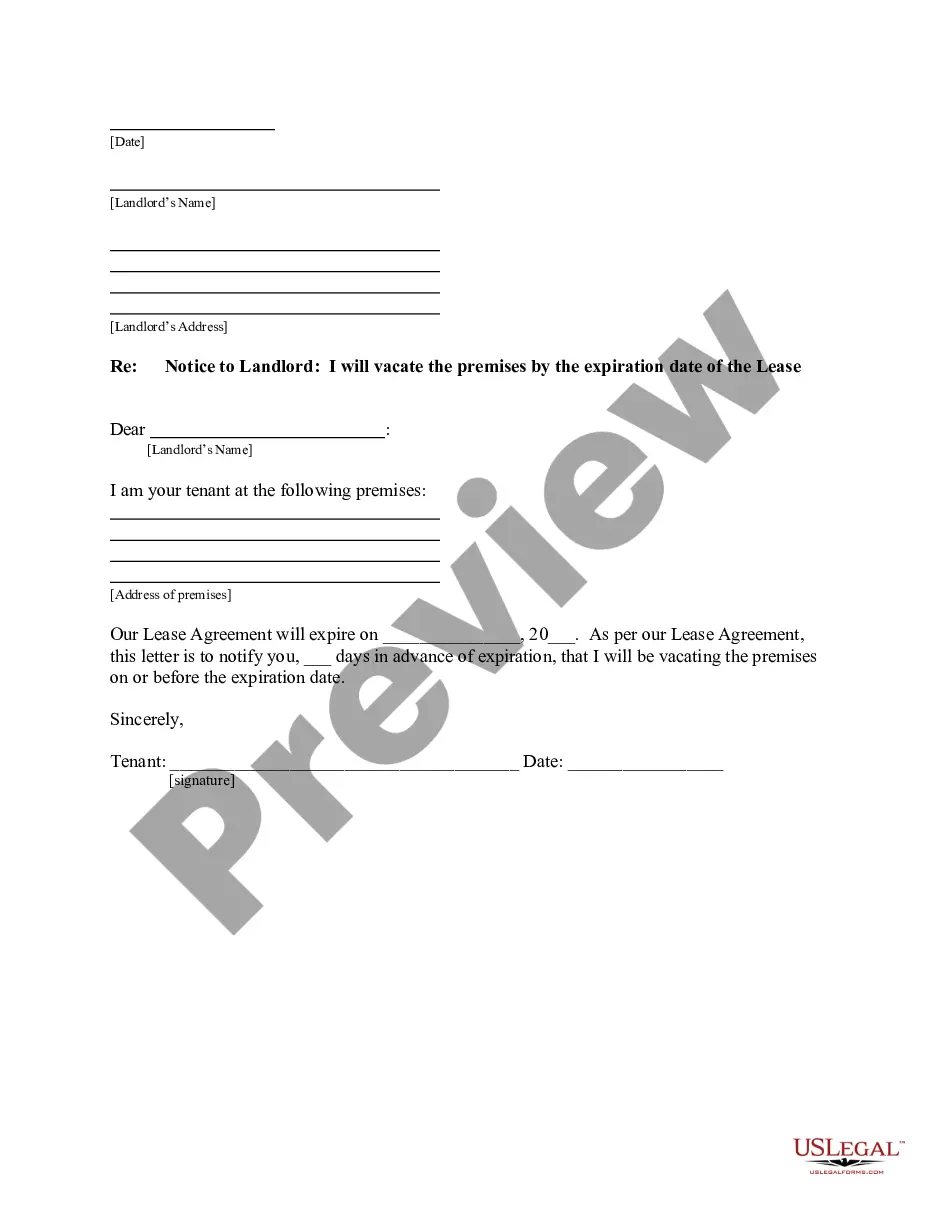

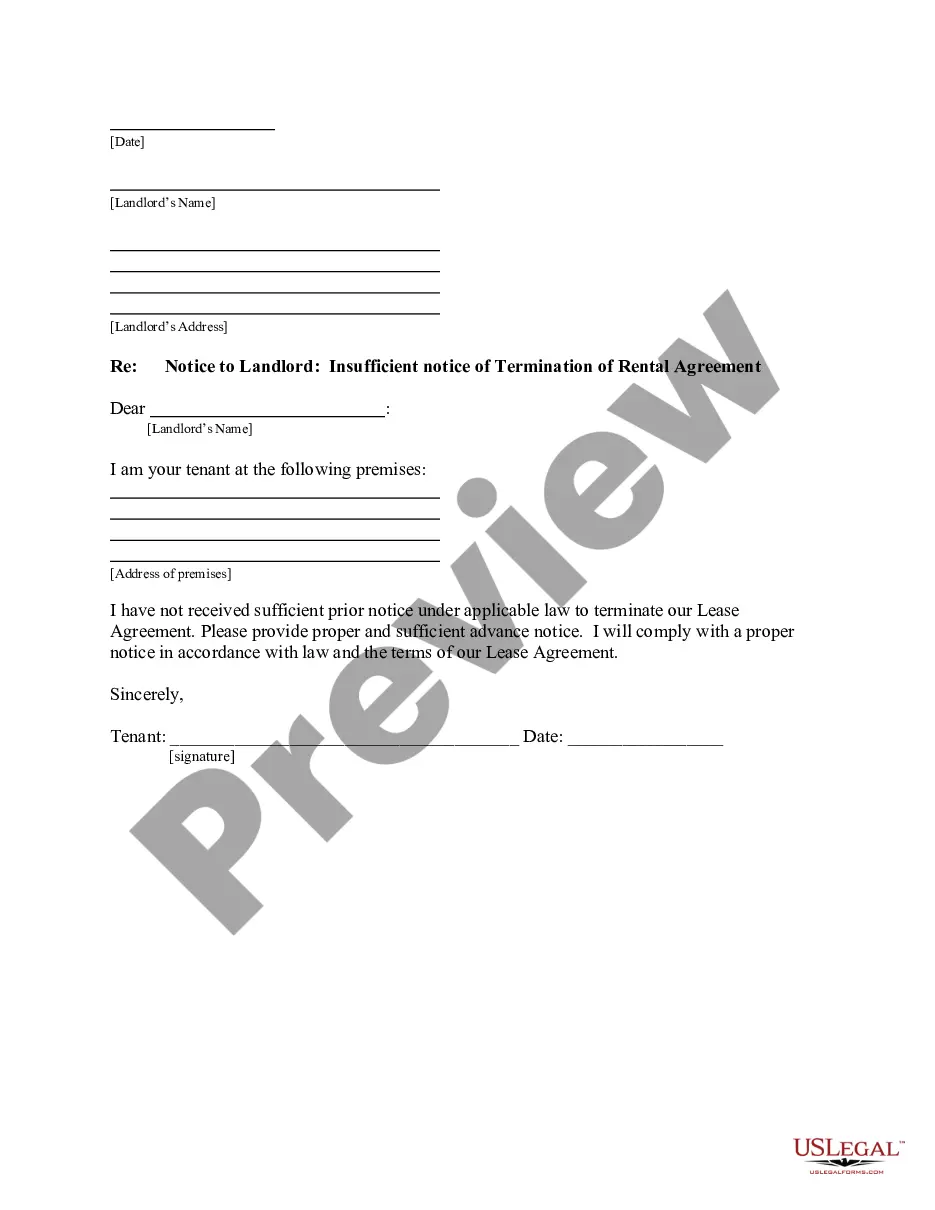

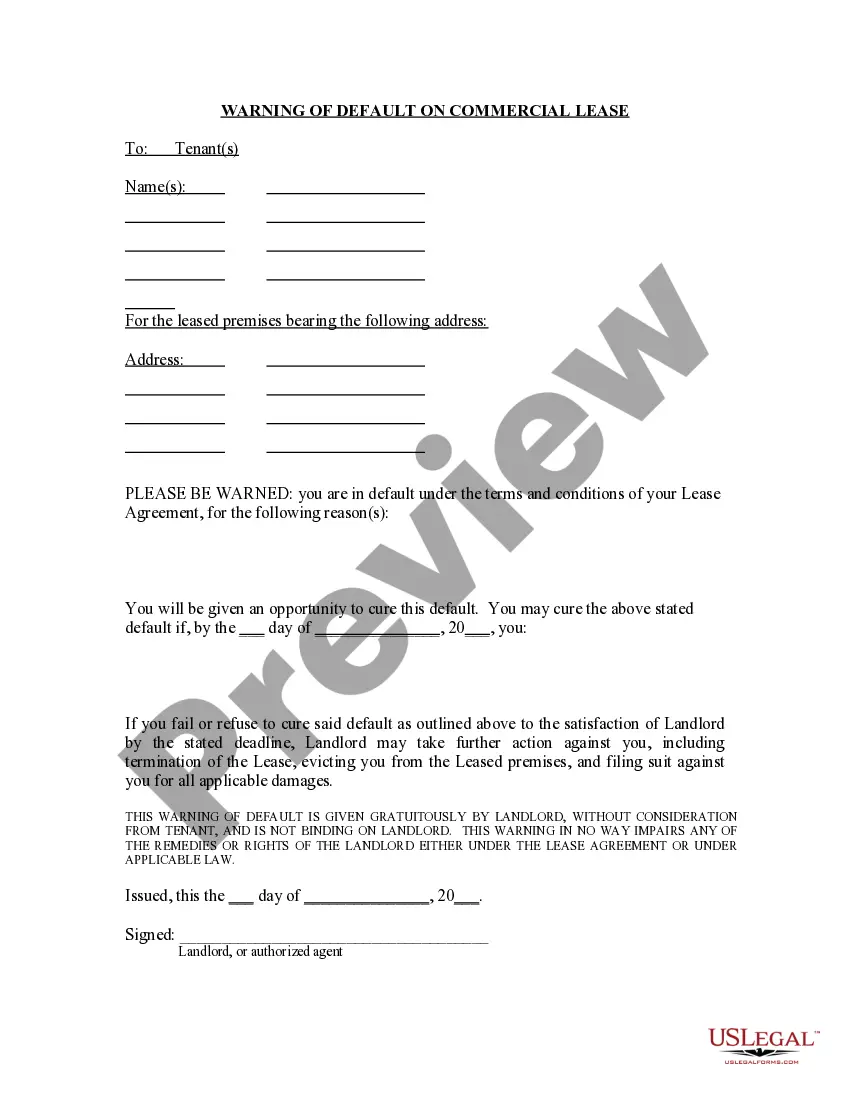

- Analyze the page content to make sure you found the appropriate sample.

- Use the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your criteria.

- Click on the Buy Now button to obtain the document when you find the appropriate one.

- Choose one of the subscription plans and log in or create an account.

- Choose how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the document in and click Download.

- Complete and sign the document on paper after printing it or do it all electronically.

That's the easiest and most economical way to get up-to-date templates for any legal scenarios. Locate them all in clicks and keep your documentation in order with the US Legal Forms!