Fairfax Virginia Complaint Against Drawer of Check that was Dishonored Due to Insufficient Funds (Bad Check) A complaint against a drawer of a check that was dishonored due to insufficient funds (bad check) is a legal action taken by the recipient of the check to seek compensation for the financial loss incurred due to the bounced or returned payment. In Fairfax, Virginia, there are several types of complaints that can be filed, depending on the specific circumstances of the bad check issue. Here are a few types of complaints against the drawer of a bad check in Fairfax, Virginia: 1. Civil Complaint: A civil complaint is a legal action filed in a civil court seeking compensation for the amount owed. In the case of a bad check, the recipient can file a civil complaint against the drawer to recover the original amount of the check, plus any related fees, penalties, and other damages. 2. Criminal Complaint: In certain cases, writing a bad check can be considered a criminal offense. If the drawer intentionally wrote the bad check or committed fraud, the recipient may choose to file a criminal complaint with the appropriate law enforcement agency in Fairfax, Virginia. This could potentially lead to criminal charges being brought against the drawer. 3. Small Claims Complaint: Small claims court is an option for pursuing a complaint against a drawer of a bad check if the amount owed does not exceed a certain limit, typically around $5,000 in Virginia. This simplified and expedited court process allows individuals to represent themselves and seek compensation without the need for formal legal representation. When filing a complaint against a drawer of a bad check in Fairfax, Virginia, it is essential to gather evidence to support your claim. This evidence may include the original bounced check, any correspondence or communication with the drawer, bank statements showing the insufficient funds, and any additional documentation related to financial losses incurred as a result of the bad check. To initiate the complaint process, you will typically need to complete and file the appropriate complaint forms with the relevant court, depending on the type of complaint being filed. It is advisable to consult with an attorney or seek legal advice for the best course of action and to ensure compliance with all relevant laws and regulations in Fairfax, Virginia. In summary, a complaint against a drawer of a bad check in Fairfax, Virginia can take various forms, including civil complaints, criminal complaints, or small claims complaints. Each type of complaint serves to seek compensation for the financial loss caused by a check that was dishonored due to insufficient funds.

Fairfax Virginia Complaint Against Drawer of Check that was Dishonored Due to Insufficient Funds (Bad Check)

Description

How to fill out Fairfax Virginia Complaint Against Drawer Of Check That Was Dishonored Due To Insufficient Funds (Bad Check)?

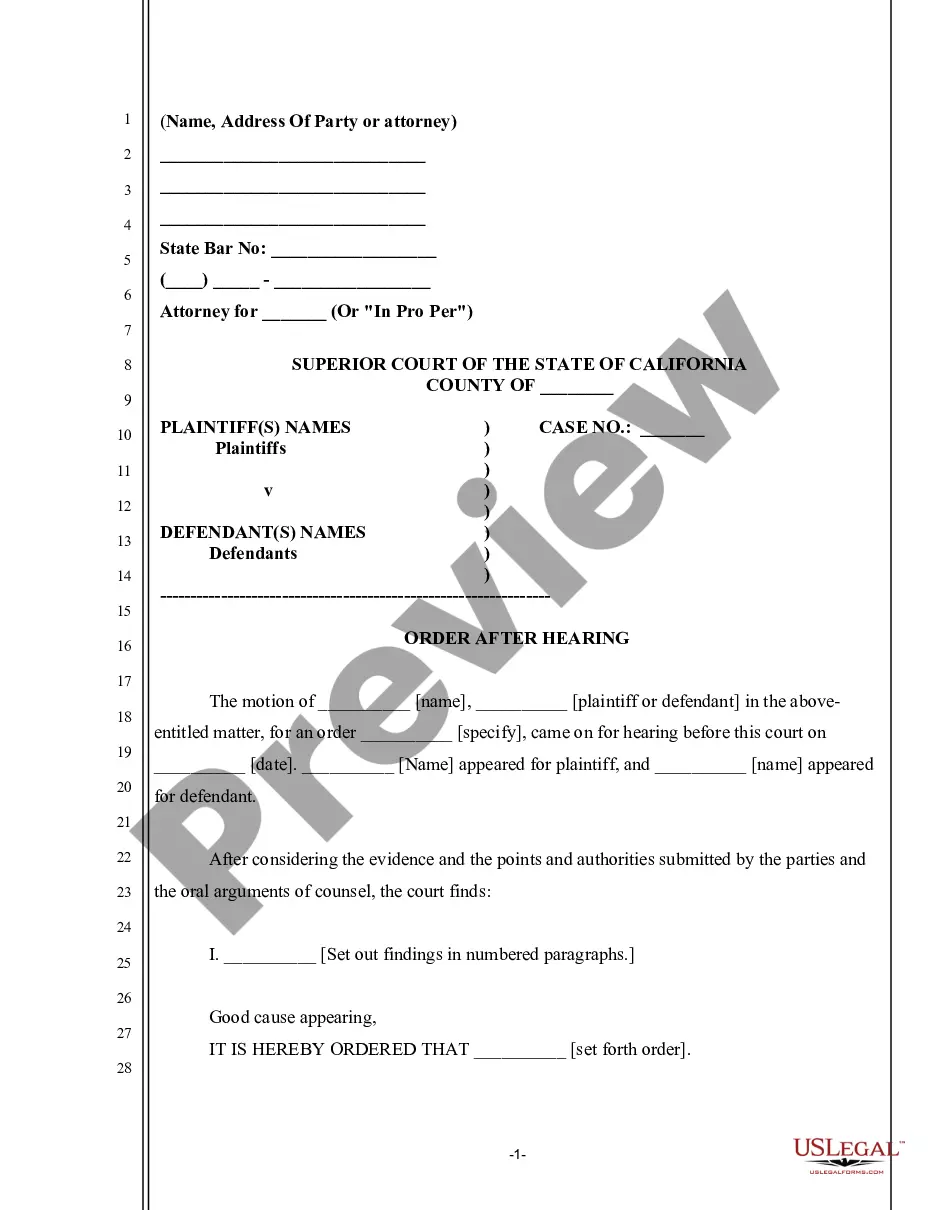

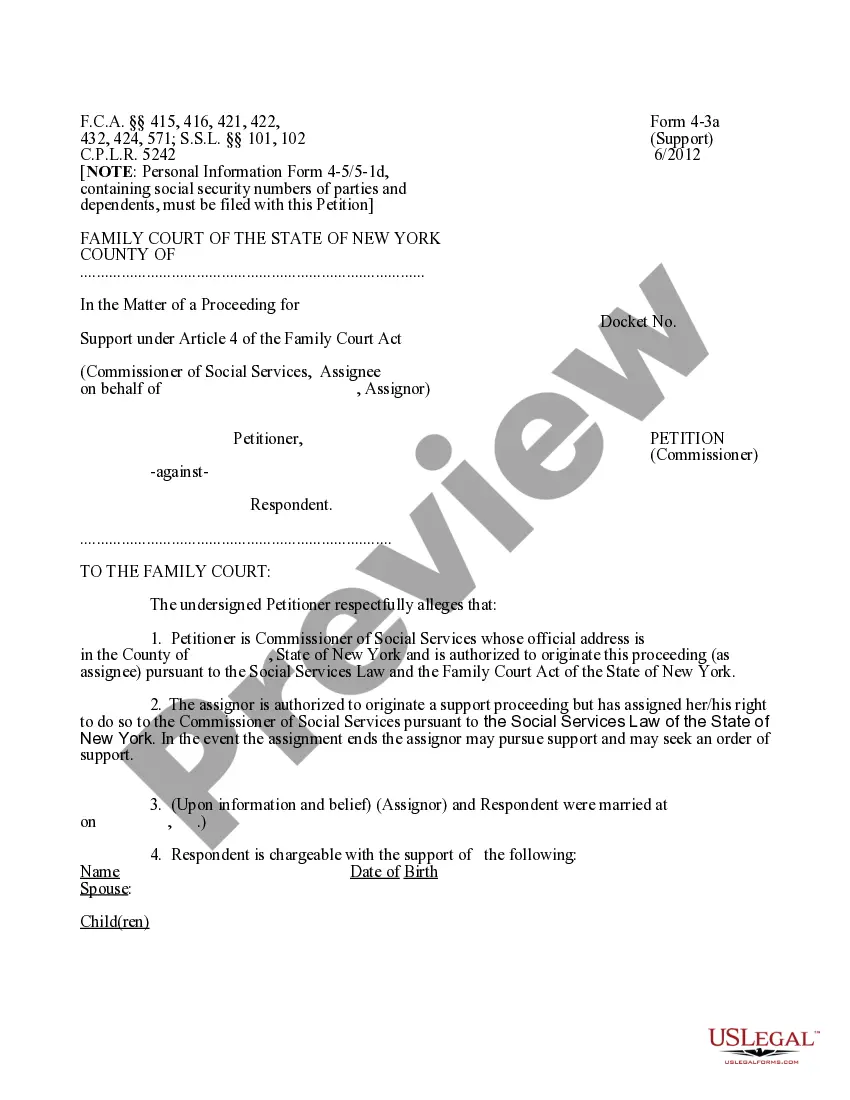

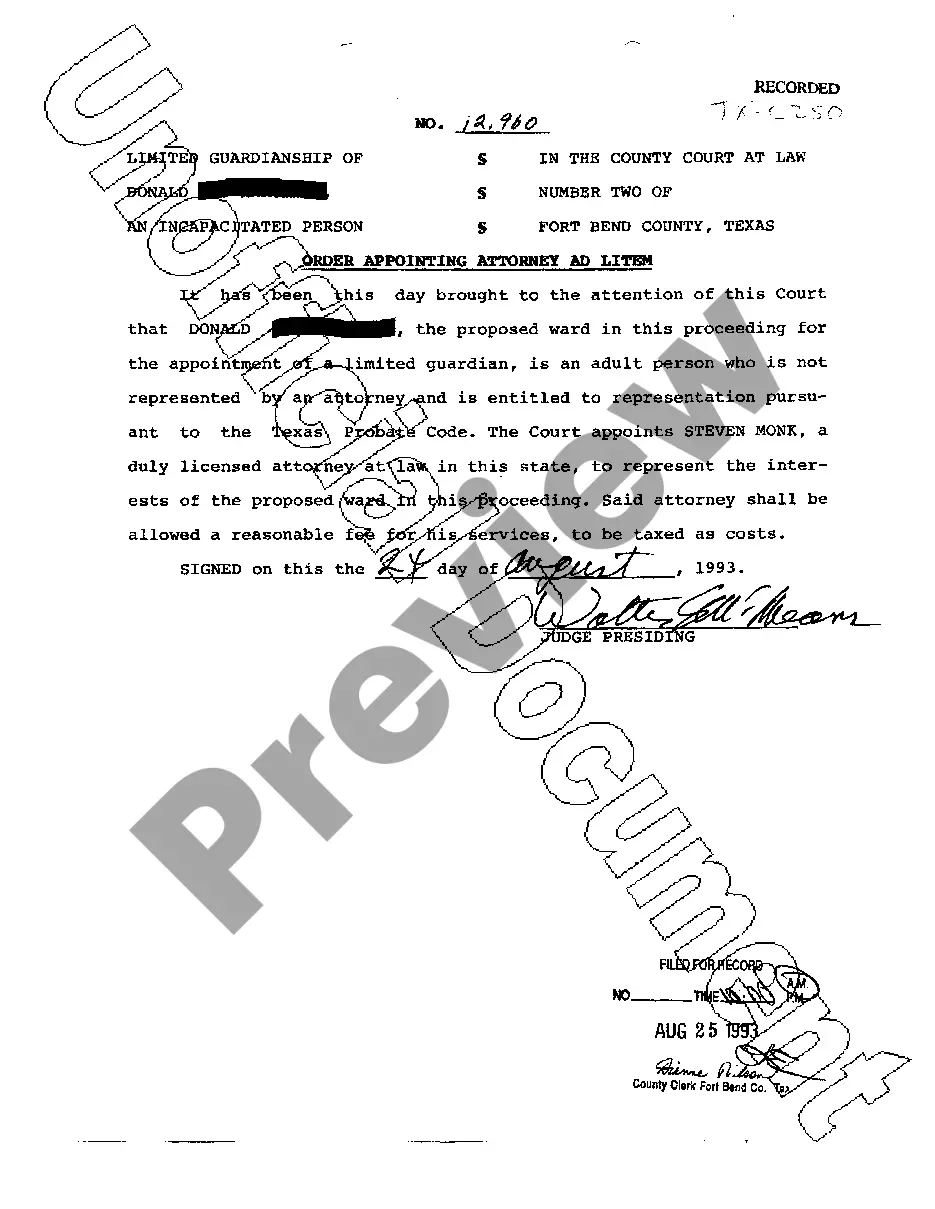

How much time does it usually take you to draft a legal document? Because every state has its laws and regulations for every life scenario, locating a Fairfax Complaint Against Drawer of Check that was Dishonored Due to Insufficient Funds (Bad Check) suiting all local requirements can be exhausting, and ordering it from a professional attorney is often expensive. Many web services offer the most popular state-specific templates for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most extensive web catalog of templates, collected by states and areas of use. Apart from the Fairfax Complaint Against Drawer of Check that was Dishonored Due to Insufficient Funds (Bad Check), here you can get any specific document to run your business or personal deeds, complying with your county requirements. Experts verify all samples for their validity, so you can be certain to prepare your paperwork correctly.

Using the service is pretty simple. If you already have an account on the platform and your subscription is valid, you only need to log in, choose the required form, and download it. You can get the file in your profile anytime later on. Otherwise, if you are new to the platform, there will be a few more steps to complete before you obtain your Fairfax Complaint Against Drawer of Check that was Dishonored Due to Insufficient Funds (Bad Check):

- Check the content of the page you’re on.

- Read the description of the sample or Preview it (if available).

- Search for another document using the related option in the header.

- Click Buy Now when you’re certain in the selected file.

- Choose the subscription plan that suits you most.

- Register for an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Change the file format if needed.

- Click Download to save the Fairfax Complaint Against Drawer of Check that was Dishonored Due to Insufficient Funds (Bad Check).

- Print the sample or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the acquired template, you can find all the samples you’ve ever saved in your profile by opening the My Forms tab. Give it a try!

Form popularity

FAQ

Inform them that their check has bounced and see if they can use an alternative payment method, like a money order. Most checks have the person's name, address and phone number on them, so it should be relatively easy to contact the check writer.

Writing bad checks in the Commonwealth of Virginia can be considered a felony offense or a misdemeanor. As you may already know, the level of fraud will depend on the type of offense. For example, if you wrote a bad check for under $200, it would be considered a Class 1 misdemeanor.

If you don't have enough money in your account to cover a payment, your bank may simply decline the transaction. But that's not all that can happen: Fees pile up: When you have insufficient funds, your bank will charge you a feeusually between $27 and $35.

Colloquially, NSF checks are known as bounced or bad checks. If a bank receives a check written on an account with insufficient funds, the bank can refuse payment and charge the account holder an NSF fee. Additionally, a penalty or fee may be charged by the merchant for the returned check.

When a check bounces, they are not honored by the depositor's bank, and may result in fees and banking restrictions. Additional penalties for bouncing checks may include negative credit score marks, refusal of merchants from accepting your checks, and potentially legally trouble.

A bad check refers to a check that cannot be negotiated because it is drawn on a nonexistent account or has insufficient funds. Writing a bad check, also known as a hot check, is illegal. Banks normally charge a fee to anyone who writes a bad check unintentionally.

It is also a crime to forge a check or write a fake check. If you believe you are a victim of a crime, report this to your police department, sheriff's office, or district attorney's office. You may also sue someone who writes you a bad check without having a valid reason for doing so.

A bad check refers to a check that cannot be negotiated because it is drawn on a nonexistent account or has insufficient funds. Writing a bad check, also known as a hot check, is illegal. Banks normally charge a fee to anyone who writes a bad check unintentionally.

Usually, this is because there is not enough money in your account to complete the transaction. State laws generally spell out what happens next: Typically, you are liable for paying the merchant and the returned-check fee.

How Do You Recover Money From a Bounced Check? As the recipient of a bounced check, you will need to get in touch with the check issuer and request payment. If you're unable to resolve it with a conversation, you could take further action by sending a demand letter via certified mail.