An Alameda California Sale and Leaseback Agreement for Commercial Building is a contractual agreement between a property owner and a potential buyer or investor. This agreement involves the sale of a commercial building by the owner to the buyer, who then leases the property back to the owner for a specified period. This arrangement allows the owner to access the capital tied up in the property while continuing to occupy and operate the business on the premises. One type of Alameda California Sale and Leaseback Agreement for Commercial Building is the Triple Net Lease (NNN). In this agreement, the property owner transfers all operating expenses, including property taxes, insurance, and maintenance costs, to the tenant. These reliefs the owner of the financial burden of these expenses while providing a predictable income stream for the buyer. Another type of Sale and Leaseback Agreement is the Ground Lease. This arrangement involves the sale of the land while the owner retains ownership and control of any buildings or improvements on the property. The buyer leases the land back to the owner, typically on a long-term basis, allowing the owner to continue using the property for commercial purposes. Sale and Leaseback Agreements can be beneficial for both parties involved. For the property owner, it provides an opportunity to unlock the property's value, access capital for expansion or other business needs, and maintain occupancy and operational control. On the other hand, the buyer/investor benefits from a steady cash flow through lease payments and potential appreciation of the property value over time. If you are considering entering into an Alameda California Sale and Leaseback Agreement for a commercial building, it is essential to seek legal advice and ensure that the agreement meets all relevant legal requirements. Proper due diligence, including a thorough review of the property's condition, market analysis, and lease terms, is also crucial for a successful transaction. In conclusion, an Alameda California Sale and Leaseback Agreement for a Commercial Building is a flexible and strategic financial arrangement that offers property owners access to capital while allowing them to continue their business operations. Whether it is a Triple Net Lease or a Ground Lease, such agreements can be advantageous for investment and expansion purposes.

Alameda California Sale and Leaseback Agreement for Commercial Building

Description

How to fill out Alameda California Sale And Leaseback Agreement For Commercial Building?

Drafting papers for the business or personal demands is always a huge responsibility. When drawing up a contract, a public service request, or a power of attorney, it's crucial to take into account all federal and state regulations of the specific region. Nevertheless, small counties and even cities also have legislative procedures that you need to consider. All these details make it tense and time-consuming to create Alameda Sale and Leaseback Agreement for Commercial Building without expert help.

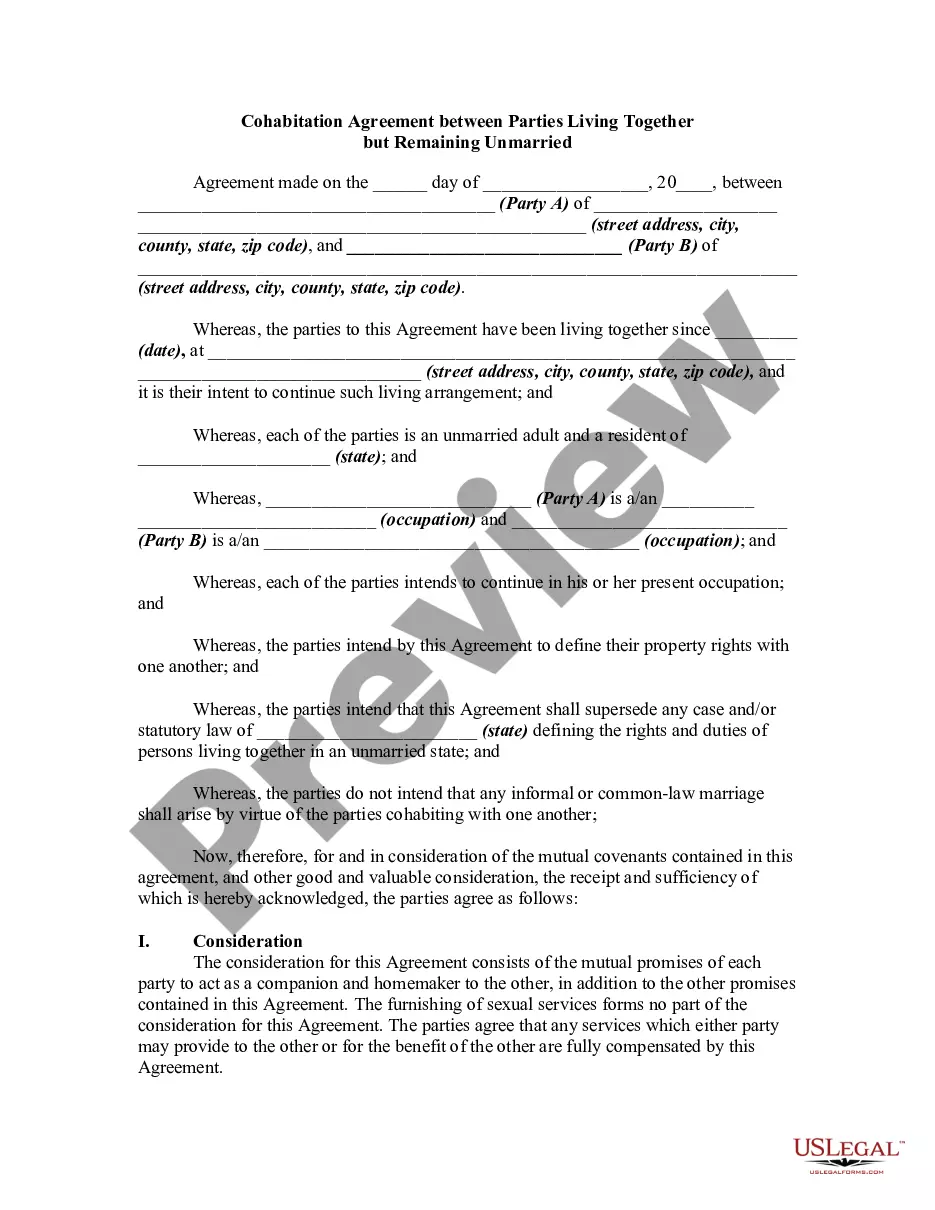

It's easy to avoid spending money on attorneys drafting your documentation and create a legally valid Alameda Sale and Leaseback Agreement for Commercial Building by yourself, using the US Legal Forms web library. It is the largest online collection of state-specific legal templates that are professionally cheched, so you can be certain of their validity when choosing a sample for your county. Earlier subscribed users only need to log in to their accounts to save the needed document.

If you still don't have a subscription, follow the step-by-step guide below to get the Alameda Sale and Leaseback Agreement for Commercial Building:

- Examine the page you've opened and verify if it has the sample you require.

- To do so, use the form description and preview if these options are available.

- To locate the one that fits your needs, utilize the search tab in the page header.

- Recheck that the template complies with juridical standards and click Buy Now.

- Choose the subscription plan, then log in or register for an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the selected file in the preferred format, print it, or fill it out electronically.

The exceptional thing about the US Legal Forms library is that all the documentation you've ever obtained never gets lost - you can access it in your profile within the My Forms tab at any moment. Join the platform and easily get verified legal forms for any situation with just a few clicks!

Form popularity

FAQ

California Prop 19 Cons Moreover, residents inheriting homes with market values more than $1 million are likely to see a bigger tax bill. Additionally, the $1 million exclusion is only for an inherited primary residence. Rental properties, vacation homes, or investment properties are subject to this exclusion.

Each year, the rent may only increase by the Annual General Adjustment (AGA), calculated at 70% of the percentage change in the Consumer Price Index for the 12-month period ending April of each year; provided, however, in no event will the Annual General Adjustment be more than 5% nor less than 1 percent.

Under the new California Proposition 19 rules effective February 16, 2021, the non-principal residence property (e.g., rental property, vacation home, or commercial property) exclusion is eliminated, and no property tax benefit will result from intrafamily rental property transfers.

A: Rent levels for all controlled units (generally, all multi-family units built before February 1995) have been frozen during the emergency. However, as of , landlords may serve tenants with notices of rent increases for no more than the current cap, which is 2.7%.

Under Proposition 19, a child or children may keep the lower property tax base of the parent(s) ONLY if the property is the principal residence of the parent(s) and the child or children make it their principal residence within one year.

Under the new California Proposition 19 rules effective February 16, 2021, the non-principal residence property (e.g., rental property, vacation home, or commercial property) exclusion is eliminated, and no property tax benefit will result from intrafamily rental property transfers.

A claim must be filed with the Assessor of the county in which the replacement property is located. A claim for relief must be filed within 3 years of the date a replacement primary residence is purchased or new construction of that replacement primary residence is completed.

Proposition 19 allows homeowners over age 55 to keep a better tax rate when they sell one house and buy another. It took effect on April 1 and applies to anywhere in the state. It's about as far reaching as the housing tax revolt of Proposition 13 that passed 1978. Related: New California law adds to Prop.

Proposition 19 allows homeowners over age 55 to keep a better tax rate when they sell one house and buy another. It took effect on April 1 and applies to anywhere in the state. It's about as far reaching as the housing tax revolt of Proposition 13 that passed 1978.

Even under Proposition 19, there is no reassessment for a transfer of 50% or less of ownership in a real estate holding. For this reason, parents can transfer real property to their children without reassessment if the real property is owned by an LLC, partnership, or corporation.