A Harris Texas Sale and Leaseback Agreement for a Commercial Building is a legal contract that involves the sale of a commercial property by the owner to a buyer (typically an investor or a real estate company) in exchange for immediate cash. Simultaneously, the owner enters into a long-term lease agreement with the buyer, allowing them to continue using the property for their business operations. This type of arrangement is common among businesses looking to unlock the equity tied up in their real estate assets without the need to relocate. Keywords: Harris Texas, Sale and Leaseback Agreement, Commercial Building, legal contract, sale, commercial property, owner, buyer, investor, real estate company, immediate cash, long-term lease agreement, business operations, equity, real estate assets, relocate. Types of Harris Texas Sale and Leaseback Agreements for Commercial Buildings: 1. Harris Texas Partial Sale and Leaseback Agreement: This variant allows the owner to sell a percentage of their commercial building while retaining ownership of the remaining portion. The owner then leases the sold portion back from the buyer, maintaining their business operations within the property. 2. Harris Texas Triple Net Leaseback Agreement: In this type of sale and leaseback agreement, the owner sells the commercial building to the buyer and becomes the tenant. The owner-turned-tenant is responsible for paying all expenses related to the property, including taxes, insurance, and maintenance, in addition to regular rent payments. This arrangement shifts the financial burden of property management to the tenant/buyer. 3. Harris Texas Financially Motivated Sale and Leaseback Agreement: Sometimes, businesses opt for a sale and leaseback agreement primarily for financial reasons. They may be experiencing cash flow issues or wish to utilize the capital unlocked from the sale to invest in other aspects of their operations. This type of agreement allows businesses to generate an immediate influx of cash while still occupying the premises. 4. Harris Texas Build-to-Suit Sale and Leaseback Agreement: This arrangement is common in cases where businesses require specific modifications or customization of the commercial space. The buyer purchases the land, constructs a building tailored to the tenant's requirements, and leases it back to the tenant. 5. Harris Texas Tax-Advantaged Sale and Leaseback Agreement: Certain sale and leaseback agreements offer tax advantages to the parties involved. The arrangement may allow the owner to deduct lease payments as rental expenses, potentially reducing their tax liability. Buyers, on the other hand, may benefit from depreciation deductions associated with the purchased property. Keywords: Partial Sale and Leaseback Agreement, Triple Net Leaseback Agreement, Financially Motivated Sale and Leaseback Agreement, Build-to-Suit Sale and Leaseback Agreement, Tax-Advantaged Sale and Leaseback Agreement, Harris Texas.

Harris Texas Sale and Leaseback Agreement for Commercial Building

Description

How to fill out Harris Texas Sale And Leaseback Agreement For Commercial Building?

Preparing paperwork for the business or individual demands is always a big responsibility. When drawing up a contract, a public service request, or a power of attorney, it's crucial to consider all federal and state laws and regulations of the specific area. Nevertheless, small counties and even cities also have legislative procedures that you need to consider. All these aspects make it tense and time-consuming to create Harris Sale and Leaseback Agreement for Commercial Building without expert help.

It's possible to avoid spending money on attorneys drafting your documentation and create a legally valid Harris Sale and Leaseback Agreement for Commercial Building on your own, using the US Legal Forms online library. It is the largest online collection of state-specific legal documents that are professionally cheched, so you can be sure of their validity when selecting a sample for your county. Previously subscribed users only need to log in to their accounts to download the required form.

If you still don't have a subscription, follow the step-by-step guide below to obtain the Harris Sale and Leaseback Agreement for Commercial Building:

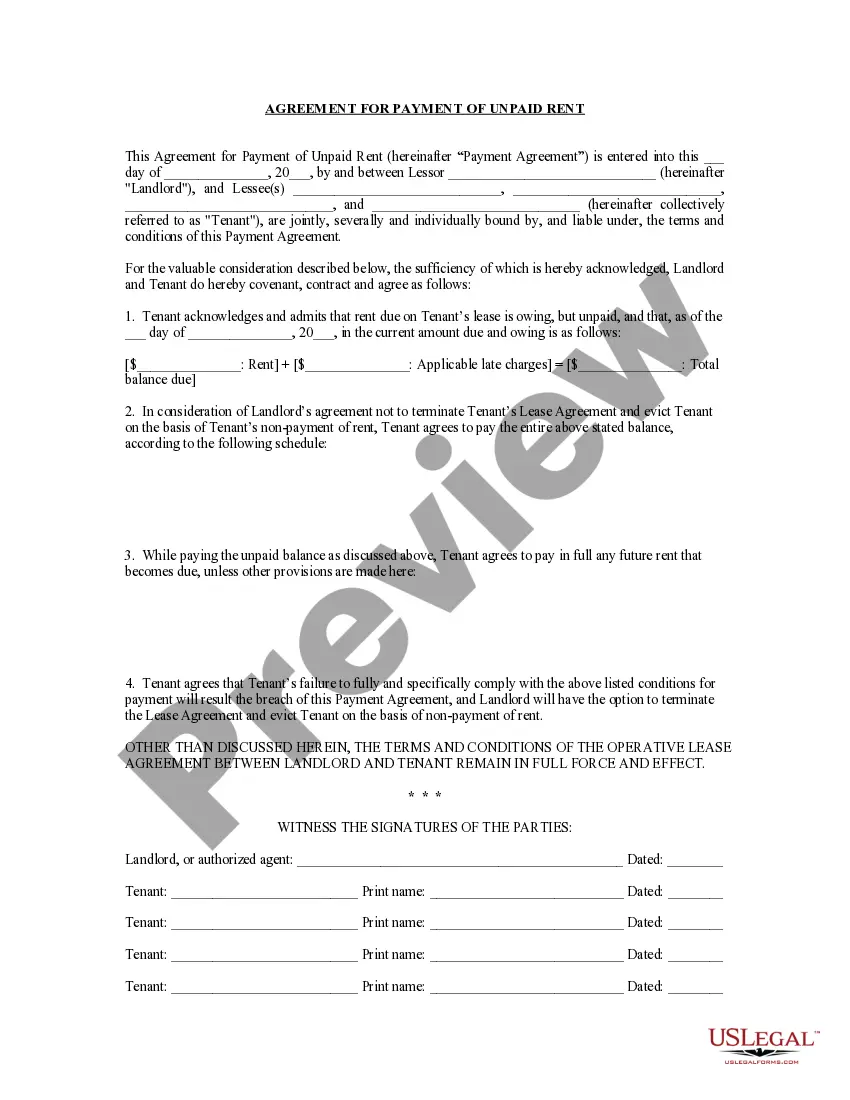

- Examine the page you've opened and check if it has the document you need.

- To achieve this, use the form description and preview if these options are presented.

- To find the one that fits your requirements, use the search tab in the page header.

- Double-check that the sample complies with juridical standards and click Buy Now.

- Choose the subscription plan, then sign in or register for an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the selected document in the preferred format, print it, or fill it out electronically.

The great thing about the US Legal Forms library is that all the documentation you've ever acquired never gets lost - you can get it in your profile within the My Forms tab at any time. Join the platform and quickly obtain verified legal templates for any use case with just a couple of clicks!