Travis Texas Sale and Leaseback Agreement for Commercial Building is a contractual arrangement wherein the owner of a commercial property sells it to a buyer while simultaneously leasing it back from the buyer. This type of financial agreement helps the property owner unlock the value of their property while ensuring uninterrupted use and occupancy. Under a Travis Texas Sale and Leaseback Agreement for Commercial Building, the property owner sells the building to an investor, often a real estate investment company or a private individual, and then enters into a long-term lease agreement with the buyer to continue using the property for their business operations. This arrangement allows the property owner to receive an immediate influx of cash from the sale while retaining operational control of the property. The Travis Texas Sale and Leaseback Agreement for Commercial Building has several benefits for both parties involved. For the property owner, it provides an opportunity to free up capital tied to the property and use it for business expansion, debt reduction, or other investment opportunities. It also eliminates the burden of property ownership, including maintenance costs, property taxes, and insurance premiums, as these responsibilities are transferred to the buyer. On the other hand, the buyer of the commercial property benefits from stable long-term rental income, assuming the property is leased on favorable terms. Additionally, the buyer also expects capital appreciation over time, as the property value may increase during the duration of the lease. Different types of Travis Texas Sale and Leaseback Agreements for Commercial Buildings may vary based on various factors such as lease terms, rental rates, purchase price, and other negotiated terms. Some common variations include: 1. Full Payout Leaseback: In this type of agreement, the sale and leaseback of the commercial building are structured so that the rental payments from the property owner cover the full purchase price, including any debt assumed by the buyer. 2. Partial Payout Leaseback: Here, the rental payments from the property owner cover only a portion of the purchase price, and the property owner retains a stake in the property's ownership. This arrangement allows the property owner to benefit from any future increase in property value while still receiving immediate cash inflow. 3. Synthetic Leaseback: This variation combines elements of a lease and a loan. The property owner effectively borrows funds from the buyer while simultaneously leasing the property. The rental payments include both interest and principal repayment components, allowing the property owner to build equity in the property over time. In conclusion, a Travis Texas Sale and Leaseback Agreement for Commercial Building provides an attractive financial option for property owners seeking liquidity, while still maintaining the use and occupancy of their building. The specific terms and variations of these agreements can vary, depending on the negotiations between the parties involved.

Travis Texas Sale and Leaseback Agreement for Commercial Building

Description

How to fill out Travis Texas Sale And Leaseback Agreement For Commercial Building?

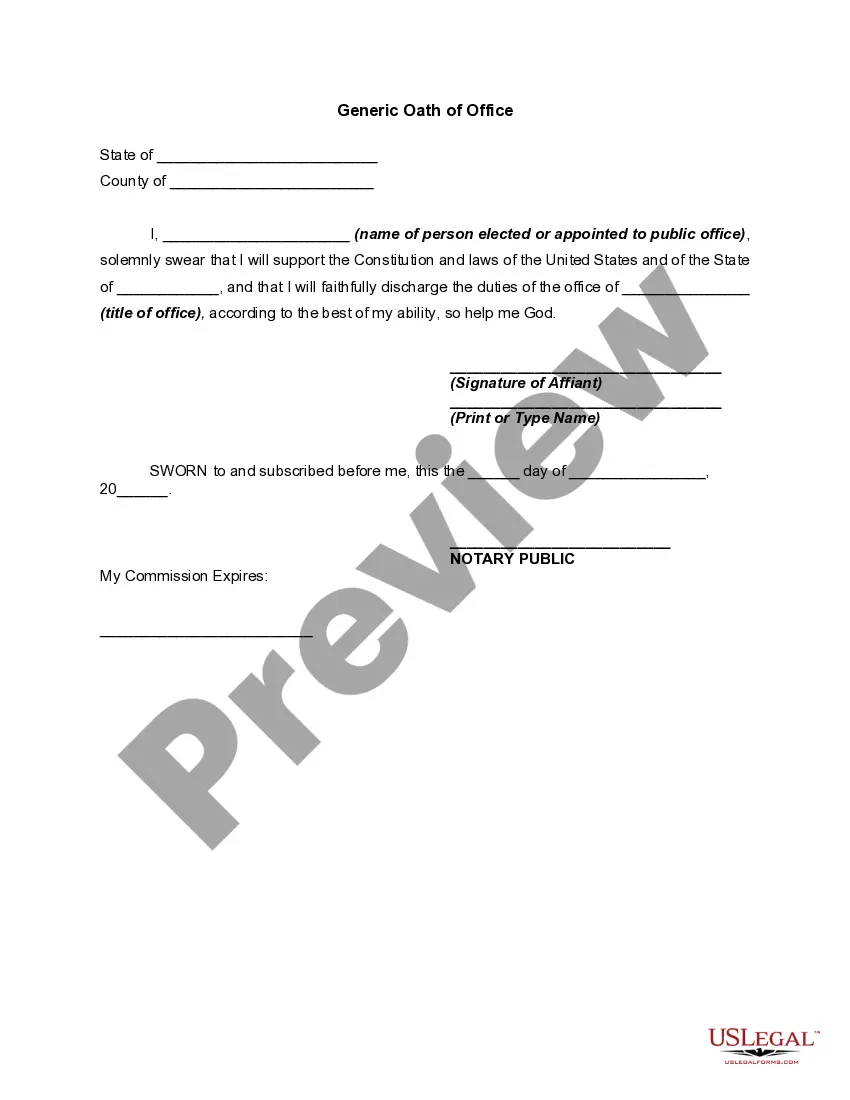

Creating documents, like Travis Sale and Leaseback Agreement for Commercial Building, to take care of your legal affairs is a tough and time-consumming task. Many situations require an attorney’s involvement, which also makes this task expensive. Nevertheless, you can acquire your legal affairs into your own hands and take care of them yourself. US Legal Forms is here to the rescue. Our website comes with over 85,000 legal forms crafted for a variety of scenarios and life situations. We make sure each document is in adherence with the laws of each state, so you don’t have to worry about potential legal problems compliance-wise.

If you're already aware of our website and have a subscription with US, you know how easy it is to get the Travis Sale and Leaseback Agreement for Commercial Building template. Simply log in to your account, download the template, and customize it to your requirements. Have you lost your document? Don’t worry. You can get it in the My Forms folder in your account - on desktop or mobile.

The onboarding process of new customers is just as simple! Here’s what you need to do before downloading Travis Sale and Leaseback Agreement for Commercial Building:

- Make sure that your document is specific to your state/county since the regulations for writing legal documents may differ from one state another.

- Find out more about the form by previewing it or going through a brief intro. If the Travis Sale and Leaseback Agreement for Commercial Building isn’t something you were looking for, then use the header to find another one.

- Sign in or register an account to begin using our service and get the form.

- Everything looks good on your end? Hit the Buy now button and choose the subscription option.

- Select the payment gateway and type in your payment information.

- Your template is good to go. You can go ahead and download it.

It’s easy to locate and purchase the appropriate template with US Legal Forms. Thousands of organizations and individuals are already benefiting from our extensive collection. Subscribe to it now if you want to check what other advantages you can get with US Legal Forms!