Clark Nevada Order Refunding Bond is a financial instrument issued by the county of Clark in Nevada for the purpose of refinancing existing debt obligations. This type of bond allows the county government to lower its borrowing costs by taking advantage of lower interest rates or favorable market conditions. The Clark Nevada Order Refunding Bond is typically used when the county identifies an opportunity to reduce its debt burden by swapping older bonds for new ones with more favorable terms. By refinancing the debt, the county can achieve savings by locking in lower interest rates or extending the repayment period. There are different types of Clark Nevada Order Refunding Bonds, each tailored to cater to specific needs. Some common types include: 1. Current Refunding Bonds: These bonds are issued when the outstanding bonds can be refunded immediately, typically within 90 days. 2. Advanced Refunding Bonds: These bonds are issued when the outstanding bonds cannot be refunded immediately, but an escrow account is established to hold the proceeds until the call date or maturity date of the old bonds, usually within 90 days to 3 years. 3. Escrow Refunding Bonds: These bonds are issued when the proceeds are used to purchase U.S. Treasury securities or other highly-rated securities to be held in an escrow account. The interest and principal payments of the BS crowed securities are then used to pay off the old bonds. The Clark Nevada Order Refunding Bond offers several benefits for both the county government and investors. By refinancing the debt, the county can reduce its interest expense, free up funds for other projects, or reallocate resources to essential services. Investors, on the other hand, are attracted to these bonds because they are backed by the full faith and credit of the county, which ensures a relatively higher level of safety. Investors considering Clark Nevada Order Refunding Bonds should carefully assess the creditworthiness of the county and the specific terms of each bond issue, such as interest rates, maturity dates, and call provisions. Additionally, potential investors should consult with their financial advisors to determine if these bonds align with their investment objectives and risk tolerance. Overall, the Clark Nevada Order Refunding Bond provides an opportunity for the county of Clark to efficiently manage its debt portfolio and reduce borrowing costs while offering investors a relatively safe investment option.

Clark Nevada Order Refunding Bond

Description

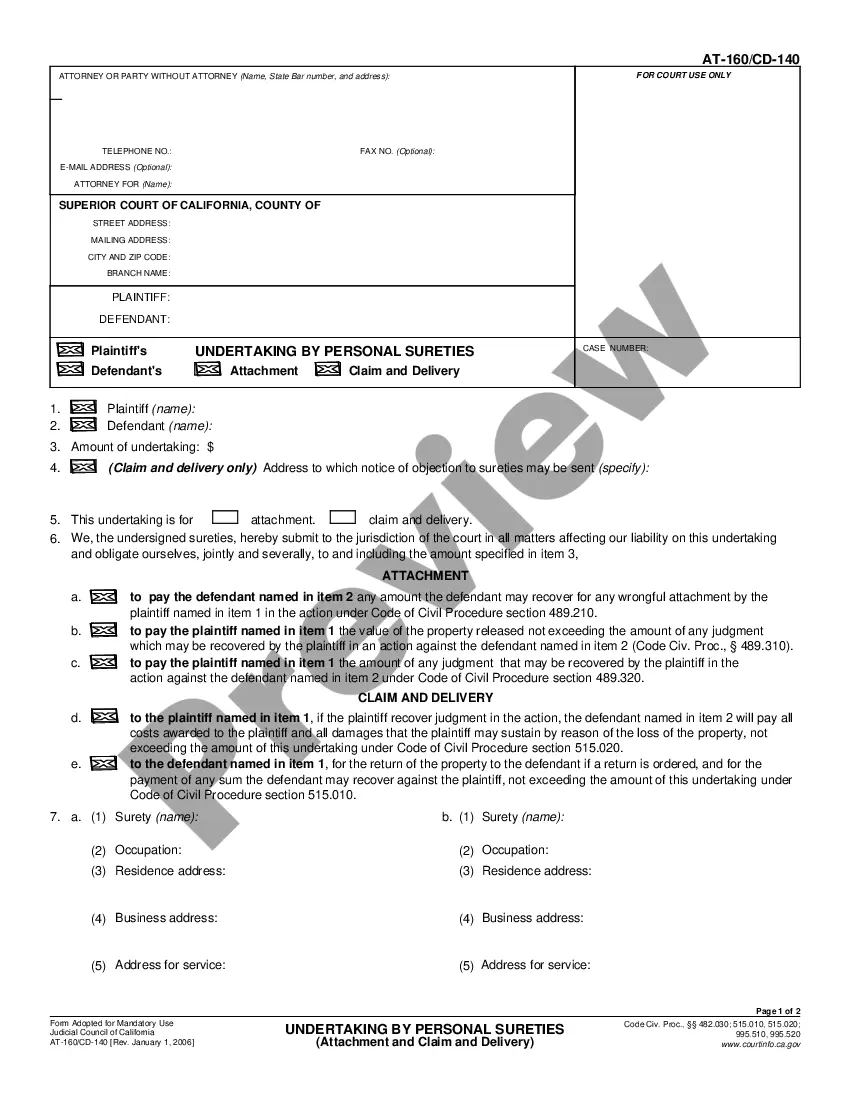

How to fill out Clark Nevada Order Refunding Bond?

Are you looking to quickly draft a legally-binding Clark Order Refunding Bond or maybe any other document to handle your own or business affairs? You can select one of the two options: hire a legal advisor to write a valid paper for you or draft it completely on your own. Thankfully, there's another solution - US Legal Forms. It will help you receive professionally written legal paperwork without paying sky-high fees for legal services.

US Legal Forms offers a huge collection of over 85,000 state-compliant document templates, including Clark Order Refunding Bond and form packages. We offer documents for an array of use cases: from divorce paperwork to real estate documents. We've been on the market for more than 25 years and gained a rock-solid reputation among our customers. Here's how you can become one of them and get the necessary template without extra troubles.

- To start with, carefully verify if the Clark Order Refunding Bond is adapted to your state's or county's regulations.

- In case the form comes with a desciption, make sure to verify what it's intended for.

- Start the searching process again if the document isn’t what you were looking for by using the search bar in the header.

- Select the plan that best suits your needs and move forward to the payment.

- Choose the file format you would like to get your form in and download it.

- Print it out, complete it, and sign on the dotted line.

If you've already registered an account, you can easily log in to it, find the Clark Order Refunding Bond template, and download it. To re-download the form, simply go to the My Forms tab.

It's effortless to find and download legal forms if you use our catalog. Additionally, the paperwork we provide are updated by industry experts, which gives you greater peace of mind when writing legal matters. Try US Legal Forms now and see for yourself!