The Dallas Texas Order Refunding Bond is a financial instrument that allows the city of Dallas, Texas, to refinance existing debt obligations at a lower interest rate. This bond serves as a tool for the city to effectively manage its debt and financial obligations. By refinancing existing bonds, the city can save money on interest payments and potentially free up funds for other important projects and initiatives. There are several types of Dallas Texas Order Refunding Bonds, each serving specific purposes: 1. General Obligation Refunding Bonds: These bonds are backed by the full faith and credit of the city of Dallas. They are issued to refinance general obligation bonds that were originally used to fund various public projects, such as infrastructure improvements, schools, or public facilities. 2. Revenue Refunding Bonds: These bonds are secured by specific revenue sources, such as sales taxes or user fees. They are issued to refinance revenue bonds that were initially issued to finance revenue-generating projects. The revenue generated from these projects is then used to repay the bonds and cover the interest. 3. Water and Sewer System Revenue Refunding Bonds: Dallas has a separate bond program dedicated to its water and sewer system. Water and Sewer System Revenue Refunding Bonds are issued to refinance existing bonds tied to the financing of water treatment plants, pipelines, and other infrastructure related to the provision of water and sewer services. The primary goal of the Dallas Texas Order Refunding Bond is to achieve cost savings by taking advantage of lower interest rates in the market. This process involves issuing new bonds to replace the existing ones and using the proceeds to pay off the original debt. Through careful analysis of interest rate trends, economic conditions, and consultation with financial advisors, Dallas can determine the optimal time to initiate the refunding process. The Dallas Texas Order Refunding Bond not only benefits the city in terms of decreased interest payments but also allows for enhanced financial flexibility and efficient management of its debt. By successfully refinancing its bonds, Dallas can allocate more funds towards essential public services, infrastructure improvements, and other projects that support the well-being and growth of the city and its residents.

Dallas Texas Order Refunding Bond

Description

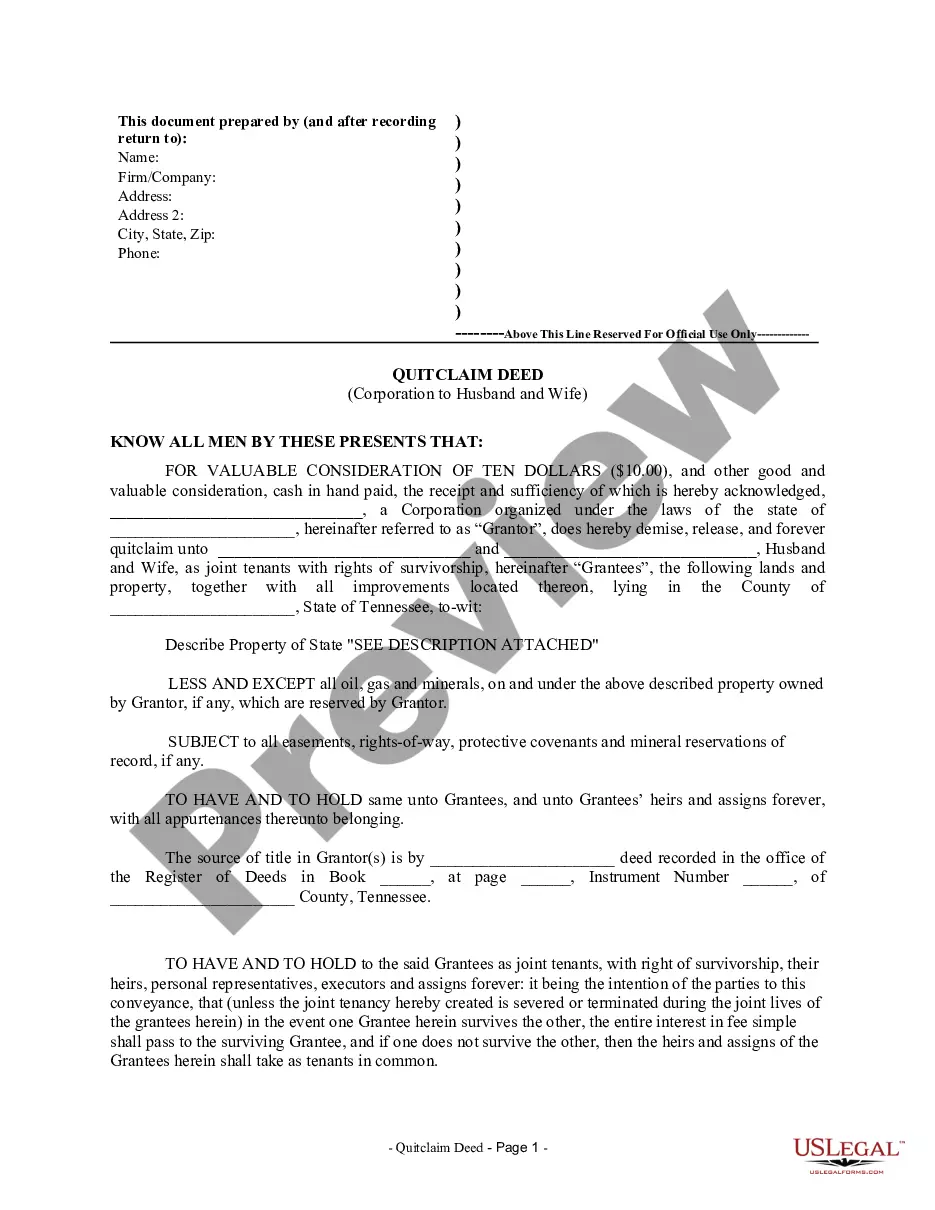

How to fill out Dallas Texas Order Refunding Bond?

Preparing legal documentation can be burdensome. Besides, if you decide to ask a legal professional to write a commercial contract, documents for ownership transfer, pre-marital agreement, divorce paperwork, or the Dallas Order Refunding Bond, it may cost you a lot of money. So what is the best way to save time and money and draft legitimate documents in total compliance with your state and local laws? US Legal Forms is an excellent solution, whether you're searching for templates for your individual or business needs.

US Legal Forms is the most extensive online collection of state-specific legal documents, providing users with the up-to-date and professionally checked forms for any scenario collected all in one place. Consequently, if you need the current version of the Dallas Order Refunding Bond, you can easily locate it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample using the Download button. If you haven't subscribed yet, here's how you can get the Dallas Order Refunding Bond:

- Look through the page and verify there is a sample for your region.

- Examine the form description and use the Preview option, if available, to ensure it's the sample you need.

- Don't worry if the form doesn't satisfy your requirements - look for the right one in the header.

- Click Buy Now once you find the required sample and select the best suitable subscription.

- Log in or register for an account to pay for your subscription.

- Make a transaction with a credit card or through PayPal.

- Choose the document format for your Dallas Order Refunding Bond and download it.

When done, you can print it out and complete it on paper or import the samples to an online editor for a faster and more convenient fill-out. US Legal Forms enables you to use all the paperwork ever obtained many times - you can find your templates in the My Forms tab in your profile. Try it out now!