Franklin Ohio Order Refunding Bond is a municipal bond issued by the city of Franklin, Ohio, as a means of refinancing its existing debt obligations. This bond is specifically designed to help the city manage its debt by replacing and refunding existing bonds with new ones, which often offer lower interest rates and better terms. The Franklin Ohio Order Refunding Bond is a financial instrument that provides investors with an opportunity to invest in the city's infrastructure and development projects while also benefiting the local economy. By issuing these bonds, the city can free up capital to fund new initiatives and stimulate growth in the community. There are several types of Franklin Ohio Order Refunding Bonds that investors can choose from, based on their preferences and investment goals: 1. General Obligation (GO) Bonds: These bonds are backed by the full faith and credit of the city of Franklin, meaning that the city pledges its taxing authority to repay the bondholders. GO bonds are known for their low default risk and are considered safer investments. 2. Revenue Bonds: These bonds are backed by the revenue generated by specific projects or city services, such as toll roads or water utilities. The repayment of these bonds depends on the success of the underlying revenue-generating source. Revenue bonds often carry a slightly higher risk than GO bonds but also offer potentially higher returns. 3. Tax Increment Financing (TIF) Bonds: These bonds are issued to finance infrastructure improvements within designated tax increment financing districts. The repayment of these bonds is supported by the increased property tax revenue generated from the district's development. TIF bonds provide investors with exposure to the growth potential of specific districts within the city. Investing in Franklin Ohio Order Refunding Bonds can offer investors a steady stream of income through regular interest payments and the return of principal at maturity. These bonds can be an attractive option for those seeking relatively stable investments with the potential for capital appreciation while contributing to the overall well-being of the local community. Note: Keywords related to this topic may include Franklin Ohio, municipal bond, order refunding bond, refinancing debt, investor opportunity, local economy, infrastructure, development projects, general obligation (GO) bonds, revenue bonds, tax increment financing (TIF) bonds, investing, interest payments, capital appreciation, community growth.

Franklin Ohio Order Refunding Bond

Description

How to fill out Franklin Ohio Order Refunding Bond?

Creating legal forms is a must in today's world. However, you don't always need to look for professional help to draft some of them from the ground up, including Franklin Order Refunding Bond, with a service like US Legal Forms.

US Legal Forms has more than 85,000 forms to choose from in various categories ranging from living wills to real estate paperwork to divorce papers. All forms are organized according to their valid state, making the searching process less frustrating. You can also find detailed resources and guides on the website to make any activities associated with document completion simple.

Here's how you can purchase and download Franklin Order Refunding Bond.

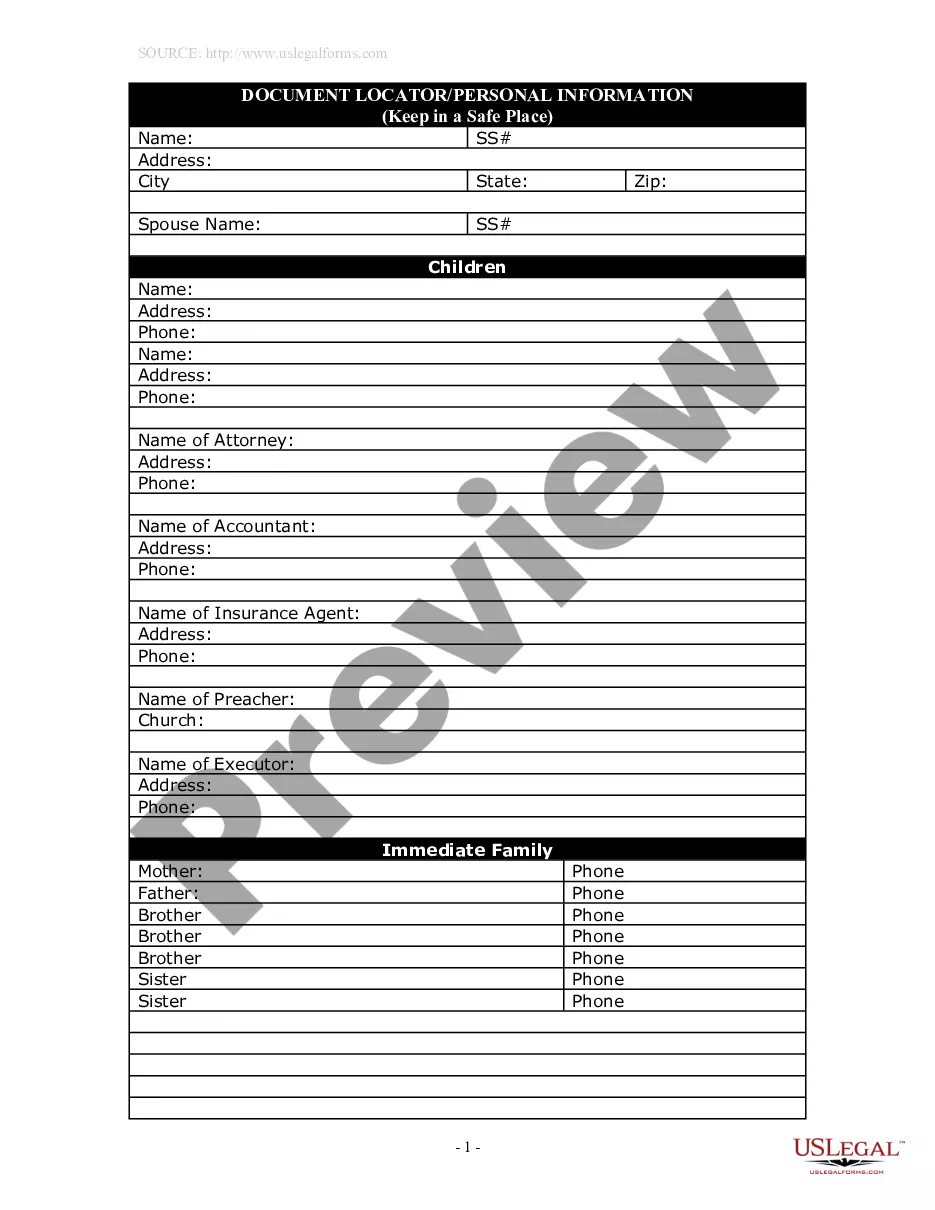

- Go over the document's preview and outline (if available) to get a basic idea of what you’ll get after downloading the document.

- Ensure that the document of your choice is specific to your state/county/area since state laws can affect the validity of some records.

- Check the related document templates or start the search over to locate the appropriate file.

- Hit Buy now and create your account. If you already have an existing one, select to log in.

- Pick the pricing {plan, then a suitable payment method, and buy Franklin Order Refunding Bond.

- Choose to save the form template in any offered file format.

- Go to the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can locate the needed Franklin Order Refunding Bond, log in to your account, and download it. Needless to say, our website can’t take the place of a legal professional entirely. If you need to cope with an extremely difficult situation, we recommend getting a lawyer to check your form before executing and submitting it.

With more than 25 years on the market, US Legal Forms proved to be a go-to provider for many different legal forms for millions of customers. Join them today and get your state-specific paperwork with ease!