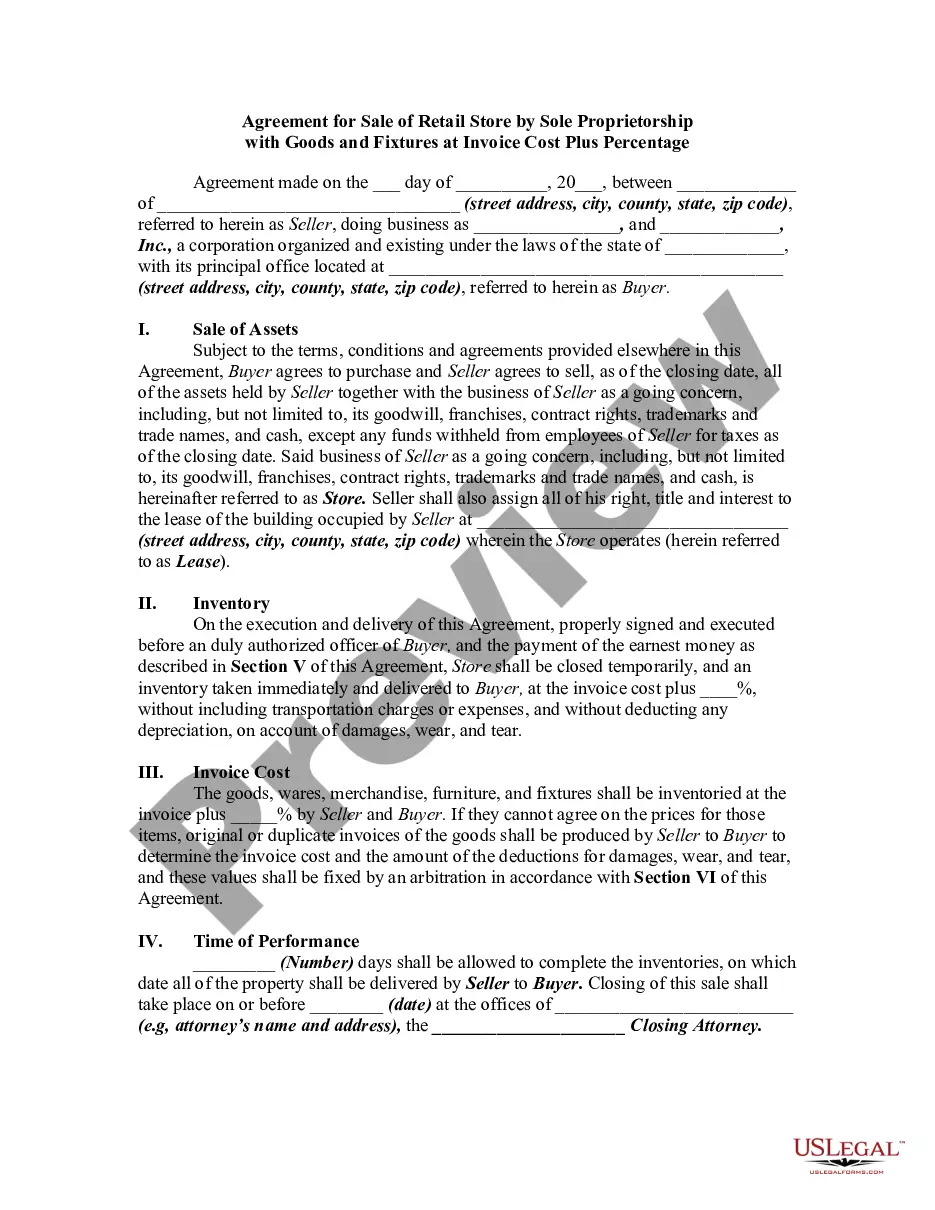

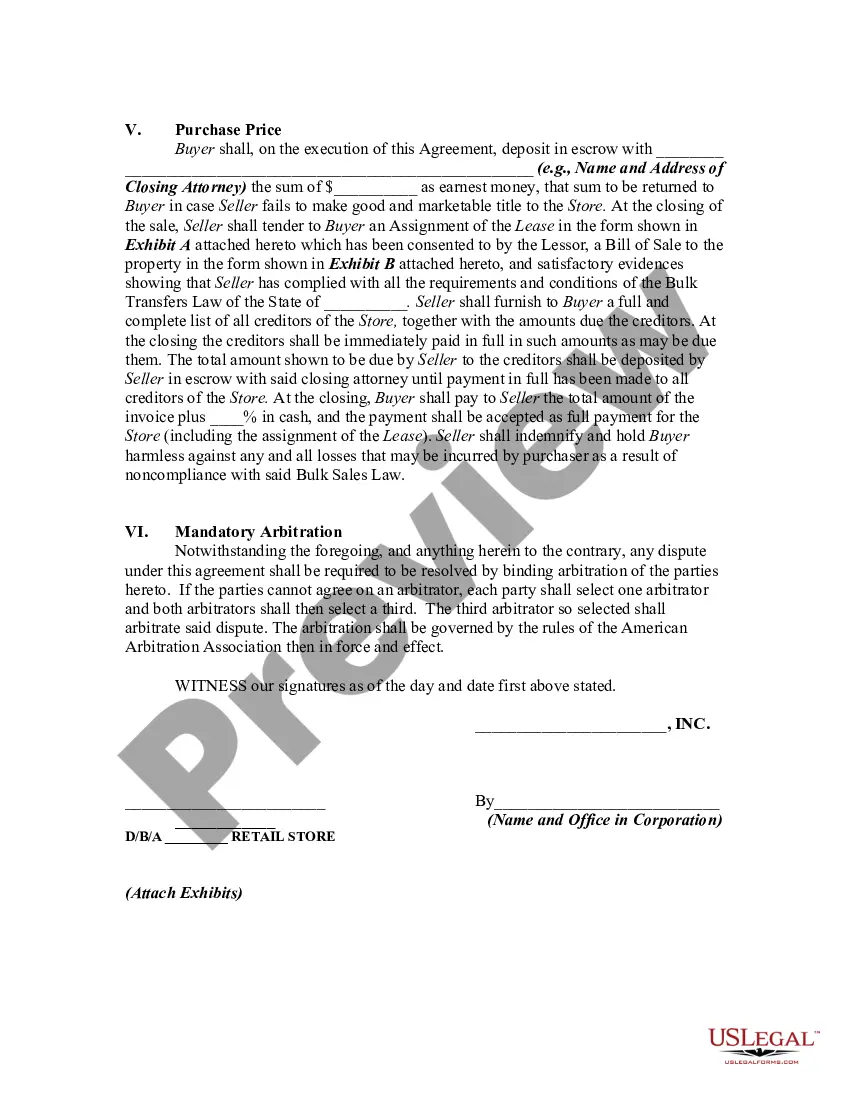

The Allegheny Pennsylvania Agreement for Sale of Retail Store by Sole Proprietorship with Goods and Fixtures at Invoice Cost Plus Percentage is a legally binding contract between a sole proprietor who owns a retail store in Allegheny, Pennsylvania, and a potential buyer interested in acquiring the business. This agreement outlines the terms and conditions under which the sale will take place, including details about the assets being sold, the purchase price, payment terms, and any other relevant provisions. In this agreement, the goods and fixtures refer to the inventory, equipment, furniture, and other tangible assets that are included in the sale. The invoice cost plus percentage refers to the agreed-upon pricing method, where the purchase price will be determined by calculating the cost of the goods and fixtures based on their original invoice cost plus an additional percentage agreed upon by both parties. The purpose of this agreement is to establish the rights and obligations of both the seller and the buyer, ensuring a smooth and transparent transaction. It provides legal protection to both parties by specifying the terms of sale, preventing any misunderstandings or disputes that may arise during the process. Different types of this agreement may vary based on specific clauses, exclusions, or additional terms added to meet the unique needs of the buyer and seller. Some variations could include provisions related to the transfer of employee contracts, non-compete agreements, warranties, or indemnifications. Overall, the Allegheny Pennsylvania Agreement for Sale of Retail Store by Sole Proprietorship with Goods and Fixtures at Invoice Cost Plus Percentage aims to facilitate a fair and mutually beneficial sale of a retail business while protecting the interests of both parties involved.

Allegheny Pennsylvania Agreement for Sale of Retail Store by Sole Proprietorship with Goods and Fixtures at Invoice Cost Plus Percentage

Description

How to fill out Allegheny Pennsylvania Agreement For Sale Of Retail Store By Sole Proprietorship With Goods And Fixtures At Invoice Cost Plus Percentage?

A document routine always accompanies any legal activity you make. Opening a company, applying or accepting a job offer, transferring ownership, and many other life scenarios demand you prepare official paperwork that differs from state to state. That's why having it all accumulated in one place is so helpful.

US Legal Forms is the most extensive online library of up-to-date federal and state-specific legal forms. Here, you can easily find and download a document for any personal or business objective utilized in your region, including the Allegheny Agreement for Sale of Retail Store by Sole Proprietorship with Goods and Fixtures at Invoice Cost Plus Percentage.

Locating templates on the platform is amazingly simple. If you already have a subscription to our library, log in to your account, find the sample using the search bar, and click Download to save it on your device. Following that, the Allegheny Agreement for Sale of Retail Store by Sole Proprietorship with Goods and Fixtures at Invoice Cost Plus Percentage will be available for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, adhere to this quick guide to get the Allegheny Agreement for Sale of Retail Store by Sole Proprietorship with Goods and Fixtures at Invoice Cost Plus Percentage:

- Make sure you have opened the correct page with your local form.

- Make use of the Preview mode (if available) and browse through the template.

- Read the description (if any) to ensure the form corresponds to your requirements.

- Look for another document using the search tab if the sample doesn't fit you.

- Click Buy Now when you find the necessary template.

- Select the appropriate subscription plan, then log in or create an account.

- Select the preferred payment method (with credit card or PayPal) to continue.

- Opt for file format and save the Allegheny Agreement for Sale of Retail Store by Sole Proprietorship with Goods and Fixtures at Invoice Cost Plus Percentage on your device.

- Use it as needed: print it or fill it out electronically, sign it, and send where requested.

This is the easiest and most trustworthy way to obtain legal paperwork. All the samples available in our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs effectively with the US Legal Forms!