The Clark Nevada Agreement for Sale of Retail Store by Sole Proprietorship with Goods and Fixtures at Invoice Cost Plus Percentage is a legally binding contract between a sole proprietor and a potential buyer for the purchase of a retail store along with its inventory and fixtures. This agreement outlines the terms and conditions of the sale, including the price, payment terms, and any additional provisions. In this type of agreement, the seller agrees to sell the retail store, including all goods and fixtures, to the buyer. The inventory and fixtures are sold at the invoice cost, which is the original purchase price, plus a predetermined percentage. This allows the seller to recoup the cost of the inventory and fixtures while also making a profit on the sale. The Clark Nevada Agreement for Sale of Retail Store by Sole Proprietorship with Goods and Fixtures at Invoice Cost Plus Percentage provides protection for both the seller and the buyer. It ensures that all assets included in the sale are accurately represented and accounted for. It also establishes the obligations of both parties, such as transfer of ownership, inspection of the goods and fixtures, and warranties. There may be different variations or types of the Clark Nevada Agreement for Sale of Retail Store by Sole Proprietorship with Goods and Fixtures at Invoice Cost Plus Percentage, depending on specific circumstances or requirements. These variations could include agreements with different percentages added to the invoice cost or additional terms regarding the transfer of licenses or lease assignments. It is important to carefully review and customize the agreement to suit the needs of both the seller and the buyer. Overall, the Clark Nevada Agreement for Sale of Retail Store by Sole Proprietorship with Goods and Fixtures at Invoice Cost Plus Percentage is designed to facilitate a smooth and fair transaction between a sole proprietor seller and a buyer interested in purchasing a retail store. It sets clear expectations and minimizes the potential for disputes or misunderstandings, ensuring a successful transfer of ownership.

Clark Nevada Agreement for Sale of Retail Store by Sole Proprietorship with Goods and Fixtures at Invoice Cost Plus Percentage

Description

How to fill out Clark Nevada Agreement For Sale Of Retail Store By Sole Proprietorship With Goods And Fixtures At Invoice Cost Plus Percentage?

Creating legal forms is a must in today's world. However, you don't always need to seek professional help to create some of them from scratch, including Clark Agreement for Sale of Retail Store by Sole Proprietorship with Goods and Fixtures at Invoice Cost Plus Percentage, with a service like US Legal Forms.

US Legal Forms has more than 85,000 forms to choose from in various categories varying from living wills to real estate papers to divorce documents. All forms are organized based on their valid state, making the searching process less overwhelming. You can also find information materials and guides on the website to make any tasks associated with document execution simple.

Here's how to find and download Clark Agreement for Sale of Retail Store by Sole Proprietorship with Goods and Fixtures at Invoice Cost Plus Percentage.

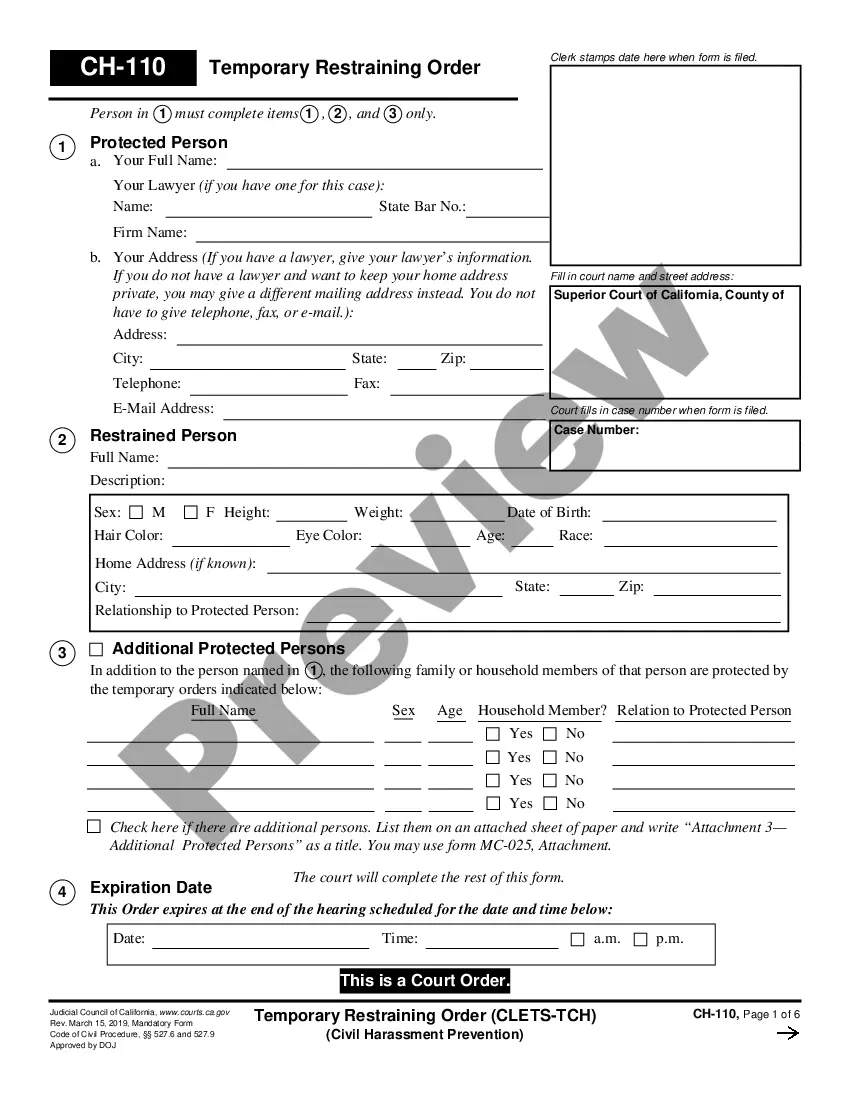

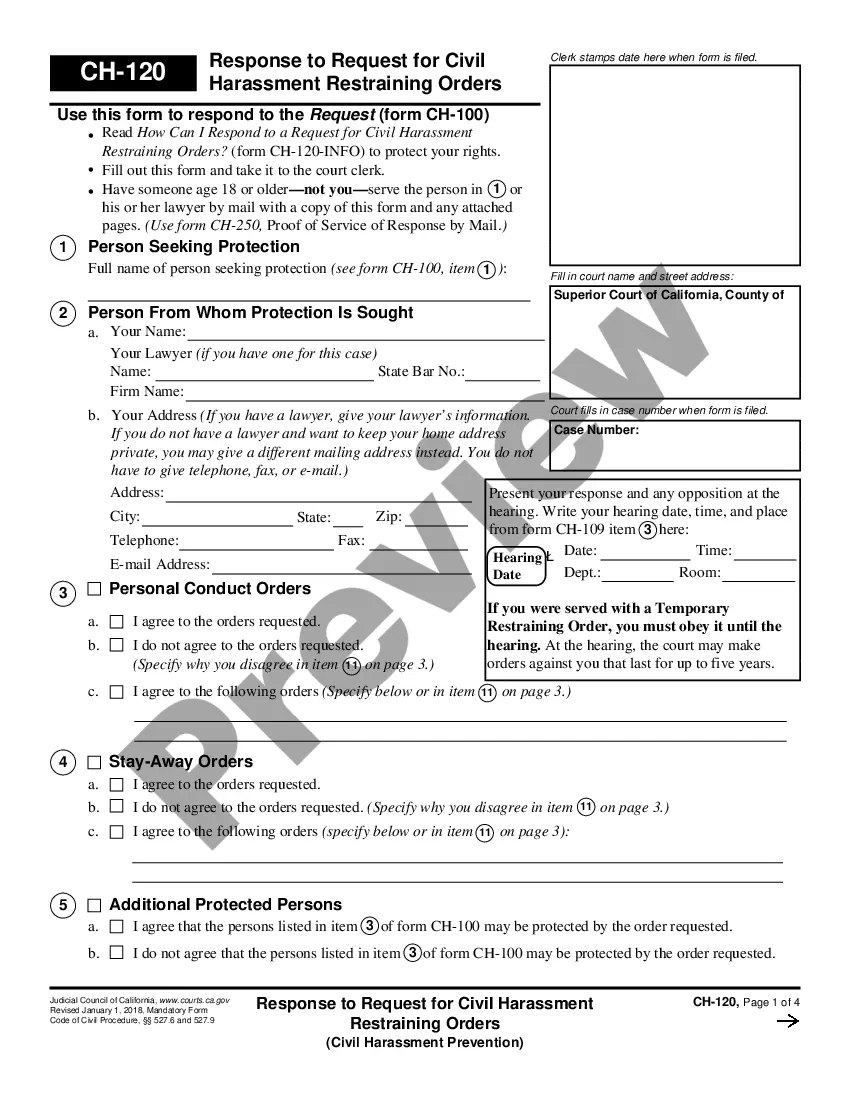

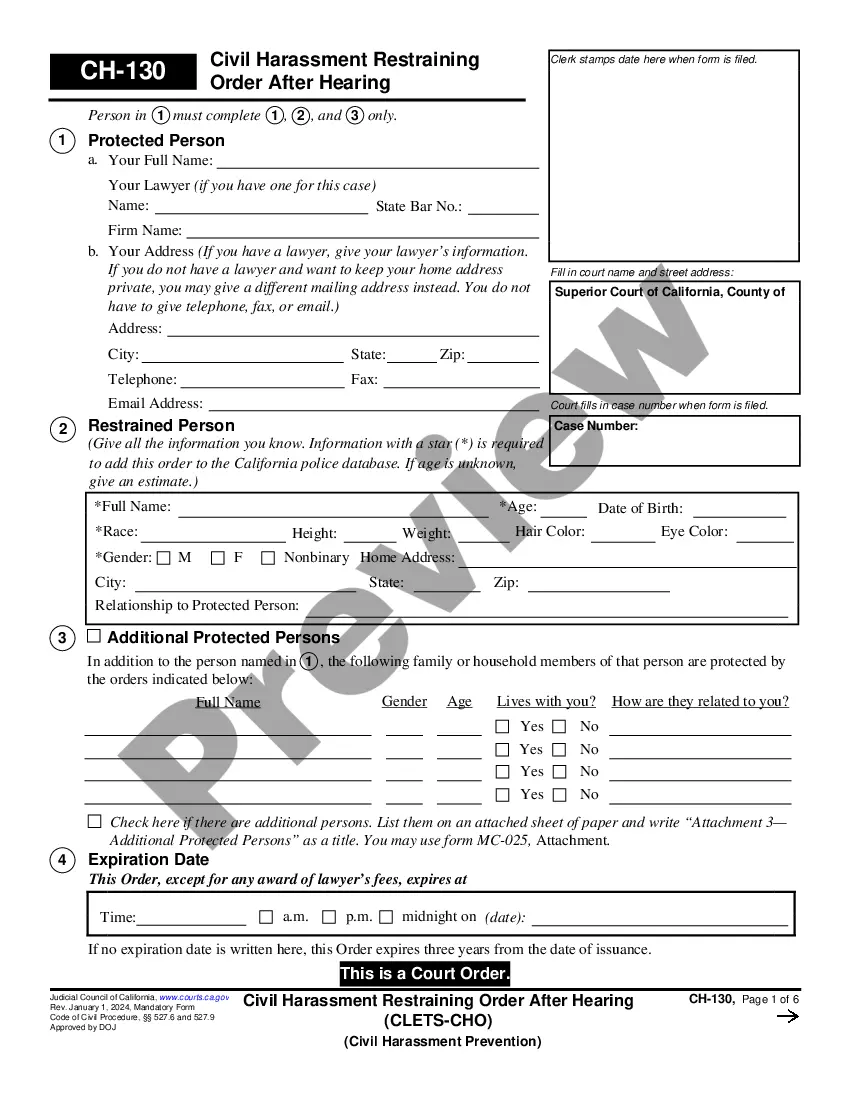

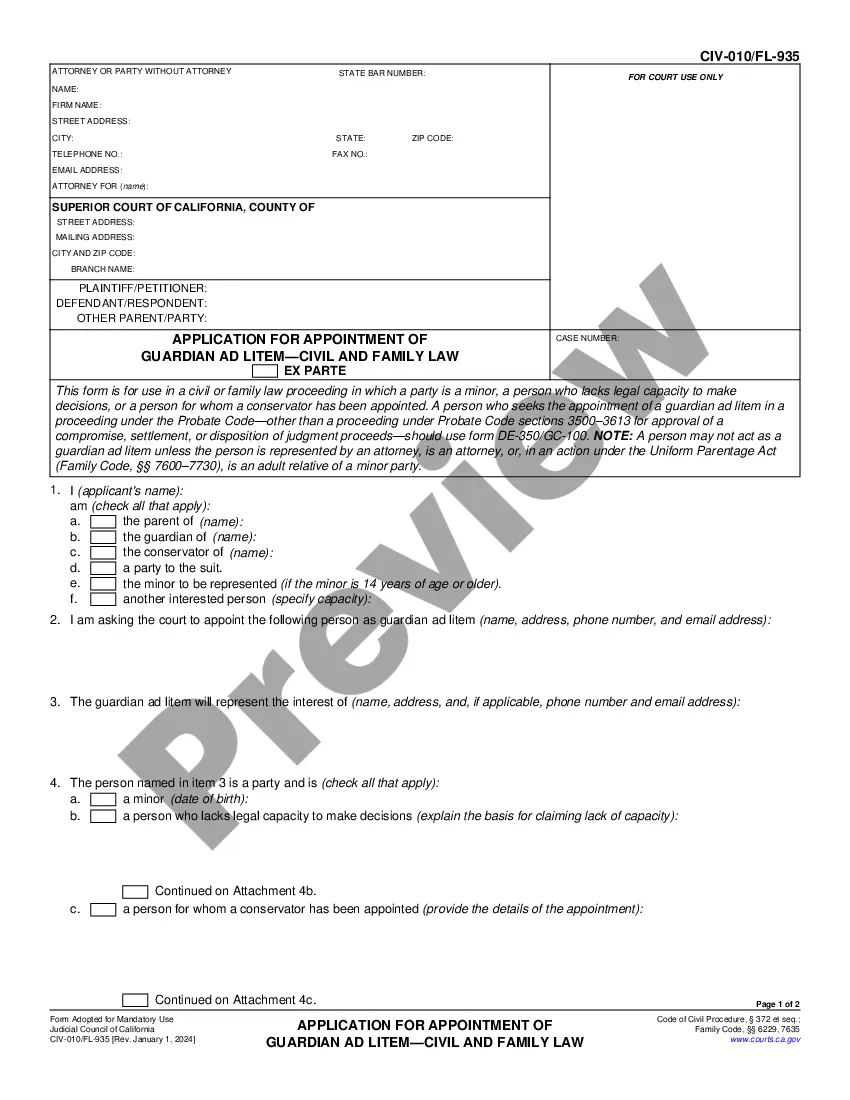

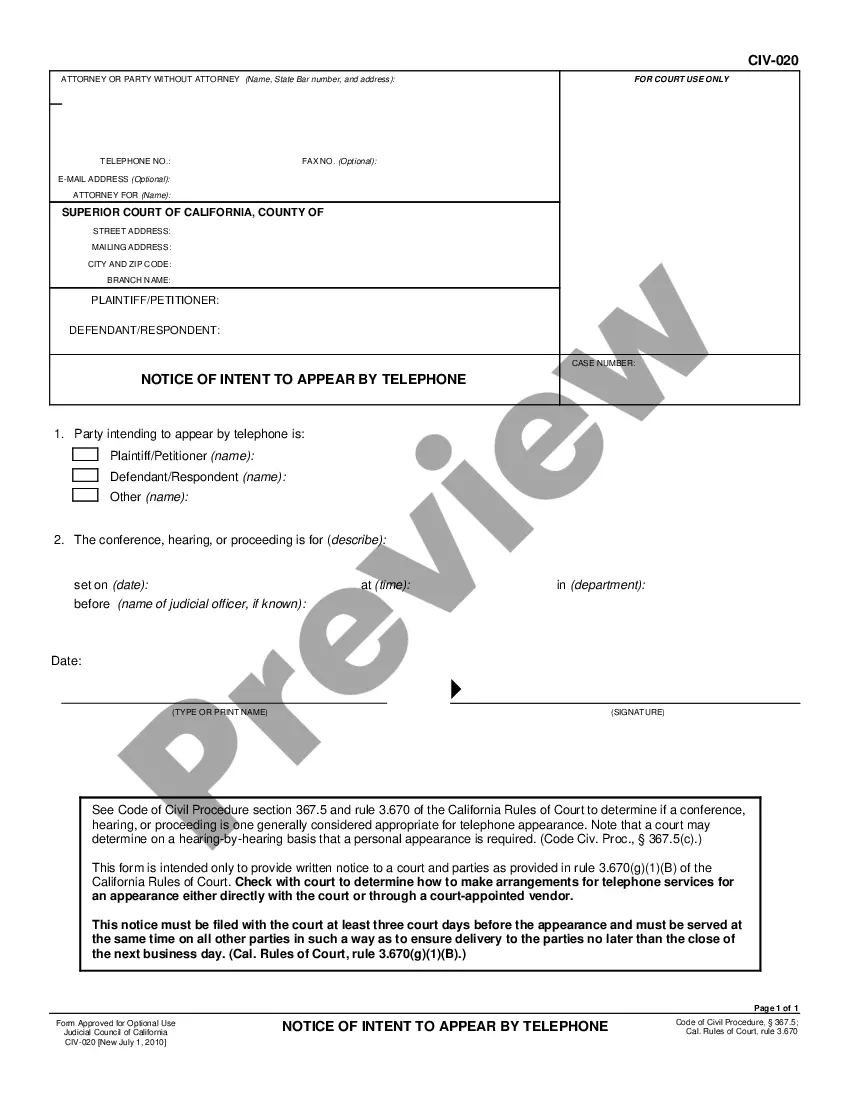

- Take a look at the document's preview and description (if available) to get a general information on what you’ll get after getting the document.

- Ensure that the document of your choice is specific to your state/county/area since state laws can impact the validity of some records.

- Examine the similar forms or start the search over to locate the right document.

- Click Buy now and register your account. If you already have an existing one, select to log in.

- Pick the option, then a needed payment method, and purchase Clark Agreement for Sale of Retail Store by Sole Proprietorship with Goods and Fixtures at Invoice Cost Plus Percentage.

- Select to save the form template in any available format.

- Go to the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can locate the appropriate Clark Agreement for Sale of Retail Store by Sole Proprietorship with Goods and Fixtures at Invoice Cost Plus Percentage, log in to your account, and download it. Needless to say, our website can’t take the place of an attorney entirely. If you have to deal with an exceptionally complicated situation, we recommend using the services of an attorney to examine your form before executing and filing it.

With over 25 years on the market, US Legal Forms became a go-to provider for various legal forms for millions of users. Become one of them today and get your state-specific documents with ease!