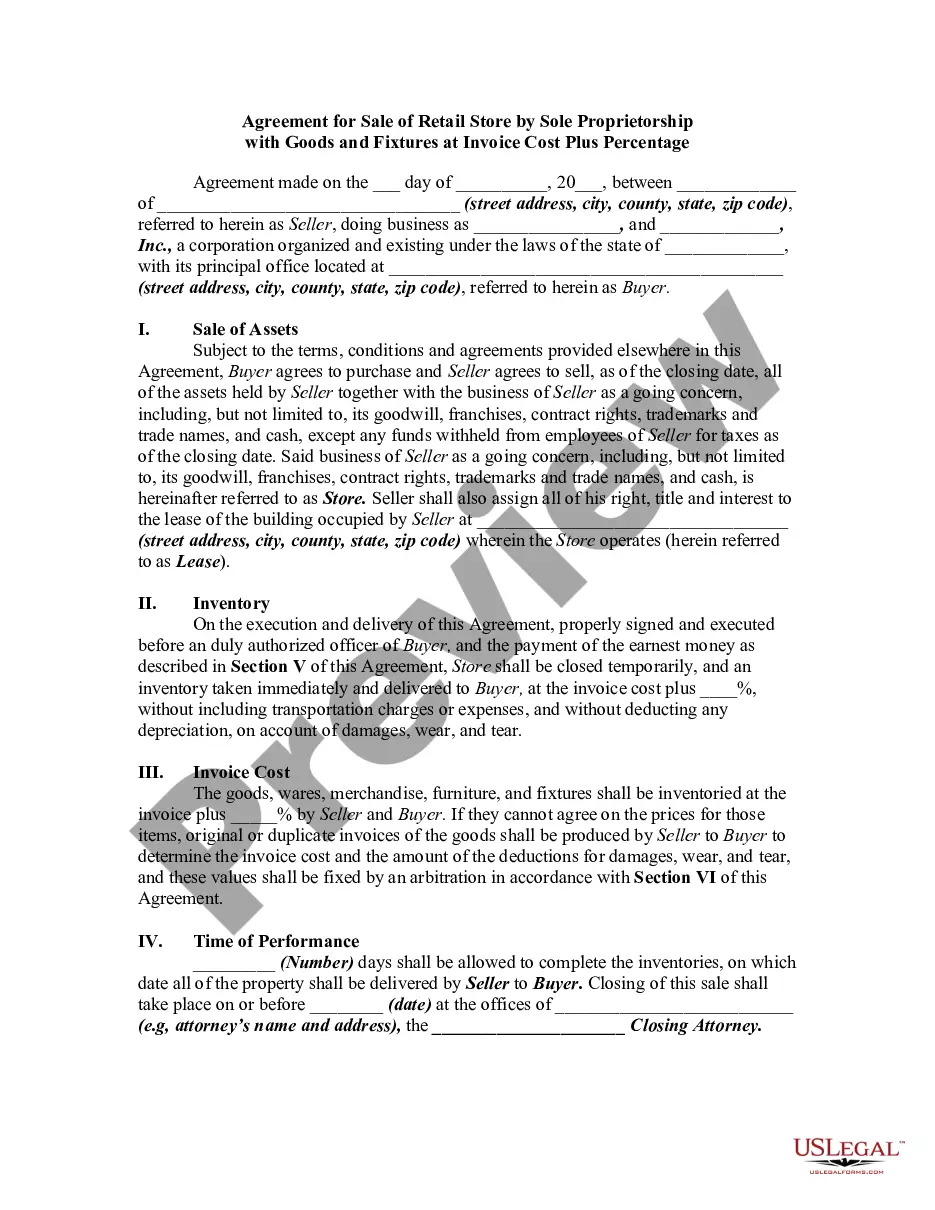

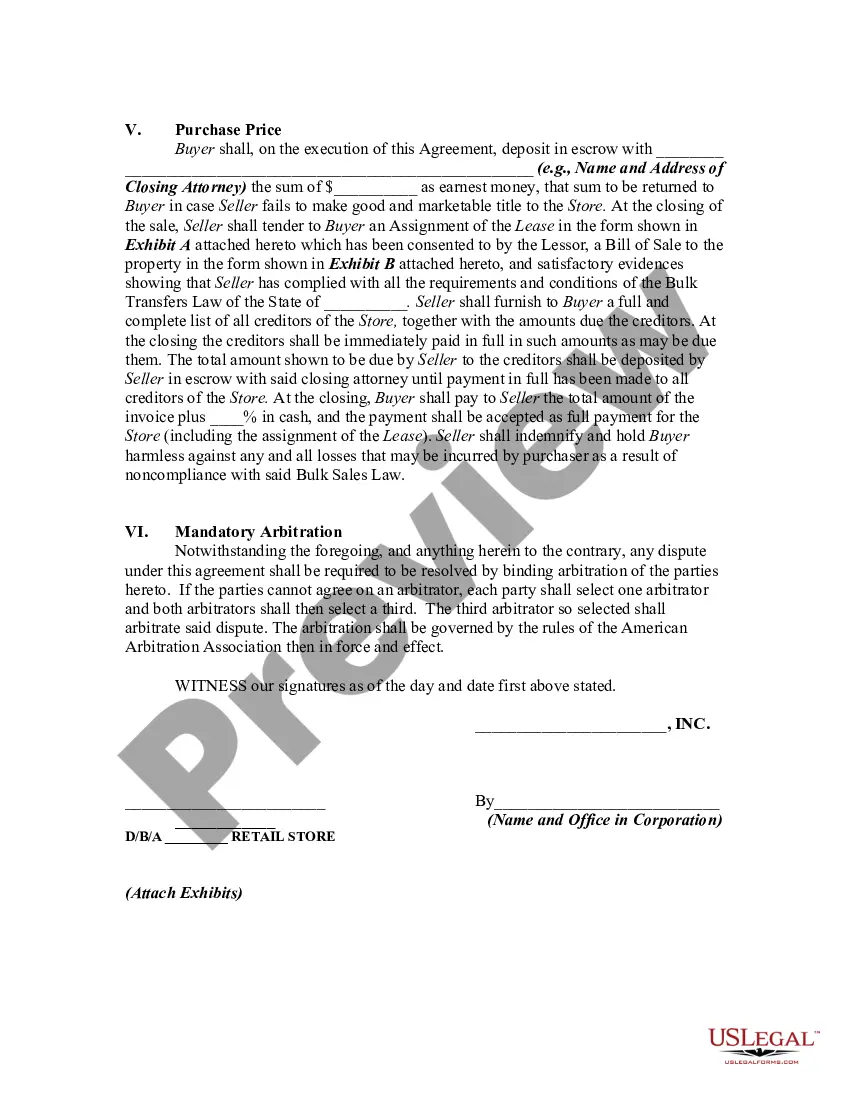

The Fulton Georgia Agreement for Sale of Retail Store by Sole Proprietorship with Goods and Fixtures at Invoice Cost Plus Percentage is a legal contract that outlines the terms and conditions of transferring ownership of a retail store from a sole proprietor to a buyer. This agreement includes specific provisions related to the goods and fixtures included in the sale, as well as the pricing structure. Sole proprietors in Fulton, Georgia who wish to sell their retail store can rely on this agreement to establish a clear understanding between buyer and seller. With the inclusion of relevant keywords, here is a detailed description of this agreement: 1. Sale of Retail Store: The agreement provides a comprehensive overview of the retail store being sold, including its location, name, and any associated licenses or permits. It also outlines the exact nature of the business being conducted by the store. 2. Transfer of Ownership: This section specifies that the sole proprietor, who is the seller, intends to transfer ownership of the retail store to the buyer. It highlights the buyer's acknowledgment of assuming all responsibilities and liabilities associated with the business upon completion of the sale. 3. Goods and Fixtures: The agreement includes a detailed inventory of all goods and fixtures being sold as a part of the retail store transfer. This inventory may include merchandise, equipment, furniture, technology, signage, and any other assets related to the store's operation. Each item is typically listed along with its description, quantity, condition, and value. 4. Invoice Cost Plus Percentage: In this agreement, the pricing structure for the sale is based on the invoice cost of the goods and fixtures, plus a predetermined percentage. The exact percentage or formula for calculating the sale price should be clearly outlined in the agreement. 5. Payment Terms: This section specifies the payment terms agreed upon by both parties. It typically includes the total sale price, any required deposits, payment due dates, and acceptable methods of payment (e.g., cash, check, or bank transfer). It is essential to include provisions for installment payments or financing arrangements if applicable. 6. Representations and Warranties: The agreement may include representations and warranties made by both the seller and the buyer. These ensure that each party confirms the accuracy of the information provided regarding the store's financial status, legal compliance, and any other relevant details. 7. Closing and Delivery: The closing date refers to the date of the final transaction, when ownership and possession of the store are officially transferred. This section may outline the tasks required for closing, such as the execution of additional documents, handover of keys, or transfer of any other relevant information. Different types or variations of the Fulton Georgia Agreement for Sale of Retail Store by Sole Proprietorship with Goods and Fixtures at Invoice Cost Plus Percentage may exist depending on specific circumstances. For instance, there could be customized agreements based on the size of the retail store, the industry it operates in, or any additional terms negotiated between the buyer and seller (such as non-compete clauses or employee retention). It is crucial for both the seller and the buyer to consult legal professionals to ensure the agreement complies with Fulton, Georgia's laws and protects their respective interests throughout the sale process.

Fulton Georgia Agreement for Sale of Retail Store by Sole Proprietorship with Goods and Fixtures at Invoice Cost Plus Percentage

Description

How to fill out Fulton Georgia Agreement For Sale Of Retail Store By Sole Proprietorship With Goods And Fixtures At Invoice Cost Plus Percentage?

Laws and regulations in every area differ throughout the country. If you're not an attorney, it's easy to get lost in countless norms when it comes to drafting legal documentation. To avoid expensive legal assistance when preparing the Fulton Agreement for Sale of Retail Store by Sole Proprietorship with Goods and Fixtures at Invoice Cost Plus Percentage, you need a verified template legitimate for your region. That's when using the US Legal Forms platform is so advantageous.

US Legal Forms is a trusted by millions web catalog of more than 85,000 state-specific legal templates. It's a great solution for professionals and individuals looking for do-it-yourself templates for various life and business scenarios. All the forms can be used many times: once you obtain a sample, it remains available in your profile for subsequent use. Thus, when you have an account with a valid subscription, you can just log in and re-download the Fulton Agreement for Sale of Retail Store by Sole Proprietorship with Goods and Fixtures at Invoice Cost Plus Percentage from the My Forms tab.

For new users, it's necessary to make a few more steps to get the Fulton Agreement for Sale of Retail Store by Sole Proprietorship with Goods and Fixtures at Invoice Cost Plus Percentage:

- Analyze the page content to ensure you found the correct sample.

- Take advantage of the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your requirements.

- Click on the Buy Now button to get the template once you find the correct one.

- Opt for one of the subscription plans and log in or create an account.

- Choose how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the document in and click Download.

- Fill out and sign the template on paper after printing it or do it all electronically.

That's the easiest and most affordable way to get up-to-date templates for any legal purposes. Find them all in clicks and keep your documentation in order with the US Legal Forms!