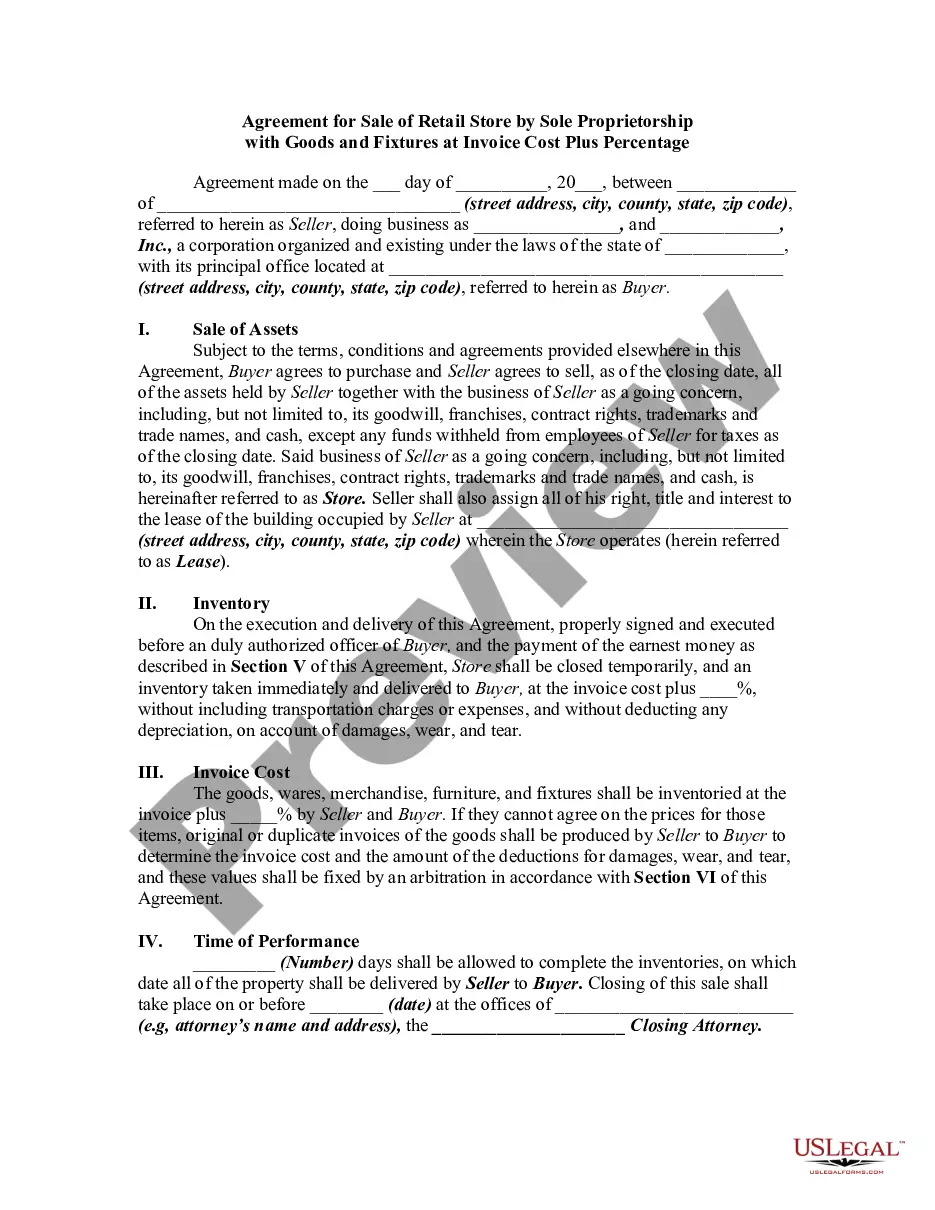

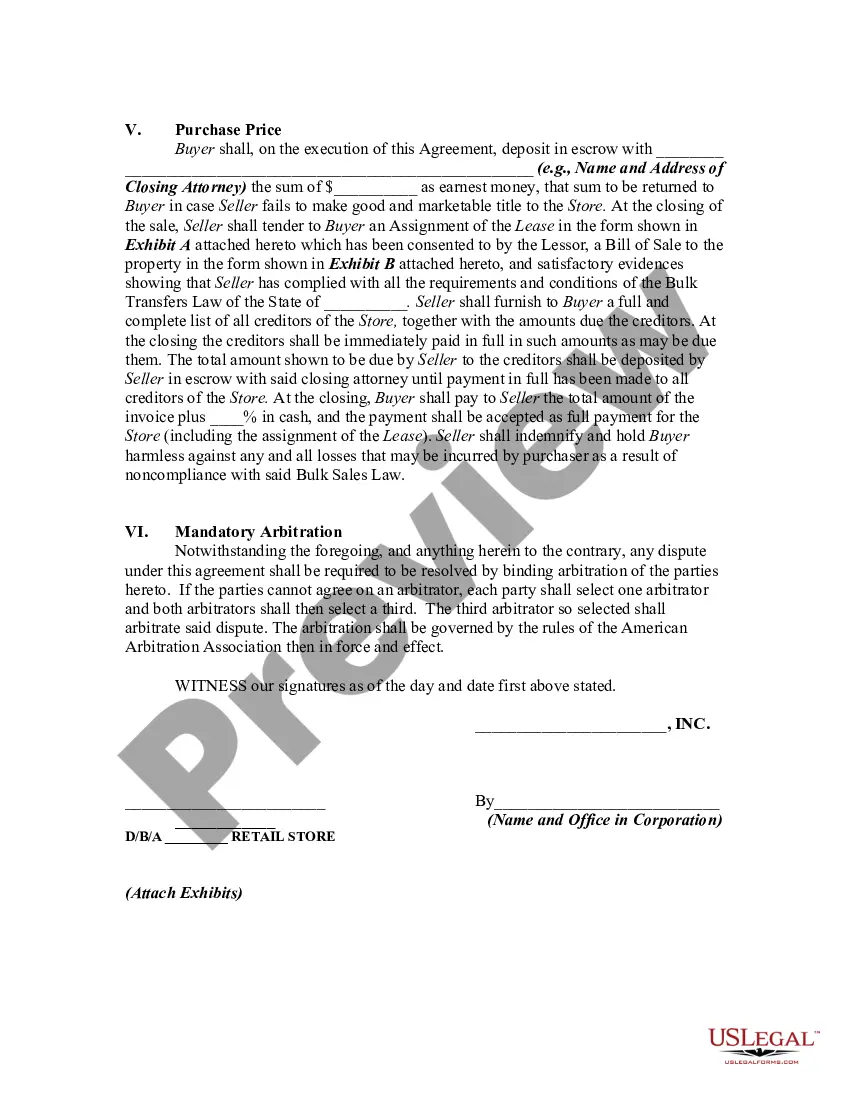

Miami-Dade Florida Agreement for Sale of Retail Store by Sole Proprietorship with Goods and Fixtures at Invoice Cost Plus Percentage is a legally binding contract that outlines the terms and conditions of selling a retail store owned by a sole proprietor in Miami-Dade County, Florida. This agreement is specifically designed to include the sale of goods and fixtures at their invoice cost plus a percentage markup. The agreement is structured to protect the interests of both the seller and the buyer. It includes provisions for the transfer of ownership, payment terms, and the condition of the goods and fixtures being sold. By incorporating the invoice cost plus percentage method, the agreement ensures a fair and transparent pricing mechanism for all parties involved. Key terms and sections included in the Miami-Dade Florida Agreement for Sale of Retail Store by Sole Proprietorship with Goods and Fixtures at Invoice Cost Plus Percentage may include: 1. Parties Involved: Names and contact information of the sole proprietor selling the retail store and the buyer acquiring the store. 2. Effective Date: The date when the agreement becomes legally enforceable. 3. Description of the Retail Store: Detailed information about the store being sold, including its location, size, and any additional assets included in the transaction. 4. Transfer of Ownership: Clear provision for the transfer of ownership from the seller to the buyer, ensuring all legal requirements are met. 5. Goods and Fixtures: A comprehensive list of all goods and fixtures included in the sale, specifying their condition and the invoice cost at which they were originally purchased. 6. Purchase Price: Calculation of the total purchase price, which is determined by adding the invoice cost of the goods and fixtures with a predetermined percentage markup. 7. Payment Terms: Clauses stipulating the payment methods, installments (if applicable), and any applicable interest rates if payments are delayed. 8. Representations and Warranties: Statements made by the seller about the accuracy of the information provided in the agreement, ensuring that it is correct and complete. 9. Covenants: Agreed-upon actions or restrictions that both the seller and buyer must adhere to. 10. Confidentiality: Provisions to protect the confidentiality of any sensitive information exchanged during the sale process. 11. Governing Law and Jurisdiction: Establishes the jurisdiction where disputes will be resolved and the laws that will govern the agreement. While there may not be different types of Miami-Dade Florida Agreements for Sale of Retail Stores by Sole Proprietorship with Goods and Fixtures at Invoice Cost Plus Percentage, variations and amendments can be made to accommodate the specific needs and preferences of the parties involved. It is advisable to consult with legal professionals or seek guidance from experienced business advisors to ensure the agreement aligns with applicable laws and regulations.

Miami-Dade Florida Agreement for Sale of Retail Store by Sole Proprietorship with Goods and Fixtures at Invoice Cost Plus Percentage

Category:

State:

Multi-State

County:

Miami-Dade

Control #:

US-00869BG

Format:

Word;

Rich Text

Instant download

Description

This form is used to document an agreement of the sale of a business. Particular statutory requirements may have to be complied with in the sale of certain businesses. If the statutory requirements are not met, the sale is void as against the seller's creditors, and the buyer may be personally liable to them.

Miami-Dade Florida Agreement for Sale of Retail Store by Sole Proprietorship with Goods and Fixtures at Invoice Cost Plus Percentage is a legally binding contract that outlines the terms and conditions of selling a retail store owned by a sole proprietor in Miami-Dade County, Florida. This agreement is specifically designed to include the sale of goods and fixtures at their invoice cost plus a percentage markup. The agreement is structured to protect the interests of both the seller and the buyer. It includes provisions for the transfer of ownership, payment terms, and the condition of the goods and fixtures being sold. By incorporating the invoice cost plus percentage method, the agreement ensures a fair and transparent pricing mechanism for all parties involved. Key terms and sections included in the Miami-Dade Florida Agreement for Sale of Retail Store by Sole Proprietorship with Goods and Fixtures at Invoice Cost Plus Percentage may include: 1. Parties Involved: Names and contact information of the sole proprietor selling the retail store and the buyer acquiring the store. 2. Effective Date: The date when the agreement becomes legally enforceable. 3. Description of the Retail Store: Detailed information about the store being sold, including its location, size, and any additional assets included in the transaction. 4. Transfer of Ownership: Clear provision for the transfer of ownership from the seller to the buyer, ensuring all legal requirements are met. 5. Goods and Fixtures: A comprehensive list of all goods and fixtures included in the sale, specifying their condition and the invoice cost at which they were originally purchased. 6. Purchase Price: Calculation of the total purchase price, which is determined by adding the invoice cost of the goods and fixtures with a predetermined percentage markup. 7. Payment Terms: Clauses stipulating the payment methods, installments (if applicable), and any applicable interest rates if payments are delayed. 8. Representations and Warranties: Statements made by the seller about the accuracy of the information provided in the agreement, ensuring that it is correct and complete. 9. Covenants: Agreed-upon actions or restrictions that both the seller and buyer must adhere to. 10. Confidentiality: Provisions to protect the confidentiality of any sensitive information exchanged during the sale process. 11. Governing Law and Jurisdiction: Establishes the jurisdiction where disputes will be resolved and the laws that will govern the agreement. While there may not be different types of Miami-Dade Florida Agreements for Sale of Retail Stores by Sole Proprietorship with Goods and Fixtures at Invoice Cost Plus Percentage, variations and amendments can be made to accommodate the specific needs and preferences of the parties involved. It is advisable to consult with legal professionals or seek guidance from experienced business advisors to ensure the agreement aligns with applicable laws and regulations.

Free preview