Los Angeles, California Agreement for Assignment and Sale of Partnership Interest and Reorganization with Purchaser as New Partner, including Assignment, is a legal agreement that outlines the process of transferring partnership interests and restructuring the partnership with a new partner in Los Angeles, California. This agreement is crucial when a partnership wishes to bring in a new partner or reallocate partnership interests among existing partners. The key components of this agreement include: 1. Assignment and Sale of Partnership Interest: This clause outlines the terms and conditions for the selling partner to assign their partnership interest to the purchaser. It covers the purchase price, payment terms, and any warranties or representations made by the selling partner. 2. Reorganization of Partnership: This section details how the partnership will be restructured after the assignment and sale of partnership interest. It addresses the admission of the purchaser as a new partner, including their rights, responsibilities, and capital contributions. 3. Transfer of Assets and Liabilities: In the event of a reorganization, the agreement specifies how assets and liabilities of the partnership will be transferred to accommodate the new partner. It covers the valuation, transfer process, and any necessary consents or approvals. 4. Consideration and Consideration Adjustment: This clause determines the consideration amount to be paid by the purchaser for the partnership interest. It may also include provisions for possible adjustments to the consideration, such as additional payments or earn-outs based on future performance. 5. Representations and Warranties: Both the selling partner and purchasing partner make certain representations and warranties to ensure the validity and accuracy of the transaction. These may include representations regarding ownership, authority, and financial statements. 6. Governing Law and Dispute Resolution: The agreement typically specifies that it will be governed by the state laws of California and designates a specific jurisdiction for resolving any disputes that may arise. It may also include provisions for mediation or arbitration as alternative dispute resolution methods. Types of Los Angeles California Agreement for Assignment and Sale of Partnership Interest and Reorganization with Purchaser as New Partner, including Assignment, can vary based on the specific circumstances and needs of the parties involved. For instance, there may be agreements tailored for limited partnerships, general partnerships, or specific industries such as real estate or technology. Additionally, partnerships may include additional clauses or modifications to address unique considerations or contingencies relevant to their particular situation, such as tax implications or non-compete provisions.

Los Angeles California Agreement for Assignment and Sale of Partnership Interest and Reorganization with Purchaser as New Partner including Assignment

Description

How to fill out Los Angeles California Agreement For Assignment And Sale Of Partnership Interest And Reorganization With Purchaser As New Partner Including Assignment?

Preparing documents for the business or personal needs is always a big responsibility. When creating a contract, a public service request, or a power of attorney, it's essential to consider all federal and state regulations of the specific region. Nevertheless, small counties and even cities also have legislative provisions that you need to consider. All these details make it burdensome and time-consuming to draft Los Angeles Agreement for Assignment and Sale of Partnership Interest and Reorganization with Purchaser as New Partner including Assignment without expert help.

It's possible to avoid wasting money on lawyers drafting your documentation and create a legally valid Los Angeles Agreement for Assignment and Sale of Partnership Interest and Reorganization with Purchaser as New Partner including Assignment by yourself, using the US Legal Forms online library. It is the greatest online catalog of state-specific legal documents that are professionally verified, so you can be certain of their validity when picking a sample for your county. Earlier subscribed users only need to log in to their accounts to save the necessary document.

If you still don't have a subscription, adhere to the step-by-step guide below to obtain the Los Angeles Agreement for Assignment and Sale of Partnership Interest and Reorganization with Purchaser as New Partner including Assignment:

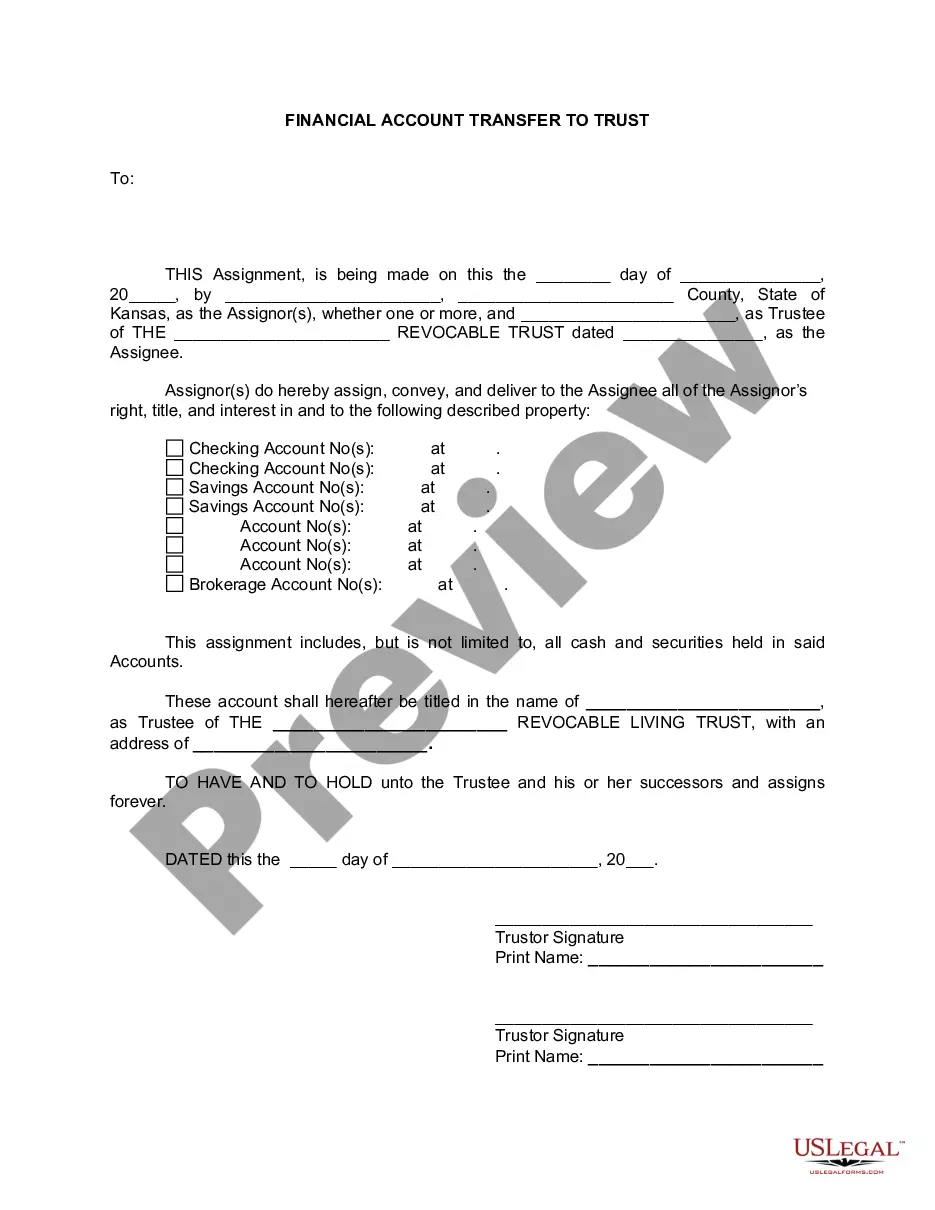

- Look through the page you've opened and verify if it has the document you require.

- To accomplish this, use the form description and preview if these options are presented.

- To find the one that meets your needs, utilize the search tab in the page header.

- Double-check that the sample complies with juridical criteria and click Buy Now.

- Pick the subscription plan, then log in or register for an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the chosen document in the preferred format, print it, or fill it out electronically.

The great thing about the US Legal Forms library is that all the documentation you've ever acquired never gets lost - you can access it in your profile within the My Forms tab at any moment. Join the platform and easily get verified legal templates for any use case with just a few clicks!

Form popularity

FAQ

A sale of a partnership interest occurs when one partner sells their ownership interest to another person or entity. The partnership is generally not involved in the transaction. However, the buyer and seller will notify the partnership of the transaction.

An assignment and assumption agreement is used after a contract is signed, in order to transfer one of the contracting party's rights and obligations to a third party who was not originally a party to the contract.

A partner can transfer his interest so as to substitute the transferee in his place as the partner, without the consent of all the other partners; a member of company cannot transfer his share to any one he likes.

Assignment of Contract Explained Assignment of contract allows one person to assign, or transfer, their rights, obligations, or property to another. An assignment of contract clause is often included in contracts to give either party the opportunity to transfer their part of the contract to someone else in the future.

Transferring ownership of a partnership depends on what type of interest is being transferred. Partnerships can have two forms: general and limited....Final overview Review the partnership agreement. Obtain a valuation. Decide whether to use an interest sale agreement. Amend the partnership agreement.

The assignment agreement definition is a portion of the common law that is in charge of transferring the rights of an individual or party to another person or party. The assignment agreement is often seen in real estate but can occur in other contexts as well.

Assignment is a legal term whereby an individual, the assignor, transfers rights, property, or other benefits to another known as the assignee. This concept is used in both contract and property law. The term can refer to either the act of transfer or the rights/property/benefits being transferred.

Unilateral Ownership Transfer Most states have modeled their partnership laws after the Revised Uniform Partnership Act, which allows a partner to transfer his economic interest in the partnership to a third party without the consent of the other partners.

Transferring Interest A new partnership will be formed between the member to whom the interest was transferred and the remaining members of the first partnership. This new partnership will be expected to continue on in the business of the first partnership.

An Assignment of Partnership Interest occurs when a partner sells their stake in a partnership to a third party. The assignment document records the details of the transfer to the new partner.