Alameda California Resolution Selecting Bank for Corporation and Account Signatories — Corporate Resolutions is a key legal process that corporations in Alameda, California must undertake when selecting a bank for their financial operations and designating account signatories. This detailed description will provide an overview of this resolution, its importance, and the different types that may exist. Firstly, the selection of a bank for a corporation in Alameda, California is a critical decision that impacts various financial aspects of the business. This resolution outlines the steps taken to evaluate and choose the most suitable bank that aligns with the corporation's needs, financial objectives, and regulatory requirements. It ensures that all legal obligations and corporate governance standards are met while establishing a business-bank relationship that fosters efficient financial operations. Account signatories play a crucial role in managing the corporation's financial transactions and authorizing fund transfers, check issuance, and other financial activities. The resolution also addresses the appointment of account signatories, outlining the process through which responsible individuals are nominated, vetted, and authorized to act on behalf of the corporation in financial matters. This ensures accountability, clear lines of authority, and safeguards against unauthorized access to corporate accounts. It's important to note that the specific types of Alameda California Resolution Selecting Bank for Corporation and Account Signatories — Corporate Resolutions may vary depending on the corporation's unique requirements and circumstances. However, some potential variations include: 1. General Resolution: This type of resolution encompasses the standard selection of a bank and appointment of account signatories for routine financial operations. It addresses the corporation's overall banking needs and establishes a framework for account management. 2. Secondary Resolution: In cases where a corporation already has an existing banking relationship but wishes to select an additional bank or appoint new account signatories, a secondary resolution may be required. This type of resolution modifies or supplements the existing banking arrangements without completely replacing them. 3. Emergency Resolution: Sometimes, unforeseen circumstances arise that necessitate urgent changes to the banking arrangements or the designation of account signatories. An emergency resolution enables swift decision-making and ensures that the corporation can continue its financial operations seamlessly in critical situations. The Alameda California Resolution Selecting Bank for Corporation and Account Signatories — Corporate Resolutions is a vital legal process that ensures corporations in Alameda, California have an appropriate banking partner and designated individuals to oversee financial transactions. By adhering to this resolution, corporations can maintain transparent financial practices, adhere to legal requirements, and safeguard their assets.

Alameda California Resolution Selecting Bank for Corporation and Account Signatories - Corporate Resolutions

Description

How to fill out Alameda California Resolution Selecting Bank For Corporation And Account Signatories - Corporate Resolutions?

A document routine always accompanies any legal activity you make. Staring a company, applying or accepting a job offer, transferring ownership, and lots of other life situations require you prepare official documentation that differs from state to state. That's why having it all collected in one place is so beneficial.

US Legal Forms is the biggest online library of up-to-date federal and state-specific legal forms. Here, you can easily locate and get a document for any personal or business objective utilized in your county, including the Alameda Resolution Selecting Bank for Corporation and Account Signatories - Corporate Resolutions.

Locating samples on the platform is amazingly straightforward. If you already have a subscription to our service, log in to your account, find the sample using the search bar, and click Download to save it on your device. Afterward, the Alameda Resolution Selecting Bank for Corporation and Account Signatories - Corporate Resolutions will be available for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, adhere to this simple guideline to get the Alameda Resolution Selecting Bank for Corporation and Account Signatories - Corporate Resolutions:

- Make sure you have opened the right page with your local form.

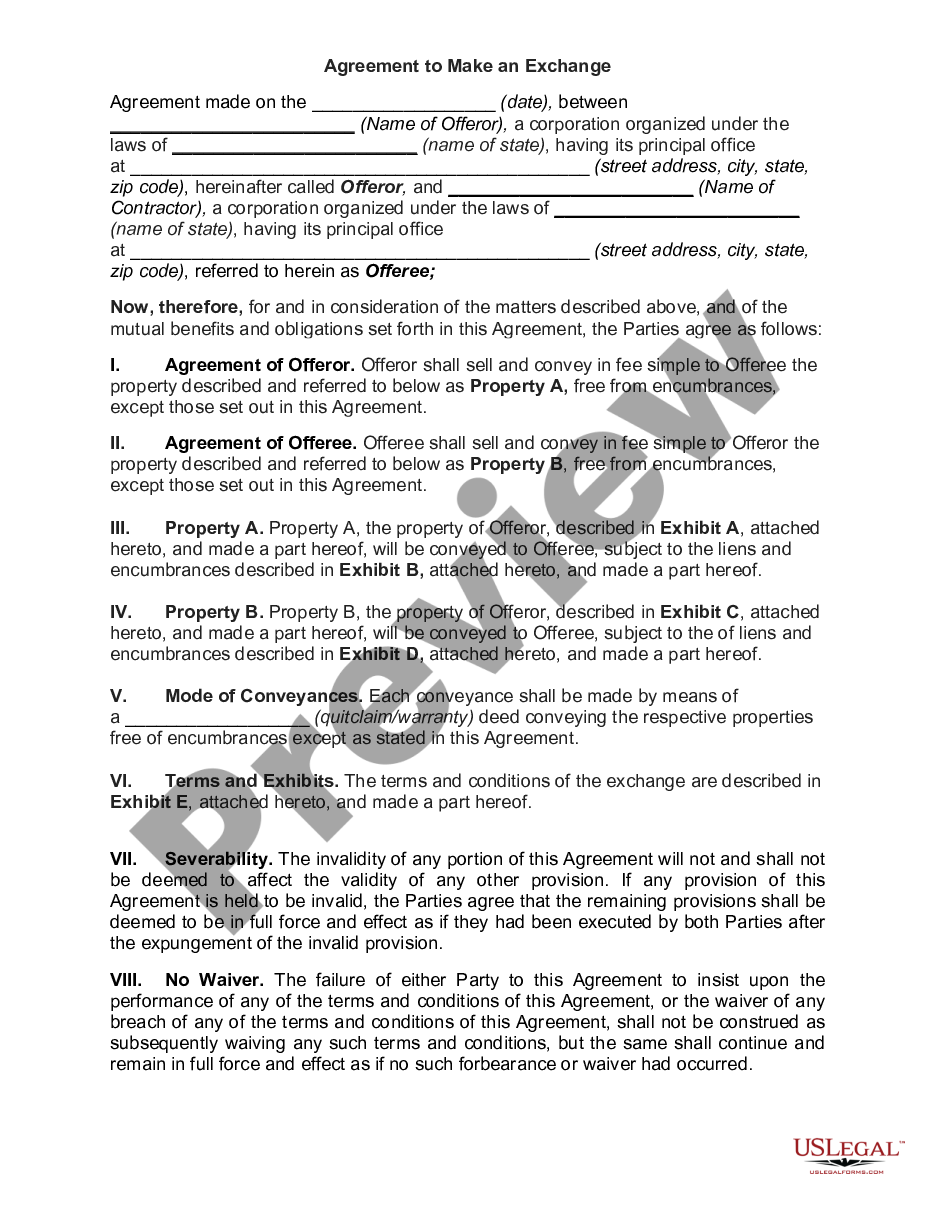

- Use the Preview mode (if available) and scroll through the template.

- Read the description (if any) to ensure the template satisfies your requirements.

- Search for another document via the search tab if the sample doesn't fit you.

- Click Buy Now when you find the required template.

- Decide on the suitable subscription plan, then log in or create an account.

- Choose the preferred payment method (with credit card or PayPal) to proceed.

- Opt for file format and download the Alameda Resolution Selecting Bank for Corporation and Account Signatories - Corporate Resolutions on your device.

- Use it as needed: print it or fill it out electronically, sign it, and send where requested.

This is the easiest and most trustworthy way to obtain legal documents. All the samples provided by our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and manage your legal affairs efficiently with the US Legal Forms!