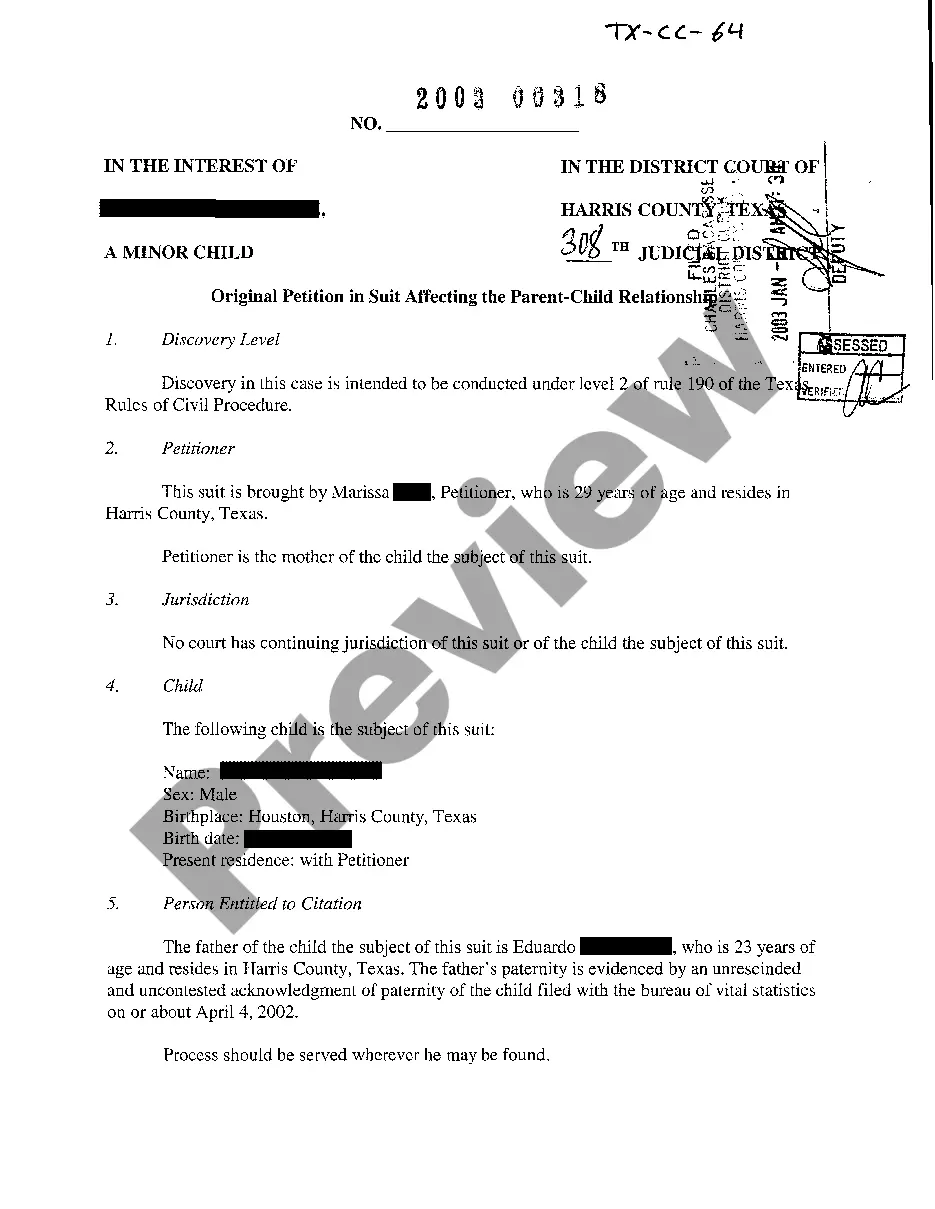

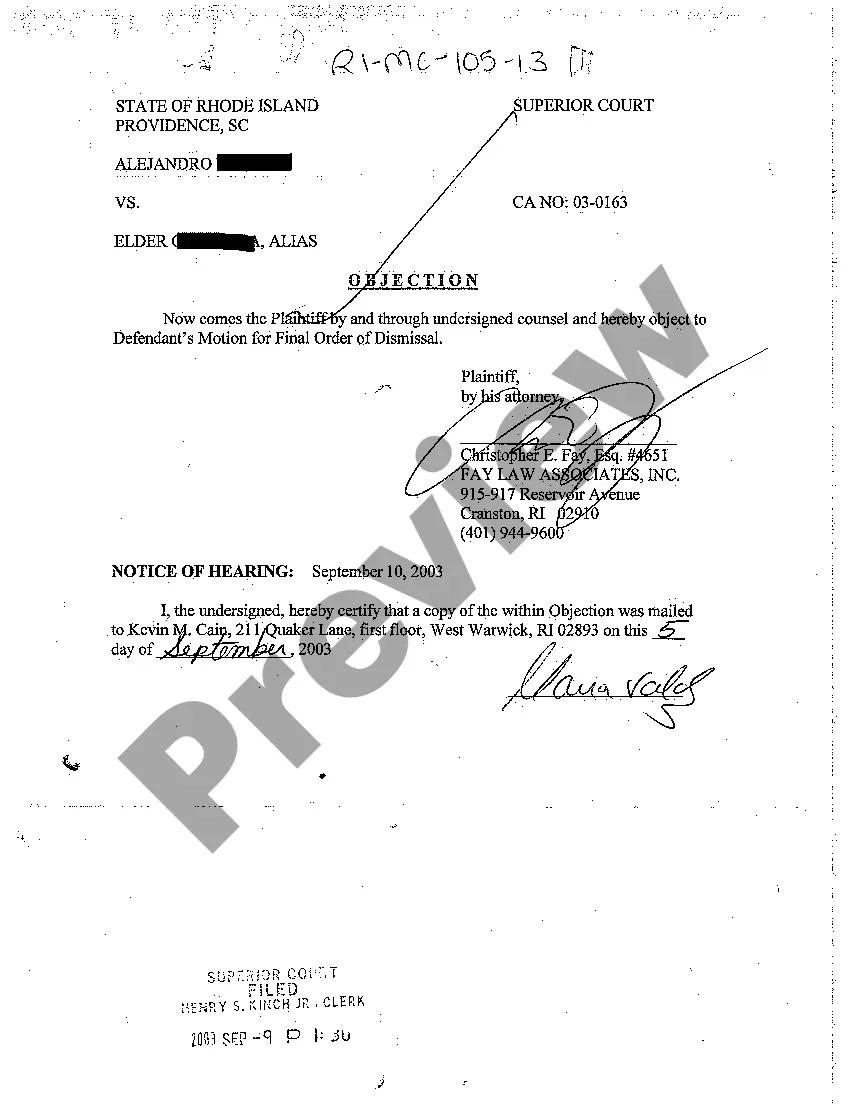

Maricopa Arizona Resolution Selecting Bank for Corporation and Account Signatories — Corporate Resolutions In Maricopa, Arizona, when a corporation requires a bank to handle its financial transactions, a resolution selecting a bank and determining authorized signatories becomes crucial. This corporate resolution ensures that the corporation's finances are managed efficiently and in compliance with legal requirements. The resolution acts as an official document, outlining the corporation's decision-making process and establishing guidelines for banking activities. The Maricopa Arizona Resolution Selecting Bank for Corporation and Account Signatories — Corporate Resolutions serves as a formal agreement between the corporation and the chosen financial institution. It includes the following key details: 1. Identifying the Corporation: — The resolution begins by precisely identifying the corporation for which the bank account and signatories are being selected. This includes the legal name, registered address, and any relevant identification numbers such as the corporation's tax identification number. 2. Intention to Establish Banking Relationship: — The resolution clearly states the corporation's intention to establish a banking relationship with a specific financial institution. It emphasizes that the chosen bank will serve as the primary financial institution for the corporation's transactions. 3. Determining Authorized Signatories: — One crucial aspect of this resolution is to designate and define the authorized signatories who will have the power to access and manage the corporation's bank accounts. The names and positions of these individuals, typically officers or directors, are provided within the resolution. The resolution should also state the requirements for joint signatories, if applicable. 4. Granting Banking Authority: — The resolution explicitly grants authority to the authorized signatories to carry out financial transactions on behalf of the corporation. This authority includes depositing or withdrawing funds, issuing checks or electronic transfers, and executing other necessary banking activities. 5. Bank Account Details: — The resolution specifies the type of bank account required by the corporation, such as a checking account, savings account, or any specialized accounts needed to accommodate specific business activities. Furthermore, it includes instructions for opening the account, such as the necessary documentation and any initial deposit requirements. 6. Additional Provisions: — Depending on the corporation's specific needs, the resolution may include additional provisions. These provisions may relate to matters such as online banking access, credit facilities, interest rates, fees, or any restrictions on banking activities. Different Types of Maricopa Arizona Resolution Selecting Bank for Corporation and Account Signatories — Corporate Resolutions: 1. Resolution Selecting Bank for General Corporate Transactions: — This type of resolution selects a bank to handle general corporate transactions, including routine payments, deposits, and general cash management functions. 2. Resolution Selecting Bank for Specialized Business Activities: — In certain cases, a corporation may require a specific bank to handle specialized business activities. This resolution selects a bank that caters to the unique requirements of those activities. 3. Resolution Selecting Bank for International Transactions: — If a corporation engages in international business transactions, an international banking resolution may be necessary. This resolution selects a bank experienced in handling foreign currency exchange, international wire transfers, and any necessary compliance with international regulations. In summary, the Maricopa Arizona Resolution Selecting Bank for Corporation and Account Signatories — Corporate Resolutions plays a vital role in establishing a corporation's banking relationship and securing authorized signatories. It ensures that the corporation's financial activities comply with legal obligations, while also allowing for efficient and secure management of financial transactions.

Maricopa Arizona Resolution Selecting Bank for Corporation and Account Signatories - Corporate Resolutions

Description

How to fill out Maricopa Arizona Resolution Selecting Bank For Corporation And Account Signatories - Corporate Resolutions?

Do you need to quickly create a legally-binding Maricopa Resolution Selecting Bank for Corporation and Account Signatories - Corporate Resolutions or maybe any other document to handle your personal or corporate affairs? You can go with two options: contact a professional to draft a valid paper for you or draft it entirely on your own. Luckily, there's another option - US Legal Forms. It will help you get professionally written legal documents without paying sky-high prices for legal services.

US Legal Forms provides a rich collection of more than 85,000 state-compliant document templates, including Maricopa Resolution Selecting Bank for Corporation and Account Signatories - Corporate Resolutions and form packages. We offer documents for an array of life circumstances: from divorce papers to real estate document templates. We've been on the market for over 25 years and got a rock-solid reputation among our customers. Here's how you can become one of them and obtain the needed template without extra hassles.

- To start with, carefully verify if the Maricopa Resolution Selecting Bank for Corporation and Account Signatories - Corporate Resolutions is tailored to your state's or county's laws.

- If the form includes a desciption, make sure to verify what it's intended for.

- Start the searching process over if the form isn’t what you were looking for by utilizing the search bar in the header.

- Select the plan that is best suited for your needs and move forward to the payment.

- Select the format you would like to get your form in and download it.

- Print it out, complete it, and sign on the dotted line.

If you've already set up an account, you can easily log in to it, locate the Maricopa Resolution Selecting Bank for Corporation and Account Signatories - Corporate Resolutions template, and download it. To re-download the form, simply head to the My Forms tab.

It's easy to find and download legal forms if you use our services. Additionally, the paperwork we offer are reviewed by law professionals, which gives you greater peace of mind when writing legal affairs. Try US Legal Forms now and see for yourself!