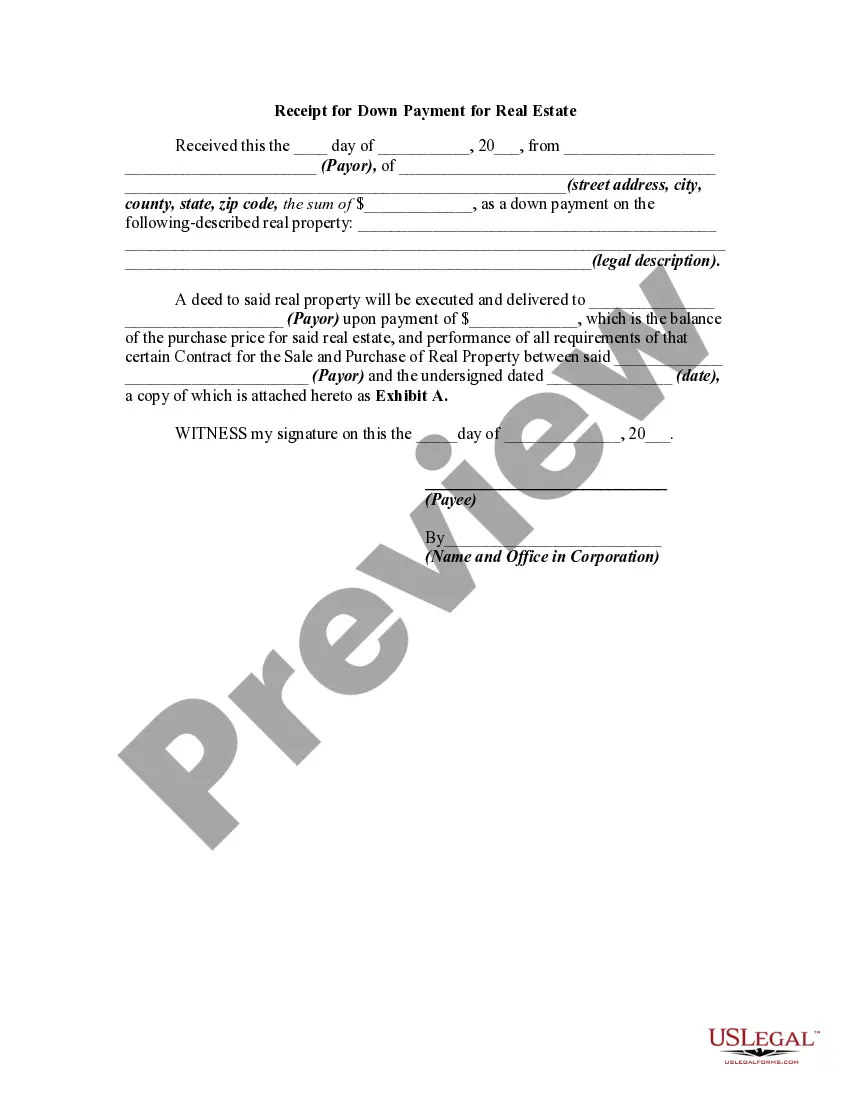

A Harris Texas Receipt for Down Payment for Real Estate is a legal document that serves as proof of payment made by a buyer to a seller or real estate agent as a down payment towards the purchase of a property in Harris County, Texas. This receipt outlines the terms of the payment and is important for both parties involved in the real estate transaction. The Harris Texas Receipt for Down Payment for Real Estate includes key information such as the date of payment, the amount paid, the buyer's and seller's names, the property address, and any conditions or contingencies associated with the payment. It also includes details about how the payment was made, such as cash, check, or wire transfer. Different types of Harris Texas Receipt for Down Payment for Real Estate may vary depending on the specific conditions or terms agreed upon by the buyer and seller. Some common types include: 1. Standard Receipt: This is a basic receipt that includes all the essential information listed above. It is typically used for straightforward real estate transactions with no additional or complex terms. 2. Contingency Receipt: In cases where the buyer's down payment is subject to certain contingencies, such as obtaining financing or completing a satisfactory inspection, a Contingency Receipt may be used. This receipt would clearly outline the conditions under which the down payment could be refunded to the buyer. 3. Escrow Receipt: When a third-party escrow agent is involved in the transaction, an Escrow Receipt may be used. This receipt acknowledges that the down payment has been placed in an escrow account and will be held by the escrow agent until the closing of the real estate transaction. 4. Conditional Receipt: In some cases, the buyer may provide a down payment with specific conditions attached, such as the seller completing certain repairs or improvements before the closing. A Conditional Receipt would outline these conditions and ensure that the payment is not considered finalized until the conditions are met. It is important to note that the exact format and terminology used in a Harris Texas Receipt for Down Payment for Real Estate may vary based on individual preferences, legal requirements, or specific guidelines set by real estate agencies or professionals. Therefore, it is advisable to consult with a real estate attorney or professional to ensure that the receipt conforms to all necessary regulations and accurately reflects the terms of the transaction.

Harris Texas Receipt for Down Payment for Real Estate

Description

How to fill out Harris Texas Receipt For Down Payment For Real Estate?

A document routine always accompanies any legal activity you make. Creating a company, applying or accepting a job offer, transferring ownership, and lots of other life situations demand you prepare formal documentation that differs from state to state. That's why having it all collected in one place is so valuable.

US Legal Forms is the largest online collection of up-to-date federal and state-specific legal templates. On this platform, you can easily locate and download a document for any personal or business objective utilized in your county, including the Harris Receipt for Down Payment for Real Estate.

Locating templates on the platform is extremely simple. If you already have a subscription to our library, log in to your account, find the sample through the search bar, and click Download to save it on your device. Afterward, the Harris Receipt for Down Payment for Real Estate will be available for further use in the My Forms tab of your profile.

If you are using US Legal Forms for the first time, follow this simple guideline to obtain the Harris Receipt for Down Payment for Real Estate:

- Make sure you have opened the right page with your localised form.

- Utilize the Preview mode (if available) and scroll through the template.

- Read the description (if any) to ensure the template corresponds to your requirements.

- Look for another document using the search option in case the sample doesn't fit you.

- Click Buy Now when you locate the necessary template.

- Decide on the suitable subscription plan, then sign in or register for an account.

- Choose the preferred payment method (with credit card or PayPal) to continue.

- Choose file format and save the Harris Receipt for Down Payment for Real Estate on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the easiest and most reliable way to obtain legal documents. All the samples provided by our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs properly with the US Legal Forms!