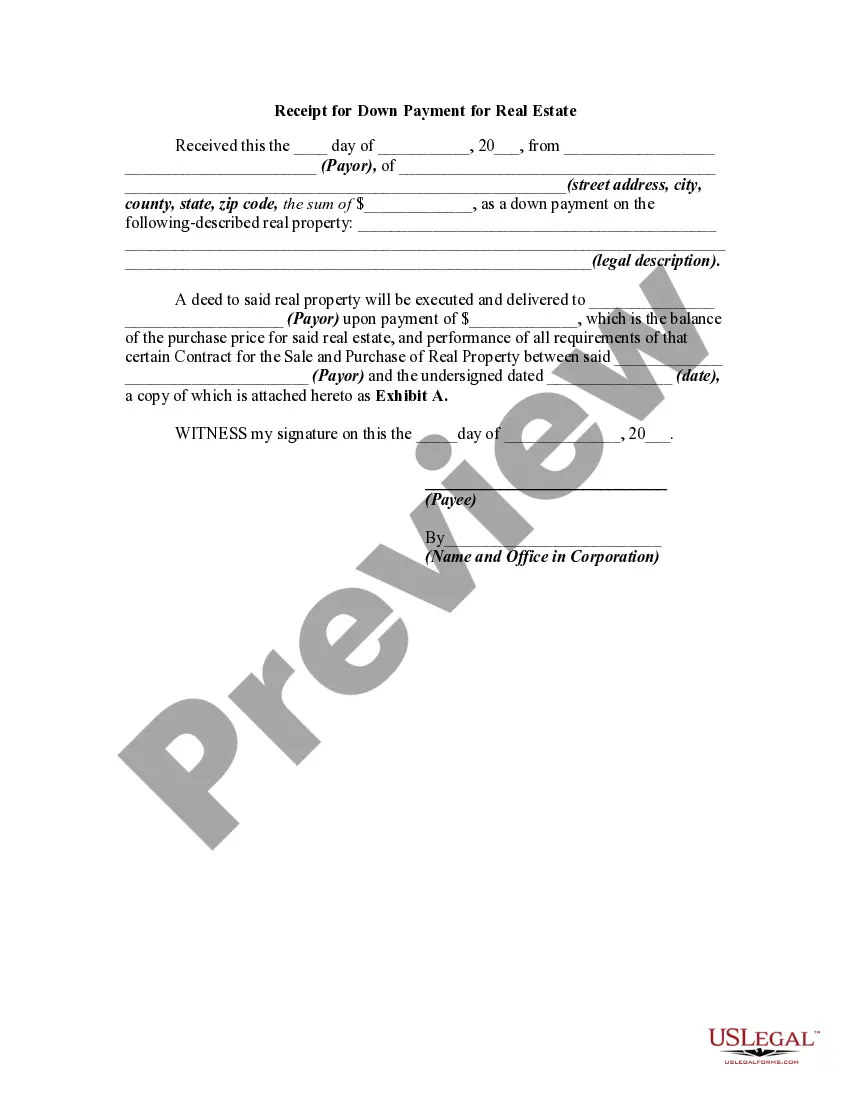

Travis Texas Receipt for Down Payment for Real Estate is a legal document used to confirm the receipt of a down payment made by a buyer in the real estate transaction process in Travis County, Texas. This receipt serves as evidence that the buyer has transferred a specific amount of money to the seller or the seller's representative as part of the purchase agreement. In Travis County, Texas, there are specific rules and regulations governing real estate transactions, and having a formal receipt is essential to ensure transparency and protect the interests of both parties involved. The receipt contains crucial information that accurately represents the transaction, such as the names of the buyer and seller, property details, the date and amount of the down payment, and any conditions or contingencies associated with the payment. There are different types of receipts for down payments used in Travis County, Texas, depending on the nature of the transaction. Some common variants include: 1. Standard Down Payment Receipt: This type of receipt is utilized for general real estate transactions where a buyer makes an upfront payment as part of the purchase agreement. It outlines the basic details of the transaction, including the property address, the agreed-upon down payment amount, and the signatures of both parties involved. 2. Down Payment Receipt with Contingencies: In some cases, a down payment might be subject to certain conditions or contingencies. This receipt type highlights any specific conditions associated with the payment, such as a successful home inspection or loan approval. It ensures that the seller will not cash the check or utilize the payment until the contingencies are met. 3. Down Payment Receipt for New Construction: When a buyer invests in a newly constructed property, a special type of receipt may be issued. This receipt includes additional details relevant to new construction, such as the builder's name, a description of the construction project, the estimated completion date, and any warranties or guarantees provided by the builder. 4. Down Payment Receipt for Commercial Real Estate: For commercial real estate transactions, a tailored receipt may be used to accommodate the unique requirements of commercial properties. This receipt often includes additional information like zoning regulations, leasing agreements, or any specific permits or licenses required for the commercial property. In summary, a Travis Texas Receipt for Down Payment for Real Estate is a vital legal document that confirms the buyer's transfer of down payment funds to the seller during a real estate transaction in Travis County. Different types of receipts exist to cater to various types of transactions, such as standard transactions, transactions with contingencies, new construction projects, and commercial real estate deals. Ensuring the receipt accurately reflects the terms and conditions of the transaction helps ensure a smooth and transparent real estate process.

Travis Texas Receipt for Down Payment for Real Estate

Description

How to fill out Travis Texas Receipt For Down Payment For Real Estate?

Are you looking to quickly create a legally-binding Travis Receipt for Down Payment for Real Estate or maybe any other form to manage your personal or business matters? You can select one of the two options: hire a legal advisor to write a valid document for you or draft it entirely on your own. The good news is, there's a third solution - US Legal Forms. It will help you get neatly written legal papers without having to pay unreasonable prices for legal services.

US Legal Forms offers a huge collection of over 85,000 state-specific form templates, including Travis Receipt for Down Payment for Real Estate and form packages. We offer templates for a myriad of life circumstances: from divorce papers to real estate document templates. We've been out there for over 25 years and gained a rock-solid reputation among our customers. Here's how you can become one of them and obtain the needed document without extra hassles.

- To start with, double-check if the Travis Receipt for Down Payment for Real Estate is tailored to your state's or county's laws.

- If the document has a desciption, make sure to verify what it's intended for.

- Start the searching process over if the form isn’t what you were seeking by using the search box in the header.

- Choose the plan that best fits your needs and move forward to the payment.

- Select the format you would like to get your document in and download it.

- Print it out, fill it out, and sign on the dotted line.

If you've already set up an account, you can simply log in to it, locate the Travis Receipt for Down Payment for Real Estate template, and download it. To re-download the form, simply go to the My Forms tab.

It's effortless to find and download legal forms if you use our services. Moreover, the paperwork we offer are reviewed by law professionals, which gives you greater confidence when dealing with legal matters. Try US Legal Forms now and see for yourself!