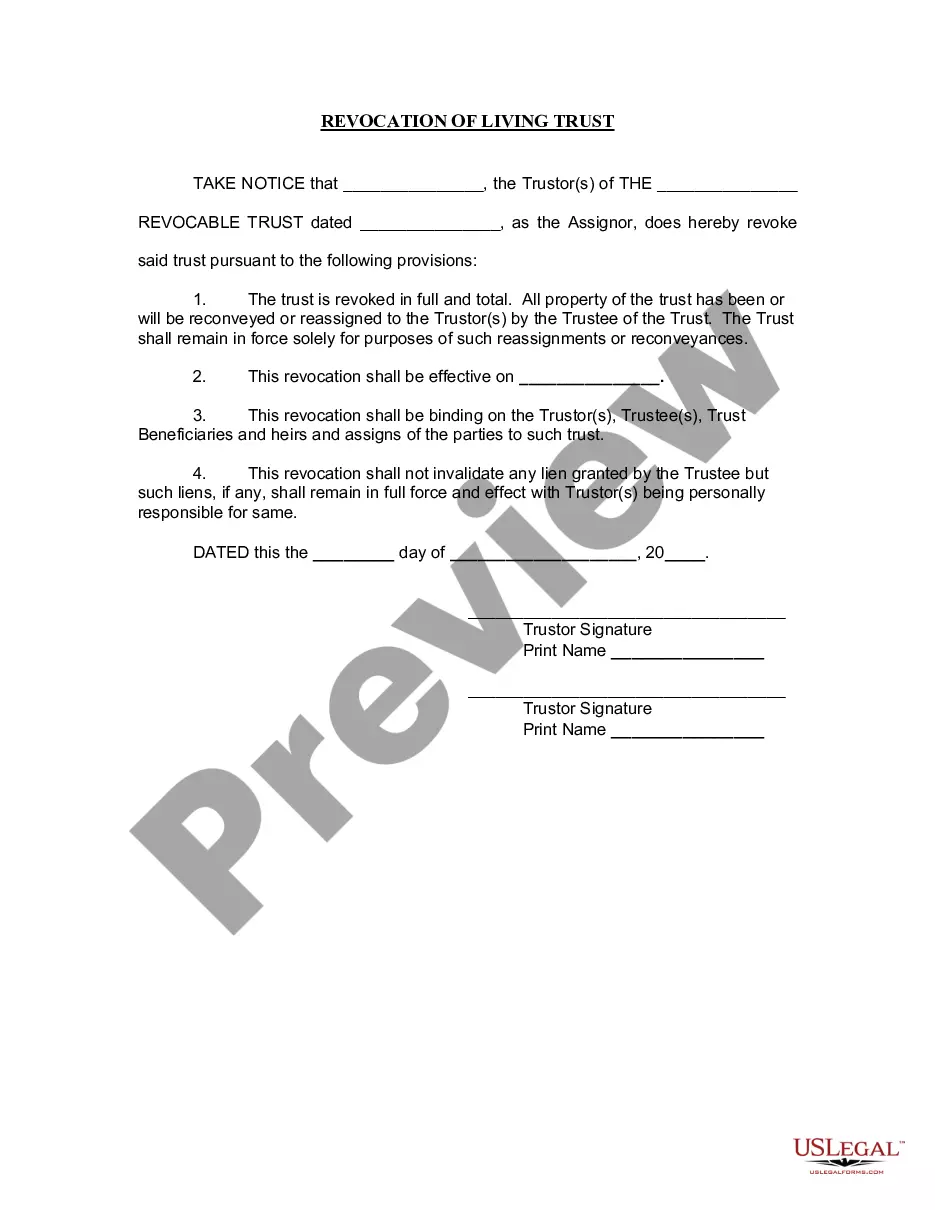

A Collin Texas Receipt for Payment of Rent is a legal document issued by a landlord or property manager to acknowledge the payment of rent by a tenant in Collin County, Texas. This receipt serves as evidence that the tenant has fulfilled their financial obligation for the specified period. Keywords: Collin Texas, receipt, payment, rent, landlord, property manager, tenant, Collin County, legal document, acknowledgement, financial obligation. There are different types of Collin Texas Receipts for Payment of Rent that can be customized based on specific circumstances. Some possible variations include: 1. Monthly Rent Receipt: This type of receipt acknowledges the regular monthly rent payment made by a tenant to the landlord or property manager. 2. Security Deposit Receipt: This receipt is issued when a tenant pays a security deposit at the beginning of the tenancy. It confirms the receipt of the deposit and outlines its purpose and conditions for refund. 3. Late Rent Payment Receipt: If a tenant makes a rent payment after the due date, this receipt acknowledges the late payment and may include any applicable late fees or penalties. 4. Partial Rent Payment Receipt: When a tenant pays only a portion of the rent due, this receipt recognizes the partial payment while noting the remaining balance. 5. Rent Receipt for Roommates: In cases where multiple tenants share a rental property, a receipt can be issued individually or collectively to each tenant, specifying their respective portion of rent paid. 6. Rent Receipts for Commercial Tenants: For commercial rental properties, specialized receipts can be used to document rent payments from businesses, including details such as the name of the company and the purpose of the rental space. Regardless of the type, a Collin Texas Receipt for Payment of Rent should include key information such as the tenant's name, address, payment date, the rental period covered, the amount paid, and the signature of the landlord or property manager. It is crucial to keep copies of these receipts for record-keeping and potential disputes or legal matters.

Collin Texas Receipt for Payment of Rent

Description

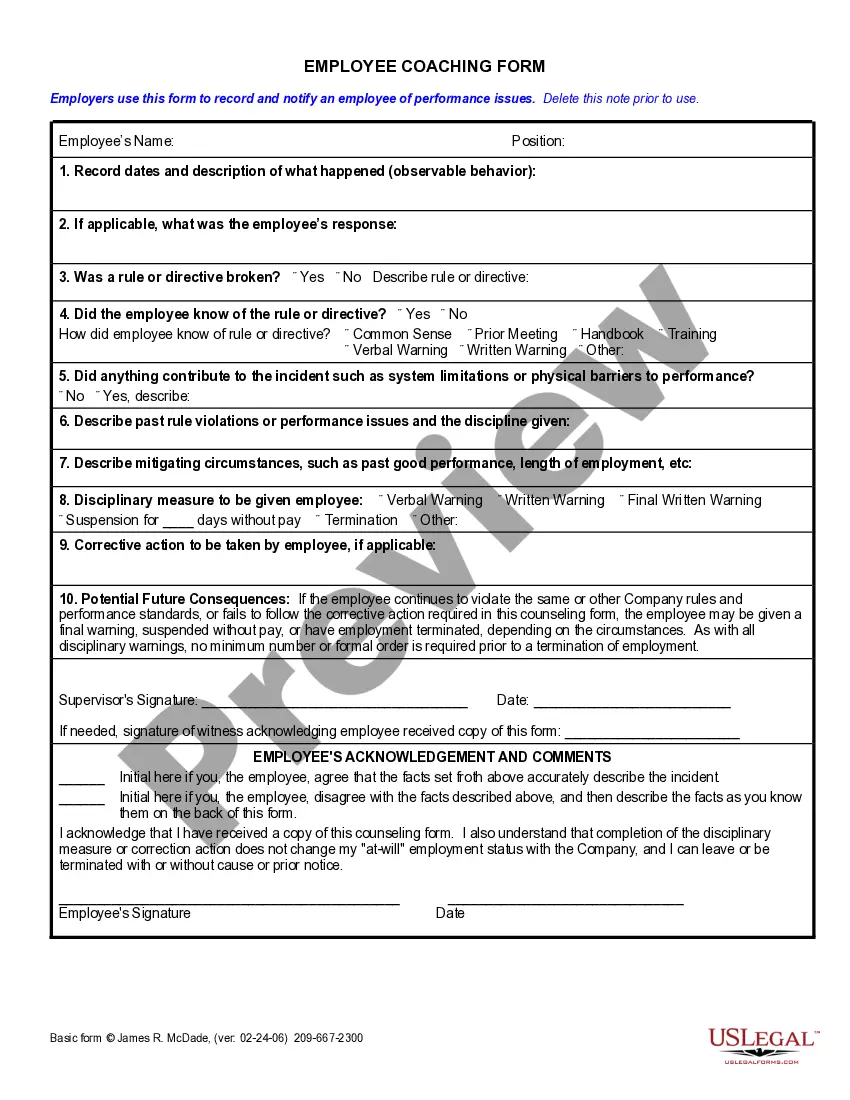

How to fill out Collin Texas Receipt For Payment Of Rent?

Whether you plan to start your company, enter into a contract, apply for your ID update, or resolve family-related legal issues, you must prepare certain documentation meeting your local laws and regulations. Locating the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 expertly drafted and verified legal templates for any personal or business occasion. All files are grouped by state and area of use, so opting for a copy like Collin Receipt for Payment of Rent is fast and easy.

The US Legal Forms website users only need to log in to their account and click the Download key next to the required template. If you are new to the service, it will take you a couple of additional steps to obtain the Collin Receipt for Payment of Rent. Follow the guidelines below:

- Make sure the sample meets your personal needs and state law requirements.

- Read the form description and check the Preview if available on the page.

- Make use of the search tab specifying your state above to find another template.

- Click Buy Now to obtain the sample when you find the right one.

- Select the subscription plan that suits you most to proceed.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the Collin Receipt for Payment of Rent in the file format you prefer.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Documents provided by our website are reusable. Having an active subscription, you can access all of your earlier purchased paperwork at any time in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date formal documents. Sign up for the US Legal Forms platform and keep your paperwork in order with the most extensive online form library!

Form popularity

FAQ

Section 92.104 of the Texas Property Code describes what a landlord may deduct from a security deposit: Before returning a security deposit, the landlord may deduct from the deposit damages and charges for which the tenant is legally liable under the lease or as a result of breaching the lease.

Texas courts have held that a landlord may not enter your home unless you allow the entry or the lease gives the landlord specific reasons to enter. Some lease agreements give a list of reasons when the landlord can enter and other leases do not mention landlord's entry at all.

When you leave, if you and your landlord or agent both agree on how much of the deposit you should get back, you should get it back within ten days of agreeing. If your deposit was held in a custodial scheme, you will also receive some interest on the deposit.

If a landlord does not return the entire amount of the tenant's security deposit within the 21 days required by law, and the tenant disputes the deductions from the deposit: The tenant can write a letter to the landlord explaining why he or she believes he or she is entitled to a larger refund.

Landlord rights and responsibilities According to Texas state law, landlords have the right to collect rent as specified on the lease agreement, deduct repair costs from extreme damages to their property (more than normal wear-and-tear), and other miscellaneous items.

What is landlord harassment? Landlord harassment is when a landlord or property manager willingly creates a situation where a tenant feels uncomfortable, so uncomfortable that they wish to move or terminate a lease agreement.

Gathering Evidence for Court a clear statement of how much money you claim your landlord owes you, and any penalties or other fees you seek, such as interest on the deposit (if required by your state or city) a copy of your demand letter and other correspondence with your landlord regarding the deposit.

Under Texas law, you must give the landlord a forwarding address in order to receive your returned security deposit. The landlord must return your deposit less any amount deducted for damages within 30 days.

Can my landlord increase my rent now that the public health emergency has ended? No. Rent increases cannot occur until after December 31, 2021. Landlords must provide a minimum of a 30-day notice before a rent increase can occur, so higher rent cannot be charged until February 2022.

The right to "quiet enjoyment" of your home. This means your landlord cannot evict you without proper cause (most commonly nonpayment of rent) or otherwise disturb your right to live in peace and quiet. Your landlord must also protect you from any wrongful actions taken by other tenants.