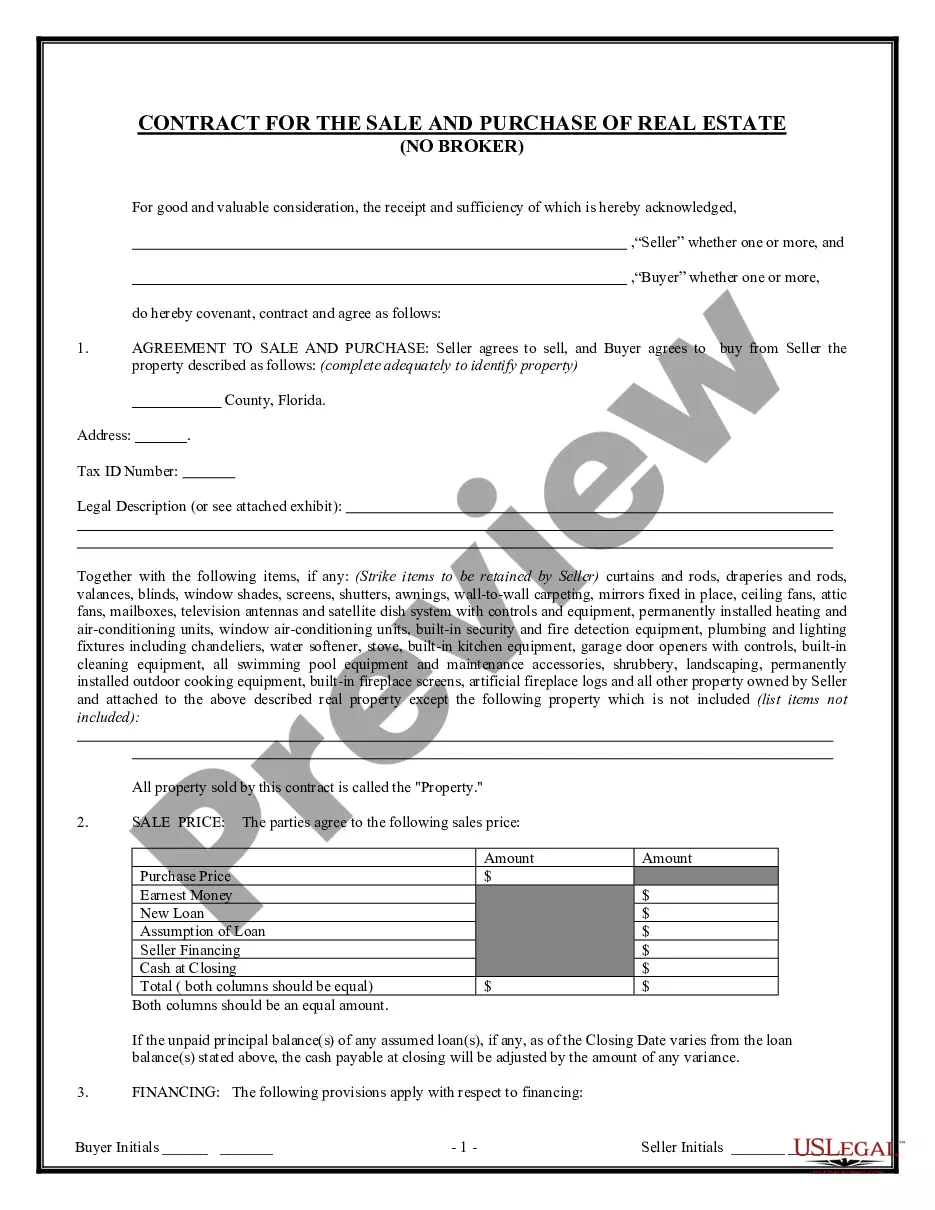

The Collin Texas Agreement to Incorporate Close Corporation is a legal document used in the state of Texas to establish a close corporation. This agreement outlines the terms and conditions of forming a close corporation and governs the relationship between its shareholders, directors, and officers. Keywords: Collin Texas, agreement to incorporate, close corporation, legal document, state of Texas, terms and conditions, shareholders, directors, officers. There are various types of Collin Texas agreements to incorporate close corporations based on the specific needs and requirements of the business. Some common types include: 1. Basic Agreement to Incorporate Close Corporation: This type of agreement establishes the fundamental rights, responsibilities, and obligations of the shareholders, directors, and officers of the close corporation. 2. Shareholder Agreement: This agreement details the rights and obligations of individual shareholders, including voting rights, share ownership, dividends, and transfer restrictions. 3. Officer and Director Agreement: This agreement specifies the roles, responsibilities, and duties of the officers and directors within the close corporation, as well as the process for their appointment, removal, and compensation. 4. Buy-Sell Agreement: This type of agreement addresses the buyout and transfer of shares among shareholders in the event of retirement, death, disability, or voluntary exit from the close corporation. 5. Employment Agreement: This agreement outlines the terms of employment for key executives or employees of the close corporation, including compensation, benefits, job duties, and non-disclosure provisions. 6. Non-Compete Agreement: This agreement restricts shareholders, directors, and key employees from engaging in competition with the close corporation during and after their employment or involvement with the company. It is important to consult with a qualified attorney while drafting any type of Collin Texas Agreement to Incorporate Close Corporation to ensure compliance with state laws and address specific needs of the business.

Collin Texas Agreement to Incorporate Close Corporation

Description

How to fill out Collin Texas Agreement To Incorporate Close Corporation?

If you need to find a trustworthy legal form provider to find the Collin Agreement to Incorporate Close Corporation, consider US Legal Forms. No matter if you need to start your LLC business or manage your belongings distribution, we got you covered. You don't need to be knowledgeable about in law to find and download the appropriate form.

- You can search from over 85,000 forms arranged by state/county and case.

- The self-explanatory interface, number of learning resources, and dedicated support team make it simple to find and execute different documents.

- US Legal Forms is a reliable service offering legal forms to millions of customers since 1997.

Simply type to search or browse Collin Agreement to Incorporate Close Corporation, either by a keyword or by the state/county the document is intended for. After locating necessary form, you can log in and download it or retain it in the My Forms tab.

Don't have an account? It's effortless to start! Simply find the Collin Agreement to Incorporate Close Corporation template and check the form's preview and description (if available). If you're confident about the template’s language, go ahead and hit Buy now. Create an account and choose a subscription option. The template will be immediately ready for download as soon as the payment is completed. Now you can execute the form.

Taking care of your legal affairs doesn’t have to be expensive or time-consuming. US Legal Forms is here to demonstrate it. Our comprehensive variety of legal forms makes this experience less expensive and more affordable. Create your first company, organize your advance care planning, create a real estate agreement, or complete the Collin Agreement to Incorporate Close Corporation - all from the comfort of your home.

Sign up for US Legal Forms now!

Form popularity

FAQ

Pros of Close Corporations Fewer formalities. The most obvious advantage of a close corporation is fewer rules to follow.Limited liability. In general, shareholders of a close corporation are not personally liable for the business's debt.More shareholder control.More freedom.

A closed corporation is a company whose shares are held by a select few individuals who are usually closely associated with the business.

The most obvious advantage of a close corporation is fewer rules to follow. You still must abide by regulations concerning the filing of incorporation documents, but beyond that, owners can focus on running the company instead of worrying about corporate regulatory compliance. Limited liability.

Advantages of a corporation include personal liability protection, business security and continuity, and easier access to capital. Disadvantages of a corporation include it being time-consuming and subject to double taxation, as well as having rigid formalities and protocols to follow.

Disadvantages to a Close Corporation Close corporations do not exist in all states.A close corporation often costs more money to organize. While shareholders have the benefit of greater control over the sale of shares, shareholders in a close corporation are also burdened with increased responsibility.

Advantages They require fewer formalities than standard corporations. Close corporation shareholders have a great degree of control over sales of shares to outsiders. Liability protection for shareholders is strong.Disadvantages. Close corporations are not available in all states.

As a juristic person, the close corporation is a separate legal entity distinct from its members.

For instance, US grocery giant Albertsons was a popular name as a close corporation with the backing of private equity firm Cerberus. In 2020, Albertsons became a publicly-traded company. It means that anybody can sell or buy these companies' shares from the open market.

The easiest definition of a close corporation is one that is held by a limited number of shareholders and is not publicly traded. The company is run by the shareholders and is generally exempt from many requirements of other corporations, including having a board of directors and holding annual meetings.