The Franklin Ohio Agreement to Incorporate Close Corporation is a legally binding document used for establishing a close corporation in Franklin, Ohio. This agreement outlines the terms and conditions agreed upon by the incorporates, shareholders, and directors involved in the incorporation process. Close corporations, also known as closely held corporations or small corporations, are characterized by having a limited number of shareholders and restrictions on the transferability of shares. These corporations often operate like partnerships, allowing for close collaboration between shareholders in decision-making and management. The Franklin Ohio Agreement to Incorporate Close Corporation is designed to comply with the specific laws and regulations of Franklin, Ohio. It sets forth various provisions related to the governance and operation of the close corporation, including but not limited to: 1. Incorporates: This section identifies the individuals initiating the incorporation process and their responsibilities. It includes the primary incorporates' names, addresses, and contact information. 2. Name and Purpose: The agreement specifies the proposed name of the close corporation and outlines its business purpose or objectives. It is important to choose a unique and distinguishable name that complies with the requirements of the Ohio Secretary of State. 3. Authorized Capital and Shares: This section determines the authorized capital of the corporation and the number of shares to be issued. It may also outline the classes and types of shares, rights, and restrictions associated with each class. 4. Directors and Officers: The agreement describes the composition, responsibilities, and powers of the board of directors and officers. It may specify the term of office, decision-making processes, and voting rights of directors and officers. 5. Shareholder Rights: This section elaborates on the rights and privileges of shareholders, including voting rights, dividend entitlements, and restrictions on the transfer of shares. It may also address issues like shareholder agreements, buy-sell provisions, and dispute resolution mechanisms. 6. Bylaws and Amendments: The agreement often references the corporation's bylaws, providing guidelines for their creation, maintenance, and amendment. Bylaws typically address internal governance matters, such as meeting procedures, quorum requirements, and voting procedures. 7. Dissolution and Liquidation: This section outlines the procedures for dissolution and liquidation of the corporation. It may include provisions on how assets will be distributed among shareholders or creditors in the event of dissolution. The Franklin Ohio Agreement to Incorporate Close Corporation ensures compliance with Ohio statutory requirements while tailoring the corporation's formation to meet the specific needs and objectives of the incorporates. It is essential to consult with legal professionals or use templates provided by reputable sources to ensure accuracy and completeness in creating this agreement. Additional types or variations of the Franklin Ohio Agreement to Incorporate Close Corporation may include specialized versions catering to certain industries or specific provisions, such as those related to professional corporations (e.g., attorneys, doctors) or benefit corporations (corporate entities dedicated to societal or environmental impacts). These variations address unique legal and operational considerations applicable to such corporations.

Franklin Ohio Agreement to Incorporate Close Corporation

Description

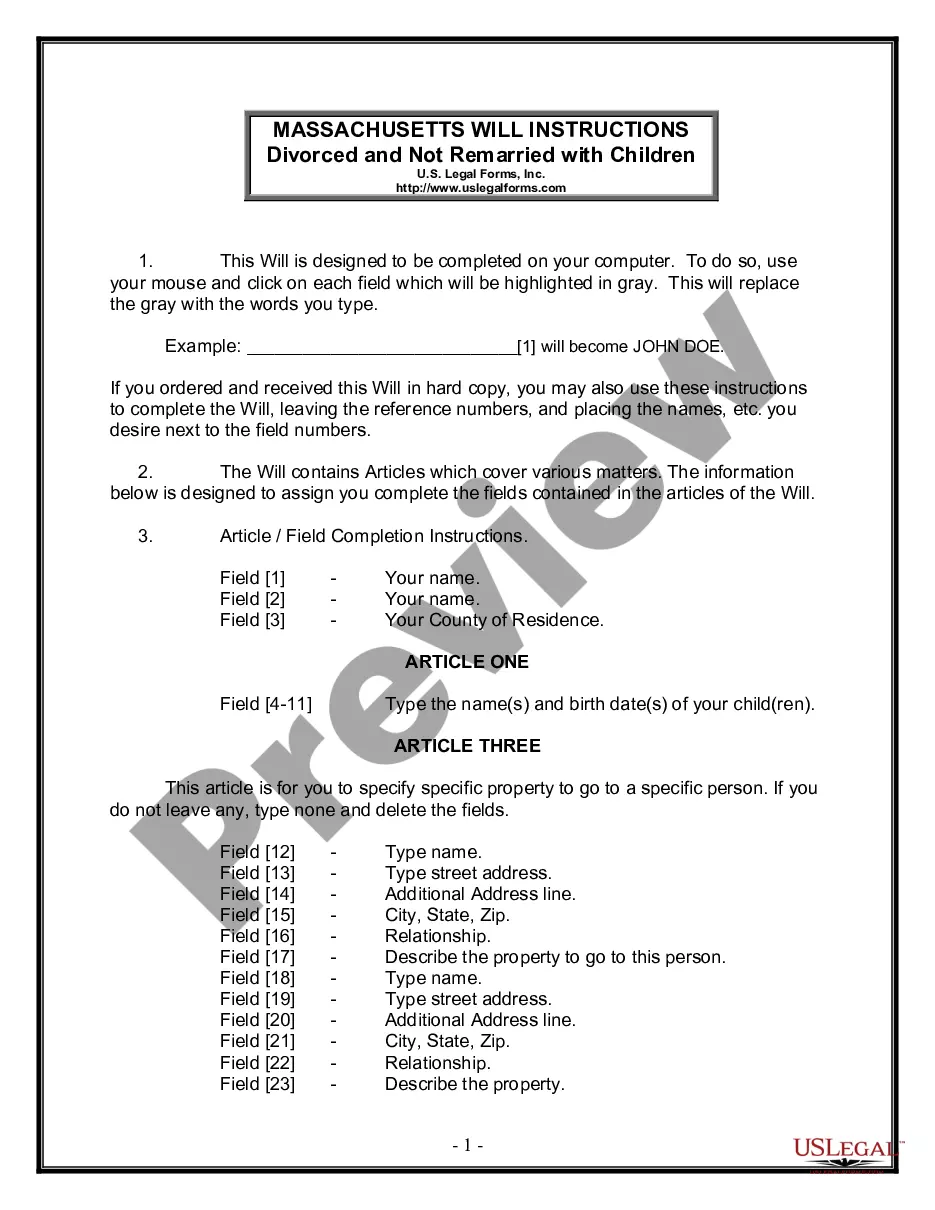

How to fill out Franklin Ohio Agreement To Incorporate Close Corporation?

Laws and regulations in every area vary around the country. If you're not an attorney, it's easy to get lost in a variety of norms when it comes to drafting legal documents. To avoid expensive legal assistance when preparing the Franklin Agreement to Incorporate Close Corporation, you need a verified template legitimate for your region. That's when using the US Legal Forms platform is so advantageous.

US Legal Forms is a trusted by millions web collection of more than 85,000 state-specific legal templates. It's an excellent solution for specialists and individuals searching for do-it-yourself templates for various life and business occasions. All the forms can be used multiple times: once you obtain a sample, it remains available in your profile for further use. Thus, if you have an account with a valid subscription, you can simply log in and re-download the Franklin Agreement to Incorporate Close Corporation from the My Forms tab.

For new users, it's necessary to make some more steps to get the Franklin Agreement to Incorporate Close Corporation:

- Examine the page content to make sure you found the appropriate sample.

- Use the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your criteria.

- Utilize the Buy Now button to get the document once you find the correct one.

- Opt for one of the subscription plans and log in or sign up for an account.

- Select how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the file in and click Download.

- Complete and sign the document in writing after printing it or do it all electronically.

That's the simplest and most affordable way to get up-to-date templates for any legal scenarios. Find them all in clicks and keep your paperwork in order with the US Legal Forms!