Title: Phoenix, Arizona: Understanding the Letter Tendering Payment in Order to Obtain Release of Mortgaged Premises Introduction: In the realm of real estate transactions, obtaining a release of mortgaged premises is a crucial step towards property ownership. In Phoenix, Arizona, a specific procedural process involving a letter tendering payment is commonly used to secure the release. This article will provide an in-depth explanation of what a letter tendering payment is and the various types associated with obtaining the release of mortgaged premises in Phoenix, Arizona. 1. What is a Letter Tendering Payment? A letter tendering payment is a formal written communication sent by a borrower to the mortgage holder or lender, expressing the intent to pay off the mortgage in full. This letter serves as a legal document that initiates the release of the mortgage lien on the property, ultimately leading to the transfer of ownership rights to the borrower. 2. Outlining the Basic Components of the Letter: — Addressed to the mortgage holder or lender: The letter should be directed to the appropriate party responsible for releasing the mortgage. — Clear identification of the borrower: The letter must mention the full name(s) of the borrower(s) as mentioned in the mortgage agreement. — Statement of intent to pay: The letter must explicitly express the borrower's intention to pay off the mortgage in full. — Details of payment: Provide the exact amount of payment intended to be tendered and the method of payment (e.g., certified check, wire transfer, etc.). — Request for release documents: Include a request for all necessary release documents, such as a mortgage satisfaction document or a reconveyance deed. 3. Types of Phoenix, Arizona Letter Tendering Payment: a. Regular Mortgage Release Letter: This is a standard letter tendering payment used when a borrower wishes to pay off the mortgage loan and obtain a release of mortgaged premises. b. Deed-in-Lieu of Foreclosure Release Letter: In cases where borrowers are facing financial hardship and are unable to make mortgage payments, they may negotiate with the lender for a deed-in-lieu of foreclosure. This letter is used to initiate the process of transferring ownership to the lender in exchange for the cancellation of the mortgage debt. c. Short Sale Release Letter: During a short sale, when a property is sold for less than the remaining mortgage balance, the borrower may need to submit a short sale release letter to the lender for approval and to obtain a release of the mortgaged premises. Conclusion: Understanding the Phoenix, Arizona letter tendering payment in order to obtain the release of mortgaged premises is vital for borrowers seeking to complete real estate transactions. Whether it's a regular mortgage release, a deed-in-lieu of foreclosure, or a short sale release, adhering to specific guidelines and using the appropriate letter type is essential to secure the release and gain full ownership of the property. As always, consulting with legal professionals and mortgage experts is advised for accurate guidance throughout this process.

Phoenix Arizona Letter Tendering Payment in Order to Obtain Release of Mortgaged Premises

Description

How to fill out Phoenix Arizona Letter Tendering Payment In Order To Obtain Release Of Mortgaged Premises?

Laws and regulations in every sphere differ from state to state. If you're not a lawyer, it's easy to get lost in countless norms when it comes to drafting legal documentation. To avoid high priced legal assistance when preparing the Phoenix Letter Tendering Payment in Order to Obtain Release of Mortgaged Premises, you need a verified template legitimate for your region. That's when using the US Legal Forms platform is so advantageous.

US Legal Forms is a trusted by millions online catalog of more than 85,000 state-specific legal templates. It's an excellent solution for professionals and individuals looking for do-it-yourself templates for various life and business scenarios. All the forms can be used multiple times: once you pick a sample, it remains accessible in your profile for subsequent use. Thus, if you have an account with a valid subscription, you can simply log in and re-download the Phoenix Letter Tendering Payment in Order to Obtain Release of Mortgaged Premises from the My Forms tab.

For new users, it's necessary to make several more steps to get the Phoenix Letter Tendering Payment in Order to Obtain Release of Mortgaged Premises:

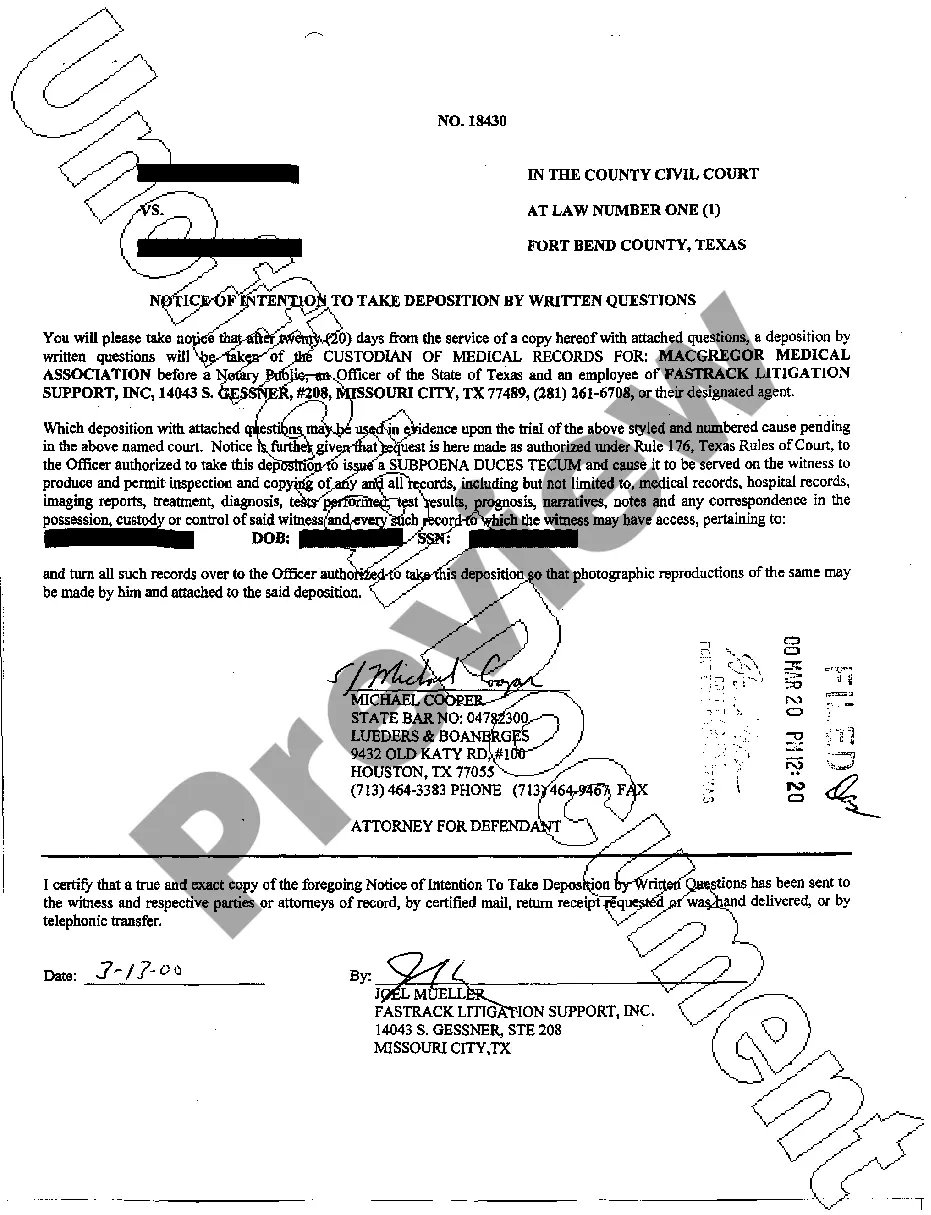

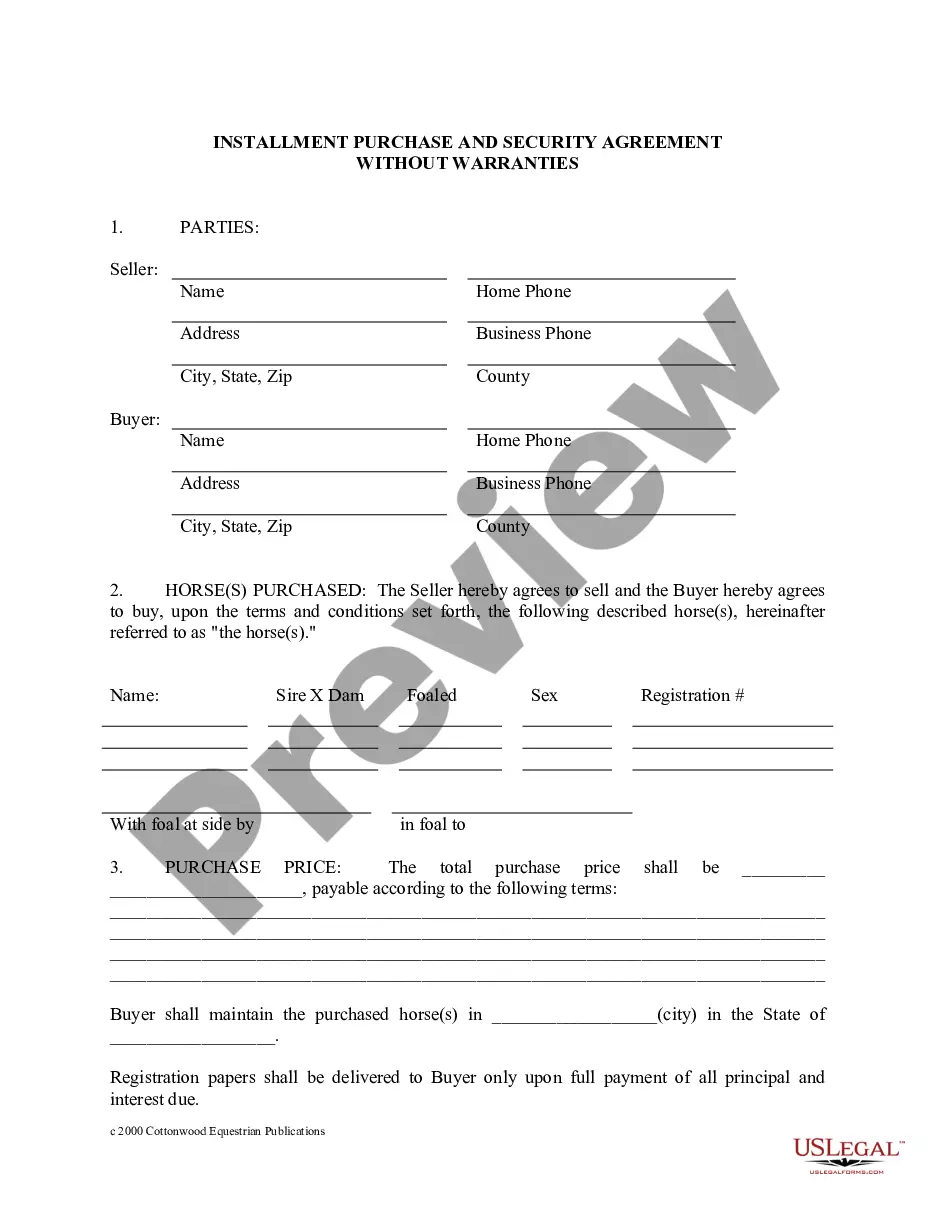

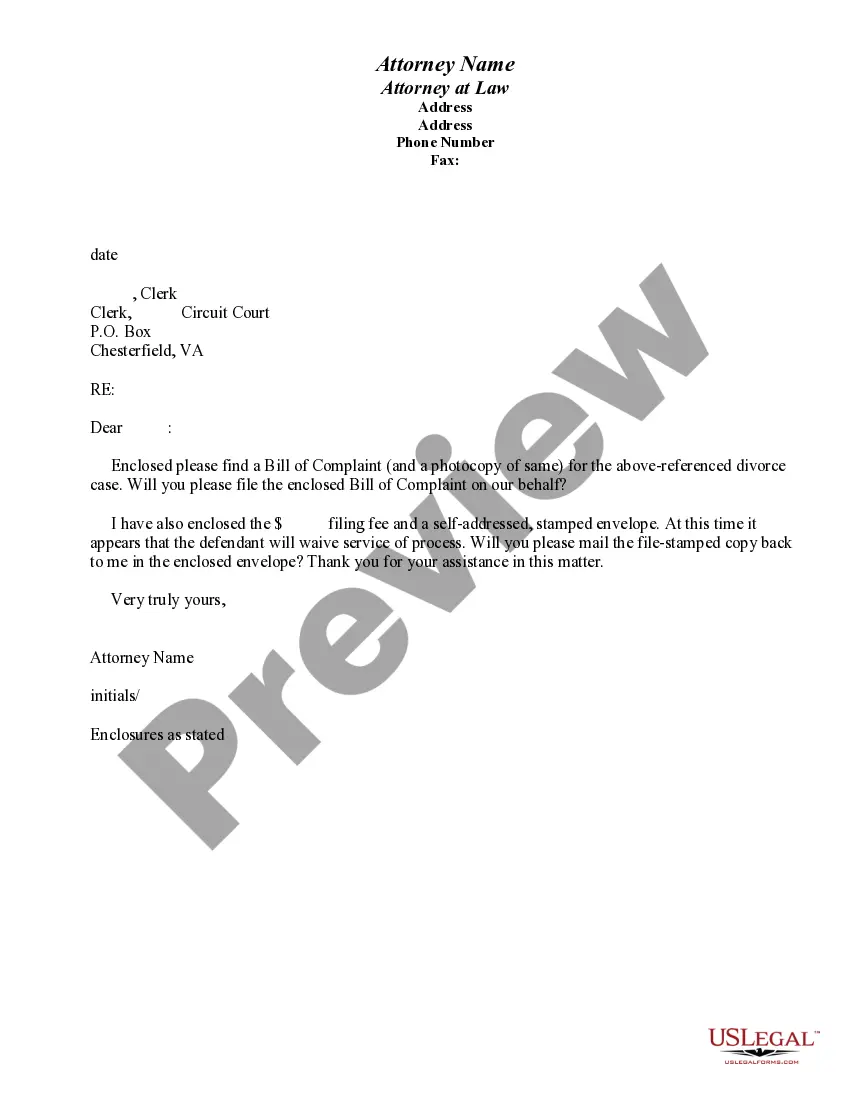

- Examine the page content to ensure you found the right sample.

- Use the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your criteria.

- Click on the Buy Now button to get the template once you find the appropriate one.

- Opt for one of the subscription plans and log in or sign up for an account.

- Choose how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the file in and click Download.

- Fill out and sign the template in writing after printing it or do it all electronically.

That's the easiest and most affordable way to get up-to-date templates for any legal scenarios. Locate them all in clicks and keep your paperwork in order with the US Legal Forms!