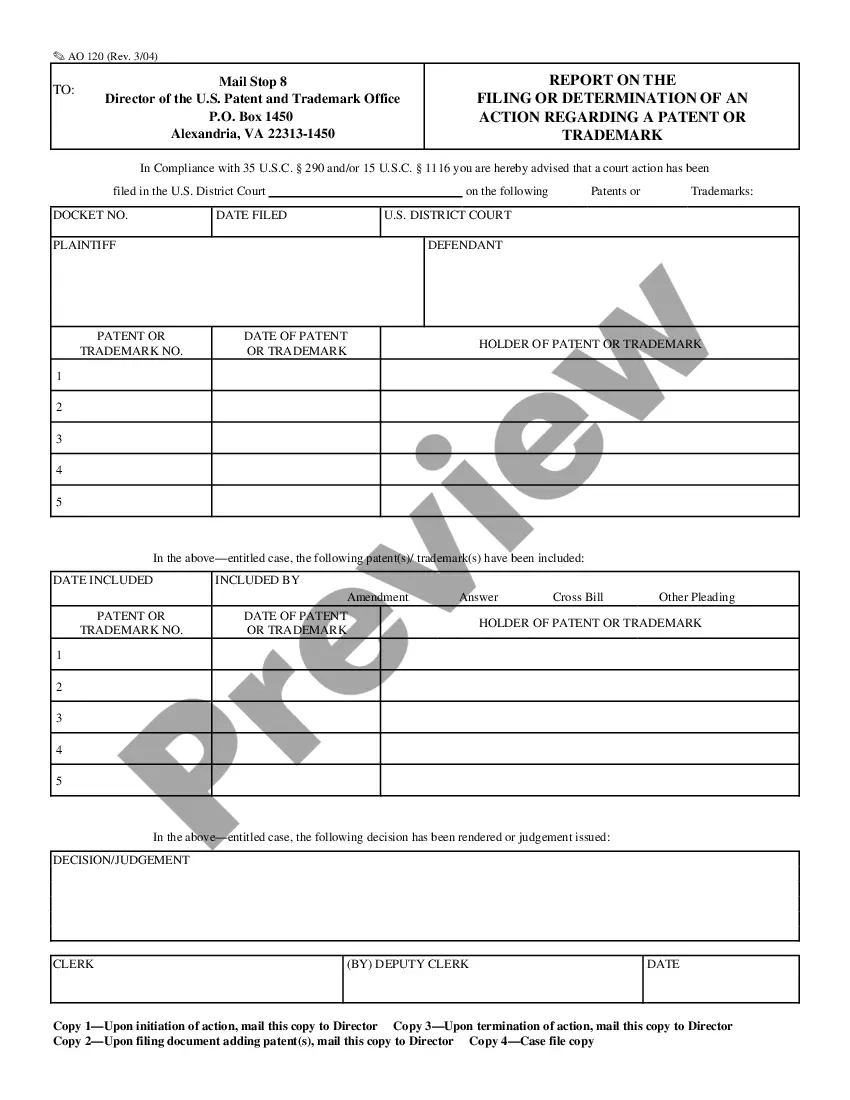

A judgment lien is created when a court grants a creditor an interest in the debtor's property, based upon a court judgment. A plaintiff who obtains a monetary judgment is termed a "judgment creditor." The defendant becomes a "judgment debtor."

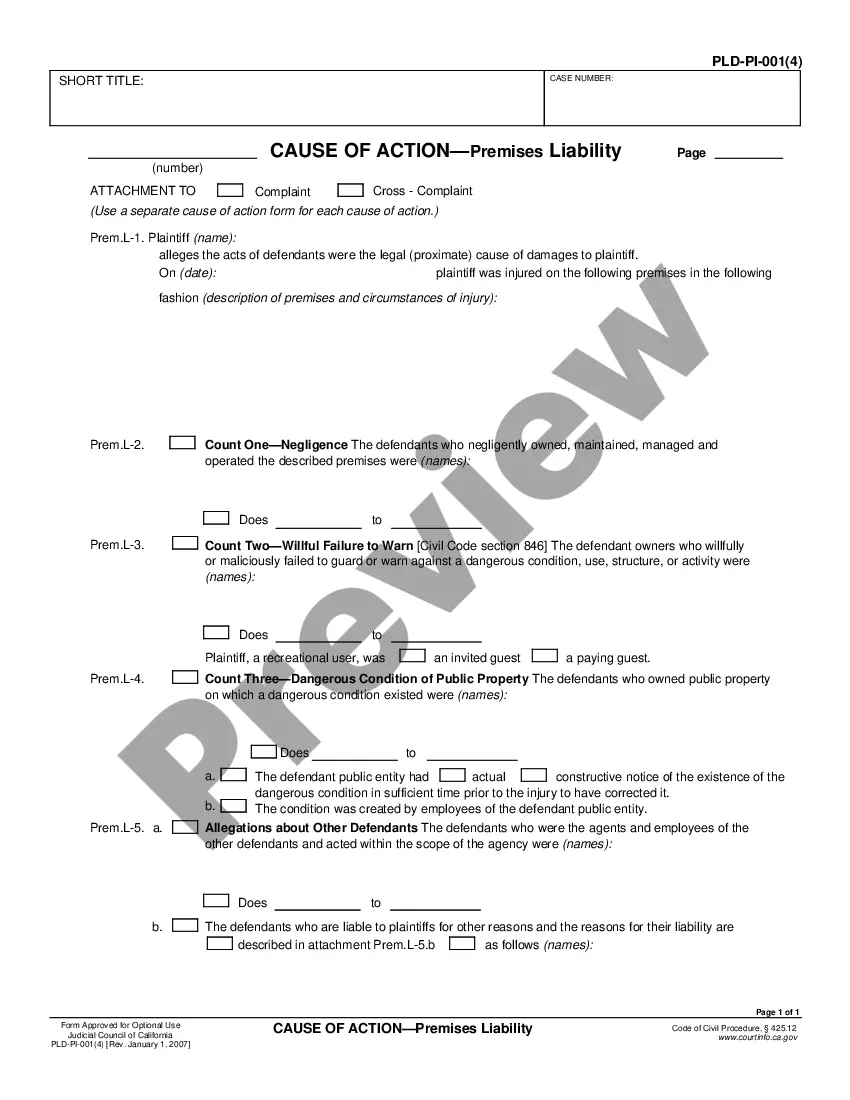

Judgment liens may be created through a wide variety of circumstances.

Fulton County, Georgia is located in the northern part of the state and is home to the city of Atlanta. It is the most populous county in Georgia and one of the most prominent areas in the Southeast region. Fulton County plays a significant role in the state's economy, culture, and history. In the legal realm, a lien on real property regarding judgment in a federal court refers to a legal claim placed on a property's title as a result of a judgment rendered by a federal court. This type of lien can have various implications and consequences for property owners. It is important to understand the different types of Fulton Georgia liens on real property regarding judgment in a federal court, as they can affect property rights, ownership, and financial obligations. 1. Federal Tax Lien: This type of lien is initiated by the Internal Revenue Service (IRS) when a property owner fails to pay federal taxes owed. The federal tax lien attaches to all assets, including real property, owned by the debtor, providing security for the government to recover the unpaid tax debt. 2. Judgment Lien: A judgment lien is created when a court grants a judgment against a debtor, typically as a result of a lawsuit. If the judgment remains unpaid, it can be enforced through placing a lien on the debtor's real property. This ensures that the creditor has a legal claim on the property until the debt is satisfied. 3. Support Lien: A support lien is applicable when there are outstanding child support or alimony payments owed by a property owner. In Fulton County, Georgia, a support lien can be placed on real property as a means to enforce the payment of these support obligations. 4. Mechanics' Lien: This type of lien is specific to the construction industry and is typically filed by contractors, subcontractors, or suppliers who have not been fully compensated for services or materials provided for a property's construction or improvement. A mechanics' lien can impact a property's title and make it difficult for the property owner to sell, refinance, or transfer ownership. When dealing with a Fulton Georgia lien on real property regarding a judgment in a federal court, it is crucial for property owners to seek legal advice and understand their options. Clearing these liens often requires satisfying the underlying debt or negotiating with the creditor to release the lien upon payment arrangements or other agreements. Property owners may also need to file appropriate legal documents to resolve these encumbrances and regain full ownership rights to their property.